Until recently, luxury shopping in the US was typically concentrated in cities such as New York and Los Angeles. But now, a shift is underway as new wealth centers emerge across the country, including Sunbelt states. We took a closer look at some of these markets to see how demographic changes are creating new retail opportunities and understand what may lie ahead for the brick-and-mortar luxury sector.

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 6.6% (2000=100) in December to 222.2 from the revised November reading of 208.3. In December, the commercial component of the DMI rose 8.4%, and the institutional component ticked up 2.7%. “One of the key construction storylines for 2022 was the return of enthusiasm and optimism in prospects for nonresidential growth,” stated Richard Branch, chief economist for Dodge Construction Network.

HM.B-OME’s most recent sales report for 4Q2022, which ended in November, raised concerns that the Swedish fast fashion company isn’t moving fast enough to keep up with established rivals like Zara and newer entrants like Shein. In today’s Insight Flash, we take advantage of our newly launched Continental European data – tracking spend in Austria, France, Germany, Italy, and Spain – to understand the company’s performance across continents, digging into brand trends and how their higher priced brands are faring around the world.

Last year (2022) marked a significant opening up of retail as the wider landscape enjoyed the first true post-pandemic period. Yet, the upside of finally moving beyond pandemic-driven limitations was quickly offset by a myriad of economic challenges including inflation and high gas prices. Analyzing our Mall Indexes over the past year has shown the impressive resilience of top-tier malls across the three sub-segments throughout the year.

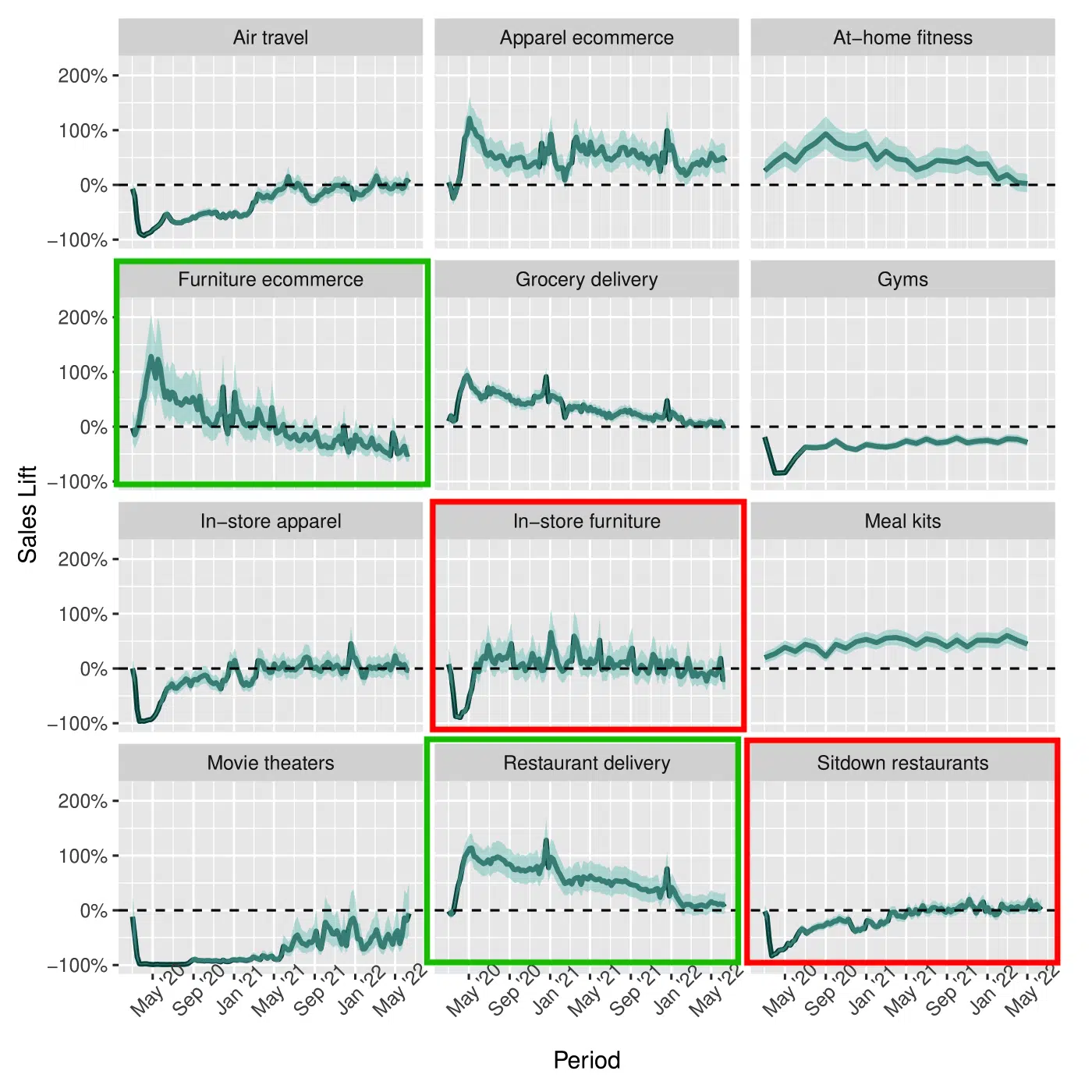

The COVID-19 pandemic disrupted consumer spending patterns in countless ways, driving us away from crowded venues and retail stores towards at-home alternatives such as delivery and e-commerce services. Our paper uncovers the short- and long-term impacts of COVID across 12 categories, revealing not only the effects of the pandemic immediately after its onset, but how those effects have evolved as we move into the “new normal.” We do so by first predicting what category-level activity would have been in the absence of the pandemic in these 12 categories, then comparing what consumers actually spent to this “no-pandemic baseline.”

Welcome to the first Apartment List National Rent Report of 2023. Our national index fell by 0.8 percent over the course of December, marking the fourth straight month-over-month decline. The timing of this cooldown in the rental market is consistent with the typical seasonal trend, but its magnitude has been notably sharper than what we’ve seen in the past. This suggests that the recent swing to falling rents is reflective of a broader shift in market conditions beyond seasonality alone.

Chinese ecommerce giant Shein has experienced a meteoric rise in the U.S. fast fashion market, with its sales and market share overtaking competitors such as H&M, Fashion Nova, Forever 21, ASOS, and Zara during the COVID-19 pandemic. Using U.S. consumer spending data, we analyzed how Shein’s U.S. sales have boomed over the past few years, as well as how other fast fashion companies have fared.

With another Q4 behind us, we dove into nationwide retail foot traffic data and looked at the performance of key categories to understand how the ongoing economic uncertainty impacted this year’s holiday shopping season. Despite the economic uncertainty and ongoing consumer concerns, the 2022 holiday shopping season once again drove consumers to brick-and-mortar stores. Retail visits began creeping up in early November, although early holiday foot traffic was not as strong as it was in 2021, when pent-up demand and inventory concern drove consumers to visit stores significantly earlier than usual.

In an exercise of focused speculation, we kick off 2023 the way we’ve kicked off every year – with a look at the retailers and segments we think are uniquely well positioned for the year to come. The only rule? They can’t have been on the list a year prior, and there must be at least a few “bold” predictions. Last year, we correctly broke down the continued dominance of Target, the uniquely strong positioning for beauty leaders like Ulta and Sephora, and the recoveries for grocery leaders like H-E-B and Costco.

Welcome in to our sixth annual worldwide and U.S. download leader charts, the full year scoreboard of user acquisition winners - the most in-demand apps on the planet. We have 33 top charts below for you to review. Did your company's app make it this year? Before you start, you may want to understand what a mobile app download is, what this metric is good at measuring and what it does not measure.

Over the past year and until very recently, the US labor market has been extremely tight: We saw record job switches and employers struggling to recruit talent. In such a tight market, we expect formal education requirements in job postings to decrease on average, as companies become more lenient towards the qualifications of their workers. This is indeed what we observe in our job postings data: The share of all US job postings requiring at least a bachelor’s degree reached its peak at the start of the pandemic, when most job postings were for essential workers with higher qualifications. Since then, the share of education requirements has plummeted.

For a moment, it seemed like Manhattan and its surrounding boroughs were on the verge of losing their status as America’s economic and cultural capitals. COVID-19 hit the city particularly hard, and a substantial out-migration had some saying that the city would never recover, with a popular narrative claiming that cities were “over” in favor of the suburbs. But it takes a lot more than a pandemic to keep New York down.

Millennials have made up the largest share of home purchase mortgage applications for the last six years. According to the CoreLogic Loan Application Database, Millennial homebuyer share rose to its highest level in 2022, comprising about 54% of overall home-purchase applications (Figure 1). The Millennial home purchase share has steadily increased since 2015, rising about two to three percentage points per year. At the same time, Gen Z — the generation succeeding Millennials whose members were born after 1997 — is entering the housing market. This year, the cohort comprised about 4% of overall home-purchase applications.

Sports advertising has been around for decades, but thanks to advances in out-of-home advertising technology, advertising during live sporting events has recently become more accessible to brands and more engaging to consumers. But how can companies decide which types of events to sponsor? To help provide an answer to this question, we dove into the location intelligence data for some of the biggest sporting matches held at Madison Square Garden in 2022 to understand how different types of events draw different crowds – and what this means for sponsors and advertisers.

As 2022 comes to a close, this week we’re revisiting the biggest workforce trends of the year. Here is a collection of our most powerful insights. The labor market was strong throughout 2022, but towards the end of the year, layoffs became a major concern especially with high-profile companies such as Amazon, Meta, and Twitter announcing large-scale layoffs. Using individual-level data, we have identified which roles are most at risk of being laid off.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through October 2022. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next. The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

Super Saturday – the last Saturday before Christmas – draws crowds of last-minute gift buyers to retailers across the country. We dove into the data to understand how this day fit into the wider 2022 holiday shopping season and how consumer concern over rising prices impacted this year’s performance. Super Saturday presented a continuation of a trend seen in recent months — a more extended holiday season limits the peaks of any specific day. There is even more time for shopping ahead of the holiday and ample evidence that the lack of major doorbuster deals limits the urgency on any specific day.

In 2022, Black Friday spending increases across retail far surpassed visitation increases. When analyzing this major shopping holiday with data from PlaceIQ, we can see larger basket sizes, higher in-store conversion rates, and pent–up demand for savings drove these spikes. Black Friday 2021 was very successful compared to 2020; traffic and spend rebounded greatly. This year, we didn’t see the same leaps and bounds, but it was another successful weekend for retailers. Covid is no longer holding us back, but inflation and macroeconomic factors keep things grounded from a year-over-year perspective.

****

Messaging regarding the recovery of the business travel segment has been mixed. Since the onset of the COVID-19 pandemic, a number of the industry’s leading voices have claimed that business travel will never fully recover due to changing working habits – namely remote working and digital nomadism; company cost reduction; and a growing awareness of environmental issues.

San Francisco is one of the country’s oldest and most storied cities. This anchor of the Bay Area has witnessed the Gold Rush, the Summer of Love, and the hi-tech revolution. Now, a shift is taking place. During COVID, the city had one of the highest outbound migration rates in the country, perhaps due to its high concentration of remote-work-friendly companies, rising cost of living, and shuttering of several major offices. And while the trend has begun to reverse, the populations now moving into San Francisco are not quite the same as those who left.