The 2020 pandemic brought various forms of disruption, hardship and human tragedy. Governments and businesses around the world had to rely on trial and error to find the best response. There have been some high-profile corporate winners – companies that support home working, online delivery and logistics providers, packaging firms, some pharmaceuticals. But Covid has highlighted economic and social inequalities, and added “health poverty” to the lexicon.

In this Placer Bytes, we dive into the Q4 performances of McDonald’s and Whole Foods and one element that prepared Amazon for a stellar Q4. McDonald’s is among the best-positioned brands in 2021 with a high value offering that should be particularly appealing in a year likely to be defined by continued economic uncertainty. Whole Foods was among the few to face real and tangible struggles.

Another dire week for global aviation with more lockdowns, sudden suspensions of services and the threat of having to stay in a quarantine hotel at Heathrow looming for anyone brave enough to want to enter the United Kingdom. Can things get any worse; probably but let’s hope not and try to stay positive.

Mobility levels in the big northern cities failed to recover to their pre-pandemic levels following lockdown in the summer, in contrast to their southern counterparts new data shows. Footfall in cities across the North and South dropped to just above half of their usual levels during the first lockdown recovered over a period of 8 weeks, according to Huq Industries’ high frequency mobile data.

Few industries have been impacted more severely by the COVID-19 pandemic than Travel & Leisure. According to Credit Benchmark, which captures the credit risk views of over 40 of the world’s leading financial institutions, 44% of companies in the global Travel & Leisure sector fell from investment grade to high yield between March and November of 2020. That means the consensus credit risk scores for these so-called ‘fallen angels’ fell below the bbb- threshold at some point during the pandemic.

As millions of Americans sheltered in place and shifted to working from home and remote learning during the COVID-19 pandemic, ongoing research from Comscore (Nasdaq: SCOR), a trusted partner for planning, transacting and evaluating media across platforms, found that overall in-home data usage levels throughout 2020 remained significantly higher than in 2019.

2020 was to be the year of Climate Action around the world by a wide range of organizations; at least that was the vision until COVID-19 caused a global pandemic. However, “2020 will likely be one of three warmest years on record,… Ocean heat is at record levels. Extreme heat, wildfires and floods, as well as a record-breaking Atlantic hurricane season, have affected millions of people.

Looking at visits to Starbucks overall in 2020 saw a tremendous start with visits up 12.3% on average in January and February year over year. And post-shutdown, the brand was recovering strongly before being hit hard by a resurgence of COVID cases during an especially critical time. In 2019, Black Friday and Thursday, December 26th marked the two highest-visit days by far for the brand nationwide, and November and December were the two strongest months for visits overall.

As the COVID-19 global pandemic has created havoc in the global economy, millions of American homeowners are struggling to keep up with their mortgage payments. As a result, the mortgage delinquency rate has soared. The CoreLogic Loan Performance Insights Report analyzes mortgage performance for all home loans. Based on this report, the serious delinquency rate for October 2020 was 4.1 percent, representing a 2.8 percentage point increase compared with October 2019.

As we look back on 2020, we can reflect on a year that felt more like three than one. 2020 ripped up all previous forecasts. Thanks to Covid-enforced lockdowns, all the emerging mobile behaviors that had been bubbling away suddenly exploded. Niche mobile habits went mainstream. Three years of projected changes were squeezed into one.

EU residents are returning to their places of work after the Christmas break but UK staff appear more constrained, less enthusiastic – or both. The latest data from Huq Industries puts European office workers 7% ahead of their UK counterparts in the 20 days since the year began, and that gap is widening still.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. While rideshare sales have been gradually recovering over the past several months, November marked a decline for the first time since April. Sales declined even further in December, with Uber sales down 71 percent year-over-year and Lyft sales down 73 percent year-over-year.

With COVID-19 vaccinations just beginning, alongside a further wave of the virus spreading across the globe, Earnest partnered with Fable Data, a European transaction data provider, to assess consumer spending trends across the US, UK, and Germany. We have compared performance across countries and within various sectors since the start of the pandemic, and assessed a ‘current-state-of-affairs’ (Dec ‘20) as consumers exit the holiday season of a global pandemic.

The fourth quarter was not good for restaurant sales; each month posted worse same-store sales growth than the previous month. By December, same-store sales growth fell to -13.3% year-over-year, the worst month for the industry since July. Same-store traffic growth for the month was -18.6%, also the worst performance in the last five months.

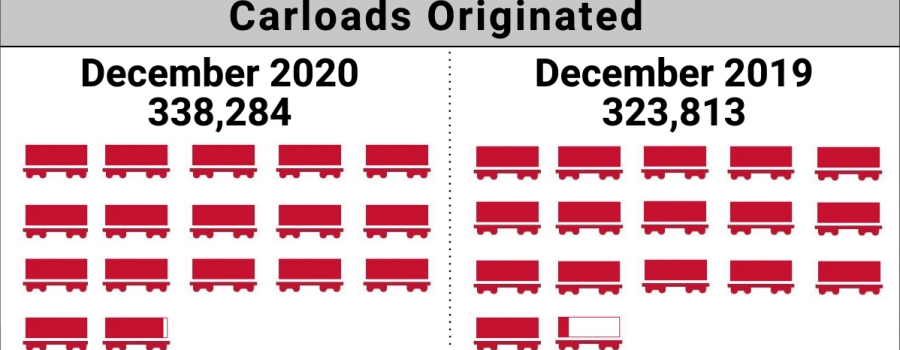

The number of carloads moved on short line and regional railroad in December 2020 was up compared to December 2019. Carloads originated increased 4.5 percent, from 323,813 in December 2019 to 338,284 in December 2020. Grain led gains with a 46.4 percent increase. Grain Mill Products was up 18.0 percent, and Waste and Scrap Materials and Stone, Clay and Glass Products increased 16.3 and 10.5 percent respectively.

Total construction starts lost 5% in December, falling to a seasonally adjusted annual rate of $784.3 billion. Nonresidential building starts fell 11% during the month, while nonbuilding starts were 5% lower. Residential starts were essentially flat over the month. Starts were lower in three of the four regions in December; the South Central was the only region to post an increase.

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 7.4% in December after rising 3.2% in November. In December, the index equaled 120 (2015=100) compared with 111.7 in November.

2020 was a whirlwind of a year for the CMBS and commercial real estate segments measured by unprecedented changes dictating how we live and do business, unlike any other economic disruption we’ve seen before. Read on for the winners, biggest surprise trades, biggest rebounds, bright spots among the distress, the "unknowns," and more.

As we head into 2021, we decided to carry out a deep dive into some of the biggest players in the UK supermarket business, namely: Tesco (TSCO), Morrisons (MRW), Ocado (OCDO), Asda (owned by Walmart, WMT), and Sainsbury’s (SBRY).

Fifty-two weeks ago, we wrote a short blog highlighting some of the regional capacity changes in Asia as a result of a small, localised outbreak of a new virus. At the time we thought that there could be some impact on global aviation, perhaps like a SARS or Ebola time impact. We were so wrong! A year later and we are reporting on what has become the single most destructive event in aviation history; it has to end soon, surely?