As some markets begin opening back up, we’ve seen early indications of industries on the road to recovery. We’ve also seen signals on what consumer behaviors are here to stay. We’ve taken a look at the mobile app categories experiencing the biggest growth in Q2 2021 compared to pre-pandemic times (Q4 2019) by downloads, consumer spend and time spent — an indication of which apps are in demand, most used and most valued.

Prime Day had yet another huge year in 2021, but while the eCommerce success is almost a given, the offline effects were certainly in question this year. In recent years, Amazon’s Prime Day has had a significant impact on offline retail, with competitors like Best Buy, Walmart and Target driving strong results in July 2019 and even seeing a bump in October 2020. We dove into these competitors, Whole Foods, and even Amazon warehouses to see how 2021’s Prime Day impact was felt in physical retail.

Another Amazon Prime Day has come and gone - and we’ve been digging into how the sales performed for the fourth consecutive year. This year, like last, Amazon kept the official Prime Day dates under wraps until a few weeks before the event, likely to make it more difficult for their competitors from planning their own sales on the same dates. As with years prior, Amazon Prime Day led to incredible sales for the e-commerce giant, with over $5.6 billion in sales within the first 24 hours.

The idea of shops anchored by a price point is an international phenomenon, with Dollar Stores opening up more new locations than any other retail concept in the US and One Pound Shops popular in the UK. In today’s Insight Flash, we compare these “Dollar” Stores across both geographies. In the US, Dollar Store Growth outpaced the larger Discount/Club industry throughout 2019 and 2020. Since February, however, that growth has slowed and “Discounters” are seeing higher spend growth.

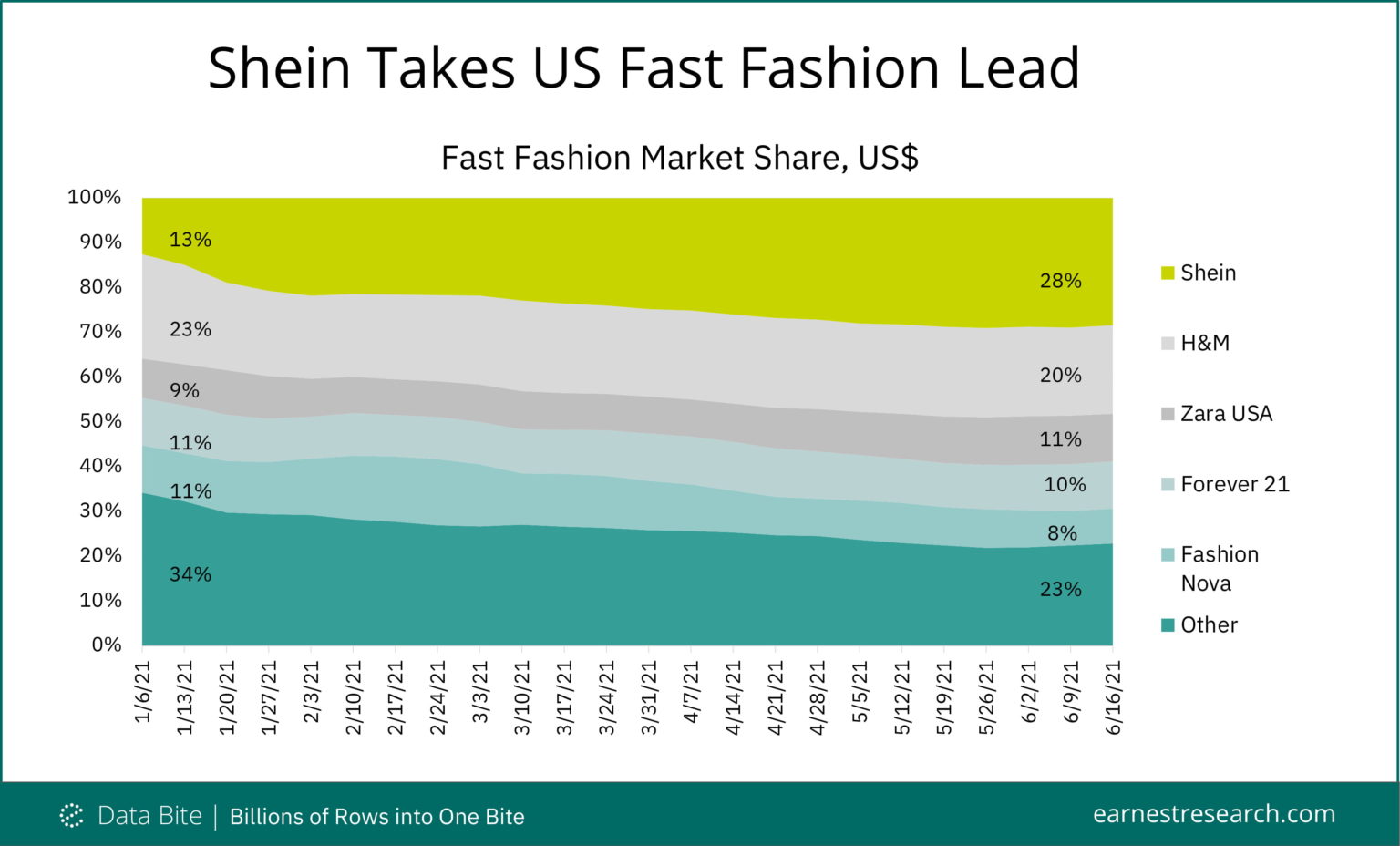

The Chinese brand loved by Gen Z and rumored to be exploring an IPO — Shein– is now the largest Fast Fashion retailer in the US by sales, only two months after displacing Amazon as the top e-commerce app downloaded in the US. Market share data from Earnest shows that Shein began 2021 with 13% of total Fast Fashion sales, trailing traditional leader H&M. Since January, Shein continued to gain share and now leads with 28% of the Fast Fashion market, with Zara the only other brand growing share during that period.

Throughout the pandemic there were certain sectors that enjoyed a particularly strong showing, like [Home Improvement](https://www.placer.ai/the-square/quarterly-indexes/home-improvement/) and [Grocery](https://www.placer.ai/the-square/quarterly-indexes/grocery/). But with the retail recovery continuing at a strong pace, we dove into three segments that could see a better than expected Back to School season. While beauty brands may have taken a hit during the pandemic, the recovery period has been especially kind to the segment. Ulta saw monthly visits up in four of the first five months of 2021 when compared to the equivalent periods in 2019

We recently shared how our data is providing early and predictive signs that growth in Food Delivery spend remains elevated. While spend remains relatively high versus pre-pandemic levels, we can look at a number of underlying customer metrics to help unpack the reasons for the improvement. This week we look at how customer cohort analysis enables a deeper and more accurate understanding of customer behaviour trends over time, relating to retention, spend frequency, order size and customer spend value.

The pandemic-driven transformation to working remotely was one of the biggest shakeups of the past year, the effects of which we are still witnessing today. With just over half the US population now vaccinated and many local economies reopened, the nature of remote work is top-of-mind: are employees returning back to the office, or will remote work be a sustained new reality in the post-pandemic workforce?

Comscore (NASDAQ: SCOR), a trusted partner for planning, transacting, and evaluating media across platforms, today announced very positive news for theatrical exhibition in France, with our exclusive data demonstrating how the recovery of the movie theater business is taking shape in the international arena. Key Comscore box office information show that France enjoyed 8.5 million admissions in one month following the reopening of the cinemas on May 19th.

As outdoor activities continue to grow in popularity, stores selling hiking and camping gear are preparing for a busy summer season. In today’s Insight Flash, we dig into performance among the top players in the Outdoor space, focusing on changes in market share, how much of the business is driven by the most loyal customers, and what average transaction size implies about product mix. Spend growth in Sporting Goods has been booming in 2021. Spend in January was up almost 50% y/y, followed by almost 30% spend growth in February.

Once upon a time in the not-so-distant past, Nike and Adidas were enjoying what seemed to be an unbreakable bond with their Chinese fans. Both brands have very popular flagship products with loyal followers, such as the Adidas Yeezy, Nike Air Max, Nike Air Jordan. But this seemingly unbreakable bond started to crumble almost in a split second when the two companies released a sensitive statement in March of this year, leading to an overnight boycott of the brands. A crushing, bombshell “break-up” neither Adidas nor Nike knew was coming

In this Placer Bytes, we dive into Torrid and its peers and take a look at the pet supply sector’s recovery. Plus-sized retailer Torrid Holdings Inc. recently filed for an Initial Public Offering, two years after withdrawing its previous IPO filing. This is huge news for Torrid, and can signal good tidings for the plus-sized clothing sector as a whole. Since Torrid was acquired by Sycamore Partners in 2013, and the same private equity firm (through affiliate Premium Apparel LLC) recently acquired additional plus-size retailers Lane Bryant and Catherines

For some seasonal industries, the COVID-19 pandemic has spurred increased demand outside of the typical busy season. This is particularly true for the direct-to-consumer (DTC) flower industry—including flower subscription box companies—which experienced strong sales growth throughout 2020 and early 2021. Consumer transaction data reveals that sales for DTC flower companies were collectively 28 percent higher in 2020 than in 2019, and 2021 year-to-date sales as of May are 10 percent higher than the same time frame in 2020.

The wider retail recovery is well underway, but a more nuanced perspective is necessary to properly appreciate the relative rebounds of specific brands. Some sectors saw significantly greater challenges, while others benefitted from the unique retail circumstances driven by the pandemic. We dove into the data to uncover some of the more impressive retail rebounds. The ‘death’ of the department store was an oft-reported trend before and during the pandemic. And while the sector has certainly experienced its fair share of challenges.

In this Placer Bytes we dive into the dining category with check-ins on Chipotle and Darden’s Restaurant portfolio. An emphasis on digital enhancements seemingly helped Chipotle weather the COVID-storm, but how is the brand performing post-pandemic? When comparing monthly visits to 2019 for one of America’s most popular chains, we see visits nearing pre-COVID levels While visits were down 22.1% in January, that visit gap shrunk to just 4.5% for March amid lifted restrictions across the dining category.

Mask mandates have been a beast for the beauty industry, especially when combined with stay-at-home orders giving shoppers fewer opportunities to glam up. With restrictions continuing to lift in the US and UK, we use our cross-continental transaction dataset to assess how the beauty recovery is progressing in both markets. In today’s Insight Flash, we dig into channel trends for the industry, changes in top brands, and which demographics are leading the recovery.

Whole Foods and Trader Joe's compete for grocer foot traffic in the premium grocery store category in San Francisco (SFO). Whole Foods operates eight stores in the area, while Trader Joe's operates six stores. They each offer prepared foods and options from local farmers as well as convenience and traditional grocery industry services. In each case, the geographic disbursement of each grocery store is more dense in the city and less so away from the urban center.

Due to the COVID-19 pandemic, the federal income tax deadline for individuals was extended for the past two years, to July 15 in 2020 and May 17 in 2021. Consumer transaction data reveals that, consequently, sales for the tax prep industry were more spread out in 2020 and 2021 compared to previous years, resulting in smaller-than-usual sales spikes the week of and week before Tax Day. However, TurboTax continues to lead the tax prep industry and has steadily gained market share from its competitors over the past three tax seasons.

As shoppers slowly emerge from months at home in their sweatpants, luxury brands are grappling with how to sell watches and purses in a post-pandemic world. Burberry reported its sales were down 48% in Q1 2020 — not surprising, considering that stores around the world were closed to stop the spread of COVID-19. Likewise, Gucci sales slid 22% in the first quarter of 2020 in spite of a boost from online shoppers. So far in Q1 2021, luxury goods seem to be regaining their pre-pandemic sparkle.

Founded in 2012, Southeast Aasia’s super app Grab is seeking an IPO through SPAC merger, which reportedly might become the biggest-ever U.S. equity offering by a South-East Asian company. Grab provides essential services including rideshare, food delivery, hotel booking, on-demand delivery, and payment services with its namesake mobile application. It now serves 670 million people across Singapore, Indonesia, Malaysia, Thailand, Philippines, Vietnam, Cambodia and Myanmar.