In this Placer Bytes, we check in on office supplies to see if there are signs of life and dive into rising visits to a leading purveyor of wine and spirits. In June, we decided to shake up our annual predictions with an added list that took into account the unique realities and potential opportunities that would come from the pandemic and recovery. And while brands like BJ’s Wholesale Club and Tuesday Morning are repaying that confidence, there is one sector that has left us disappointed: office supplies.

With the Asana IPO coming up this week we have explored some digital trends to gain insight into the company’s health. As part of the analysis we looked at trends in the number of monthly visits to the site globally and competition in the US.

In this Placer Bytes, we dive into Ascena’s strengths as a means of looking forward, break down Bed Bath & Beyond’s latest and dive into Dunkin’s surge. In 2019, and again this past June, we noted that one of the most interesting sectors in apparel was the plus-size segment. This perspective gave us more confidence in a struggling Ascena as it sits on some of the most exciting brands in the space including Lane Bryant and Catherines.

Trips to Germany’s supermarkets are running at 31% above 2019 levels, continuing a trend that reached as high as 53% above year-on-year values in mid-August. This follows a previous rise in German supermarket shopping activity observed immediately prior to lockdown in March where levels exceeded 29% of their seasonal norm.

In anticipation of Academy Sports & Outdoors’ upcoming IPO, we analyzed the retailer’s market share, channel performance, the impact of its geographic profile, and shopper cohorts including recipients of the federally granted stimulus check. Additionally, we looked at sporting goods’ wallet share among Academy’s most vs. least loyal customers. Here’s what we found.

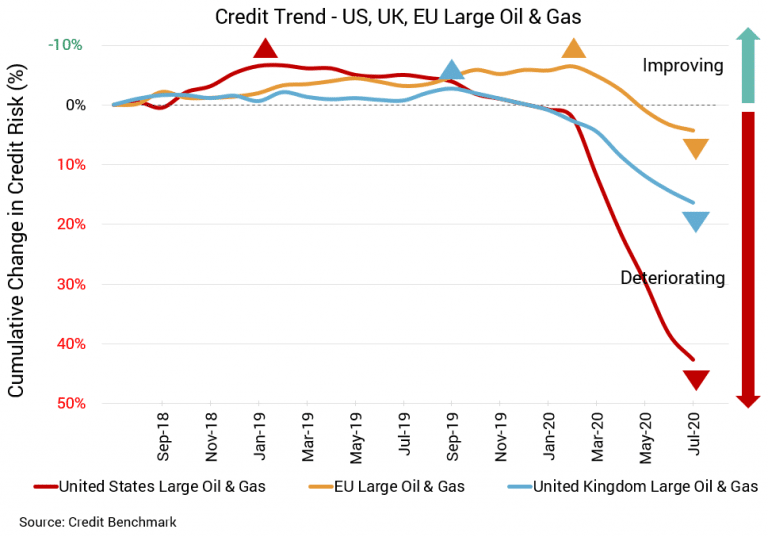

The besieged US energy sector continues to see credit deterioration, and with a multitude of problems facing the industry there is little cause for optimism. In the US, energy companies were supplying fewer barrels of gas per day even with the recovery in consumption, and shale producers are facing a cash crunch. Meanwhile, European oil producers are questioning whether it’s worth drilling.

According to data from Ookla, the quality of US mobile and fixed internet networks suffered as a result of COVID-19. As individual states implemented mandatory lockdowns and Americans spent more time indoors, internet consumption surged resulting in a virtual traffic jam. Streaming entertainment, video-conferencing, and social-media are the main culprits.

A much more discerning grocery shopper is emerging in the wake of initial widespread panic-buying sparked by COVID-19 this past spring that led consumers to disregard prices and stock up on products and ingredients required to prepare the entirety of their family meals at home.

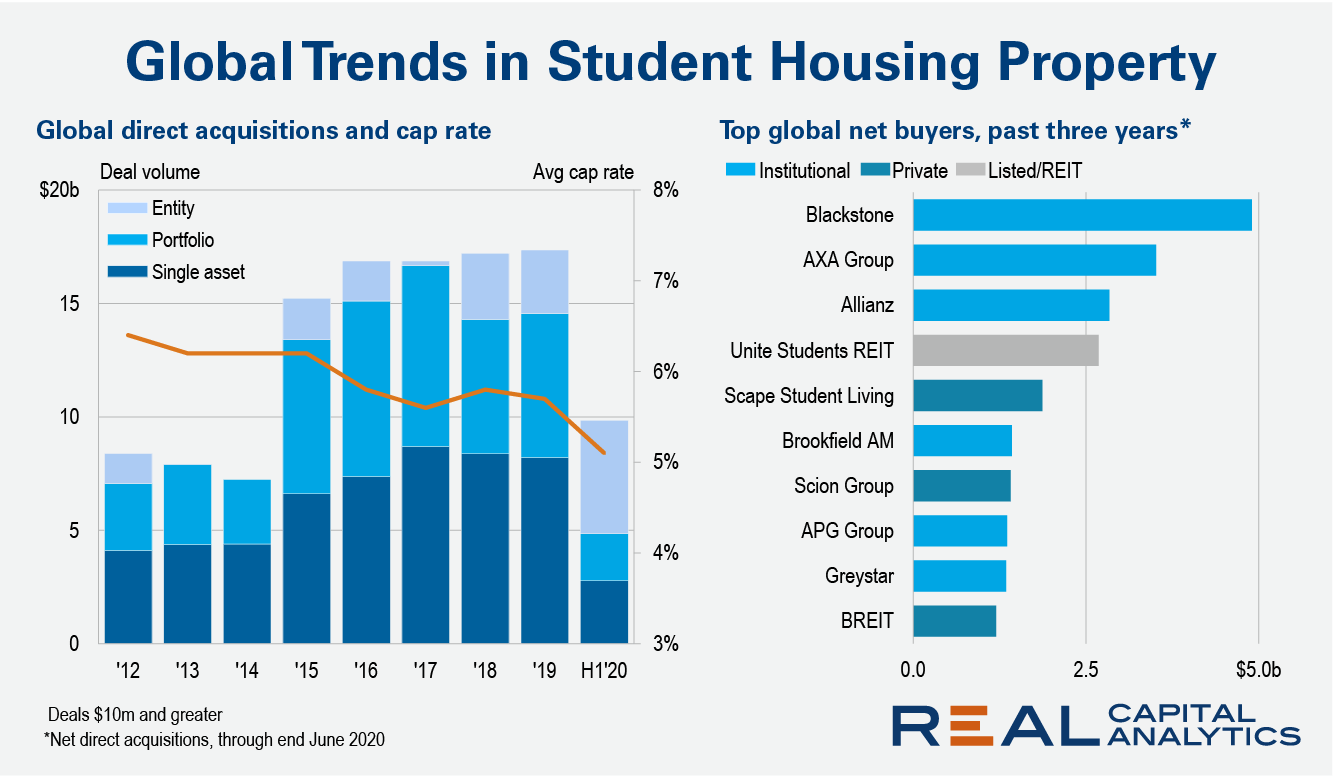

Over the past six years there has been an explosion of institutional investment into student accommodation around the world on the premise that demand for housing is robust. That premise has been thrown into doubt as Covid-19 forces universities to reduce or cancel in-person teaching and thwarts travel by international college students.

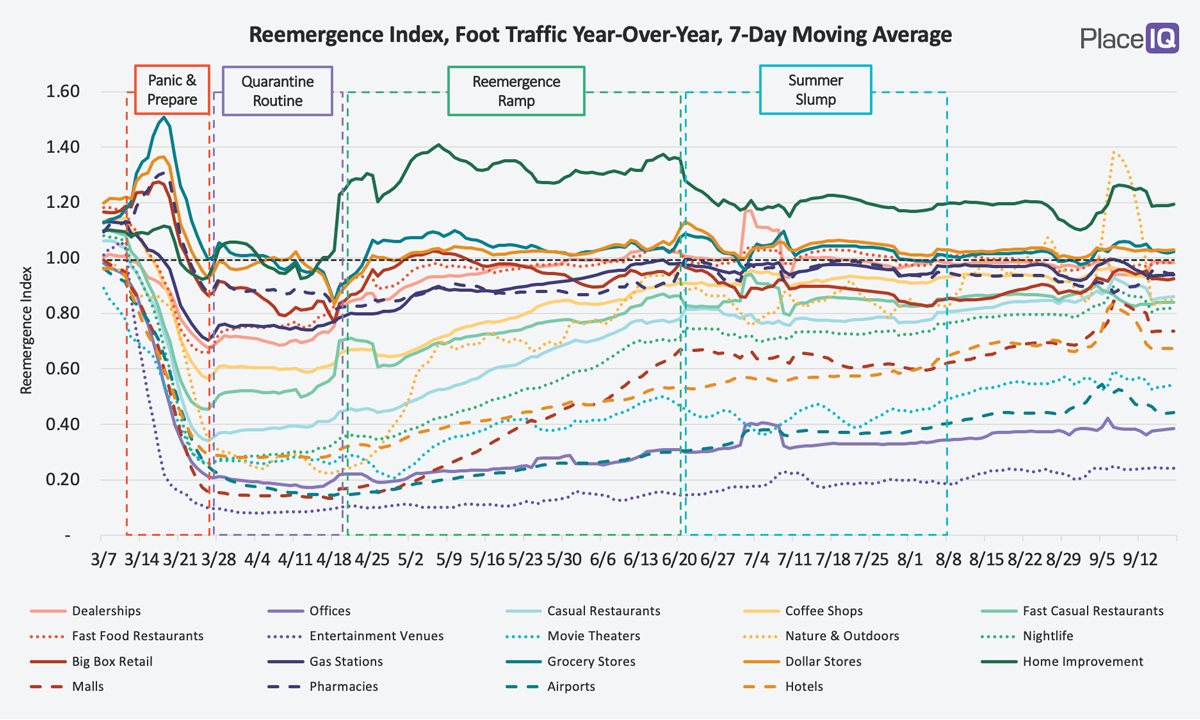

With this week, Summer is officially over. And so too our Summer Slump comes to an end, with traffic ever-so-slightly up from its August levels. Now, there’s something to note about that Labor Day spike: it’s not what it seems. Our Reemergence Index works by comparing weekday traffic year-over-year. We compare the 14th Friday in 2020 to the 14th Friday in 2019.

As the coronavirus crisis drags on, bringing with it more social distancing requirements and continued disruptions to the workplace, a crucial piece of the puzzle remains unsolved: childcare. Though some schools and daycare centers have reopened, many are still conducting classes entirely online, and almost none are back to their pre-COVID capacities. Even families with support are still struggling with parenting during COVID-19.

The return of employees to manufacturing facilities across the UK has stalled since June, with presence failing to recover beyond 60% of last year’s levels. By contrast, this seasonally-adjusted measure of daily worker presence also shows presence regaining 75% in July and growing to over 80% this month.

With the economic picture still murky, no news may be good news for the US and UK housing sectors. Credit quality has seen little change in each region with the most recent update. Recent positive signs in the US and UK markets may suggest continued stabilization. But as noted last month, the UK is experiencing its worst recession on record and the sector’s credit prospects may limited for some time. There’s more reason for optimism for the US, according to some reports.

Cloud data storage and analytics provider Snowflake set a new high bar on Wall Street this/last week with its IPO. The listing valued Snowflake at $70.4 billion – the largest in 2020, and the largest-ever for a software maker. It also earned the distinction as the biggest company to double its share price in a market debut. And although the company is not yet profitable, data sourced from our Cloud Infrastructure dataset indicates tremendous growth potential.

We have refreshed our back to school (B2S) analysis (read Part One) now that the full season is behind us, and added a detailed analysis on discounting and average selling price (ASP) trends utilizing our newest Retail Pricing data. This web-sourced sku-level dataset will be featured in our upcoming product Earnest Retail Pricing, which tracks retailers’ pricing and discounting trends, providing insight into gross profit margins.

In July, we broke down the relative recoveries of outdoor and indoor shopping centers and found that, perhaps unsurprisingly, the former were recovering faster. The combination of shoppers’ concerns about COVID, limitations on which retailers were reopening, and other factors gave outdoor centers an advantage during the early stages of the recovery.

Throughout 2020 scheduled airlines have been looking for glimmers of hope in a recovery, but it looks like the last hope of the year Thanksgiving will be memorable this year for all the wrong reasons. The summer season saw a small spike in demand and then a rapid settling back to the new normal demand levels; labour day showed a similar pattern and the end of year holiday currently looks like being worse than both of those events.

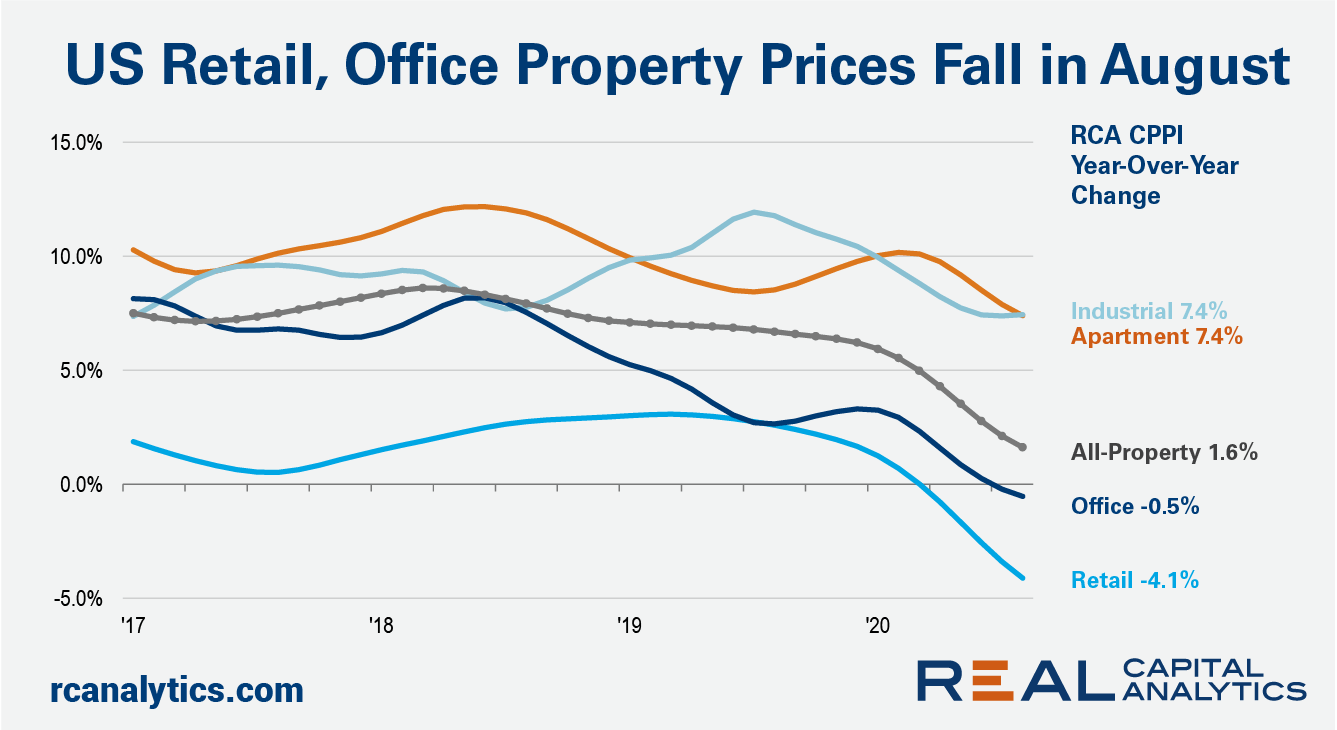

U.S. commercial property prices posted a 1.6% year-over-year gain in August as declines in retail and office pricing weighed against continued growth in industrial and apartment prices, the latest RCA CPPI summary report shows. The US National All-Property Index was rising at close to a 6% rate at the start of 2020, before the Covid-19 crisis hit the economy.

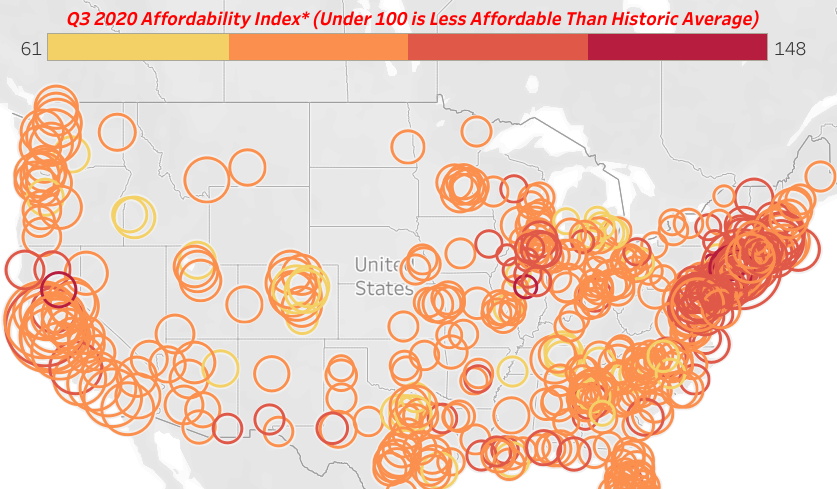

Median home prices of single-family homes and condos in the third quarter of 2020 are less affordable than historical averages in 63 percent of counties with enough data to analyze, up from 54 percent a year ago.

Months into the global pandemic, salons and barber shops are slowly opening back up at different stages, but the industry as a whole remains hit hard. An analysis of spending at personal grooming retail outlets (haircuts, barber shops, spas, salons etc.) reveals that this industry has been severely affected by COVID-19.