ATTOM Data Solutions, curator of the nation’s premier property database, today released its fourth-quarter 2020 Special Coronavirus Report spotlighting county-level housing markets around the United States that are more or less vulnerable to the impact of the virus pandemic. The report shows that pockets of the Northeast and other parts of the East Coast remained most at risk in the fourth quarter – with clusters in the New York City and Philadelphia, PA areas – while the West continued to be less vulnerable.

As we look back on 2020, we can reflect on a year that felt more like three than one. 2020 ripped up all previous forecasts. Thanks to Covid-enforced lockdowns, all the emerging mobile behaviors that had been bubbling away suddenly exploded. Niche mobile habits went mainstream. Three years of projected changes were squeezed into one.

Mobile device usage has significantly accelerated over the last year with daily time spent per user reaching 4.2 hours (a 20% year-over-year increase). While Gen Z has never known a world without smartphones, the ongoing pandemic has made all generations increasingly more reliant on mobile over the last year. Our recent 2021 State of Mobile report uncovered that in 2020, Baby Boomers in the United States spent 30% more time year over year in their most-used apps.

EU residents are returning to their places of work after the Christmas break but UK staff appear more constrained, less enthusiastic – or both. The latest data from Huq Industries puts European office workers 7% ahead of their UK counterparts in the 20 days since the year began, and that gap is widening still.

Housing activity ended 2020 on a strong note with increases across almost all major indicators.New construction activity was a bright spot for the economy in 2020. Single-family housing authorizations increased 13.97% year over year and 3.21% month over month. The housing market, however, is still experiencing some growing pains with inventory hitting record lows in December. New construction is expected to continue into 2021 to help curb tight housing supply.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. While rideshare sales have been gradually recovering over the past several months, November marked a decline for the first time since April. Sales declined even further in December, with Uber sales down 71 percent year-over-year and Lyft sales down 73 percent year-over-year.

The Tokyo Olympics didn’t happen in 2020 and now the question is will they happen in 2021. Obviously, the primary concern for the organisers is the risk of spreading covid-19, but to what extent does the event also rely on the world of global aviation being at least partially recovered.

According to the latest Air Ticket data by ForwardKeys when examining issued tickets as of 1 January 2021, bookings in Russia’s domestic market in the next 6 months are the most advanced among the top 10 domestic markets worldwide. Issued tickets have already reached 77% of 2020’s level for the next 6 month’s travel.

With COVID-19 vaccinations just beginning, alongside a further wave of the virus spreading across the globe, Earnest partnered with Fable Data, a European transaction data provider, to assess consumer spending trends across the US, UK, and Germany. We have compared performance across countries and within various sectors since the start of the pandemic, and assessed a ‘current-state-of-affairs’ (Dec ‘20) as consumers exit the holiday season of a global pandemic.

The fourth quarter was not good for restaurant sales; each month posted worse same-store sales growth than the previous month. By December, same-store sales growth fell to -13.3% year-over-year, the worst month for the industry since July. Same-store traffic growth for the month was -18.6%, also the worst performance in the last five months.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in December, sales for meal delivery services grew 138 percent year-over-year, collectively.

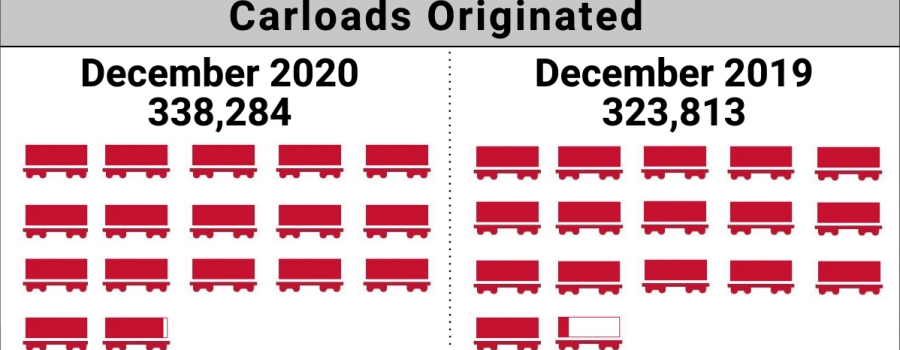

The number of carloads moved on short line and regional railroad in December 2020 was up compared to December 2019. Carloads originated increased 4.5 percent, from 323,813 in December 2019 to 338,284 in December 2020. Grain led gains with a 46.4 percent increase. Grain Mill Products was up 18.0 percent, and Waste and Scrap Materials and Stone, Clay and Glass Products increased 16.3 and 10.5 percent respectively.

One of the sectors less affected by the pandemic was the wider grocery space; yet even here, there were dramatic changes in shopping behavior. The grocery sector surged in Q1 with a big boost coming from the pre-pandemic supermarket rush. Visits were up 4.6% in the first quarter of 2020, before seeing a 9.8% decline year over year in Q2. Yet, Q3 and Q4 saw essentially flat numbers year over year with visits down 0.6% and 0.9% for the group analyzed.

Total construction starts lost 5% in December, falling to a seasonally adjusted annual rate of $784.3 billion. Nonresidential building starts fell 11% during the month, while nonbuilding starts were 5% lower. Residential starts were essentially flat over the month. Starts were lower in three of the four regions in December; the South Central was the only region to post an increase.

U.S. single-family rent growth strengthened in November, increasing 3.7% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.8% rate recorded for November 2019.

While COVID-19 has changed many consumer behaviors and limited entertainment, team sports have played on. Specifically, football on Sundays, and the foods that go with it, has remained in place as a national pastime. As the playoffs progress heading into the Super Bowl, we take advantage of CE Vision’s unique ability to easily isolate transactions by day of week to examine how food delivery on Sundays during Football Season differs from during the rest of the year.

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 7.4% in December after rising 3.2% in November. In December, the index equaled 120 (2015=100) compared with 111.7 in November.

2020 was a whirlwind of a year for the CMBS and commercial real estate segments measured by unprecedented changes dictating how we live and do business, unlike any other economic disruption we’ve seen before. Read on for the winners, biggest surprise trades, biggest rebounds, bright spots among the distress, the "unknowns," and more.

As we head into 2021, we decided to carry out a deep dive into some of the biggest players in the UK supermarket business, namely: Tesco (TSCO), Morrisons (MRW), Ocado (OCDO), Asda (owned by Walmart, WMT), and Sainsbury’s (SBRY).

Petco re-entered the public markets on 14 January, raising $864M, and its stock price was up 55% in the moments after its third IPO. The company is now trading on the ticker WOOF, and the share price has stabilized following its initial surge. Whether you participated in Petco IPO or not, we used alternative data to gain insight into the online health and performance of the company.