2020 had one last dance move to bust out, and it will change the way you look at robotics, and think about the future. Boston Dynamics robots are dancing like no one is watching (though we know Elon Musk is keeping close tabs). The company’s fleet of robots are specializing and mastering new skills, and they are starting to sell. Their intimidating Spot the dog robot is currently up for grabs for $74,500 (with 400 already sold).

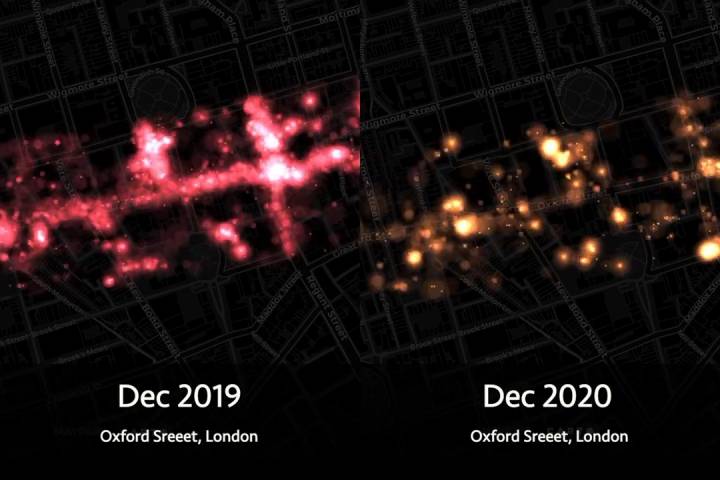

With the festive season behind us and the new year begun, Huq looks back at high-street footfall during the Christmas shopping period between December 15-24th for Oxford Street, London and the Grand Vía, Madrid. We often provide outputs from our geolocaton dataset in the form of a time-series index as this is one of the most effective ways to highlight the information contained within the underlying mobility data.

In this Placer Bytes, we dive into the Q4 performances of Bed Bath & Beyond and Walgreens to see how they ended their 2020 campaigns.

Last year, we marked Bed Bath & Beyond as one of the brands we expected to emerge as a winner in 2020. And it certainly appeared to be on that path, posting same-store sales gain for the first time since 2016. But what about Q4?

Average Wage Below Level Needed To Afford Typical Home in the U.S.; Affordability Worsened in Fourth Quarter in 55 Percent of Housing Markets; Median Home Prices Up At Least 10 Percent in Most of Nation

As we swing full-force into 2021, many people are making resolutions for the new year. Among the most popular? Getting fit. Fitness advertising traditionally spikes in January. And in the COVID era, fitness apps and websites become particularly important as users plan to get fit at home without breaking the bank.

The flattest seasonal holiday season has been reflected in the latest global capacity which has broadly remained around sixty million seats a week since the middle of December. The early Christmas present of breaking that sixty million, was just that, a present and this week’s 59.6 million is perhaps likely to be as good as we can expect in the next few weeks.

In what has been a year of upheaval, one area of normalcy for the multifamily industry has been the flow of new units into the market. After some initial delays in the early days of the pandemic, the new construction pipeline ramped back up to deliver about as many units as were delivered in both 2018 and 2019.

As the last housing market indicator in 2020, the S&P CoreLogic Case-Shiller Index finishes the year on a high note during this trying year. Home purchase activity remained consistently elevated through the end of the year, with some expected seasonal slowdown turning up as winter months approached. Still, the slowdown appears to be smaller than in a typical year.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 26, 2020. For this week, total U.S. weekly rail traffic was 405,111 carloads and intermodal units, up 8.4 percent compared with the same week last year.

This year, we’re bringing in the end of the year with a series: 12 Days ‘til New Years. We’ll continue our tradition of highlighting the most notable brands and spending across ad tech platforms, consumer media, and B2B industries.

2020 was a uniquely challenging year for the world of offline retail, but it also presented an opportunity to truly appreciate its value. The resilience of consumer demand and the ongoing ability of many brands to continue driving engagement and interest, even amid the pandemic, served as a huge testament to the retail landscape’s strength.

ForwardKeys has been paving the course for destination marketing and tourism since its inception in 2010 by creating bespoke data solutions using the latest and most comprehensive airline data in the market such as ForwardKeys Nexus.

With the New Year fast approaching and the announcement of a new travel bubble between Japan and Hawaii, the team at ForwardKeys thought to post a new blog regarding the highs and lows of the recent travel bubbles. Here’s what we’ve learned.

Problems in the energy sector are far from new, and are continuing to worsen slightly each month. This is particularly true for the US and UK energy sectors which have seen a great deal of volatility and distress in the last year or so. The picture isn’t so dire for the EU energy sector however.

In a year where grocery dominated headlines for all the right reasons, the sector also saw the addition of a new Amazon foray into grocery, Amazon Fresh stores. The focus on a strong, technologically backed shopping experience and value pricing seemed like a winning mix.

Though quarantine is keeping us at home, Americans aren’t worried about getting all dressed up with no place to go. The sneaker craze continues, so top athletic footwear companies are still putting out new designs. Let’s dive into Pathmatics marketing intelligence and take a closer look at how three of the biggest sneaker companies—Nike, Puma, and New Balance—advertised their new products throughout the month of November.

The busy bees at ForwardKeys have been enriching travel data, adding them into dashboards and sharing the multitude of insights at virtual events, partner forums and to the media. Now that 2020 is fast approaching its end, we wonder whether we must continue to hold our breaths into the New Year or can we finally release a satisfactory sigh of relief?

Just over a month ago, Google Pay relaunched with new features: tap-to-pay, peer-to-peer, personal finance aggregation, customizable deals, and other traditional banking services. Some have compared the app to Venmo, but I’d say that Google Pay is now more all-encompassing.

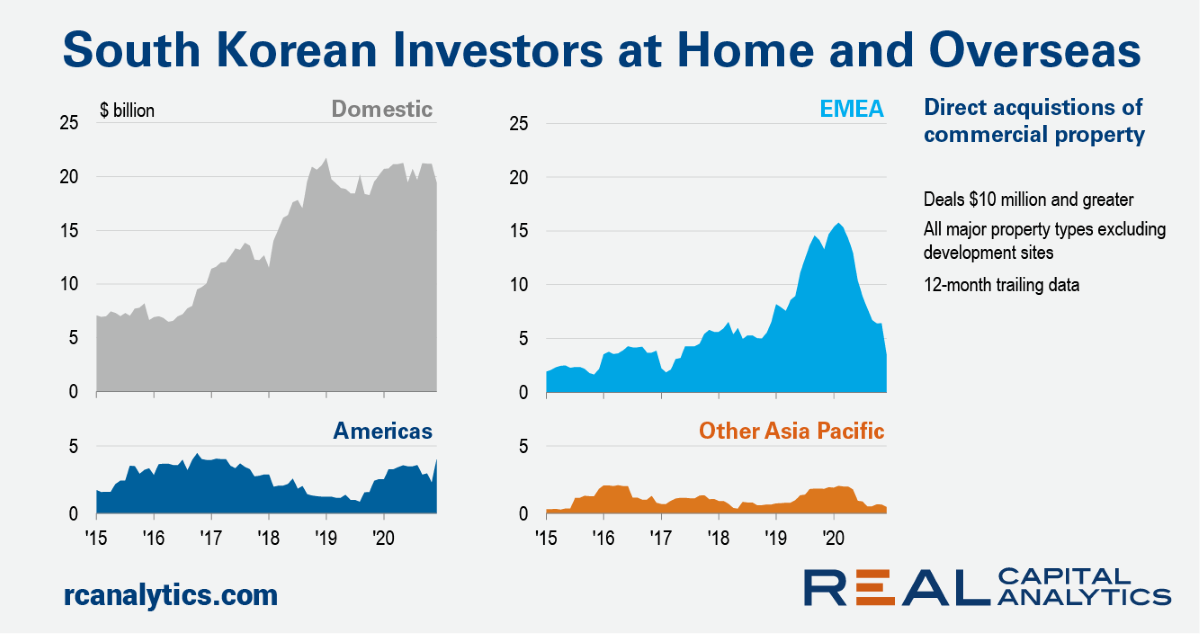

One of the biggest cross-border stories of 2019 was the outpouring of South Korean capital into Europe and the U.S. Towards the end of last year, there were signs that this trend was reaching its satiation point – asset managers had needed time to digest and syndicate the stakes in their newly acquired real estate assets back home.

Credit Benchmark have released the December Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.