In the last week alone round 50 million seats were removed from OAG’s airline schedules for the month of June. As we analyse what lies ahead, even just a few weeks out, it seems that there is a gap between what is scheduled and what is expected to fly and there are several reasons for this.

As consumers across Europe adapt to the coronavirus pandemic, Comscore data has shown that many of those confined to home have decided to tackle home improvement projects they may have been putting off. With a combination of bank holidays and the desire to improve our new home office, we have seen a significant increase in visits to online home improvement websites and apps, and this analysis will dig deeper into two of these categories.

According to data provided by the Association of American Railroads (AAR), total carloads and intermodal traffic in the United States is down 22.0% YoY for the week ending May 16. This represents only a marginal improvement from the 23.3% YoY decline for the week ending April 18, the low point for the year.

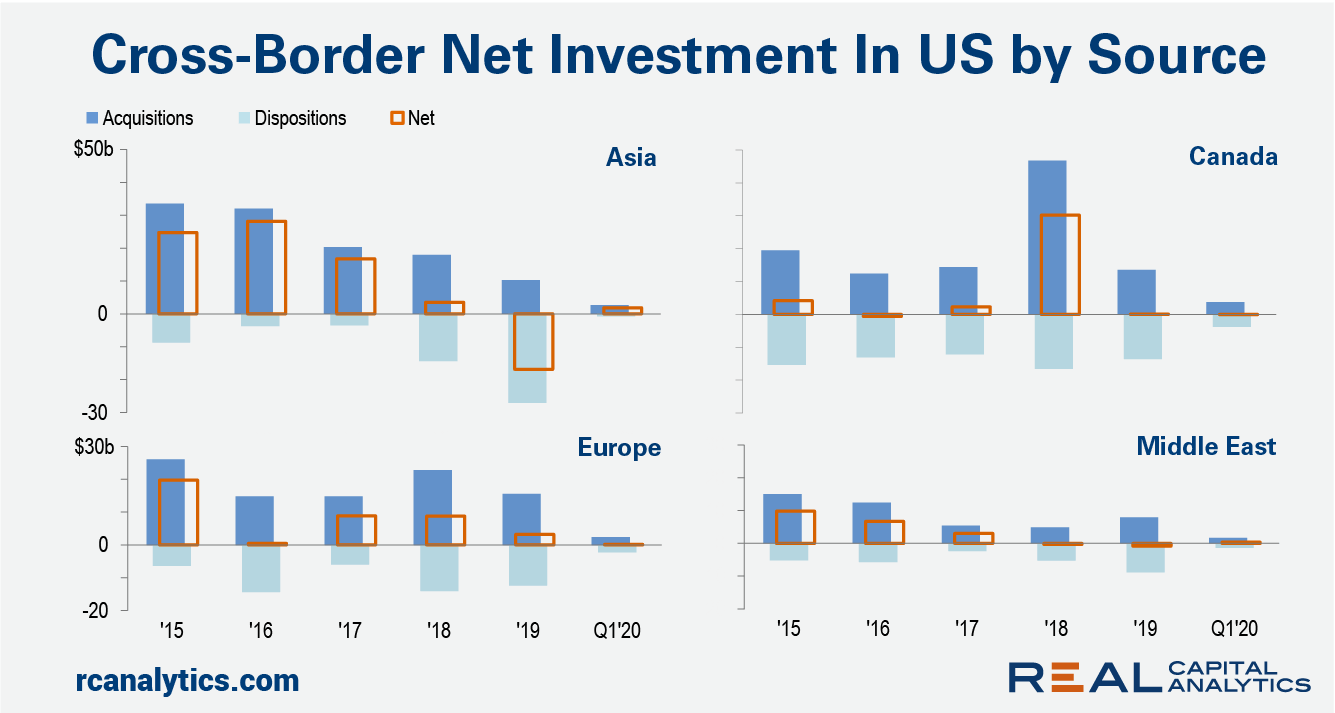

The pace of cross-border capital flowing into the U.S. commercial real estate market fell in the first quarter of 2020 compared with the year prior, the latest edition of the US Cross-Border Investment Compendium shows. The slowing marks the continuation of a trend seen before the global health crisis erupted.

Today’s consumers are inundated with information and content – much of which may not be relevant or accurate. Yet during a pandemic, it’s more important for brands than ever that consumers can rely on their updates.

STR data ending with 23 May showed another small rise from previous weeks in U.S. hotel performance. Year-over-year declines remained significant although not as severe as the levels recorded in April.

As the Chinese retail sector begins the road to recovery, it’s becoming clear that a reopening and a rebound aren’t completely synonymous. Despite China’s early start to the reopening phase, our Consumer Sentiment Study from May 2020\[1\] shows across industries, a large portion of consumers in China spent or planned to spend less than they did prior to the crisis.

The Luxury Goods sector has had phenomenal success over the past ten years. Growing global middle classes and readily available credit have paved the way for a social media-driven explosion of demand for high quality brands.

When will online consumer activity return to pre-pandemic levels? To answer these questions, we looked at online consumer activity in France, Germany, Italy, Spain, and the UK since the start of the pandemic, and analysed how that activity has evolved over time.

The drivers of the current downturn in the economy and commercial property markets are distinct from those which led to the Global Financial Crisis (GFC). This Covid-19 downturn came on suddenly, while warning bells were ringing a number of years ahead of the collapse of the housing market in the last recession. The variation in drivers could lead to a faster race to the bottom for market prices this cycle.

When COVID initially hit there was an enormous shift in consumer behavior across the economy. Online video services like Zoom saw user counts explode from 10M to over 200M users. Similar growth was seen across online workouts, online video, ecommerce and online events. One form of online interaction that didn’t see this boost was online dating.

Using mobile app data from Apptopia we can see the number of downloads and sessions for these apps both within the United States and internationally.

With Italy and Spain both hoping to welcome tourists back for the summer season over the next five weeks, data from the Huq Daily Distances Indicator suggests that as boarders open, Italian residents’ appetite for a summer slew of overseas visitors could be far greater than among their Spanish counterparts.

Though worldwide beverage alcohol volume increased slightly in 2019, reversing declines from the year prior, it will be five years before the global industry rebounds from the ongoing Covid-19 crisis, according to comprehensive new research from IWSR Drinks Market Analysis.

Problems in the US housing sector abound. Credit quality for both US- and UK-based firms continues to deteriorate, but the moves are significantly more dramatic in the US, with average probability of default increasing 3% over the last month and 13% over the past year.

Central Paris tied Manhattan as the world’s most liquid market in the first quarter of 2020 after an exceptional period of dealmaking in the French capital. The latest update of the RCA Capital Liquidity Scores shows that the Covid-19 crisis arrived too late in the quarter to dent liquidity in either European or North American markets significantly.

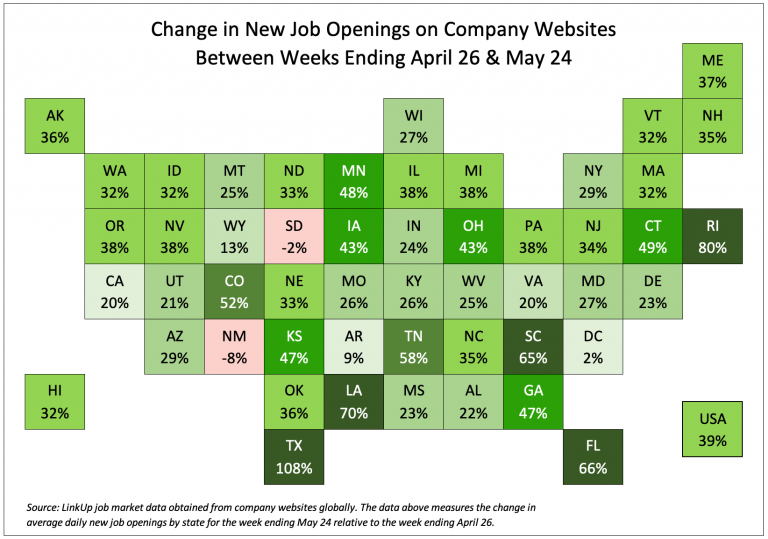

As we wrote last week, we’ve seen a relatively sharp increase in new job openings across most of the country since the end of April. Through May 17th, new job listings on company and employer websites throughout the country had risen 28% since the week ending April 26th with the largest increases in South Carolina, Louisiana, Florida, Texas, and Rhode Island.

Lex Machina continues to explore how courts are affected by the social changes due to the COVID-19 (coronavirus) pandemic. Our analysis of court activity through March and the first two weeks of April in 2020 compared to the previous two years revealed the following

Customer footfall across Italy’s hospitality sector has increased by in excess of 500% following the easing of Covid-19 restrictions on 18 May, however it remains at around a third of pre-lockdown levels as the ‘shape of recovery’ remains unclear.

According to Huq’s Key Industries Indicator for Italy, customers visiting the country’s bars, cafes and restaurants even climbed to the point of exceeding footfall to supermarkets for the first time since enforced closures came into effect on 11 March.

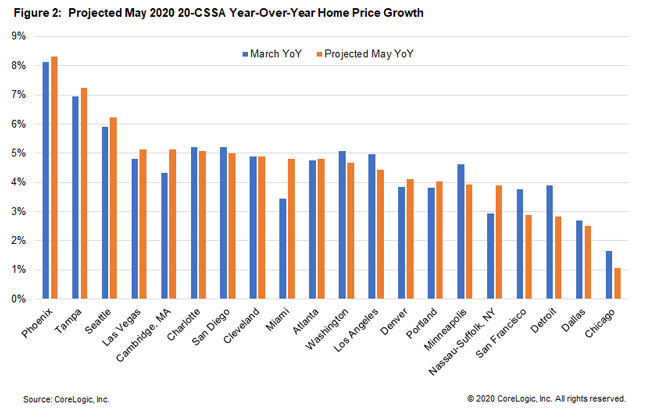

The newly released CoreLogic March Home Price Index (HPI) shows that prior to the COVID-19 outbreak home prices were starting to heat up in most places in the United States. However, home prices captured in the March report were from transactions negotiated prior to the implementation of shelter-in-place mandates, and there was a wide expectation that the growth may have decelerated in response to this interruption in demand.

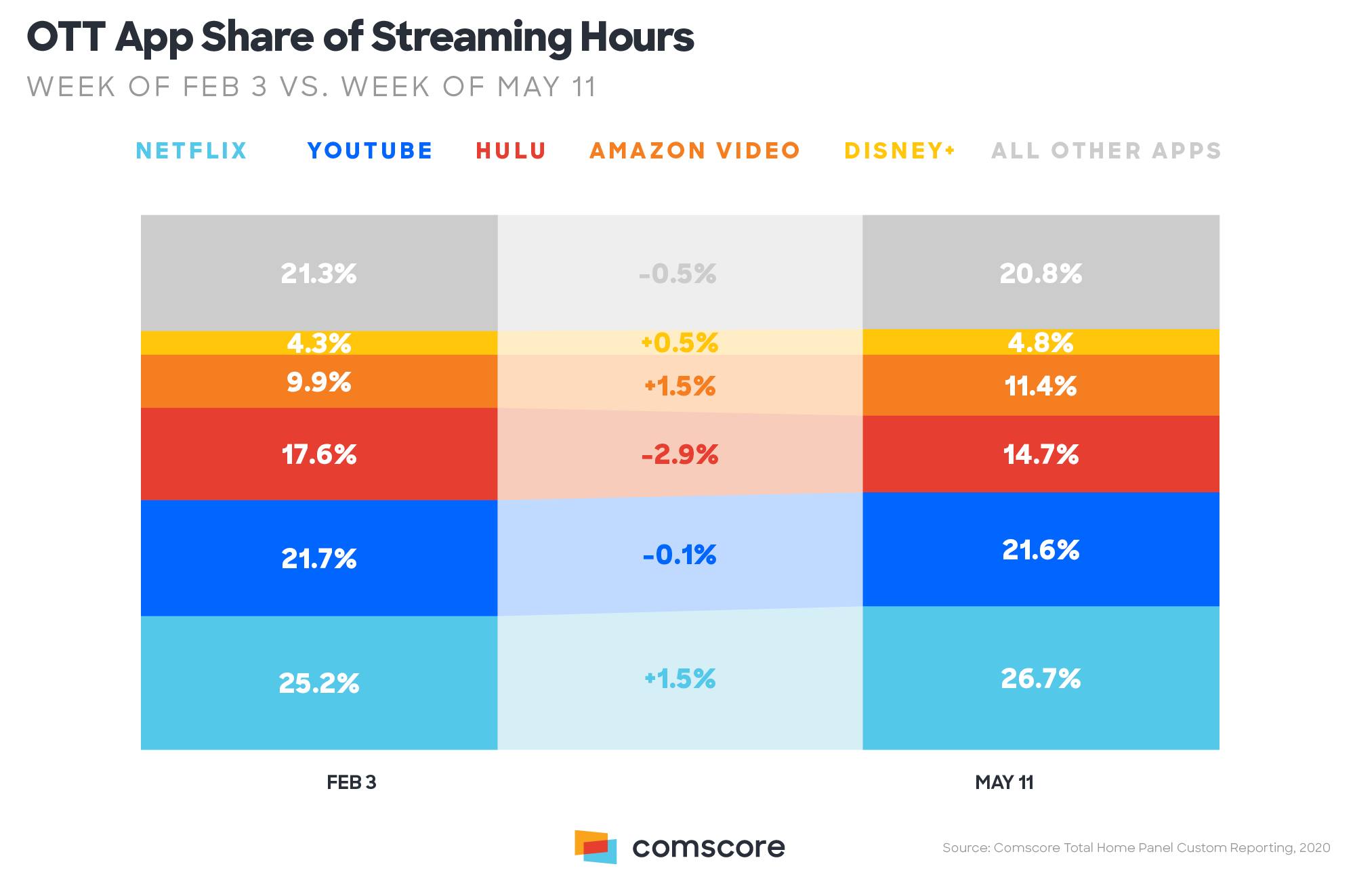

As millions of Americans adjusted to working from home and having to practice distance learning due to the COVID-19 pandemic, new research from Comscore (Nasdaq: SCOR), a trusted partner for planning, transacting and evaluating media across platforms, shows engagement with streaming services and year-over-year in-home data usage surged in the beginning of May 2020.