Pre-COVID, Lululemon was one of the most exciting brands in the apparel sector, with 2020 kicking off in incredibly strong fashion. January and February saw year-over-year visits grow 8.8% and 15.3% respectively, before March’s 61.0% decline and visits completely disappearing in April.

Global exports of liquefied natural gas in May totaled approximately 23.4 million tons on board 481 vessels, much lower than May 2019’s pace of 30.7 million tons. Approximately 29.7 million tons arrived on 488 vessels at import terminals in May, compared to 30.6 million tons in May 2019.

Technology is among the many sectors in the US seeing buying behaviors evolve due to COVID-19. Companies and consumers across the country are adapting to working from home, as shelter-in-place has become the new norm.

A warm Memorial Day always feels like the start of Summer. It’s our usual cue to dine outside, hit the beach, and put the finishing touches on our vacation plans. But what will Summer look like in the age of social distancing?

People have become more open to video content, online shopping, e-learning, and more. Observations of how global lockdown is changing user behavior.

Retail is among the many industries in the US experiencing significant shifts in buying behavior due to COVID-19. Roughly 75% of US consumers who responded to a February poll said they would steer away from shopping centers altogether due to growing concerns around the coronavirus. Unsurprisingly, March saw a drop in US retail sales by 4.4%.

Across Europe, essential industries like Biotechnology, Defence and Chemicals have seen a gradual return to some productivity since lockdown measures have eased off while more discretionary sectors (Food, Automotive and Aerospace) remain subdued.

The recovery of spend in the UK and Germany continues month on month, however the trend is slowing – this week both countries plateaued. Transport-related categories across the UK and Germany (e.g. Fuel, Taxicabs and Limousines, Public Transport) YoY performance improved modestly versus last week, although still down YoY. UK Hardware Stores’ YoY growth continued again this week, although in Germany this has slowed.

The Dodge Momentum Index moved a scant 0.1% lower in May to 129.2 (2000=100) from the revised April reading of 129.4. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The commercial component of the Momentum Index rose 1.0% during the month, while the institutional component dropped 1.9%.

Now entering the third month of the pandemic, Canadians have begun to show renewed interest in a few hard-hit categories, continue to find ways to connect with one another and are shifting their buying habits through digital media.

Three months ago, China hit a 15% occupancy level, however, on 30 May, the market posted 47% occupancy followed by U.S (38%) and Middle East (38%). Europe occupancy, however, was just 15% on that same day.

As the COVID-19 pandemic continues to unfold, we’re sharing how the virus is impacting foot traffic to a variety of places across the United States (past editions here). With the world starting to open back up, we’re seeing pent-up demand to engage in the physical world. Where will people go first?

It’s a powerful indication of the insanity plaguing the headlines these days that a global pandemic that has, so far, claimed over 100,000 lives in the U.S., put at least 40 million people out of work, driven unemployment to depression-era levels, decimated tens of thousands of businesses, and fundamentally transformed the world we live in could rightly drop from the front-pages.

For consumers in India who have been confined at home since March 24, 2020 due to stay-at-home restrictions, the internet has become their main channel to work, socialise, entertain, and explore the world.

All eyes continue to look to China as a barometer for what a recovery might look like elsewhere from the COVID shock. China’s recovery is now almost two and a half months old for a majority of cities that were shut down. We worked with data from Jigaung to understand how the recovery has been progressing.

As the country emerges from over a month of restricted living, questions now arise around how and when consumers’ lives will return to normal in the near future. Faced with uncertainty about the future, advertisers and marketers have exercised caution and are closely scrutinising their spend and activities to ensure their people and businesses remain viable once life returns to normal.

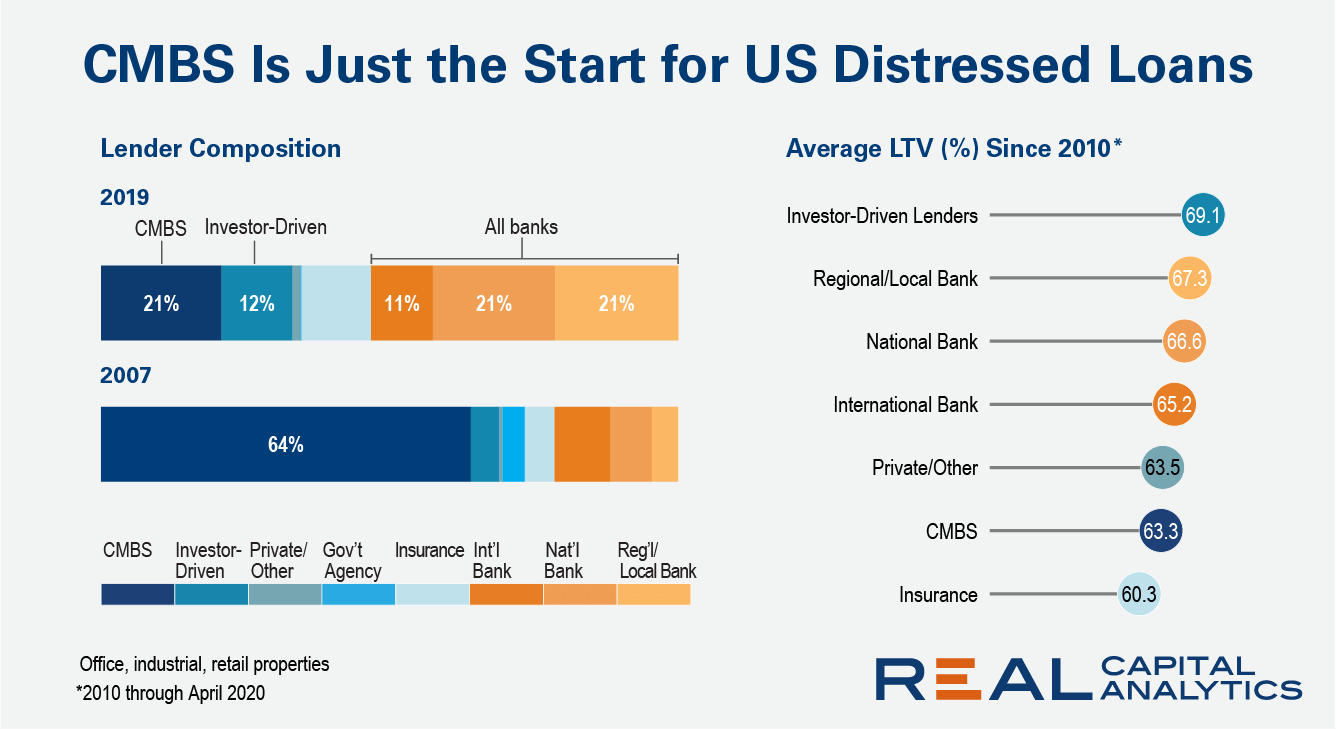

Anybody trying to implement a successful investment strategy using the distress playbook from the Global Financial Crisis (GFC) is going to be disappointed. There will be opportunities for sure as the U.S. distress cycle progresses to the work-out stage, but the big chunk of problematic loans this time were not originated for the CMBS market. Trying to source distressed deals out of special servicers will overlook most of the opportunities.

The beginning of 2020 was looking strong for B2B companies — until March 15th. That’s when we saw major changes in B2B advertising. Last week, our CEO Todd Krizelman hosted a webinar to give an insider’s look into the current state of B2B advertising.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

Customer activity across Italy’s hospitality sector has steadied at around 50% of pre-Covid levels in the three weeks since lockdown policies were eased on 18 May. With Italy set to re-open its borders to European countries today, Huq’s Key Consumer Industries Indicator confirms reports that while consumers have appetite, the country’s restaurants and cafes have some way to go to get back to normal trading.