January 21, 2022

/

Business

QSR Q4 Recap

After recovering from Delta’s effects in October, nationwide dining visits promptly fell once more as the Omicron variant gained ground. Yet, it looks like the impact of each successive wave becomes more and more short-lived, because by December 2021 – as the United States continues to battle its fifth COVID wave – dining foot traffic rose once again to near-2019 levels. So, how are the dining fluctuations affecting QSR visits? We dove into the data for major burger and chicken fast-food chains to find out.

A new report from ForwardKeys reveals the recent lockdowns in China, imposed in response to outbreaks of the Omicron strain of Coronavirus, have cast a long shadow over Chinese New Year travel plans.The latest data, as of 11th January, shows flight bookings for the upcoming holiday period, 24th January – 13th February, were 75.3% behind pre-pandemic levels but still ahead by 5.9% of last year’s dismally low levels.

The financial industry is increasingly concerned with social sustainability, which has resulted in huge interest in Environmental, Social, and Corporate Governance (ESG) roles in this sector. And these positions have been growing most within private equity, where ESG has outpaced growth of other roles since 2020. ESG Hiring Rates have been growing steadily in the last decade. Most notably, hiring rates appear to spike in the aftermath of major social movements.

The holiday season was impacted by declines in Black Friday visits and a push for an extended holiday retail season. Yet, with Omicron raging, it was difficult to understand which declines were defined by potentially permanent shifts to holiday shopping behavior and which were a direct result of COVID. While the role of rapidly rising cases is critical to understanding retail performance over recent months, the extended season concept indicates that we might see stronger visit metrics in the post-holiday period than we would normally expect.

Total construction starts were flat in December with a seasonally adjusted annual rate of $879.3 billion, according to Dodge Construction Network. Residential construction starts gained 4% in December 2021, while nonresidential building starts improved by 3%. Nonbuilding starts, however, declined 12%. Across 2021, total construction starts rose by 12% compared to 2020. Residential starts moved 20% higher, and nonresidential buildings increased 12%. Nonbuilding starts were flat in 2021.

The New Year usually brings with it a slew of diet and fitness resolutions. Along with new workout routines often comes new workout wear and gear. In today’s Insight Flash, we take advantage of the basket-level detail provided by our CE Receipt data to examine how January online sales for companies selling these products usually compare to the rest of the year, and how January-to-date is tracking so far.

In 2021, the world adapted to an ongoing pandemic. New variants kept the world on COVID alert. Industries shifted, rebounded and re-emerged; working styles adapted and consumers doubled down on their mobile-first habits: choosing to spend more time on their mobile phones than watching TV. In this new normal, the app economy continued to prosper. In App Annie's State of Mobile 2022 Report, we reveal another astonishing year for app developers, with revenue, downloads and time spent all soaring to new levels.

Our latest white paper dives into the coffee space, which has been flourishing over the past six months despite the successive COVID waves and even as the wider dining category continues to struggle. We dove into the location analytics data to find out – Who is driving the growth? What brands are the main beneficiaries of this foot traffic increase? Are there any regional differences? And what business opportunities does foot traffic data uncover?

The end of 2021 marked the release of a huge batch of new games, including Final Fantasy XIV: Endwalker on December 7, and the eagerly-awaited Halo Infinite, which dropped on December 8. In addition to new releases from AAA publishers, there was also a flurry of new games from indie studios, including Loop Hero from Four Quarters and Anvil: Vault Breakers from Action Square.

Airline capacity continues to fall as Omicron spreads with 33 million seats now dropped in two weeks to the end of March. The great thing about data is not just the actual numbers but the trends and patterns that emerge; unfortunately, those trends this weekend are probably what we anticipated. England provided their customary two batting collapses inside four days to be “whitewashed” in Australia and global aviation capacity fell again week-on-week.

U.S. single-family rent growth increased 11.5% in November 2021, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The November 2021 increase was more than three times the November 2020 increase, and while the index growth slowed in the summer of 2020, rent growth returned to its pre-pandemic rate by October 2020.

Thanks to the COVID-19 pet-boom, there are more furry-friends in our lives than ever before. In fact, the number of households in the U.S. that have at least one pet is at its all-time high – 70% according to the American Pet Products Association (APPA). It should come as no surprise then that total visits to the top 100 pet food websites jumped nearly 40% year-over-year (YoY) worldwide. Whether it’s because of ease, COVID-19 precautions, or personal preference, website traffic trends show a clear shift in consumer preference towards shopping for common goods online, pet supply brands included.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in December 2021, sales for meal delivery services grew 13 percent year-over-year, collectively. The ongoing pandemic may also be driving more Americans to make their first meal delivery purchase. In December 2021, 50 percent of U.S. consumers had ever ordered from one of the meal delivery services in our analysis, up from 45 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of a late 2020 dip, sales have been gradually recovering since April 2020. Uber sales were up 147 percent year-over-year and Lyft sales were up 117 percent year-over-year in December 2021. The breakdown of December 2021 sales between Uber and Lyft reveals that market share has remained stable, relative to prior months.

In South East Asia, Gojek and Grab remain to be the two biggest ride-hailing mobility players, just like Uber and Lyft in the US. A lot has happened to both companies in Southeast Asia in the past year: Gojek announced its merger with Tokopedia and became GoTo Group; Grab app just finished its bell-ringing ceremony at Nasdaq with the biggest SPAC deal (NASDAQ: GRAB).

After more than a month of unrelenting increases in COVID-19 cases, some regions appear to be passing over the peak. Kinsa data shows that fever incidence in the Northeast began to decrease around the beginning of January, signaling illness is on the decline. Reports of cough, runny nose and sore throat also began to fall this week. Washington D.C., one of the regions hit earliest in the Omicron wave, has already seen the average number of cases decrease every day this week.

Historically, large-balance mortgage loans, known as ‘jumbo’ loans, have had a higher interest rate than conforming loans. However, since mid-2013, the interest rate for a jumbo loan was lower than a conforming loan until June 2020. Low interest rates during the pandemic didn’t benefit homebuyers with jumbo loans the same way as it did homebuyers with conforming loans. While the conforming mortgage interest rate dropped to record lows in 2020, the jumbo-to-conforming mortgage rate spread widened and jumbo loans became relatively more expensive than conforming loans.

The first week of 2022 (2-8 January) was somewhat typical for a first week in January. U.S. hotel industry occupancy dipped to 45.4%, which was eight percentage points lower than what it was in the comparable week of 2019 but eight percentage points higher than a year ago. In STR’s 23 years of daily performance measurement, this most recent week’s occupancy was among the lowest for the comparable time period—better than what was seen in 2000 and 2011 but worse than most all of the early 2000s. The highest occupancy for this week was posted in 2018 at 56.8%, with the next highest at in 2007 (54%).

In this Placer Bytes, we break down the impact of Omicron on the office recovery and check in on the comebacks of AMC and GameStop. When we last checked in on the office recovery in New York City, we discussed the new obstacle caused by the Omicron variant and rising case numbers. And, as expected, the variant did impact the recovery, driving an increased visit gap in December 2021 when comparing visits to the equivalent months in 2019: While visits were down just 35.1%, the gap did increase to 39.7% in December.

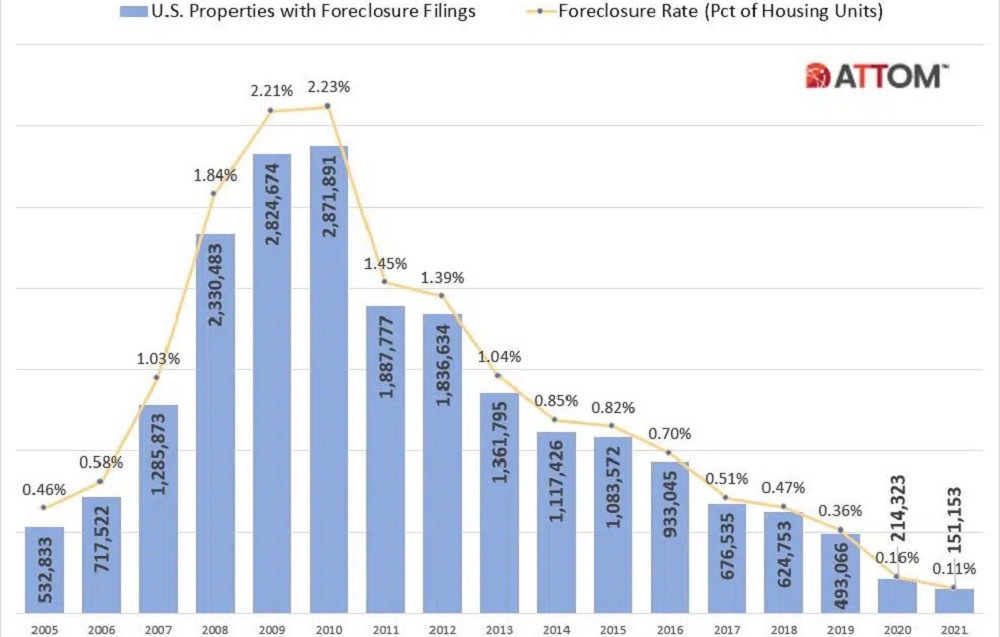

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, today released its Year-End 2021 U.S. Foreclosure Market Report, which shows foreclosure filings— default notices, scheduled auctions and bank repossessions — were reported on 151,153 U.S. properties in 2021, down 29 percent from 2020 and down 95 percent from a peak of nearly 2.9 million in 2010, to the lowest level since tracking began in 2005.