Following the COVID-19 pandemic and ensuing economic downturn, rental markets across the country experienced an uncharacteristic decline in rent prices this summer. Nationally, rents dropped 1.3 percent from March to June, a time period when rent prices rose roughly 2 percent in each of the three previous years.

Recent loan performance data from CoreLogic shows that the nation’s overall mortgage delinquency rate – the proportion of mortgage loans falling 30 or more days behind scheduled payment, including loans in foreclosure – have risen quickly during the COVID-19 pandemic, as millions of Americans lost their jobs and income due to the economic shutdown.

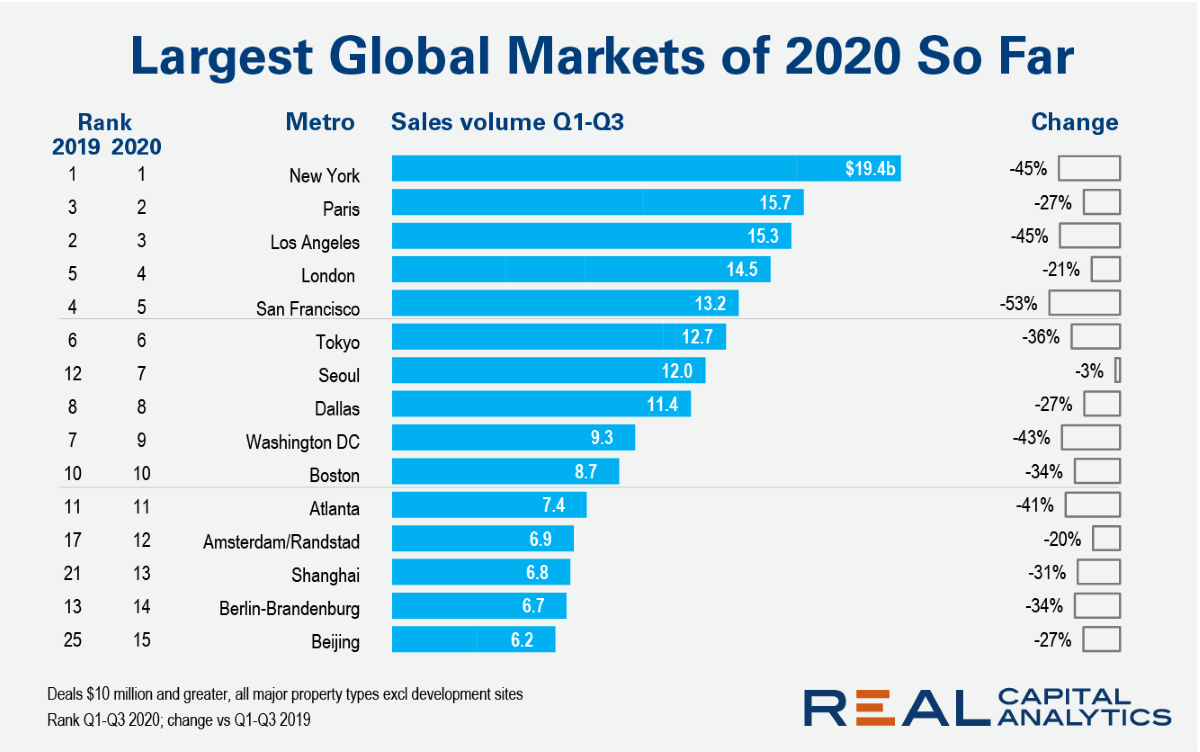

At the halfway point of 2020 there were a handful of top global metros that posted growth in deal activity versus the first half of 2019. One quarter on and there are no such positives in the list of the world’s largest metros. Seoul returned deal volume close to that of last year, but the market is still just in negative territory.

In this Placer Bytes, we dive into two department brands and look at Ross after its expansion announcement. September produced a much-needed break from the stagnant traffic levels JCPenney had seen since the recovery kicked off in earnest for the brand in June. Visits were down 35.8% year over year, buoyed by Labor Day weekend, a welcome improvement over the three months prior when visits were down an average of 43.6%.

As we approach the end of the first week of lockdown 2.0, the Huq Index shows that footfall across the UK’s foodservice outlets appears to be holding stronger than it did when businesses were forced close earlier this year.

ATTOM Data Solutions’ just released Q3 2020 U.S. Home Equity and Underwater Report reveals that 16.7 million residential properties in the U.S. were considered equity-rich in the third quarter of 2020, while just 3.5 million mortgaged homes were considered seriously underwater.

Since the week commencing the 5th October the US market has reflected a very different trend pattern to the rest of the world as the chart below highlights. Whilst the rest of the world has seen a steady decline in capacity and is now 9 points lower than at the beginning of September, the United States has seen a thirteen-point improvement; a twenty-two-point swing to use pollster terminology.

The impact that coronavirus has had on our working lives in the last 8 months has been truly staggering. For a large portion of the workforce, the pandemic has brought about changes that range from a move to remote work to reduced hours or job loss. These massive shifts have left many struggling to find their footing amid an uncertain new reality.

Hotels globally performed better in the third quarter, but the improvement proved to be only less bad, as COVID-19 continues to roil the world. U.S. hotels in Q3 achieved a gross operating performance per available room (GOPPAR) of $-9.87, which was 58% higher than the GOPPAR recorded in Q2, but 110% down from the same period a year ago, according to data from HotStats.

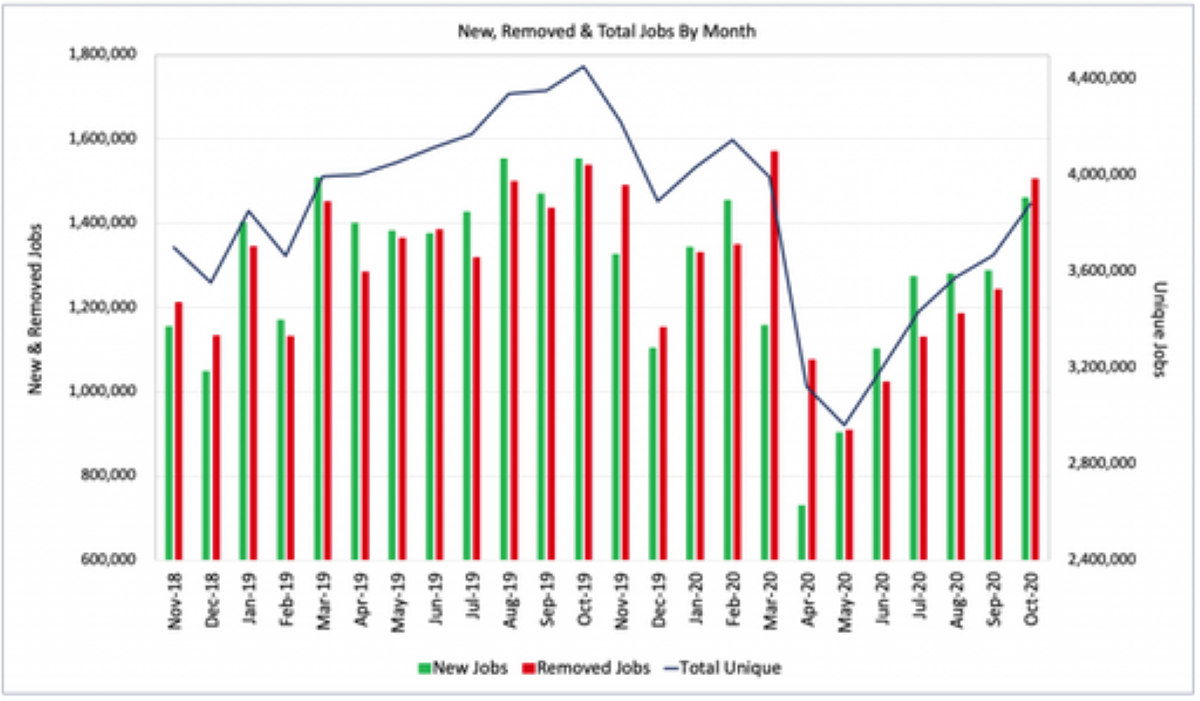

U.S. job openings on company websites globally rose 6% in October, continuing the steady recovery in U.S. labor demand that began in May. New Job listings posted to company websites rose 13% while the number of jobs removed from company websites, either because the jobs were filled or the employer no longer intended to fill the opening, rose 21%.

Footfall to UK supermarkets has so far dodged the second wave slump, with Huq’s Index recording levels higher than last year over the last week whilst all other consumer sectors dive and supermarkets on the continent see attendance cut in half.

Unlike the Great Recession, the speedy intervention provided by the CARES Act ensured mortgage forbearance options for homeowners who were financially harmed by the pandemic recession and had a federally backed loan. And while forbearance options will help some homeowners keep their homes, the path of employment rebound – which is still unclear - will be a critical determinant for many delinquency outcomes.

Equity-Rich Properties Now Outnumber Those Seriously Underwater by Almost Five-to-One Margin; Portion of U.S. Homes Considered Equity-Rich Grows to 28 Percent; Share of Seriously Underwater Properties Stay at 6 Percent

In this post, we dive deep into McDonald’s and express some of the reasons we believe the brand is poised for an exceptional bounce back. But, because At Home has been so exceptional of late, we couldn’t dedicate the full blog to McDonald’s and left some space to laud this rising home goods giant.

U.S. railroads originated 912,772 carloads in October 2020, down 6.6 percent, or 64,634 carloads, from October 2019. U.S. railroads also originated 1,169,874 containers and trailers in October 2020, up 10.0 percent, or 105,966 units, from the same month last year. Combined U.S. carload and intermodal originations in October 2020 were 2,082,646, up 2.0 percent, or 41,332 carloads and intermodal units from October 2019.

The COVID-19 pandemic has had a big effect on the mortgage market. Along with a drop in mortgage rates to a record low, the jumbo-conforming mortgage rate spread has also been affected. Before 2013 mortgage rates for jumbo loans were higher than for conforming loans. However, in 2013 the rate-difference fell, and jumbo rates have averaged 5 basis points lower than conforming during 2013-2019.

India has overtaken the United States to be Snapchat’s #1 market for downloads (new users). It took 15 months (from May 2019 to July 2020) for India to go from the #6 market, representing 4% of Snapchat’s downloads, to the #1 market, representing 20% of its downloads. That lead has been increasing as October 2020 saw India represent 32% of Snapchat’s downloads.

We’re down to the wire! With Election Day less than 24hrs away, Pathmatics has been hard at work researching the most up-to-date insights. But, to offer a more complete picture, we partnered with Embee to share a glimpse into user trends, experiences and behaviors in Instagram.

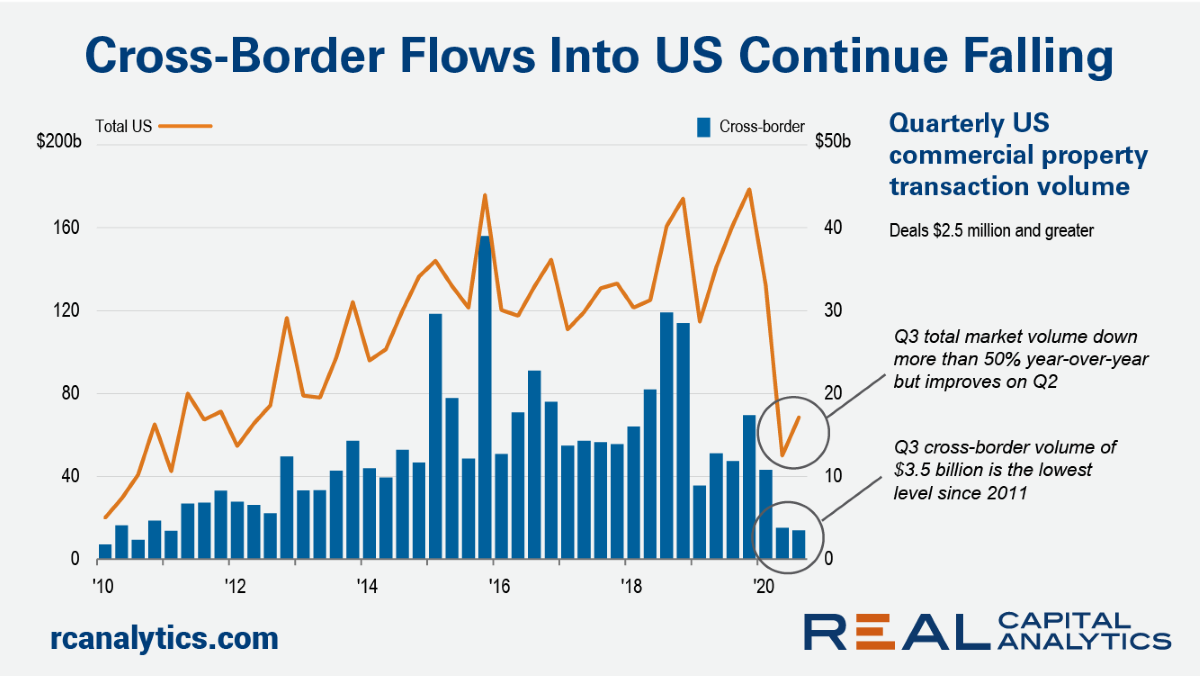

Total U.S. investment activity improved to some degree in Q3 2020, with sales volume up more relative to Q2 2020 than normal seasonal patterns would suggest. Not so for cross-border investment. Deal volume for cross-border buyers edged lower in the third quarter.

It’s no secret that B2B marketing was hard hit by the COVID-19 pandemic. Business that relies on in-person connection simply couldn’t remain unaffected by social distancing regulations. But while industries looked different this year, they certainly didn’t stop moving.