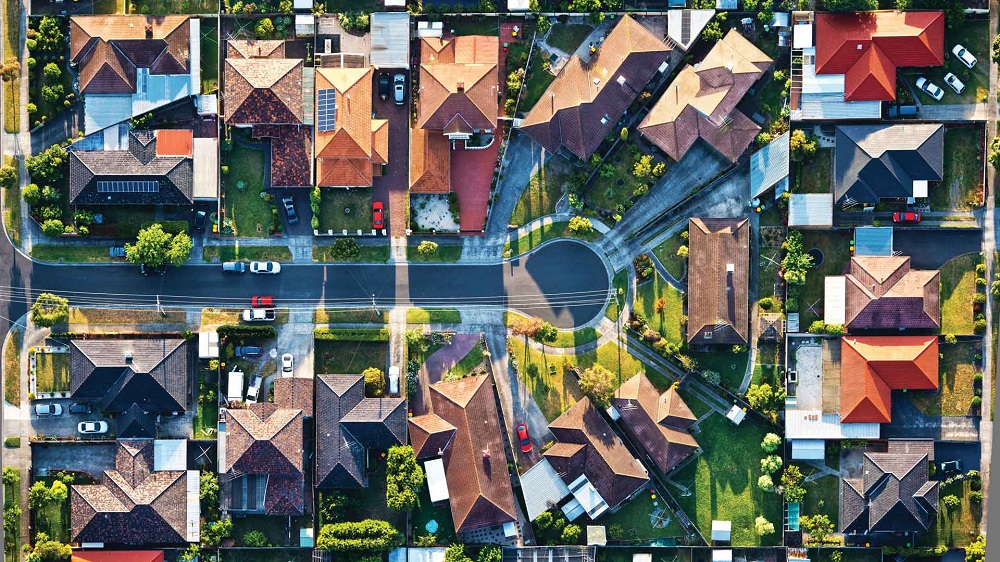

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. rent prices continued their double-digit gains in February, rising 13.1% from one year earlier to hit another new record as the highest in the history of the index. Warmer areas of the country again posted the largest price hikes, with rents in Miami up 39.5% from February 2021.

Consumer interest in department stores sometimes seems to come and go as frequently as a “One-Day Sale.” With so many shifting dynamics, CE data provides several tools for checking on Department Store health. In today’s Insight Flash, we look at how overall industry growth has paced versus Full-Price and Off-Price chains, how online penetration has been trending, and whether number of transactions or spend per transaction has been a bigger growth driver for certain chains this year.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in March 2022, sales for meal delivery services grew 6 percent year-over-year, collectively. The ongoing pandemic may also be driving more Americans to make their first meal delivery purchase. In March 2022, 51 percent of U.S. consumers had ever ordered from one of the meal delivery services in our analysis, up from 47 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of year-end dips in 2020 and 2021, sales have been gradually recovering since April 2020. Bloomberg Second Measure transaction data shows that Uber sales were up 89 percent year-over-year and Lyft sales were up 56 percent year-over-year in March 2022.

Foot traffic to Five Below has been increasing steadily for the past several years, but the pandemic catalyzed a major growth spurt. We dove into this rising retail giant to understand what contributed to its astronomical rise. In mid-March, 2020, Five Below announced that it would close all of its stores in response to the emerging Coronavirus. But even at the height of the COVID closures, Five Below CEO and President Joel Anderson (formerly the CEO of Walmart) could already see the potential opportunity.

While drivers feel pain at the pump, record high new and used car prices only add insult to injury. According to a CarFax report, listing prices for used cars in January 2022 were up 40 percent year-over-year. The ongoing global microchip shortage is primarily to blame. Auto manufacturers cannot get their hands on enough chips to keep production lines running, contributing to the sharp uptick in used sales. The biggest players in the used car marketplace have been tailoring their messaging to reluctant buyers and eager sellers.

Moonpig’s future keeps seeming brighter and brighter, with the company raising guidance as each new holiday generates an even bigger than expected sales boost. But do the service’s online cards and gifts have staying power, or was the company simply in the right place at the right time? In today’s Insight Flash, we answer that question by digging into how the company has performed versus the broader Party/Novelty/Gifts Subindustry, how frequently customers come back for additional occasions, and whether customer geography plays a role in purchases.

Australia’s construction sector has faced many headwinds due to Covid, with constrained supply pipelines causing delays in shipments of necessary materials, lockdowns hampering progress on much construction activity, and, more recently, significantly rising costs. However, over the last two years, there has still been significant investment in building new assets, thereby increasing the amount of stock and the size of the investment market.

We’ve previously discussed the strength of grocery stores during the pandemic. Here, we’ll dive into two European grocers – Aldi and Lidl – who have deepened their foothold in the US over the past few years. In a recent survey that we conducted in March 2022 of US-based adults aged 18 to 64, data shows that compared to pre-pandemic, a majority of people in the US (52.3%) are doing more of their grocery shopping online. At the same time, the vast majority of respondents – 62.5% – also stated that they visit physical grocery stores more often or about the same as they did pre-COVID

2021 was a curious year for the travel app sector. Travel was hit hard in the previous 12 months, with recreational and business travel virtually halted all over the world. 2021 saw travel rebound back towards pre-pandemic levels, thanks to a combination of vaccine rollouts, natural immunity and governmental plans for safe reopenings despite new variants causing intermittent lockdowns and travel restrictions.

Last week, Bloomberg News featured our Chief Green(washing) Officer research from the end of last year. This inspired us to revisit the role of “Chief Green Officer” (CGO), or as it is more commonly called “Chief Sustainability Officer” (CSO), to learn more about their responsibilities and impact. Below are the ten industries where the role is most common. Notably, the list is headed by industries with rather heavy ecological footprints, suggesting that there are efforts by companies to curb their unintended impacts on the environment.

Last year, foot traffic to Lululemon and Athleta consistently outpaced 2019 levels, buoyed by the growing interest in health and wellness and the rising demand for comfortable clothes. With Q1 2022 behind us, and on the heels of Lululemon’s recent footwear launch, we dove back into the data to understand how this year is shaping up for these two athleisure category leaders.

Inflation grew at a historical 7.9% in February 2022, as manufacturers passed along higher input costs as a result of higher demand and the conflict in Ukraine. However, not all brands increased prices at the same rate, leading to sudden market share changes across CPG and other retail categories, including cereal. General Mills ($GIS) topped major hot and cold cereal brands in price increases in March. Market share by sales shifted towards brands with higher price increases… but share of total units sold favored brands with mid to lower price increases

The nation’s overall delinquency rate was 3.3% in January. All U.S. states and metro areas posted year-over-year decreases in delinquencies.In January 2022, 3.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.3-percentage point decrease from January 2021 according to the latest CoreLogic Loan Performance Insights Report . This is the lowest recorded overall delinquency rate in the U.S. since at least January 1999.

The top 10 quick-service restaurant apps in the U.S. in March were downloaded 9.5 million times, 17.9 percent more than those the month prior. Year-over-year in the month of March, downloads of the top 36 quick-serve apps were up 13.4 percent. A download represents a new user and the first conversion on the mobile app customer’s journey. Apptopia only estimates first-time downloads and re-downloaded are not taken into account.

From Omicron’s impact on January visits to rising gas prices in March, the first quarter of 2022 was rife with challenges. Yet, even within this difficult environment, some retailers outperformed and showed unique levels of strength in the face of an ever-mounting series of obstacles. Here are some of the retailers and segments that thrived in an especially difficult Q1.

It was never going to be a straightforward recovery from the global pandemic for the airline industry, too many years of experience and previous events can confirm that there will be bumps on the road to a full recovery. The last week has been challenging in Europe with staff shortages across many airlines and airports while in China the zero-Covid strategy continues to have millions of people locked in at home. Despite those challenges, this week’s airline capacity continues to creep up with another 1.5 million seats added, a modest 1.5% increase week-on-week but edging ever higher.

When Jawed Karim, the co-founder of YouTube, posted the now-infamous video of himself at the zoo in front of two adorable elephants, there’s no way he could’ve predicted the meteoric rise of his creation. If you would’ve asked him in 2005 how many monthly active users YouTube would have in 2022, there’s no way he would’ve said more than two billion. If you questioned him about the amount of video people would upload to YouTube, 500 hours a minute probably wouldn’t have been on the tip of his tongue.

In an increasingly crowded food delivery marketplace, Gopuff is trying to carve out a niche by vertically integrating and positioning itself as the instant source for smaller-ticket convenience items. But how differentiated is the company’s model, and is there room for growth? Recent reports of layoffs, shift reductions, and fee increases indicate that the model may not be sustainable. In today’s Insight Flash, we dig into the drivers of Gopuff’s performance, including growth by market tenure, price per items trends, and items per basket.

The travel industry has seen its fair share of challenges over the past two years. As the wider situation begins to stabilize, will we see travel trends bounce back to pre-COVID levels? We took a closer look at Q1 2022 foot traffic data for hotels, airports, and major convention centers to find out. Travel agents are predicting that domestic tourism may return to pre-pandemic levels in 2022, as people finally get to take those trips they’d been putting off. We took a look at data to see if those predictions are reflected in the foot traffic.