After an auspicious start to its performance recovery, Mumbai’s hotel industry appeared ready to continue setting the trend for urban markets in 2021. However, a second wave of COVID-19 cases has called a temporary halt to the market’s success. Fortunately, strong domestic demand and corporate confidence, the drivers behind the market’s earlier recovery in 2020, remain poised to push performance again once cases are under control. More recently, Mumbai welcomed back corporate travelers, which helped lift demand in the first quarter of 2021. An institutional quarantine requirement helped drive demand as well, as travelers arriving from or transiting through several major world regions were required to undergo a 10-day institutional quarantine.

In this Placer Bytes, we dive into Disney’s theme park recovery and analyze whether to jump back on the Whole Foods or Trader Joe’s bandwagon. Disney World is back on the upswing after seeing visits in January and February down just 49.8% and 53.6% year over year, respectively. This is about the level the theme park had been at since the late summer. While visits were actually up 33.8% in March, the number is misleading because it is being compared to a month in 2020 that already saw COVID-related closures.

Continuing a trend we saw throughout the COVID-19 pandemic, morning commute traffic is still far below pre-COVID levels in terms of trips and vehicle-miles traveled. Nationally, VMT exceeded pre-COVID levels beginning in late February and continuing through April. In the last few weeks, trips taken by drivers in the United States have increased on a slight upward trajectory. Yet some areas are seeing fewer VMT and trips than their counterparts. For example, trip growth in Washington DC, New York and Seattle continue to lag Phoenix, Dallas and Miami. Even within metro areas, the number of trips taken varies considerably by time of day.

While home prices skyrocketed in response to low interest rates and low housing stock, single-family rental properties have also experienced a pickup in rent price growth. Single-family rents posted 3.9% year-over-year growth in February 2021; this was the strongest February in the past 5 years, as measured by the CoreLogic® Single-Family Rent Index (SFRI). Recovering from the low of 1.4% year-over-year growth in June 2020, the index has shown solid increases since the second half of 2020, propped up by the rent growth in detached properties. By October 2020, the rent growth compared to a year prior had returned to pre-pandemic levels.

Athleisure -- the fastest growing apparel category of the past decade -- has drawn the attention of both incumbent retailers and new entrants. Within this niche, Lululemon stands out as a leader with its loyal customer base and premium lines. The innovative DTC retailer, which sells through both online and brick-and-mortar stores, sets an example for others. Using Viscacha Data’s granular inventory & sales statistics, we analyze how consumers respond to Lululemon’s pricing and product strategy over the winter-spring transition to inform future strategy. First, we analyze the promotional mix at Lululemon, both frequency of promotions and magnitude of discount by product category and gender. Over the last two months, Lululemon has steadily reduced the total proportion of products on sale, from around 40 percent in early February to roughly 25 percent by the end of March.

A strong return of leisure travel has created much cause for celebration during the early months of 2021. In the U.S., hotel room demand in March was the country’s highest level recorded since the start of the pandemic. To fully recover, however, the industry needs both leisure and the various segments of business travel to return. To track evolving trends in the tourism and hospitality industry, and examine everchanging attitudes to travel, STR conducted a quantitative survey in February 2021 among 1,333 respondents from its Traveler Panel. In this latest installment of Tourism After Lockdown, we look at the potential recovery path of business travel. In this research, travelers primarily represented the United Kingdom, other countries in Europe, and North America. Sentiment about business travel was captured among those who had previously traveled for business pre-pandemic.

In this Placer Bytes, we dive into recent announcements from Best Buy, Dick’s Sporting Goods, and Nike. All three are launching new initiatives aimed at leveraging their strength in the current retail environment to drive long-term benefits. Best Buy recently announced a new annual membership to its Geek Squad service, Dick’s is testing new experiential components in stores and Nike is cutting more wholesale partnerships. All of these share a common trait – they are pushed by top-performing retailers to leverage a unique level of short-term strength to drive long-term benefits.

The volume of transits through the UK’s ports of entry since March 1st has tracked consistently at 10-15pts above January 2020 levels, while at the same time delays have returned to ’normal’ levels. This suggests that UK ports are performing more efficiently than at any time during the last year and a quarter, as the time taken to process transits has decreased by up to 15%.

The COVID-19 pandemic has highlighted the importance of homeownership and its impact on wealth accumulation among American households. Home prices soared, and among homeowners with a mortgage, the average equity gains were over $26,000 in 2020, bringing the total average equity to more than $200,000 per homeowner. While equity gains have varied significantly across the nation, in general, the availability of home equity has been the principal form of savings and household wealth for low- to moderate-income homeowners. In particular, home equity can serve as a critical financial buffer in times of economic uncertainty, such as what we experienced during the pandemic. Indeed, homeownership is a key method of accruing wealth, so differences in the attainability of homeownership directly result in differences in wealth.

Among the many afteraffects of The Great Reshuffling has been a shift in the drivers of online real estate success. Our CE Web data track these drivers for the instant buying businesses of Offerpad, Opendoor, and Zillow, and shows how the companies are adjusting to declining listings. In today’s Insight Flash, we evaluate what is happening for each in terms of ASP Growth and the ratio of homes sold to homes acquired, as well as which states are more exposed to homeowners versus renters. Since the beginning of the year, Opendoor’s Average Selling Price (ASP) growth has consistently outperformed Zillow’s. Opendoor’s ASP growth has trended within a 13-27% band since mid-January, while Zillow’s has been about 5% lower in an 8-22% range.

The week of 4-10 April was all about demand. The number of U.S. room nights sold surged to 22 million, which was the most since the start of the pandemic. As a result, occupancy reached 59.7%, also the highest level of the past year. On a total-room-inventory (TRI) basis, which includes temporarily closed hotels because of the pandemic, U.S. occupancy reached 56.6%—yes, that was another pandemic-era high. On average, the industry sold 3.2 million rooms per day during the week. A year ago, daily demand was a third of that.

The grocery sector experienced a fundamental shift during the pandemic, and while the changes were generally good for most brands, others were very poorly positioned. And these differences largely centered around critical changes in consumer behavior that elevated certain brands because of distinct characteristics. As an example, traditional grocery brands saw a significant advantage as they enabled customers to do more with a single visit and were well aligned with mission-driven shopping. And while many of these changes are likely to normalize over the coming months, some may have a surprising amount of staying power. Should these prove capable of continuing, as new factors arise from lingering COVID effects, some brands could be extremely well positioned for the coming months.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items. By analyzing industry-level data, consumer spending trends can provide insight into which sectors of the economy are recovering fastest. Overall, consumer spending in March 2021 versus the same month in 2020 is up 27 percent across all sectors, an aggregation of over 5,200 major U.S. companies. Compared to February, March’s year-over-year growth is 14 percentage points higher.

Visits to the UK’s pubs spiked up to 60pts this week, with high-frequency geo-data showing how Monday’s easing is of restrictions has drawn millions to the nation’s beer gardens. The Huq Index had recorded only nominal visits to pubs since the start of the year, which can be largely attributed to staff and venues which offer takeaway food. However, following the first phase of hospitality’s reopening on Monday, Huq’s single day measure shows a jump of 60pts+ supporting reports that many have rushed to book outdoor tables.

Total construction starts rose 2% in March to a seasonally adjusted annual rate of $825.3 billion, according to Dodge Data & Analytics. A solid gain in nonresidential building starts fueled the March gain, while growth in residential starts was minuscule and nonbuilding starts fell outright. The Dodge Index rose 2% in March, to 175 (2000=100) from February’s 172.

For the last five years, millennials have made up the largest share of home purchase mortgage applications. This demographic tailwind comprises the largest generation of households who are approaching their first-time homebuying years. Older millennials, meanwhile, are in the age-range for a move-up purchase. According to the CoreLogic Loan Application Database, prior to 2020, while millennial home purchase applications comprised less than half of all purchase applications, their share grew from 33% in 2014 to 47% in 2019, rising about 2 to 4 percentage points per year. This annual increase is consistent with the cohort of millennials reaching 33 years of age, the peak homebuying age.

As opportunities for watching sports have become more limited in the last year, opportunities for betting on sports have proliferated. Online gambling has been a popular activity since Americans first had internet access, but today’s Insight Flash digs deeper into specific recent trends including acceleration in the subindustry’s growth, loyalty to specific services, and how trends vary by US State. Since the beginning of 2019, spend for Online Gambling in the US has outpaced other Leisure and Recreation subindustries by a large margin.

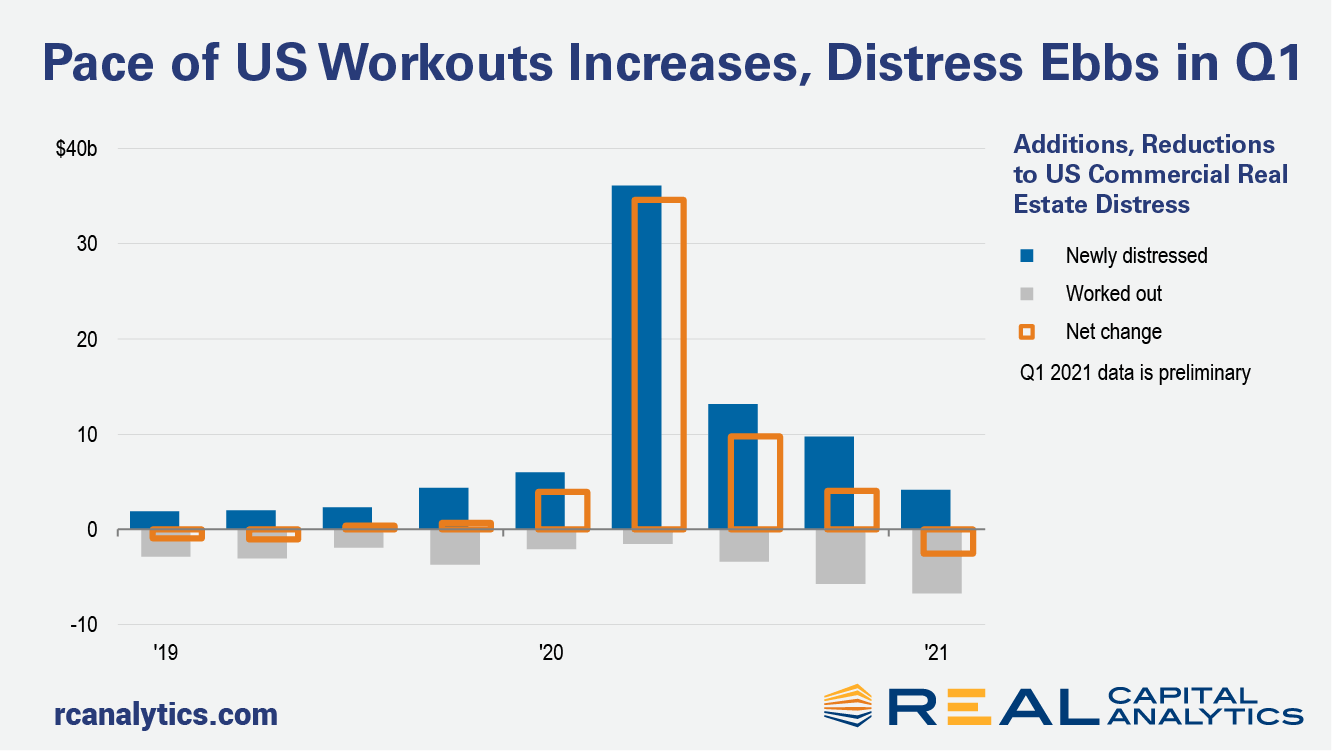

More U.S. commercial real estate distress was worked out than arose in the first quarter of 2021, preliminary Real Capital Analytics data shows. All other things being equal, this change in behavior would be an important sign of a transition in the marketplace. We are not finished with all aspects of distress, however. There is a looming supply of potentially distressed loans that still may have an impact. The pace of workouts will play an important role in the process of price discovery for commercial properties. Deal volume has contracted sharply over the last year as owners and potential buyers disagree on how assets should be priced. To the extent that there are more loan workouts, information from these negotiations will adjust buyer and seller expectations on prices that can be achieved.

Speedtest Global Index™ Market Analyses from Ookla® identify key data about internet performance in countries across the world. This quarter we’ve provided updated analyses for 21 markets about top mobile and fixed broadband providers as well as device and chipset manufacturers and some city-level data. Scroll through the article to learn about all 21 markets.

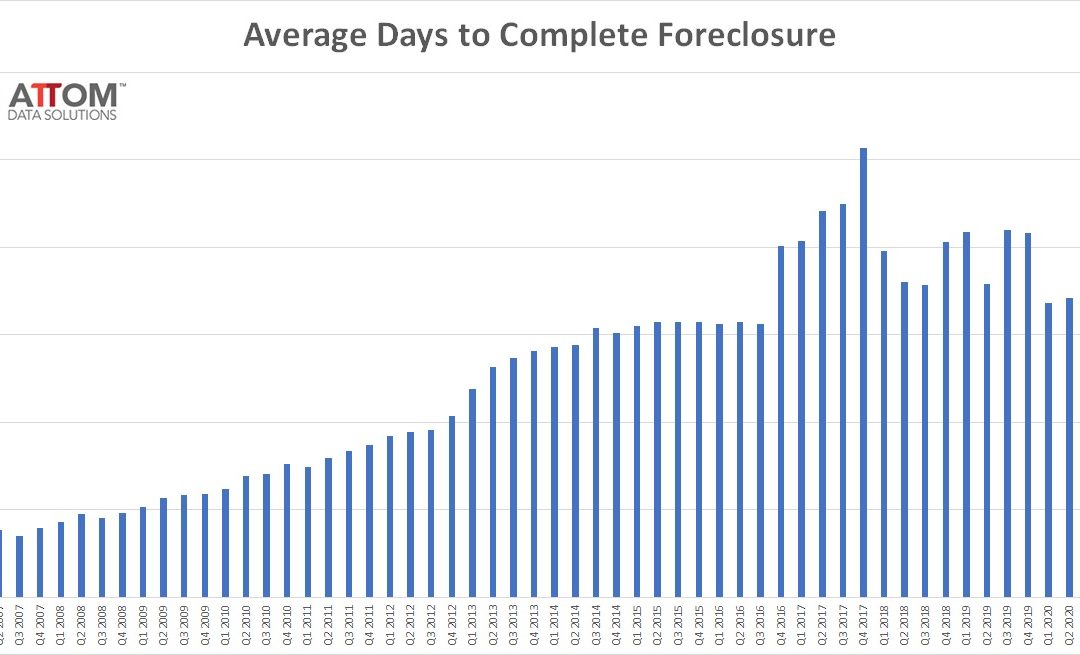

ATTOM Data Solutions, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), today released its Q1 2021 U.S. Foreclosure Market Report, which shows there were a total of 33,699 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — during the first quarter of 2021, up 9 percent from the previous quarter but down 78 percent from a year ago. The report also shows a total of 11,880 U.S. properties with foreclosure filings in March 2021, up 5 percent from the previous month but down 75 percent from March 2020 — the second consecutive month with month-over-month increases in U.S. foreclosure activity.