Even with gas prices rising, people have the travel bug. New installs and monthly active users of car rental apps in the U.S. hit all-time highs in May. MAUs are projected to be higher in June but new app installs are expected to fall slightly. Clearly, there's a lot of pent up demand as people could not or did not want to travel in 2020 or 2021.

Boot Barn, a western-focused shoe and lifestyle chain, has been one of the most successful retailers in the apparel and footwear space in recent years. We dove into the data to analyze its 2022 performance and see how the brand’s expansion is affecting its foot traffic. The footwear industry demonstrated surprising resilience over the pandemic, and Boot Barn is one of the best examples of this category’s success.

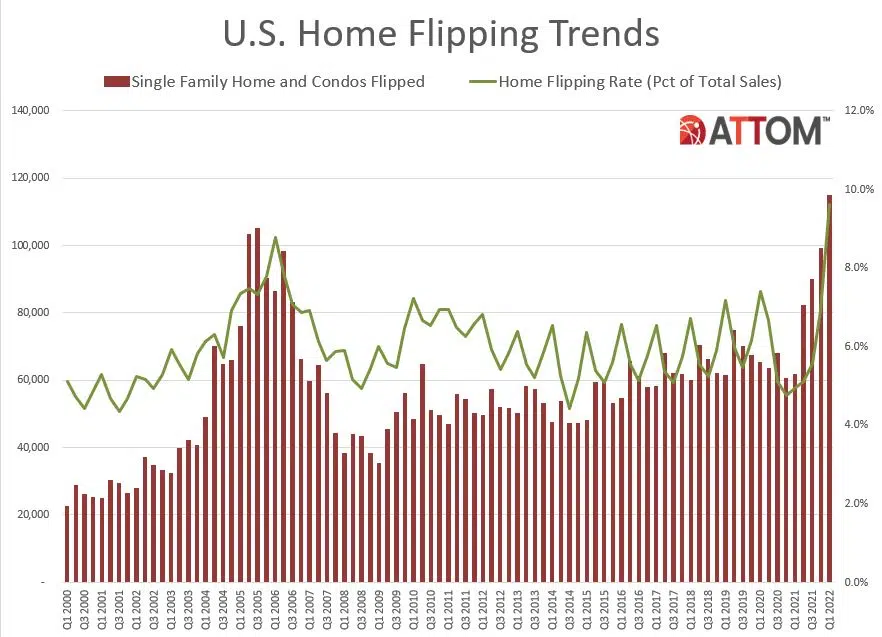

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its first-quarter 2022 U.S. Home Flipping Report showing that 114,706 single-family houses and condominiums in the United States were flipped in the first quarter. Those transactions represented 9.6 percent of all home sales in the first quarter of 2022, or one in 10 transactions – the highest level since at least 2000. The latest total was up from 6.9 percent, or one in every 14 home sales in the nation during the fourth quarter of 2021, and from 4.9 percent, or one in 20 sales, in the first quarter of last year.

Amazon Prime Day is returning this year on July 12-13, and previews of the online sales have consumers excited to take part in _Amazon’s_ biggest shopping day of the year. Although _the company_ has expanded the shopping holiday to new markets this year, US sales are still predicted to account for over 60% of all Prime Day purchases as American consumers search for deals amidst rising costs and ongoing inflation

After months of pressure from activist hedge funds, national department store chain Kohl’s Corporation (NYSE: KSS) announced in May 2022 that it was exploring a potential buyout. The announcement came amid a shifting retail industry in which several big-box retailers like Walmart and Target reported disappointing first quarter results, while some department store companies such as Macy’s Inc (NYSE: M) and Nordstrom Inc (NYSE: JWN) posted strong first quarter earnings and raised their profit outlook.

As Venture Capitalists’ billions are taking over the City of London, France has followed suit, ramping up its open-border immigration policy for workers at tech start-ups. Competition is fierce for becoming the Silicon Valley of Europe: From large cities like Berlin and Paris to smaller ones like Vilnius and Tel Aviv, who is winning the race to become the center for churning out unicorns?

It might be time to get excited about the potential of movie theaters. Even in a period dominated by the strength of streaming services, there is a confluence of trends that just might give this segment a much needed boost. A critical starting point is that when looking at visits to AMC Theaters and Regal Cinemas nationwide, there is a clear recovery trend. Looking at a 2022 ravaged by challenges from Omicron in January to inflation and rising gas prices in the Spring, and yet, the Year over Three Year visit gap was still at its lowest in May.

Last week, Apple launched Apple Pay Later at its annual developer conference. Apple Pay Later allows iPhone and Mac users in the United States to pay for purchases in four payments over the span of 6 weeks, with no interest or other fees. The announcement is big for the new industry. Apple is delving into one of the hottest areas of consumer finance, a service called buy now, pay later (BNPL). Consumers using BNPL can stretch payments for an item over a few weeks or months.

Among the top grocery store apps, user sessions were up 77% year-over-year in May, and reviews mentioning the word "coupon" shot up 75% from April. User sessions began to rise concurrently with food prices since Q3 2021. The record usage is primarily driven by inflation concerns, according to further analysis in a new report today, "Inflated Retail Records". Prior to this year, Top 10 Grocery Store apps peaked during Q1 2020, when lockdowns began and omnichannel shopping became a safety protocol.

The impact of rising inflation and gas prices has reached consumer spending. In May 2022, US retail sales fell by 0.3% relative to April as shoppers thought twice about spending their increasingly tight budget. But while some spending might be down, certain categories are thriving. One of the clear beneficiaries are those companies gaining from consumers “trading down” from higher-priced products and services in favor of cheaper alternatives. To better understand this phenomenon, we looked at year-over-year (YoY) foot traffic patterns for major retail, dining, and hospitality sub-sectors.

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. single-family rent growth continued its hot streak in April, with prices up by 14% year over year, the 13th consecutive month of record-breaking annual gains. As in past months, a shortage of rental properties on the market is putting pressure on prices, as is a thriving job market, with the nation’s economy adding nearly 430,000 new positions in April and an annual wage increase of 5.5%.

Even with gas prices skyrocketing and COVID-19 cases surging once again, this year’s summer travel season is poised to be one of the busiest on record. AirDNA reports that the booking pace for travel this spring was 49 percent higher than the same time last year, and 26 percent higher than 2019’s pre-pandemic levels. Ads for booking sites reflect this, with the top brands in the Travel Booking Services & Travel Agencies category unleashing a tidal wave of ads on streaming services like Hulu, Pluto TV, Tubi, and Peacock.

As temperatures continue to soar in Europe, airline capacity has followed reaching 98.5 million seats this week, the 100 million mark remains tantalisingly just out of reach as China adds back further capacity. Against that backdrop there is the IATA AGM taking place in Doha and the IATA Slot Conference in Seattle; it’s a busy week for the industry with current optimism mixed with growing concerns around the last half of the year as economic headwinds once again impact the aviation industry.

Earlier this month, the UK experienced a rare Platinum Jubilee in honor of Queen Elizabeth II. In today’s Insight Flash, we take advantage of our ability to pinpoint exact transaction dates in our UK Transact data to look into how shoppers celebrated during the four-day bank holiday Thursday June 2 to Sunday June 5. In general, there wasn’t a dramatic change in total UK spending. The week before and the week of the Jubilee saw spend 13% and 14% higher than the first week of January, below the spend lift seen in the week before the Early May Bank Holiday.

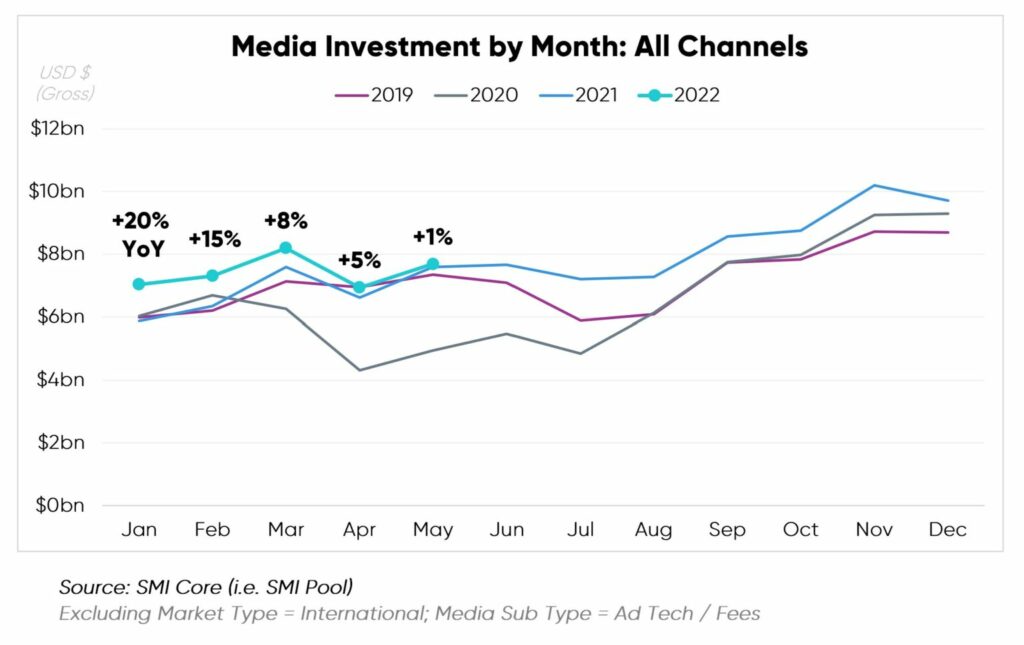

SMI Core data captures the actual spend data from the SMI Pool partners of major holding companies and large independent agencies, representing up to 95% of all US national brand ad spending, to provide a complete monthly view of the SMI Pool market size, investment share and category performance. Core Data delivers detailed ad intelligence across all media types, including Television, OTT, Digital, Out of Home, Print, and Radio.

In 2022, main players in the Southeast Asia food delivery market remain Grab, Foodpanda, Gojek, followed by Deliveroo, Shopee Food, and new joiner Airasia Food. This insight article will provide you with a quick overview of the Southeast Asia on-demand food delivery market across metrics such as market share, consumer spending analysis, and user overlap in Singapore, Malaysia, Indonesia, Thailand and Philippines – all calculated based on Measurable AI’s latest transactional data.

Feelings of dread around the inflation rate, sunken stock prices, and recession fears still loom, of course. And hiring slowdowns are being experienced across industries, occupations, and business types. Created job listings at both public and private companies have been in sync since 2020, with sharp decreases seen in all markets lately, as hiring slows. At the industry level, companies with the largest drops in job listings in May include those in: Utilities (-8.8%); Information (-7.3%); and Transportation and Warehousing (-6.8%).

Total construction starts rose 4% in May to a seasonally adjusted annual rate of $979.5 billion, according to Dodge Construction Network. Nonresidential building starts rose 20%, while residential starts fell by 4% and nonbuilding lost 2% during the month. Year-to-date, total construction was 6% higher in the first five months of 2022 compared to the same period of 2021. Nonresidential building starts rose 17% and residential starts gained 3%, while nonbuilding starts were 5% lower.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of year-end dips in 2020 and 2021, sales have been gradually recovering since April 2020. Bloomberg Second Measure transaction data shows that Uber sales were up 49 percent year-over-year and Lyft sales were up 29 percent year-over-year in May 2022.

With summer almost upon us, we took a look at foot traffic trends associated with a classic American activity – spending time in nature. We dove into visits to 20 national and state parks as well as foot traffic to a rising star in the recreational equipment space, Sierra, to see what its strength can tell us about the demand for leisure time in the great outdoors. With the recent rise in costs of consumer goods and services, people may be turning to outdoor activities as a cost-friendly leisure option.