For the fourth straight month, roughly one-in-three Americans failed to make a full, on-time housing payment. Late and unpaid housing bills are accumulating, putting financial strain on many families and deepening concerns of near-term evictions and foreclosures. As federal and local eviction bans continue expiring across the nation, 32 percent of renters (and homeowners) entered August with unpaid bills. Over 20 percent owe more than $1,000.

As the coronavirus continues to affect nearly every city in the U.S., many are struggling to envision what the road to recovery may look like. Moody’s Analytics sought to provide clarity for that vision in a recent report. They examined the top 100 metro areas in the U.S. to identify the 10 cities best positioned to recover from the coronavirus, as well as the 10 worst. We then took a look at the cities Moody’s highlighted to understand if our jobs data could add additional insights on prospects for economic recovery.

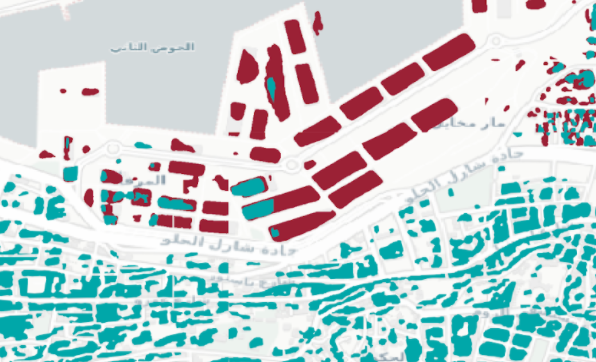

At least 135 people were killed and 5,000 wounded as of August, 5 2020 (5:20 pm EST), in the Beirut explosion. With hundreds reported missing and a lack of clarity regarding the cause of the explosion, geospatial analytics helps government analysts, NGOs, and first responders gain critical visibility into the catastrophe and have the potential to save lives. Overlaying computer vision results from May and August show exactly which structures were destroyed in the explosion in one single image.

July and August are two of Europe’s most important months for hotels with travellers spread across the continent on summer holidays. However, it is no secret that summer looks much different this time around for Europe due to the global impact of the COVID-19 pandemic. Occupancy (for reporting hotels) for the week ending with 18 July shows that most European countries are somewhere between 20-40% in occupancy.

Equity-Rich Properties Continue to Outnumber Those Seriously Underwater by Four-to-One Margin; Portion of U.S. Homes Considered Equity-Rich Ticks Up to 27.5 Percent; Seriously Underwater Properties Down to 6 Percent. 15.2 million residential properties in the United States were considered equity-rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.

With Walmart and Target among some of the brands announcing that they won’t be opening this Thanksgiving, a lot of attention is going to focus on Black Friday’s ability to make up the difference. So, is Black Friday still as critical as we think? And how might traffic patterns change if more retailers close on the day before?

The past 30 weeks have seen the number of cancelled flights go through the roof as a result of the global pandemic, causing disruption to passengers, airlines and airports. Last week we looked at how airlines managed schedules during Covid. This week take a look the cancellation disruption and management at country level and how they got it under control.

The overall distribution of consumer traffic (inclusive of all sectors) during COVID has seen morning and evening activity slow, picking up by midday. Midday (11am-3pm) share of traffic has increased about 400 bps to 33% since the middle of March. As a result of this shift to the middle of the day, weekday visits to restaurants now more closely align with visitation patterns previously seen during weekends.

The first half of 2020 was like no other in modern history. Physical lockdowns, food supply shortages, and a shift towards working from home are just a few examples of the impacts of the COVID-19 pandemic on millions of people worldwide. In this blog post, we revisited the Digital 100 list of most visited sites across key industries in the United States and look at how some of the best-in-class brands are paving the way as industry leaders.

Paris is the first major European city to see residents’ population mobility approach pre-lockdown levels, as Huq’s high-frequency geo-data shows that the cities that exercised most restraint under lockdown have been the fastest to demonstrate population movement increase. Data from Huq’s Daily Distances Indicator, which measures the the extent to which people travel about their cities, shows that while Paris has seen a significant increase over the last few weeks, cities that were less restricted during lockdown have been slower to recover – or even show a decline in resident mobility.

Traditional B2B marketing plans were scratched this year—shifting many ad dollars to digital channels. Prior to COVID-19, the Center for Exhibition Industry Research reported that B2B marketers who participated in events spent about 40% of their budgets on trade shows, which was five times more than online marketing spending. This year, trade shows and exhibitions are not taking place—and digital B2B ad spending is growing.

TikTok is a big deal in business and in pop culture. You already know that it, along with 59+ other Chinese published apps, has been banned in India and that a ban or sale of TikTok is likely to take place in the United States. The reasons why this is all taking place can be as complicated or as simple as you want them to be depending on who you talk to, but that’s not what this blog covers. We cover data trends, market shares, etc.

As INRIX reported earlier, vehicle miles traveled (VMT) is returning to pre-COVID level in states across the country. At a slower pace, cities have begun to reach their pre-COVID, February levels of traffic – yet many are still behind their normal, seasonally-adjusted VMT. In addition, the time of day people are traveling has shifted considerably under COVID-19, especially in the AM commute.

When we think about the jobs in highest demand during the coronavirus crisis, healthcare and other medical professionals immediately spring to mind. What with stories of doctors and nurses working themselves to exhaustion to keep up with the onslaught of COVID-19 patients, it would seem those tackling the crisis head-on could at least cross job security off their list of worries. But this isn’t the case.

National home prices increased 4.9% year over year in June 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The June 2020 HPI gain was up from the June 2019 gain of 3.5%. Strong demand, especially by younger home buyers, and low supply helped push home prices higher in June.

2020 has been a bumpy ride for the multifamily industry, especially the second quarter. Although the impact of COVID-19 and the new economic environment has been felt across the board, there are some distinct differences in how that has played out on the ground. One angle from which some differences become apparent is from the perspective of price class.

Consumer ad spending has had big swings this year. Each industry has had a different response to COVID-19, but flexibility remains at the core of it all. Let’s take a look at the ad spending most impacted by the latest rise in cases.

In this Placer Bytes, we dive into Hibbett’s growth and the overall strength of the sporting goods sector, and break down the latest from Panera. Hibbett Sports has had an exceptionally strong run lately, and analyzing visit trends for the brand shows that this should be of little surprise. Like industry leader Dick’s Sporting Goods, Hibbett kicked off 2020 with a bang, with 5.7% and 9.6% year-over-year visit growth in January and February respectively.

Skilled mathematicians, physicists, and computer scientists have long been coveted by top hedge funds and big tech companies. For years, these sectors have competed over this technical talent pool to generate profitable trading algorithms, build infrastructure, and targeted ad platforms. But commentary on this war for talent has been little more than conjecture. Who is actually winning the war to attract top talent - top hedge funds or big tech?

When Disney reopened in a hard-hit Florida, there was little anticipation of normalcy, but many felt the reopening failed to live up to expectations. Even comparing weekly visits to crosstown theme park rival Universal Studios saw Disney with larger gaps in terms of year-over-year traffic for the weeks of July 6th and July 13th. Yet, not only is the growth coming for Disney, but even the gap with Universal is also closing.