The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through September 2021. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

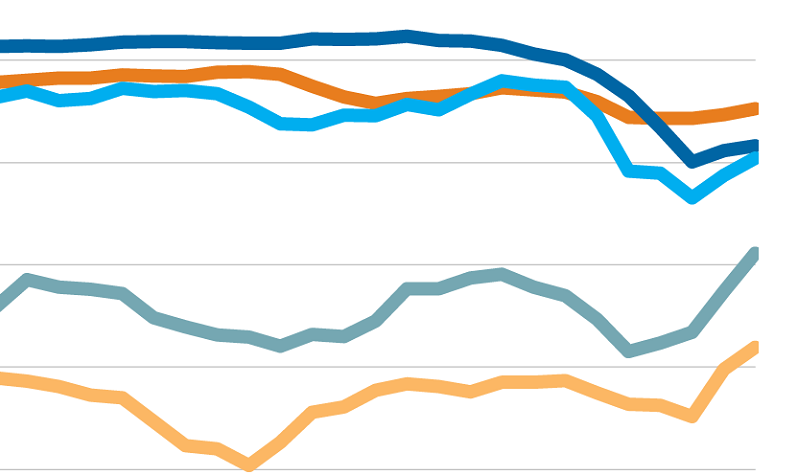

In September 2021, 3.9% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.4-percentage point decrease from September 2020 according to the latest CoreLogic Loan Performance Insights Report. Comparatively, the overall delinquency rate in September 2019 was 3.8%. This is the closest the overall delinquency has been to the pre-pandemic rate since its onset.

It is easy to say that 2021 was the hottest real estate market ever. According to the S&P CoreLogic Case-Shiller Home Price Index (HPI), annual U.S. appreciation rates from April to September have been at their highest since the inception of the index. March through June produced the highest ever monthly appreciation rates, and CoreLogic’s public records data shows 2021 is easily on pace to be the first year where total residential housing transactions will exceed $2 trillion.

The CoreLogic Homeowner Equity Insights report, is published quarterly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes negative equity share and average equity gains. The report features an interactive view of the data using digital maps to examine CoreLogic homeowner equity analysis through the third quarter of 2021. Negative equity, often referred to as being “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth.

Soaring home prices over the past year boosted home equity wealth to new highs through Q3 2021. The amount of equity in mortgaged real estate increased by $3.2 trillion in Q3 2021, an annual increase of 31.1%, according to the latest CoreLogic Equity Report . The average annual gain in equity was $56,700 per borrower, which was the largest average equity gain in at more than 11 years, and more than three times the gain from a year earlier.

Access to mortgage credit in underserved areas has always been one of the major concerns for housing policy experts and community activists. In previous years, Home Mortgage Disclosure Act (HMDA) data has been used to assess at what level the mortgage service needs in these communities are met. Though HMDA data is the most comprehensive publicly available detail on home mortgage loans across the U.S. residential mortgage market the data is dated when released only on an annual basis.

National home prices increased 18% year over year in October 2021, according to the latest CoreLogic Home Price Index (HPI®) Report . The October 2021 HPI gain was up from the October 2020 gain of 7.4% and was the highest 12-month growth in the U.S. index since the series began in 1976. The increase in home prices was fueled by low mortgage rates, low for-sale supply and an influx in homebuying activity from investors. Projected increases in for-sale supply and moderation in demand as prices grow out of reach for some buyers could slow home price gains over the next 12 months.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through October 2021 and forecasts through October 2022. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

In May 2021, 1-in-5 purchase-home loan applications had an appraisal gap (meaning the estimated value in the appraisal is lower than the agreed upon contract price) that averaged 4.5% below buyer’s offer price. The frequency of an appraisal gap has since closed quickly after rising rapidly between January and May 2021. The decline in the appraisal gap occurred amid the fastest-rising annual home prices on record but weakening month-to-month price momentum.

ATTOM’s just released Q3 2021 U.S. Residential Property Mortgage Origination Report shows that overall mortgage lending was down 8 percent in Q3 2021, marking the second straight quarterly decline and the first time in more than two years that total lending decreased in two consecutive quarters. The Q3 2021 loan origination analysis conducted by ATTOM noted the quarterly decrease in mortgage lending was the first time in any year since at least 2000 that lending activity declined in both the second and third quarters, typically peak buying seasons.

The majority of global property markets registered improving capital liquidity at the end of the third quarter, the latest _RCA Capital Liquidity Scores_ report shows, an indication that the recovery from the Covid-19 pandemic is gaining momentum. Liquidity increased from a year prior in 90 of the 155 markets covered by the analysis, up from 55 at midyear and 29 in the first quarter. However, on average, liquidity is not yet back at pre-pandemic levels.

Commercial property investment in Japan improved slightly in the third quarter of 2021, with deal volume reaching 862 billion yen ($7.6 billion), 9% higher than the same period last year. Office transactions in Tokyo constituted about half of total deal activity in the quarter. According to Real Capital Analytics data, third quarter volumes for the apartment, industrial and retail sectors each sat at a little over 100 billion yen. Office investment volume totaled well over triple this amount at 465 billion yen.

Welcome to the December Apartment List National Rent Report. Our national index increased by 0.1 percent during the month of November, the lowest month-over-month growth rate of 2021. The pace of rent growth has been cooling rapidly for the past few months, but growth is still outpacing pre-pandemic trends, with the slight uptick this month coming at a time of year when seasonality normally causes prices to dip. Since January of this year, the national median rent has increased by a staggering 17.8 percent.

More money is being spent on real estate than ever before. Through the second quarter of 2021, the total value of residential real estate transactions was over $600 billion for the third time in the past year, for a total of $750 billion. It has been steadily on the rise since 2010, but has recently taken a particularly sharp upswing. Recent totals exceed the previous peak of $568 billion in Q3 2005.The value of transactions has skyrocketed, despite sales count, continuing a relatively normal growth trend.

Investors around the world are fretting over recent spikes in inflation. The OECD reported that in the G20 countries alone, the pace of inflation jumped higher than the pre-pandemic pace to an average 4.6% rate through September of 2021. Worried about the implications for their portfolios, institutional investors are turning to commercial real estate as a hedge. Real estate can outperform inflation, but not always. Inflation can distort investment decisions. Rather than focusing on the fundamentals of a project, inflation can lead investors to underwrite above-average income growth.

The new construction pipeline, despite the various supply and labor challenges present in the market, has continued to deliver units this year to an extent greater than in recent years. Through October, more than 300,000 conventional new units have been delivered, up from just over 260,000 new units in the same portion of both 2019 and 2020. While the preexisting upward trajectory in average construction time has continued and intensified, the average lease-up duration has declined for the first time in more than four years.

U.S. single-family rent growth increased 10.2% in September 2021, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The September 2021 increase was nearly four times the September 2020 increase, and while the index growth slowed last summer, rent growth is running well above pre-pandemic levels when compared with 2019.

Global commercial real estate price growth accelerated in the third quarter of 2021, with the Asia Pacific region leading price gains, the latest _RCA CPPI Global Cities_ report shows. The RCA CPPI Global Cities Composite Index climbed 7.3% in the third quarter from a year ago, up from the 6.1% year-over-year pace seen the prior quarter and the 2.5% rate seen in the third quarter of 2020 amid the pandemic’s challenges.

The latest release of the S&P CoreLogic Case-Shiller Index indicated that home price growth remained strong in August, clocking in a 19.8% annual growth, same as the month prior. Nevertheless, after 10 months of double-digit annual home price growth nationally, home price acceleration is showing signs of reprieve. In addition to the national growth rate stalling, the 10-city annual growth slowed from 19.2% to 18.6%, and the 20-city annual rate was down from 20% to 19.7% in August, non-seasonally adjusted.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through August 2021. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.