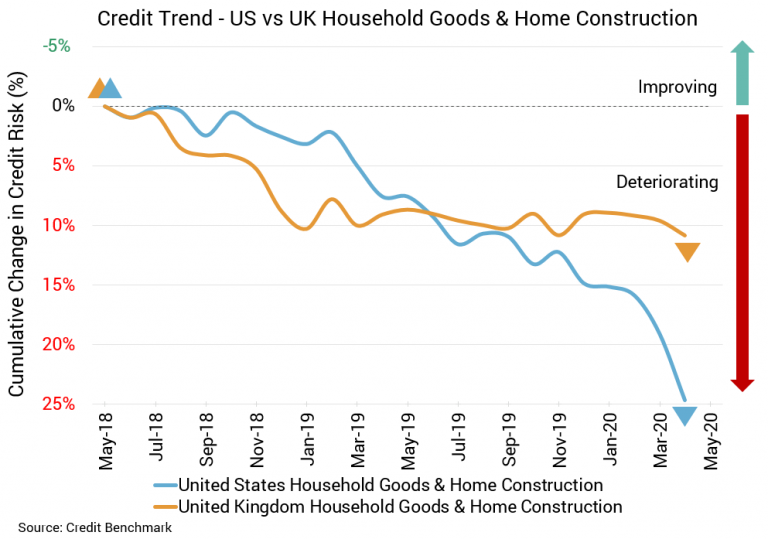

A myriad of problems are confronting the US housing market — far fewer homes are being built and new construction planning processes are diminishing. The rate of home sales is also falling. While there is some evidence emerging that things are beginning to look up, credit problems persist for this sector.

Despite millennials aging out of an urban lifestyle and people considering suburban living, demographic trends continue to favor multifamily demand at the moment. As the future of the economy remains uncertain, people are likely to prefer renting versus owning. This is especially true for graduating students with high debt, as they will prefer to rent due to the challenging nature of securing a mortgage.

The number of coronavirus cases in Latin America continues to rise, with more than 1.4 million people infected in Brazil and Mexico. The lockdowns and quarantines of recent months have weighed heavily on clean product demand in these countries – something starkly reflected in their import volumes. As we close out June, Mexican clean product imports this month are at their lowest monthly pace since 2014, halving from year-ago levels.

There has been a lot of recent news about large banks; the possibility of cutting dividends and generally not having the best looking balance sheets. As we near the end of June and the Federal Reserve’s annual stress tests on the biggest banks in the U.S. wrap up, investors are concerned about whether regulators will require dividend cuts. We decided to take a deeper look at this, hoping that recent job listings could shed some light on the direction large banks are heading.

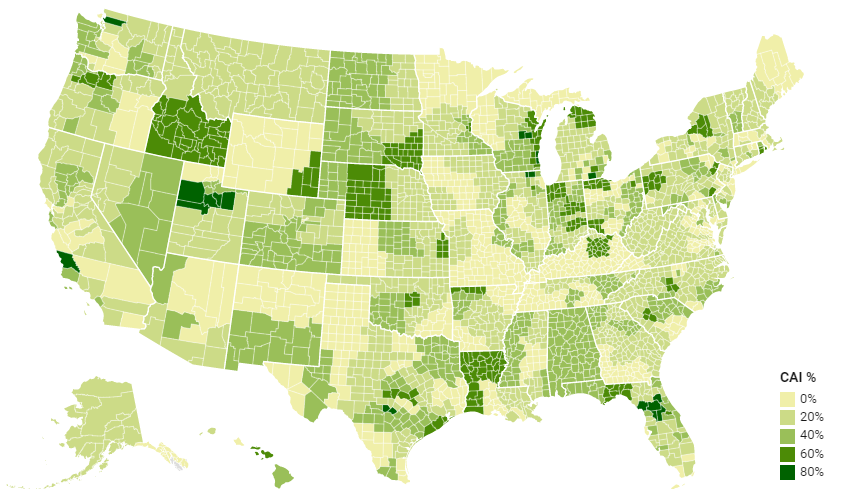

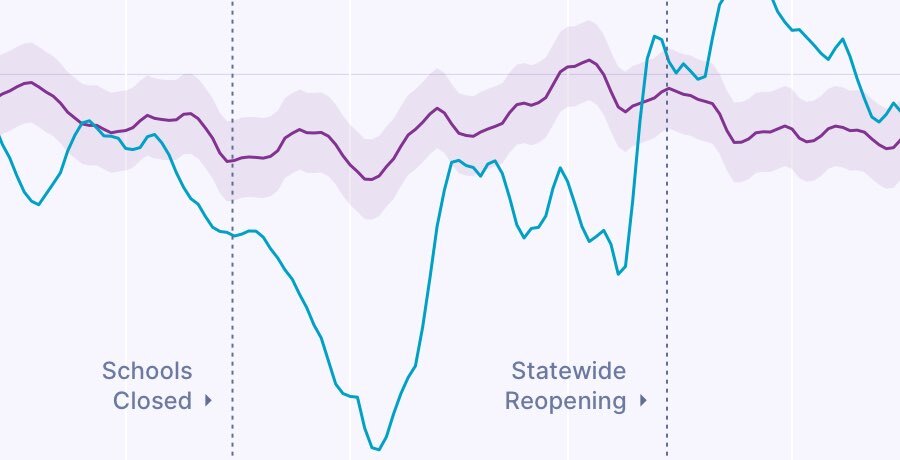

Burbio’s index, which is updated daily based on real-time activity, measures community life across five areas in every county in the US: Chambers of Commerce, government, libraries, arts and recreation, and civic and volunteer organization, scoring each county based on the level of activity and then population weighting the counties to get indices at the state and national level. Nationally, the index sits at 20.8, having been at zero in late May, up from 15.9 seven days ago.

Although shelter-in-place orders continue to loosen across the country, the number of new COVID-19 cases has begun to spike in recent days, signalling that the effects of the pandemic are far from behind us. And despite a surprising drop in the unemployment rate from April to May, a record number of Americans remain out of work, with new unemployment claims continuing to top one million per week.

With most of the country now in some stage of economic re-opening, the lockdown phase of the COVID-19 response is, at least for now, behind us. The road back to pre-pandemic normalcy is likely to be a rocky one and uncertainty abounds. Before looking ahead, let’s take a look at how stabilized properties performed in April and May while much of the country was under some form of shelter-in-place policy.

The number of Brits visiting European countries has dropped by around 80% during the last four months as Covid-19 puts a hold on non-essential international travel, potentially making 2020 the year of the staycation. According to Huq’s European Travel Indicator (GB Residents), which tracks the change in British residents present in countries across Europe, there has been very limited activity during lockdown and since measures have relaxed at the start of April.

Reviewing the data we can see that admissions in Texas and Florida are up on a year-over-year basis, indicating that state openings have had a material impact. Hospitals are feeling the strain, with admissions higher than they normally handle. New York by comparison is still 12% down year-over-year.

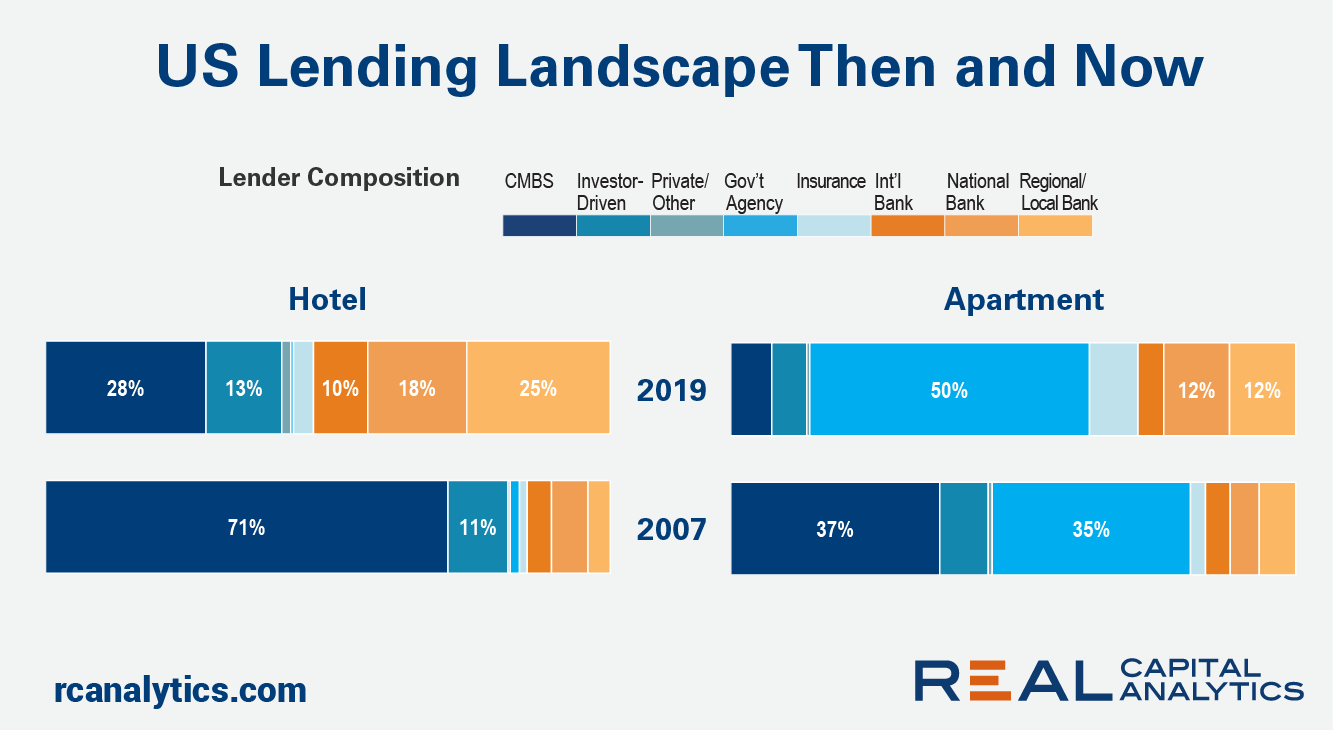

While CMBS still represented the largest slice of hotel lending in 2019, it was a much smaller piece of the pie. As the CMBS share fell back, other lender groups such as banks and investor-driven lenders filled the gap. For the apartment market, government agencies and the banks gained the most ground, while CMBS dropped to less than a 10% share of the market.

The travel market, including OTAs and vacation rental apps, took a nose dive at the start of the pandemic, as countries put strict travel bans and social distancing orders in place. In the past month or so, some of those restrictions have lifted, and it looks like people are itching to get out of the house. Vrbo Vacation Rentals by Homeaway.com has increased daily net new installs 113% over the past two months.

In April alone, 24% of new online customers were World’s Largest Retailer shoppers for the first time. Without the appropriate tools, you may have missed this too. In just a few months the onset of COVID-19 has created previously unimaginable changes to our personal lives and to the business landscape. While some of these changes will become part of a new normal, other behaviors may revert back to the way they were pre-COVID, creating both challenges and opportunities for brands and retailers.

The fires in 2019 caused immense damage across the Amazon Basin. A combination of fires being set to clear land for cattle and environmental factors that caused the fires to spread during the tropical dry season (June-December) destroyed millions of hectares of forest. What is making these fires more dangerous are the drying trends in the region.

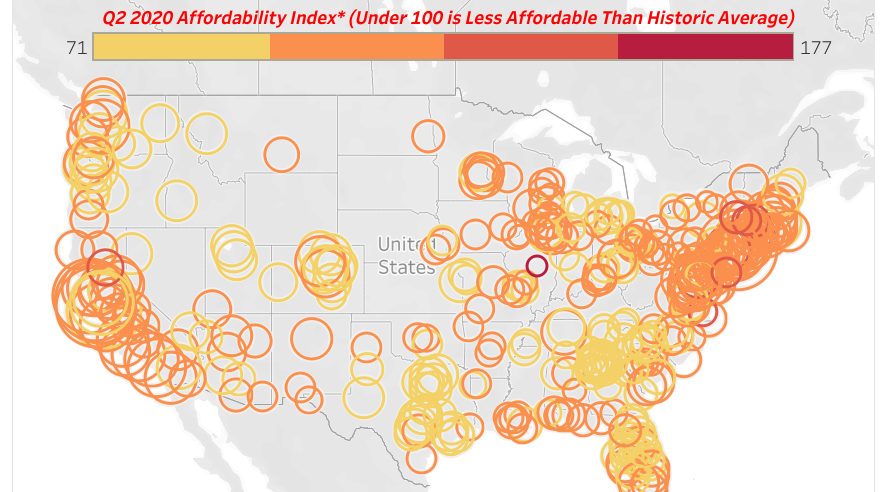

ATTOM Data Solutions, curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), today released its second-quarter 2020 U.S. Home Affordability Report, showing that median home prices of single family homes and condos in the second quarter of 2020 are more affordable than historical averages in 49 percent of U.S. counties with enough data to analyze, up from 31 percent a year ago.

McDonald’s leads competition in online spend on breakfast items via third party delivery services, with 166% more customer spending than Dunkin’ Donuts. Between the week of March 16 and April 13, national online spending on Quick Service Restaurant (QSR) breakfast items ordered via third party services like DoorDash, Uber Eats, and Grubhub grew 99%.

When you’re forced to spend several months quarantined in your own home, it’s only natural that you’ll come to identify a few areas for an upgrade. So, perhaps unsurprisingly, the wider home goods sector has been enjoying a significant uptick in traffic during the retail recovery. In fact, it’s so strong that this could be one of the few sectors to view 2020 in a far more positive light.

By successfully carving out its own identity, hard seltzer poses a threat to traditional FMB and core beer options, and even the broader alcohol category, largely because overall alcohol budgets and tolerances are finite. In comparing March and April 2020 with the same two months in 2019, hard seltzer buyers decreased their share of spending on beer and wine, with beer losing 5.6 share points and wine losing 4 share points among this consumer group, while spirits were relatively unaffected.

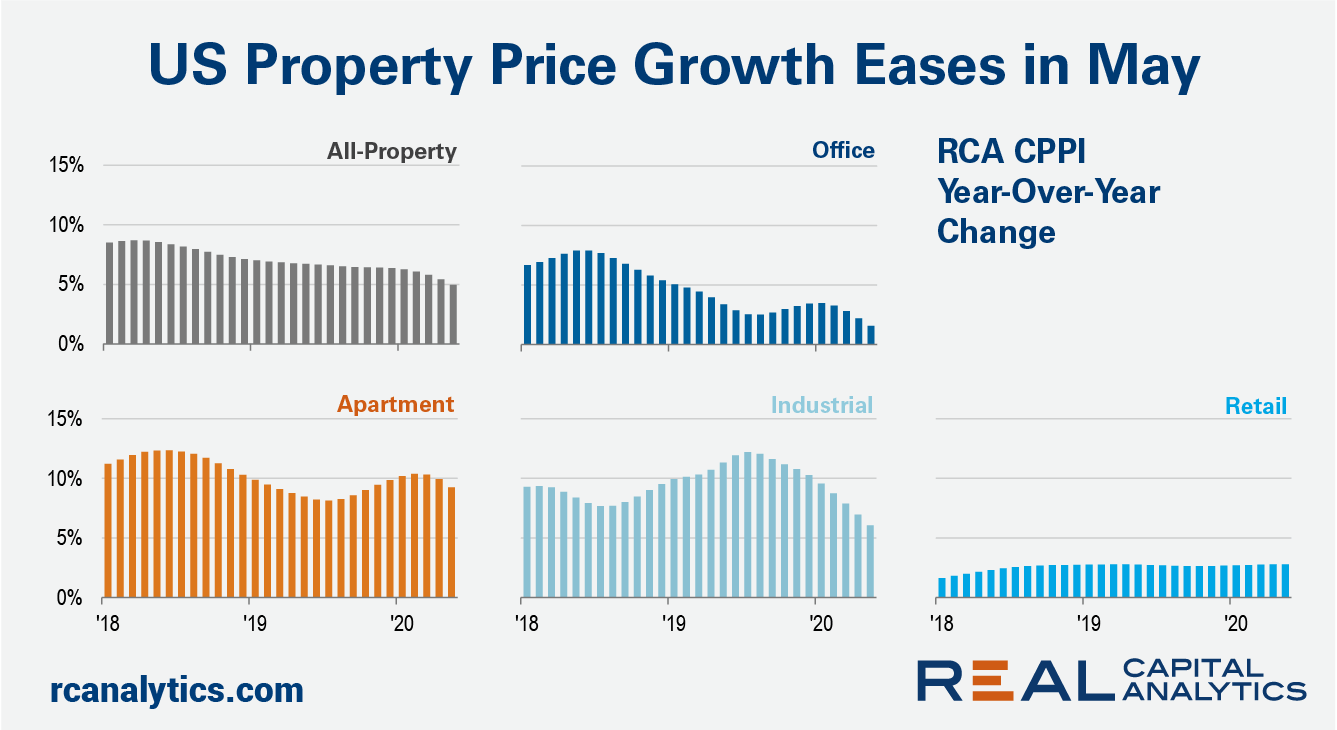

The effects of the Covid-19 crisis have begun to catch up with U.S. commercial real estate prices. The US National All-Property Index gained 4.9% in May from a year earlier, the slowest pace of growth since 2011, the latest RCA CPPI summary report shows.

Rating agency downgrades have hit unprecedented levels over the past few months, but the majority of the downgrades have been for companies that were already classed as high yield. Fallen Angels – companies that cross the boundary from Investment Grade to Junk – are still in a minority, as agencies (and their corporate clients) display an understandable reluctance to avoid the “BBB cliff”.

A disease’s effective reproductive number, Rt, is a critical metric used to understand whether an illness outbreak is under control. Using Kinsa’s fever data, we derive a real-time Rt indicator for disease spread in an area that historically follows the expected patterns for seasonal influenza.