In more ways than have yet to be realized, the novel coronavirus (COVID-19) pandemic has changed the day-to-day lives of nearly every consumer the world over. This is especially true for office workers with traditional nine-to-five day jobs, where in-person meetings were the standard and the dress code called for something more formal than leisurewear.

Consumers are looking for activities to help them stay occupied and healthy as COVID-19 necessitates social distancing. As a result, a number of outdoor categories have experienced explosive growth, our Retail Tracking Service data shows. Typically, June is a critical selling month for the outdoor industry. In this article, we explore five outdoor activities consumers have flocked to and analyze how June 2020 dollar sales stacked up to last year.

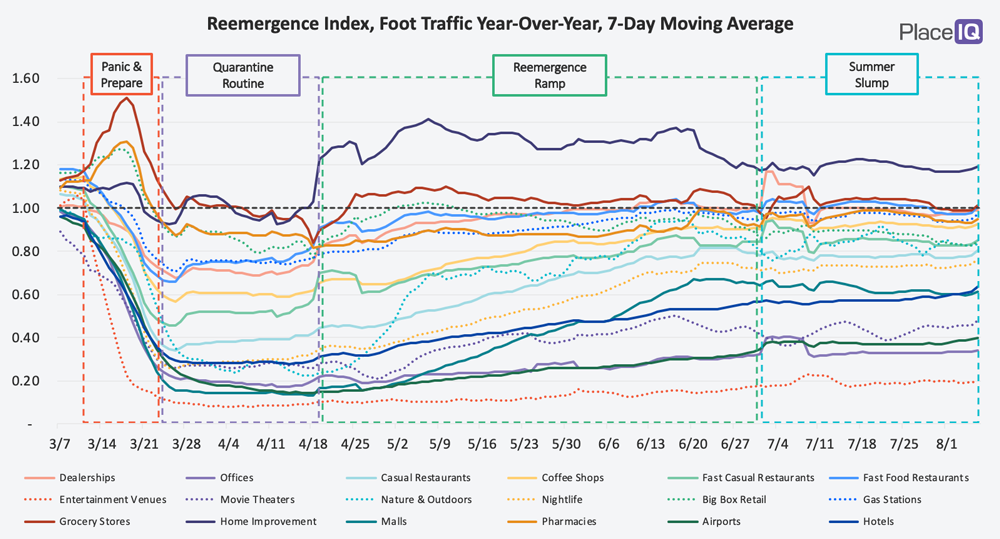

Time moves differently during a Pandemic. The news is constant, cramming what would have been a week’s worth of content into a single day. But at the same time, here we are in August. Time both crawls and runs in the era of COVID. Reviewing this week’s foot traffic category indices, we were similarly struck by how long the Summer Slump has persisted. Here we are, in August, still in the thick of sustained, flat traffic.

When we received stay-at-home orders back in March, the app market, and social media in particular, got a huge boost. Facebook, WhatsApp, Messenger, Instagram, TikTok, Snapchat and Twitter all broke their respective records for time spent in-app, globally, in March 2020. I, for one, spent too many hours scrolling through TikTok– I even made it to "beanTok" (if you know, you know). Anyway, more people than ever were tuning in to watch the latest trends, AND more people than ever were contributing to the content. How do I know?

The overall distribution of consumer traffic (inclusive of all sectors) during COVID has seen morning and evening activity slow, picking up by midday. Midday (11am-3pm) share of traffic has increased about 400 bps to 33% since the middle of March. As a result of this shift to the middle of the day, weekday visits to restaurants now more closely align with visitation patterns previously seen during weekends.

The first half of 2020 was like no other in modern history. Physical lockdowns, food supply shortages, and a shift towards working from home are just a few examples of the impacts of the COVID-19 pandemic on millions of people worldwide. In this blog post, we revisited the Digital 100 list of most visited sites across key industries in the United States and look at how some of the best-in-class brands are paving the way as industry leaders.

Paris is the first major European city to see residents’ population mobility approach pre-lockdown levels, as Huq’s high-frequency geo-data shows that the cities that exercised most restraint under lockdown have been the fastest to demonstrate population movement increase. Data from Huq’s Daily Distances Indicator, which measures the the extent to which people travel about their cities, shows that while Paris has seen a significant increase over the last few weeks, cities that were less restricted during lockdown have been slower to recover – or even show a decline in resident mobility.

TikTok is a big deal in business and in pop culture. You already know that it, along with 59+ other Chinese published apps, has been banned in India and that a ban or sale of TikTok is likely to take place in the United States. The reasons why this is all taking place can be as complicated or as simple as you want them to be depending on who you talk to, but that’s not what this blog covers. We cover data trends, market shares, etc.

COVID-19 and quarantining forced most people to alter their fitness routine. While some mobile fitness apps managed to get traction with consumers, the reality is that commitment to a new habit is difficult, as illustrated by the data. Based on a sample of 11 popular mobile fitness apps, data from Apptopia show that COVID-19 had a significant impact on their rate of downloads. In January there was a 60% increase in downloads, totaling 3.37 million in just one month.

People are rediscovering the great outdoors with a new enthusiasm that we did not see in our data last summer. Why? Entertainment options may be closed for now but you can’t close the great outdoors. It’s giving people something to do while they can’t do anything.

As the presidential campaign ramps up, there has been discussion about how different social platforms are managing political ads. After the 2016 election, there is a lot of debate surrounding the role of social media in free speech, fact checking and its role in democracy. Each social platform has a different stance. Here’s the latest.

Bike shops sold out quickly, and cyclists seemed to be everywhere during May’s widespread stay-home orders. But were Americans actually cycling more? Our analysis provides cycling facts instead of anecdotes about cycling during COVID. And some of the results surprised us.

It has now been four full months since the World Health Organizations (WHO) declared the coronavirus a global pandemic and the digital retail category continues to fluctuate. As COVID-19 forced both kids and adults to stay at home, we initially saw surges in visitation to retail categories like “Home Furnishings” and “Consumer Electronics.”

You don’t need a data analyst to tell you people are going outside a lot more these days. Camping sites are nearly impossible to come by. You can’t find an RV to rent. Bikes are sold out everywhere. These trends illustrate a pattern we’ve observed during COVID: if an activity is nearby, safe, and cheap people will flock to it. Beaches and forests are often within driving distance, outdoors, and (generally) lend themselves well to social distancing. This is a summer of road trips.

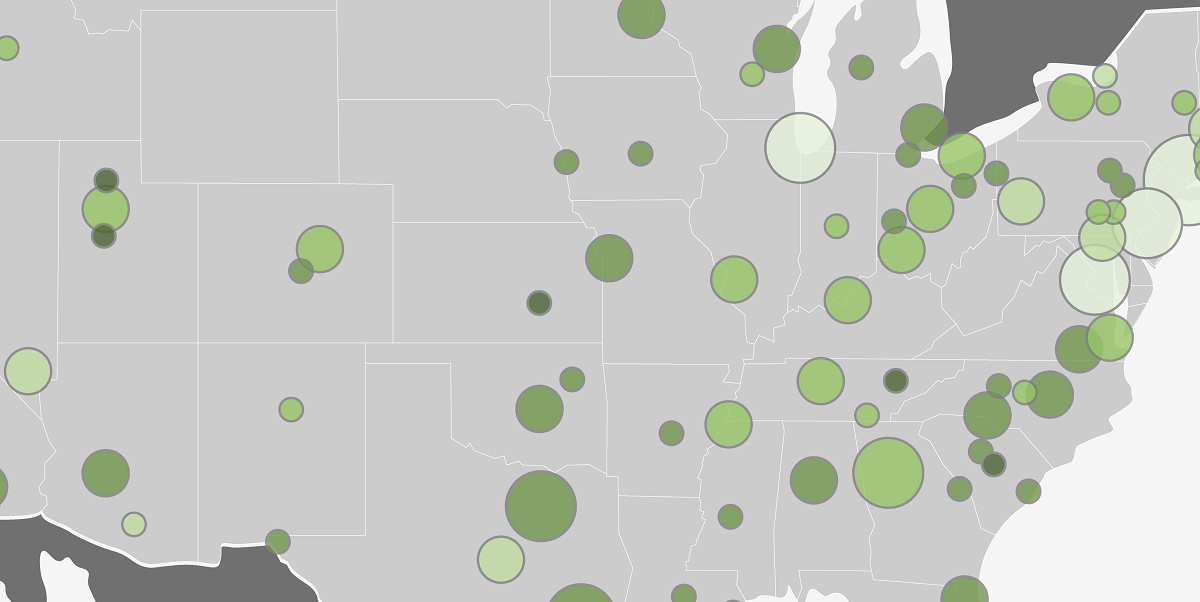

While the coronavirus’s short-term impact on the housing market has already started to materialize in the form of softening rents, the long-term implications for the urban landscape are still far from certain and being hotly debated. One of the biggest outstanding questions is the degree to which COVID will shift preferences away from cities. Over the past several months, many consider the close quarters associated with urban density to be a liability, and many of the local amenities that city-dwellers love are shut down in compliance with social distancing requirements.

We’re not quite ready to call it a new phase in our quarantine life, but the Reemergence Ramp has largely plateaued in recent weeks. The change kicked in around June 20th, as we saw regional upticks in cases throughout the south and west, and has persisted through some holiday spikes. We’ll dive into the slowdown of traffic in more detail below.

Many states are starting to pause or turn around their reopening plans—indicating that even when businesses start to feel optimistic, things can shift quickly. This makes planning trade shows and large events difficult. Venues, travel reservations and speaker commitments have to be dependable. Due to instability, hopes of in-person events returning this year are looking grim. What does this mean for event organizers and sponsors?

With Covid-19 changing the ways in which U.S. audiences are using online tools for socialization and work, we are also seeing large shifts in engagement with conferencing and collaboration tools. This blog post examines trends in collaboration platforms to find insights for the industry. It is estimated that American workers typically spend 220 million minutes per month just in meetings.

Gyms were one of the first sectors to close among the spread of the pandemic, and rightfully so. But, as the economy begins to reopen across the country and gyms are permitted to open again, how will they perform? With most people working from home and creating their own “at-home” gyms, will the sector be able to bounce back?

Footfall to Restaurants and Pubs in the UK has climbed to a third of pre-lockdown levels, with high-frequency geo-data showing how attendance has continued to rise following ‘Super Saturday’ but remains low overall. According to Huq’s Index for Restaurants and Pubs, footfall reached a new high of 33% of ‘normal’ levels on Friday (10 July).