It has now been four full months since the World Health Organizations (WHO) declared the coronavirus a global pandemic and the digital retail category continues to fluctuate. As COVID-19 forced both kids and adults to stay at home, we initially saw surges in visitation to retail categories like “Home Furnishings” and “Consumer Electronics.”

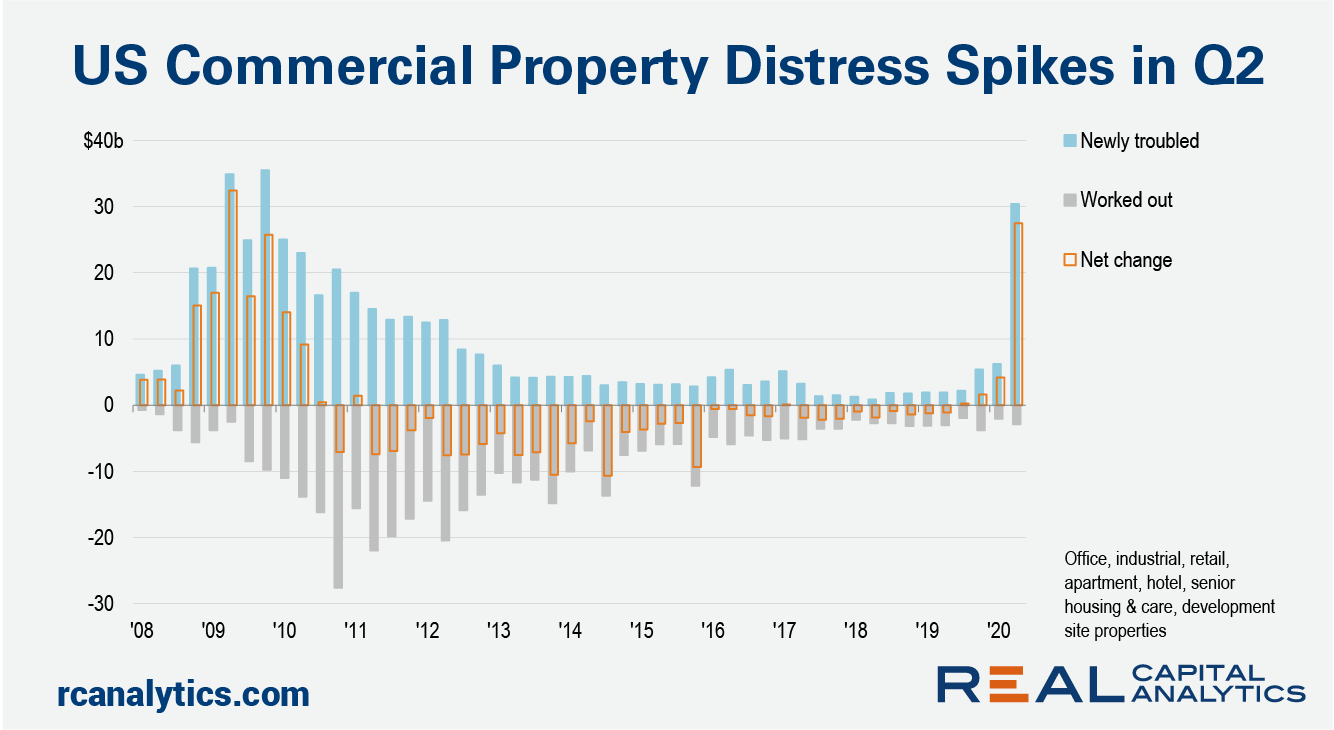

U.S. commercial real estate transaction activity during the coronavirus-blighted second quarter was far from the worst on record. However, the magnitude of the drop from the first quarter was unprecedented. Evidence of distress is mounting, according to Real Capital Analytics data, though it’s clear that the pain from the Covid-19 crisis has not been experienced equally across all the property types.

Following the lifting of restrictions both domestically and for visitors from overseas, holiday favourites Spain and Italy have recovered 87% and 78% of 2019 levels respectively. Greece meanwhile is flat through June-July at around -150% of year-on-year levels. To provide additional context, the UK stands at just 22% of of latest year’s equivalent value while throughout lockdown Sweden experienced an average maximum drop to around 55% of year-on-year levels, and is now above or inline with 2019 at 105%.

You don’t need a data analyst to tell you people are going outside a lot more these days. Camping sites are nearly impossible to come by. You can’t find an RV to rent. Bikes are sold out everywhere. These trends illustrate a pattern we’ve observed during COVID: if an activity is nearby, safe, and cheap people will flock to it. Beaches and forests are often within driving distance, outdoors, and (generally) lend themselves well to social distancing. This is a summer of road trips.

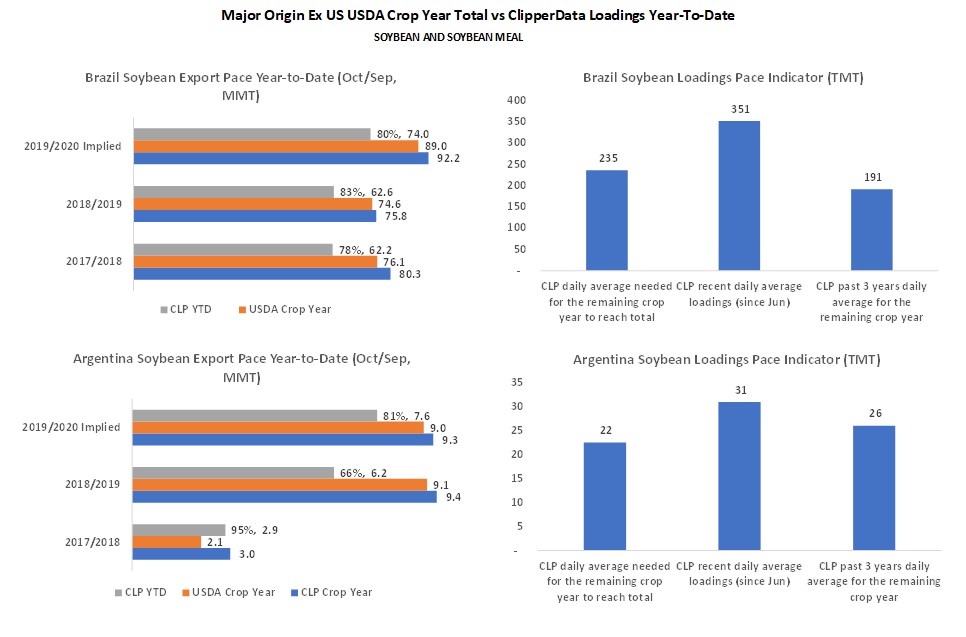

The export tracker provides us a view of where we stand in terms of pace in grains exports. By comparing Clipperdata’s up-to-date tracking of commodity loadings and the USDA estimated crop year exports, it calculates the ratio that has been shipped for the current marketing year, factoring a historical average difference between crop year Clipperdata trackings and USDA officials.

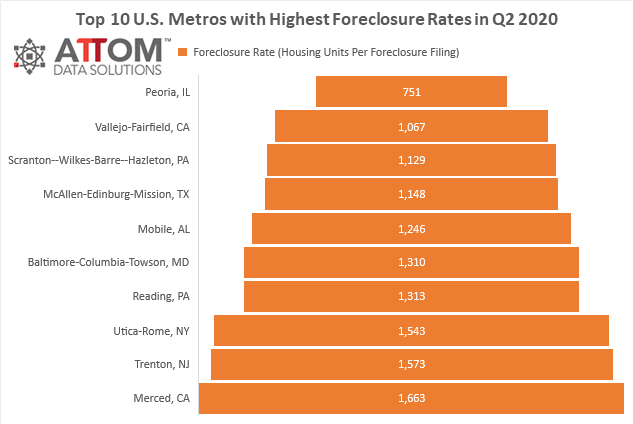

According to ATTOM Data Solutions’ recently released Midyear 2020 U.S. Foreclosure Market Report, U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2020, hit an all-time low with 165,530 filings reported. Nationwide 0.12 percent of all housing units (a foreclosure rate of one in every 824 housing units) had a foreclosure filing in the first half of 2020.

I used to eat fast food nearly everyday growing up. Luckily, I turned out okay, and now I only indulge once in a while. But when the quarantine first hit, you better believe I got in the McDonald's drive-thru line and risked it all for a McFlurry. Mobile app data, thankfully, reassured me that I wasn't alone. In March, at the start of quarantine, the top fast-food apps in the U.S. took a very small hit, with app downloads declining almost 9% month-over-month.

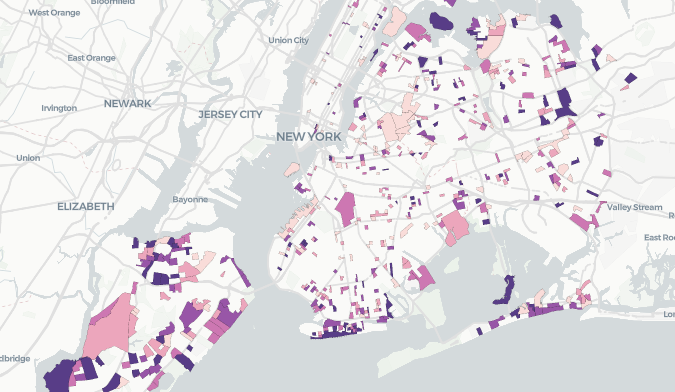

While the coronavirus’s short-term impact on the housing market has already started to materialize in the form of softening rents, the long-term implications for the urban landscape are still far from certain and being hotly debated. One of the biggest outstanding questions is the degree to which COVID will shift preferences away from cities. Over the past several months, many consider the close quarters associated with urban density to be a liability, and many of the local amenities that city-dwellers love are shut down in compliance with social distancing requirements.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that, through the end of June, sales for meal delivery services more than doubled year-over-year, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In May, 29 percent of American consumers had ever ordered from one of the services in our analysis, up from 23 percent a year ago.

Every quarter we look at the IAB 250 Direct Brands to Watch, and using our unique datasets and methodology to analyze the website traffic and growth of these sites we put together a list of the 25 fastest-growing direct-to-consumer (D2C) brands.

In general, we found that the areas that have returned Workers the most are the same - often low-income - areas hardest-hit by COVID-19, and that Workers in these areas tend to live around where they work. Conversely, the areas that have not returned as many Workers have a higher percentage of commuters, and are often more developed office building-oriented. When we dig in a little deeper, further distinctions arise between different boroughs and neighborhoods.

On the whole, June was a significant step forward for the wider fast food industry, but the month did show signs that leading brands may not be in the clear just yet. Analyzing eight top brands across the fast-food sector saw June bring a further push to the overall sector’s recovery. The group saw an average year-over-year decline of 27.1% in June, a significant improvement on visits that were down an average of 37.3% year over year in May and 54.4% at the pandemic’s shutdown peak in April.

Australia’s advertising market has been devastated by the COVID pandemic, with SMI reporting record declines in monthly year-on-year ad spend in April and then again in May. But our forwards data clearly shows the market has begun to improve and we’re now providing more detail to help media position themselves for the upswing.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. Though rideshare is beginning to bounce back, in June, Uber and Lyft sales were down 78 percent and 75 percent, respectively, year-over-year.

There were a total of 165,530 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2020, down 44 percent from the same time period a year ago and down 54 percent from the same time period two years ago.

The number of Brits present in countries across Europe reached a new high on the day the Government ended its 14-day quarantine rule for returning travellers on Friday (10 July) According to Huq’s European Travel Indicator for GB Residents, which tracks the change in British residents present in countries across Europe, the number of ‘Brits abroad’ regained 59% of pre-lockdown levels as they were permitted to travel to other countries without the need to self isolate upon return. However, this rise only corresponds to 38% of 2019 levels.

We’re not quite ready to call it a new phase in our quarantine life, but the Reemergence Ramp has largely plateaued in recent weeks. The change kicked in around June 20th, as we saw regional upticks in cases throughout the south and west, and has persisted through some holiday spikes. We’ll dive into the slowdown of traffic in more detail below.

Many states are starting to pause or turn around their reopening plans—indicating that even when businesses start to feel optimistic, things can shift quickly. This makes planning trade shows and large events difficult. Venues, travel reservations and speaker commitments have to be dependable. Due to instability, hopes of in-person events returning this year are looking grim. What does this mean for event organizers and sponsors?

With Covid-19 changing the ways in which U.S. audiences are using online tools for socialization and work, we are also seeing large shifts in engagement with conferencing and collaboration tools. This blog post examines trends in collaboration platforms to find insights for the industry. It is estimated that American workers typically spend 220 million minutes per month just in meetings.

The RV market in the US looks like it may have found a new client base during the pandemic. As reported by the New York Times, companies like Cruise America, the largest RV rental company in the US, typically count on overseas visitors for about 40% of their bookings.