ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its third-quarter 2020 U.S. Home Sales Report, which shows that profits for home sellers nationwide continue to hit high points despite the economic distress caused by the worldwide Coronavirus pandemic.

U.S. single-family rent growth strengthened in August, increasing 2.1% year over year, a bit higher than the 1.7% rate reported for July 2020, but a slowdown from the 2.9% rate recorded for August 2019, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

According to ATTOM Data Solutions’ newly released September and Q3 2020 U.S. Foreclosure Market Report, foreclosure filings are down 12 percent from Q2 2020 and down 81 percent from Q3 2019, to the lowest level since ATTOM began tracking quarterly filings in Q1 2008. The reports shows there were a total of 27,016 U.S. properties with foreclosure filings in the third quarter of 2020.

Total construction starts dipped 18% in September to a seasonally adjusted annual rate of $667.7 billion, essentially taking back August’s gain. While some of this decline is certainly payback from several large projects entering start in August, the drop in activity brought total construction starts below levels seen in June and July. Nonresidential starts fell 24%, while residential building dropped 21% over the month.

Since the Great Recession of 2008, the real estate market has rebounded nicely to say the least. In fact, as home prices continue to climb, it has become increasingly difficult for the average American to afford to purchase a home. Simply put, home prices are increasing at a faster rate than income.

The holiday season approaches, and another quarter is in the books. The second quarter was a rough one for multifamily, as with the broader economy, but some positive signs emerged in the last few months. This month we take a closer look at Q3 performance and, as always, numbers will refer to conventional properties of at least 50 units.

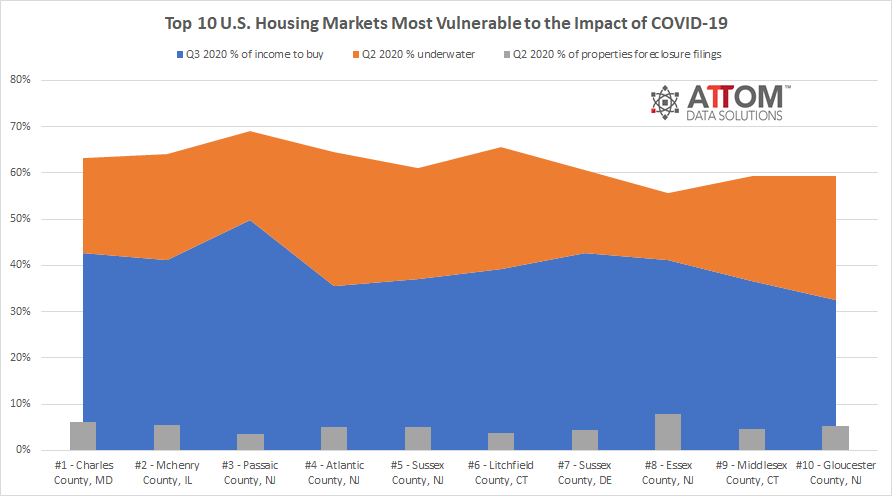

ATTOM Data Solutions’ just released Q3 2020 Special Report, spotlighting the U.S. housing markets more or less at risk of an economic impact related to the Coronavirus pandemic, shows that pockets of the Northeast and Mid-Atlantic regions were most vulnerable in Q3 2020, while the West and now Midwest fared less at risk.

U.S. commercial real estate deal volume has fallen sharply in 2020 but there is still capital flowing into the sector, which supports asset pricing. More capital flowed to refinancing activity than into new acquisitions in the first half of 2020, the latest edition of US Capital Trends shows.

Most Vulnerable Counties in Third Quarter of 2020 Concentrated in States Running from Connecticut through Maryland; New York City, Baltimore, Washington, D.C. and Now Philadelphia Among Areas with Clusters of High-Risk Counties; Midwest Joins the West as Regions Less at Risk of Housing-Market Problems

While seemingly defying the odds, home price growth has persisted throughout the pandemic and showed little sign of slowing down even though the nation is facing a potentially bigger contraction than the Great Recession. According to the latest CoreLogic HPI, home prices have grown about 70% from their post-Great Recession nadir in 2011.

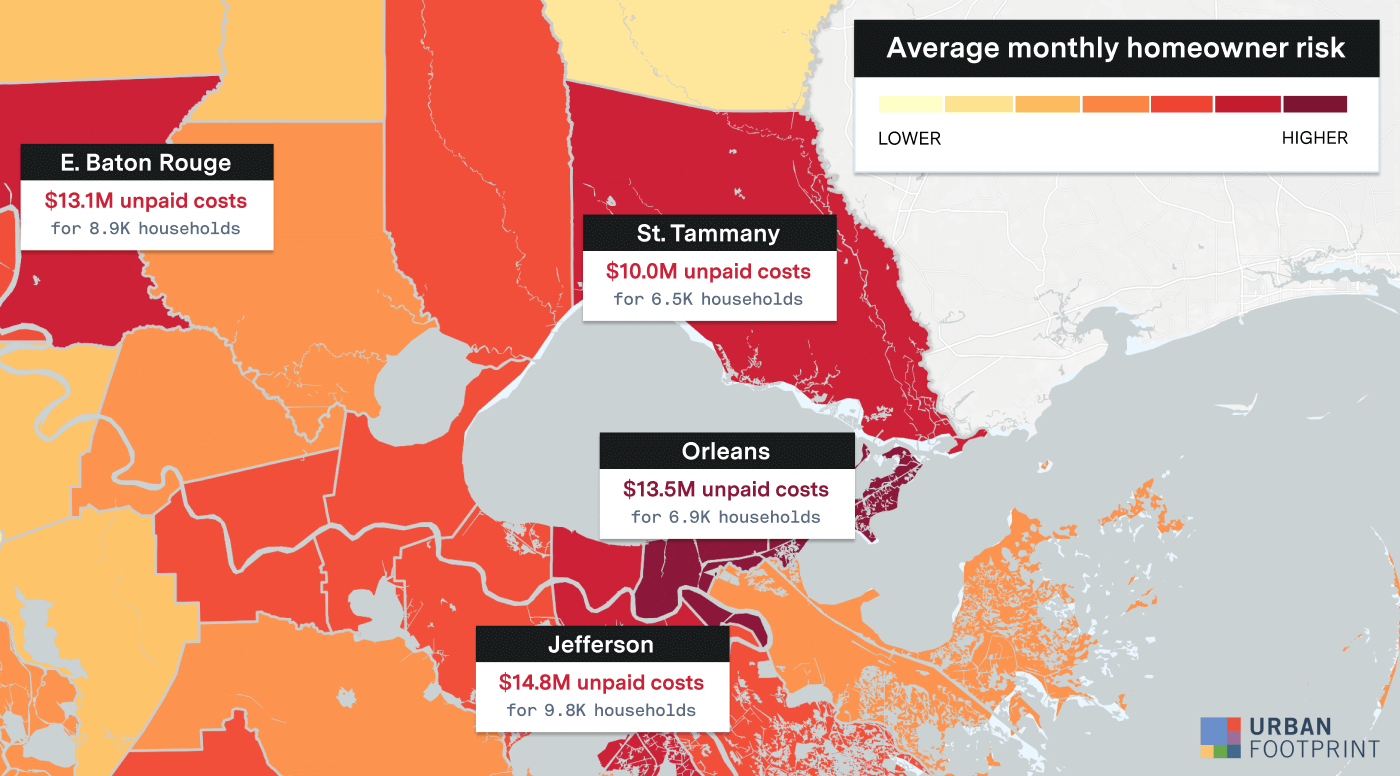

With less than a month until election day, the COVID-19 pandemic and the resulting economic fallout continue to be defining issues of the campaign. Amid this continued volatility, we find that widespread struggles with housing costs have been troublingly stable since the start of the pandemic. And despite their pressing needs, we find that those who are struggling most are least likely to make their voices heard at the ballot box on November 3rd.

One of the trends that has emerged in 2020 is a flight to affordability, with expensive markets and properties being especially adversely affected in many cases. Today we take a closer look at third quarter performance for the five most expensive US markets based on average effective rent per unit. Those markets are San Francisco – Oakland, New York City, Boston, Los Angeles – Orange County and San Diego.

German investors have new incentives to look at commercial real estate investments in the U.S. This group of investors was the second largest source of cross-border capital for deals in the U.S. over the last 12 months, behind Canadian players. A short while ago it was difficult for German investors to look at U.S. because of hedging costs. Those costs are fading and can make U.S. investments look comparatively inexpensive.

More than 6 months into the COVID-19 crisis, the pressure placed on rental markets by widespread unemployment and the economic strains of the pandemic is clear. The job losses or income reduction impacting millions of American households have left many unable to pay rent, placing them in the crosshairs of eviction and homelessness, and increasing financial stress on landlords as their tenants can’t pay.

National home prices increased 5.9% year over year in August 2020, according to the latest Home Price Index (HPI®) Report. The August 2020 HPI gain was up from the August 2019 gain of 3.5% and was the highest year-over-year gain since June 2018. Meanwhile, for-sale inventory has continued to dwindle, dropping 17% year over year in August, which created upward pressure on home price appreciation as buyers compete for the limited supply of homes.

ATTOM Data Solutions’ most recent U.S. Home Sales Report shows that homeowners who sold in the second quarter of 2020 had owned their homes an average of 7.95 years. According to the report, that number is up slightly from 7.85 years in Q1 2020, and nearly the same as the peak of 7.96 years in Q4 2019.

The latest CoreLogic® Home Price Index (HPI) for the U.S. recorded an acceleration in annual price growth to 5.5% for July, about two percentage points faster than the prior July – despite much higher unemployment. The gain reflected rising demand and a supply shortage; Record low mortgage rates fueled homebuyer activity, especially for first-time buyers, and the health risks engendered by the pandemic persuaded many older home sellers to delay their listing to a later, healthier time.

As summer transitions to fall, we exit what is traditionally peak moving season. But of course, nothing about this season has been traditional -- from March through June of this year, our national rent index fell quickly during the months when rents generally rise fastest.

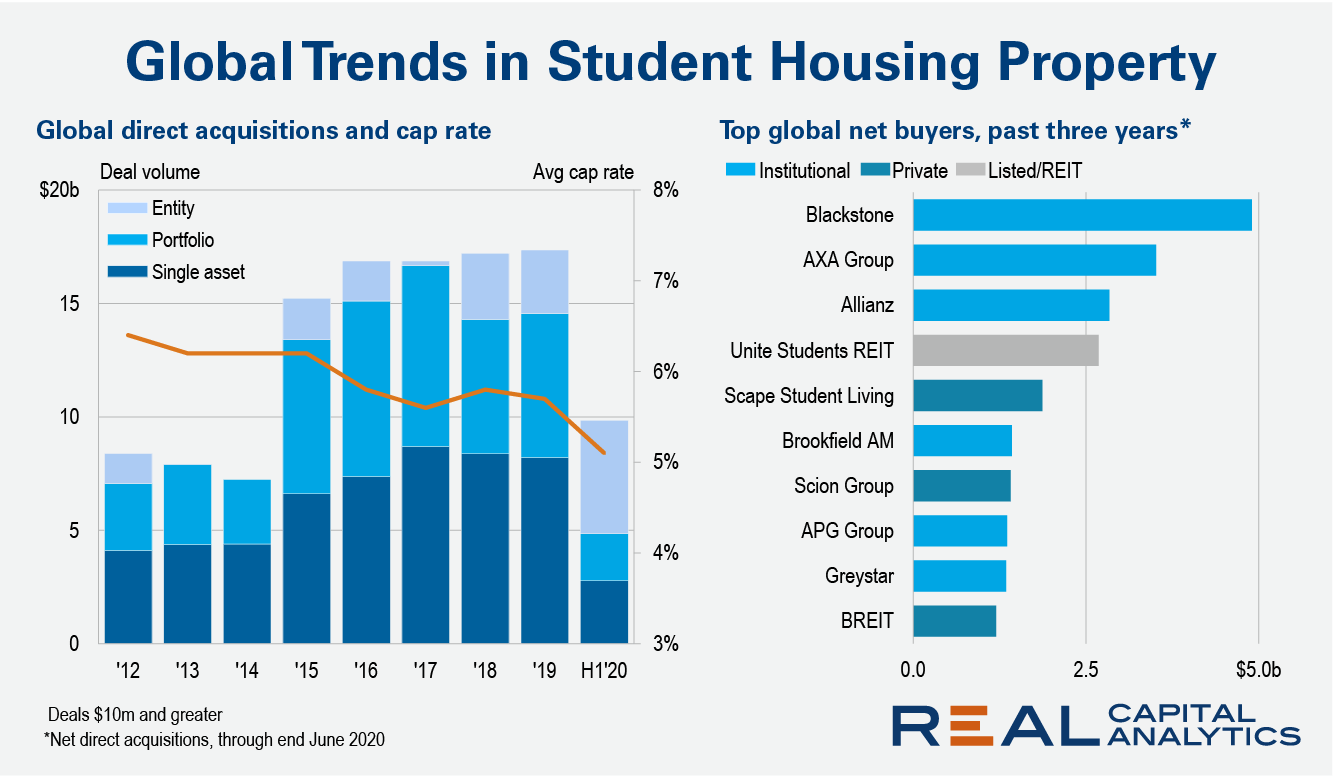

Over the past six years there has been an explosion of institutional investment into student accommodation around the world on the premise that demand for housing is robust. That premise has been thrown into doubt as Covid-19 forces universities to reduce or cancel in-person teaching and thwarts travel by international college students.

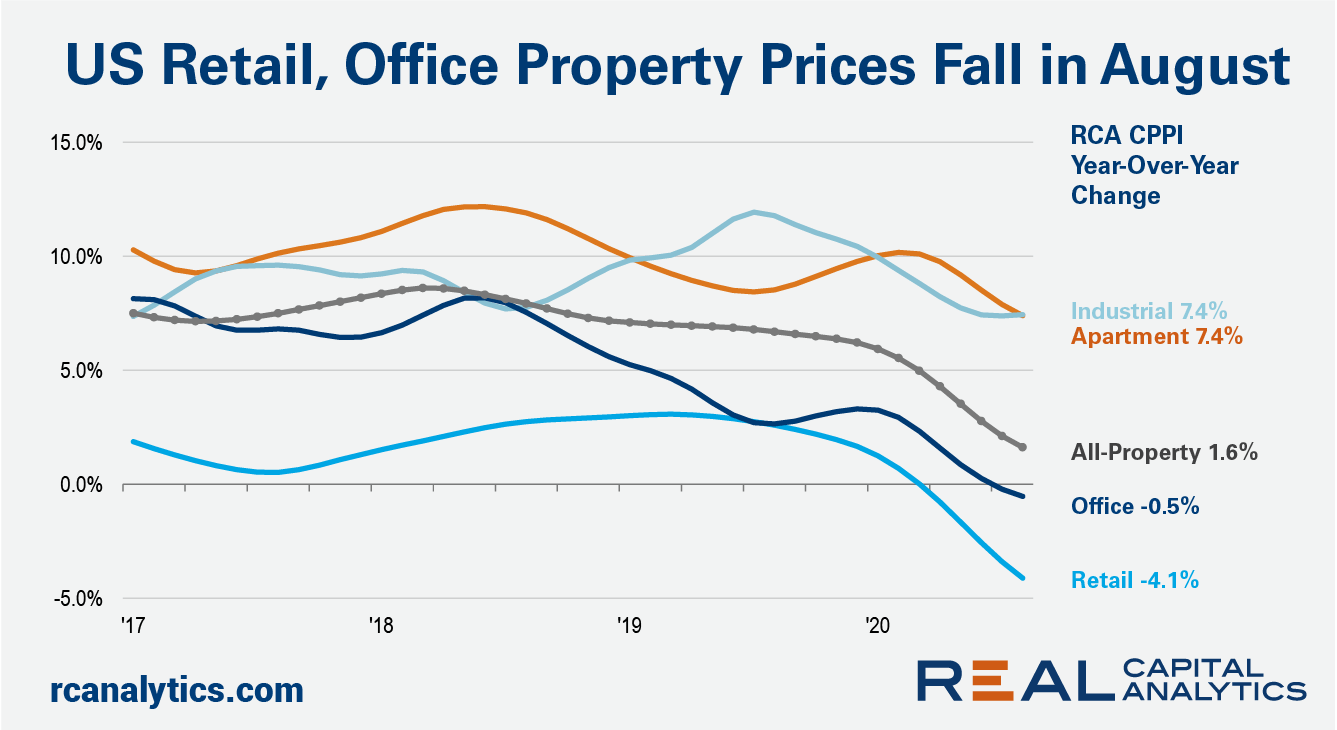

U.S. commercial property prices posted a 1.6% year-over-year gain in August as declines in retail and office pricing weighed against continued growth in industrial and apartment prices, the latest RCA CPPI summary report shows. The US National All-Property Index was rising at close to a 6% rate at the start of 2020, before the Covid-19 crisis hit the economy.