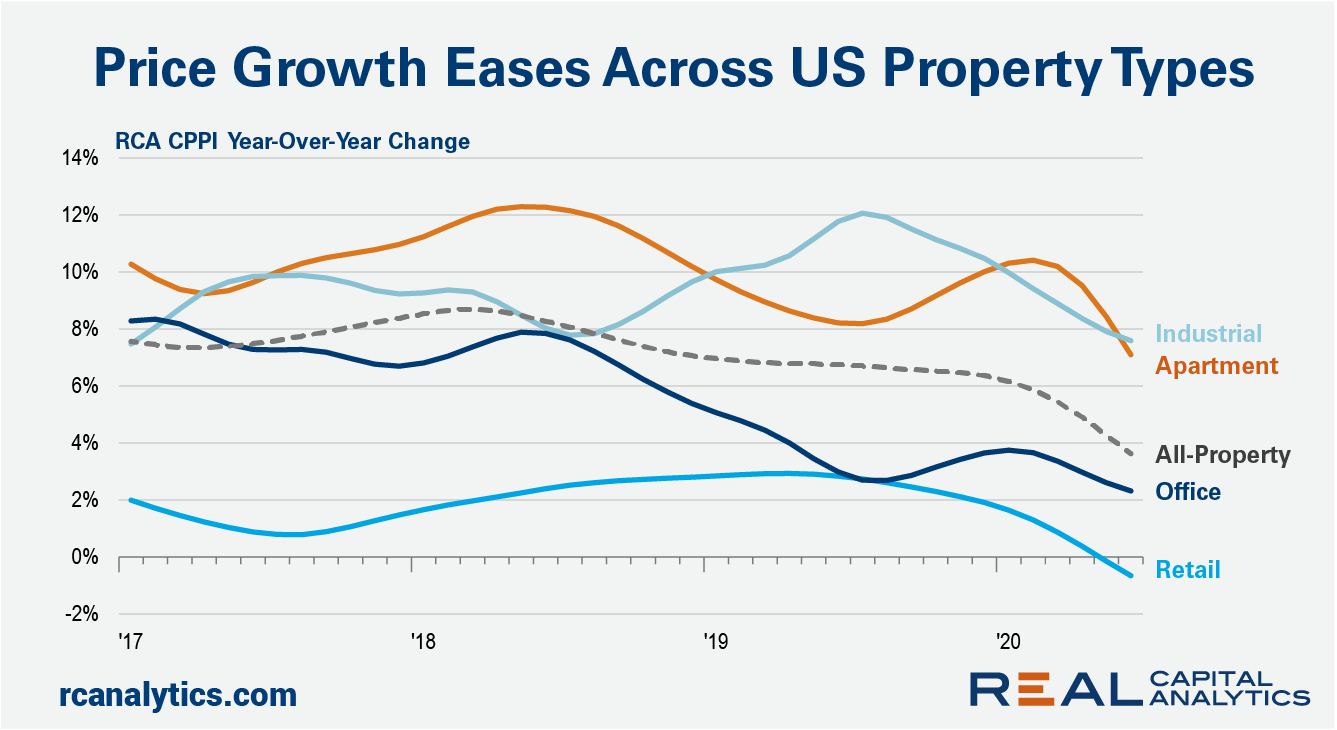

Commercial property price growth slowed in June across all U.S. property types, dragged down by the continued impact of the health and economic crisis. The US National All-Property Index was flat in June from May and gained just 3.6% year-over-year, the latest RCA CPPI summary report shows. Retail prices fared the worst of the sectors, dipping 0.3% from May and down 0.7% over the past year.

Bike shops sold out quickly, and cyclists seemed to be everywhere during May’s widespread stay-home orders. But were Americans actually cycling more? Our analysis provides cycling facts instead of anecdotes about cycling during COVID. And some of the results surprised us.

Earnest continues to monitor the consumer response to the resurgence of coronavirus cases across parts of the U.S. In this refresh, we take a look at spending and foot traffic in the first half of July across states and categories, and drill-down into Restaurant and Home categories in Florida and New York. Additionally, we provide a brief check-in on Amazon’s delayed Prime Day, and review how alcohol sales are performing in light of the resurgence.

The US faces a deep coronavirus crisis as new cases are surging to record highs in many states. Texas was one of the first states to reopen in May with restaurants, retail stores, malls and even theaters to allow to reopen at limited capacity. Looking at the mid-May data, the foot traffic in Texas at Advan’s consumer discretionary index was down about 35% compared to the pre-COVID era and kept increasing through mid-June, adding a 15% increase to -20%.

Kinsa’s data show that illness transmission accelerated in many states over the past few weeks, and this trend is now translating into growing COVID-19 cases in states like Louisiana, South Carolina and Tennessee. But two of the states that are on our watchlist – Pennsylvania and Michigan – have not yet seen significant growth in cases. Our data suggest that may be about to change.

Overall earnings were up 3% from May ($10.2B) and 9% over June 2019 ($9.6B). Both PC and console revenue were down from their 2020 peaks set in March. This was offset by growth in mobile revenue, which hit an all-time high. Mobile game spending typically sees a boost in the summer months, and this seasonal growth was likely further bolstered by the limited availability of other entertainment options due to COVID-19.

Footfall across UK supermarkets has risen to 90% of pre-Covid levels in the last two weeks as Huq’s mobility data suggests that Brits have had more confidence to visit these outlets since the 4th July, which coincides with the date that hospitality and dine-in establishments were allowed to re-open.

The COVID-19 pandemic and resulting recession have wreaked havoc on U.S. building markets. According to Dodge Data & Analytics, commercial and multifamily starts were quite healthy during January and February but stalled as the pandemic hit the nation in March. For the first three months of 2020, U.S. multifamily and commercial building starts inched up 1% from the same period of 2019.

During the shut-down in March and April, hospitals took a huge financial hit. Most of their revenue comes from non-life-threatening procedures, and these were halted causing US hospitals to lose more than $50 billion a month. Now that we’re facing a new wave of COVID-19, how will this affect hospitals looking forward? To get a clear picture, we looked at the general public’s interest in orthopedic procedures.

The wholesale sector has been so thoroughly dominated by Costco in recent years, that one can be forgiven for ignoring other players in the space. Yet, Sam’s Club has been on the rise and BJ’s Wholesale has seen a massive surge since the start of the pandemic. So, has the space gotten more competitive with Costco seeing downturns in visits for the first time in years? Can the giant recover considering it still operates heavily in some of the hardest-hit states?

As we prepare for a large swath of companies to report earnings in the next few weeks, LinkUp decided to take a look at jobs data to see if we could find an indication of what to expect. To start, we selected a handful of stocks whose 10 day average of active jobs have shown movement either up or down over the past 30 days.

In today’s Financial Times, European Economics reporter Valentina Romei and Data Visualisation journalist John Burn-Murdoch reveal how an overall plateau in economic activity points to headwinds for the region. Among other datasources including Google, OpenTable and Refinitiv, the FT uses data from Huq’s European Travel Monitor to reflect how international travel across ten countries is recovering from the effects of Covid-19.

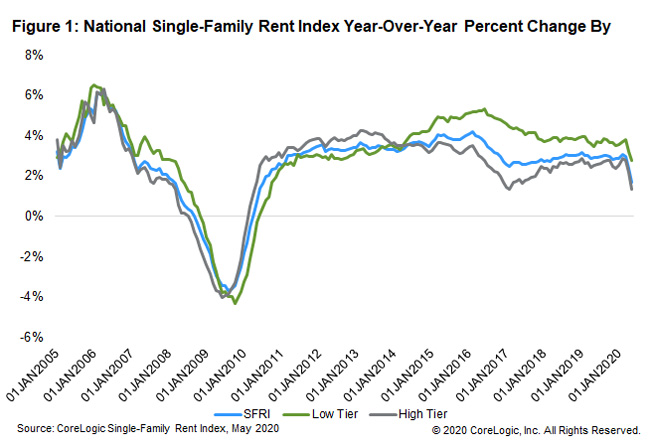

U.S. single-family rents increased 1.7% year over year in May 2020, a sharp slowdown from the prior month, and the lowest growth rate since July 2010, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

In this Placer Bytes, we break down Tractor Supply’s surge, Chipotle’s post-shutdown status, and the potential of some of Bloomin’ Brands’ top assets. Tractor Supply did not kick off 2020 with the strongest start, but the company’s pandemic and recovery performance have been especially impressive. Even with the difficulties created by the COVID pandemic, the brand has seen four out of six months in 2020 with year-over-year visit growth including massive jumps of 31.6% and 19.9% in May and June, respectively.

Data up until Saturday July 18th shows that mean footfall across all US Consumer industries has regained 90% of pre-lockdown levels, as Huq’s high-frequency geo-location data shows that the country is leading it’s comparative set of developed nations in terms of consumer-led economic recovery from Covid-19. Huq’s ‘All Consumer’ Indicator shows that the US had been tracking closely in line with China despite its head-start, with the two economic juggernauts rising steadily after lows in March 2020.

Total construction starts increased 6% in June to a seasonally adjusted annual rate of $641.4 billion. This marks the second consecutive monthly gain in construction starts following the COVID-19 induced declines in March and April. In June nonresidential building starts gained 6% and starts in the nonbuilding sector moved 27% higher. Residential starts, by contrast, fell 6% during the month. Through the first six months of the year, starts were down 14% from the same period in 2019.

The blows to the US retail sector continue. Well-known names declaring bankruptcy include Neiman Marcus, JC Penny, J. Crew, Tuesday Morning and GNC. More recently, Lucky Brand, Brooks Brothers, and Sure La Table have joined the list. One analysis is even suggesting the recent COVID-19-induced hit to retail is worse than that experienced during the Great Recession.

After Netflix and the banks kicked off earnings season last week, the companies reporting this week get a bit more diversified as different industries step into the spotlight. This week is the appetizer after last week’s amuse-bouche, and the next two weeks will constitute the main course of this earnings season.

Ahead of Snowflake's rumored IPO, ETR reviews its most recent data to determine whether Snowflake can maintain its elevated adoption rate & continue penetrating the largest accounts in the world. The information below was collected through a topical study ETR conducted in May 2020.

Once regarded as one of the most highly valued unicorn companies, the last year has been a rough ride for co-working giant WeWork. In an interesting turn of events, Executive Chairman Marcelo Claure revealed in a recent interview that the long beleaguered company is on a faster track to profitability than once thought. Claure, the former Sprint CEO who joined WeWork’s parent company SoftBank in 2018, told the Financial Times that WeWork expects to be cash-flow positive in 2021, a first stop on the road to turning actual profits.