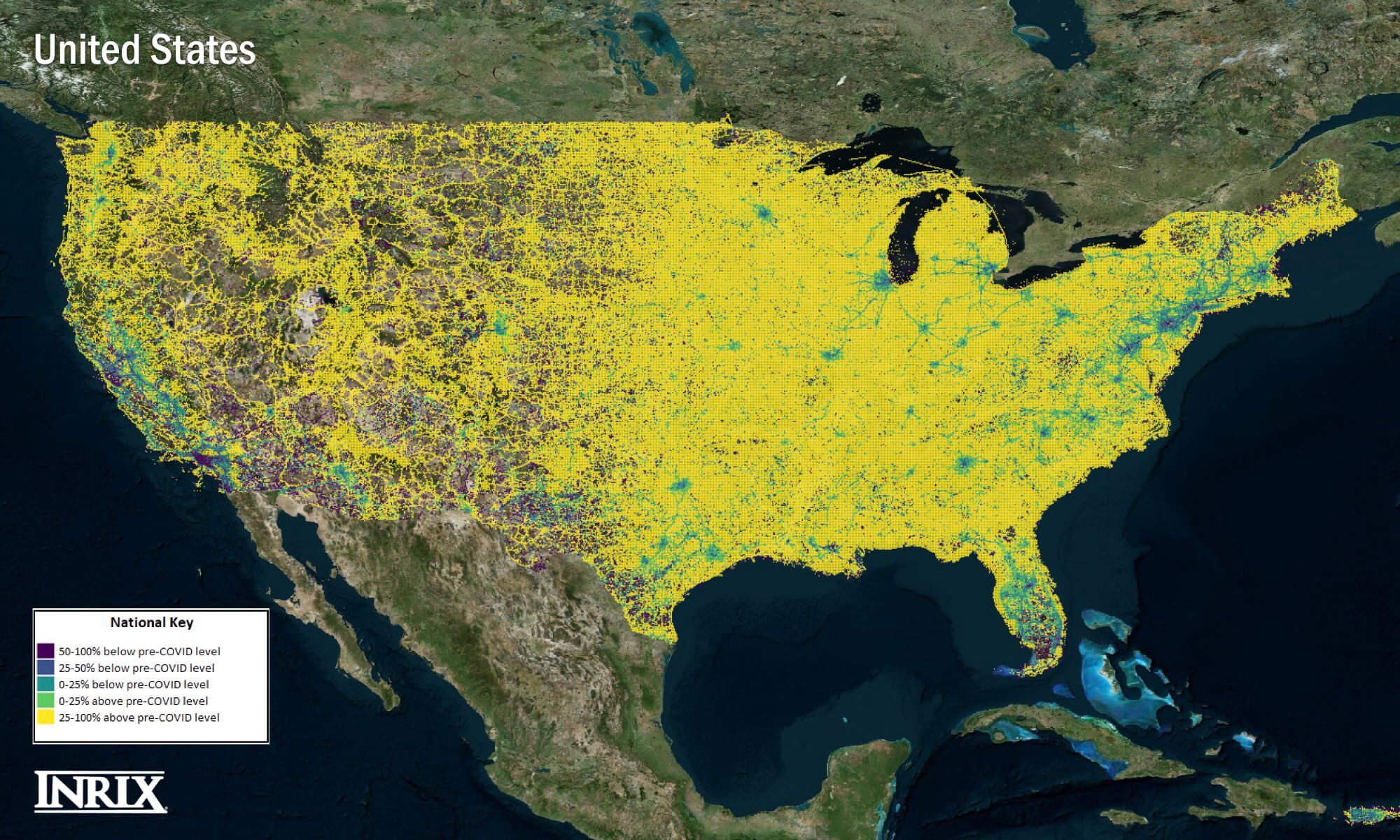

As governments at all levels across the country ease restrictions relating to COVID-19, INRIX continues to monitor activities across the United States. We have focused specifically on a few main areas: vehicle miles traveled, trips, traffic speeds and re-emergence, the increase in access for residents by all modes of travel.

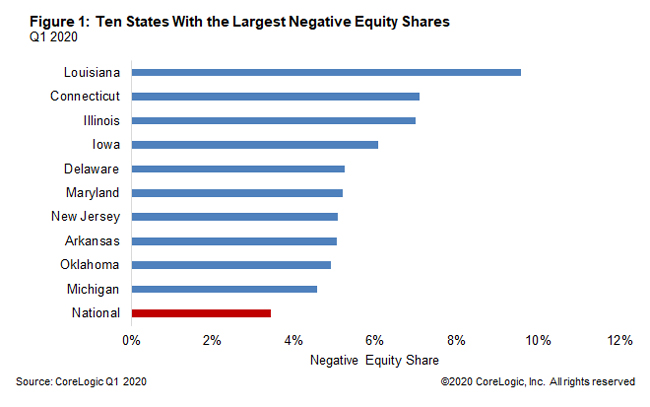

The housing market collapse of 2008 and 2009 underscored the importance of keeping a watchful eye on combined loan-to-value (CLTV)—a ratio of all secured loans on a property to the value of the property. Lenders use the CLTV ratio, along with other calculations, to determine the risk of extending a loan to a borrower.

Which way the economic winds will blow come Monday is the question on many minds as businesses across the country prepare to step back towards normality. For some of us, the chance for a flutter is finally imminent as the UK allows non-essential retail – and betting shops among them – to resume conventional trade.

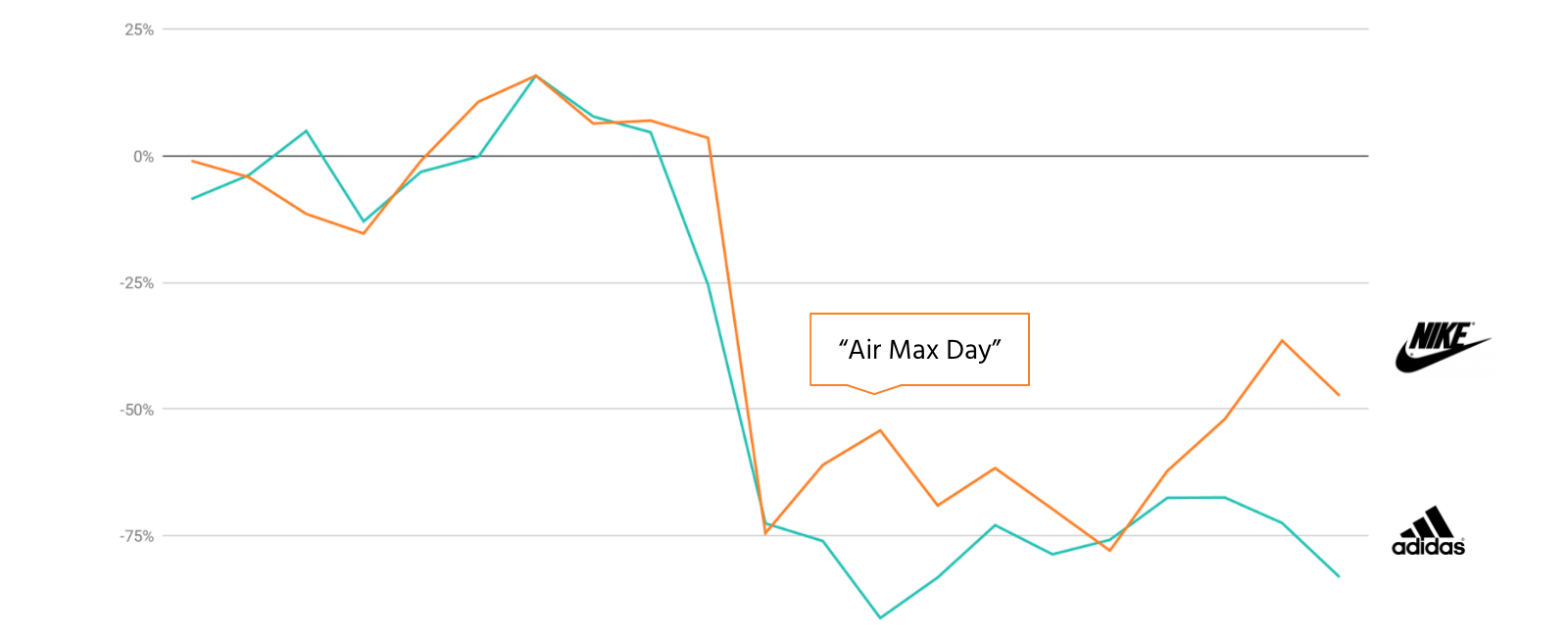

As many Americans have spent weeks at home during the COVID-19 pandemic, apparel retail has been among the hardest hit industries, while ecommerce has been thriving. Where does this leave online sellers of secondhand fashion? Like the merchandise on their sites, the answer is a mixed bag.

With a decrease in social distancing measures across most states, and markets reaching record highs, the past couple of weeks had felt like a tentative breakthrough after months of lockdown and uncertainty. Yet news from the Fed today that they would hold rates steady for the foreseeable future and another heavy week for jobless claims led to a 5% drop in the Nasdaq.

The outlook for the CRE CLO segment evolved with the sudden outbreak of the coronavirus and widespread mitigation policies that have been put in place. The impact has been broad-ranging and has extended across industries beyond just the commercial real estate space. CRE CLOs enjoyed immense growth in 2019 which was bolstered by the continued strength of the US economy, strong capital availability, and heavy appetite for higher-yielding opportunities in a low interest rate backdrop.

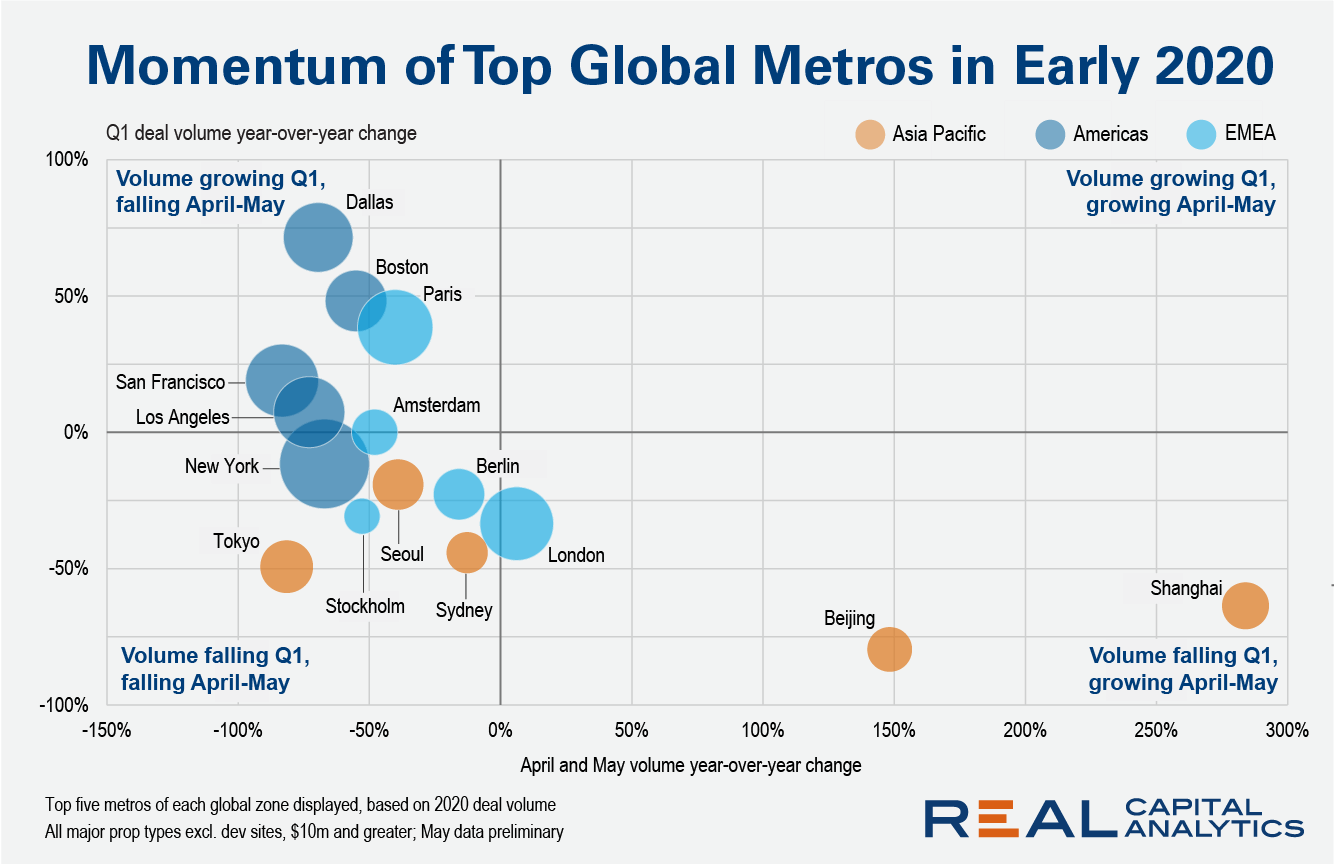

Do not be fooled into thinking that U.S. commercial property prices have already fallen at high double-digit rates. Until market participants can comfortably start visiting properties, clients, and other service providers – and we enter the [price discovery phase](https://www.rcanalytics.com/distress-cycle-looks-like/) of the downturn – prices cannot move. However, the spread between buyer and owner expectations on pricing has widened sharply.

Participants from OAG’s webinars gave us an early indication of future travel behaviour. We asked our respondents what consumer sentiment was like in their country and when they would be willing to fly. Largely from within the travel ecosystem - airlines and airports, consultants, financial institutions, travel tech and hospitality, government and industry bodies as well as education, research and the media.

Let’s just say that the video game industry is not hurting this year. No matter how you look at the numbers, business is looking good. Microsoft’s Game Pass surpassed 10 million users in April. Nintendo’s Switch console sales were up 24% year-over-year. Twitch’s number of gaming hours increased 50% between March and April.

COVID-19 dealt the global hospitality industry a vicious blow. A Chuck Norris roundhouse kick combined with a Mike Tyson uppercut that left it immobile. The scores of hotel closures and staggering number of job losses are evidence of the pandemic’s pernicious impact on the industry. An overwhelming number of hotels have suspended operations because of lack of demand, while hotels that remain open are running bare-bone operations.

The grocery sector has been among the most interesting to analyze during the pandemic. During the crisis, some brands grew, while others struggled. And even when looking at the visits that did happen, consumer shopping patterns changed significantly. So as the US begins to reopen, how has the grocery sector been affected?

U.S. clothing retailers got a welcomed jolt of recovery heading into June 2020 as more people headed back to bricks and mortar locations. Store visits had fallen as much as 90% in some states since shutdown orders were first issued, while the national average sits about -50% since reopening began, significantly lagging restaurant or grocery retailer visits.

The amount of equity in mortgaged real estate increased by $590 billion in the first quarter of 2020 from the first quarter of 2019, an annual increase of 6.5%, according to the latest CoreLogic Equity Report. Borrower equity hit a new high in the first quarter of 2020, and borrowers have gained over $6 trillion in equity in the last 10 years.

In Europe, 40% of respondents said that they purchased more items online, including supplies and groceries, since the pandemic began, according to the latest wave of Comscore’s Global Digital Payments Tracker.

A great deal of attention has been brought to the racial inequities in the United States in recent days. Given that these concerns may persist within organizational structures, we wanted to take a look at how demographics differ across companies.

Consumer activity across the UK consumer sector has been consistently lower than the US, Italy and Australia over the last two months, as data from Huq’s ‘All Consumer’ Indicator suggests that retail across the country has a lot of ground to make up after re-opening on Monday.

The restaurant industry has been heavily impacted by the global COVID-19 pandemic. Stay-at-home orders and the closure of large swaths of the economy in many U.S. states have limited human mobility for weeks and in some cases months. To remain competitive, or just afloat, many restaurant operators have pivoted to offer delivery, or curbside pick-up options, and it’s been working pretty well.

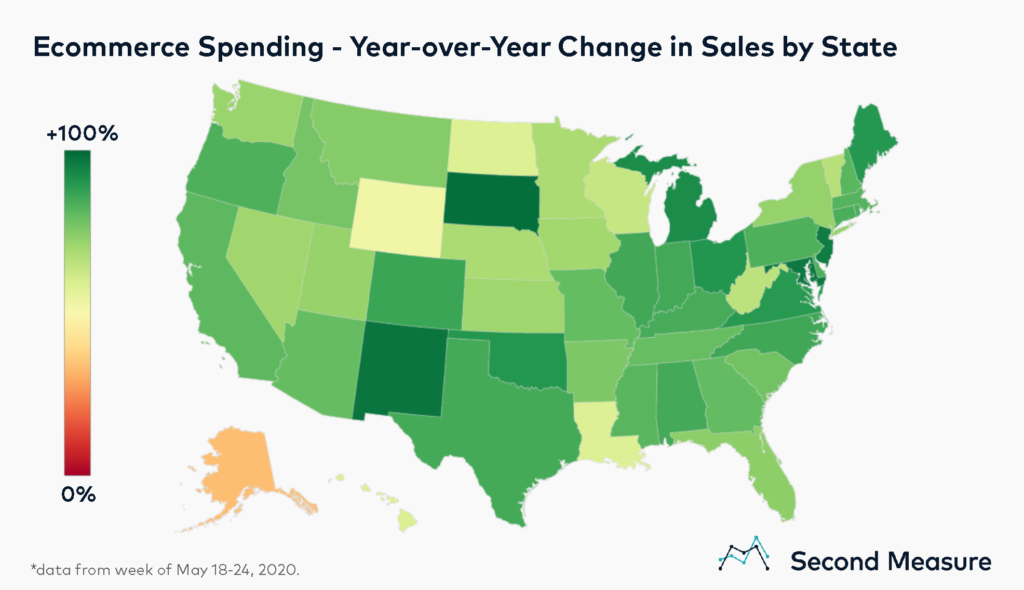

The COVID-19 pandemic has crippled many traditional retailers, with previous analyses showing clothing store sales dropping by half, or more. As many Americans are still unable to patronize brick-and-mortars, that spending may be increasingly displaced toward online shopping. Nationwide, the latest data reveals that weekly ecommerce sales are up 80 percent year-over-year.

Despite the slowdown in real estate markets accelerating across most of the world into the second quarter of the year, acquisition trends in two key global cities, both in China, have turned positive. Global volumes started to wane around March this year, but the weakness in Asia Pacific had already been apparent for some time, as all of the region’s top 10 metros suffered double-digit declines in the first quarter.

COVID-19 plunged a knife in the collective heart of the global hotel industry and in one fell swoop destroyed demand, sending revenue and profit to historically low levels. This global pandemic is the most harrowing event to ever besiege the hospitality industry. As stridently as room sales have plummeted, the crash in food and beverage (F&B) is even louder.