Since launching in 2007, Hulu has made a name for itself with an ability to offer a seemingly endless stream of premium content, including the likes of It’s Always Sunny In Philadelphia, The Handmaid’s Tale and a variety of titles from the Marvel Universe. Outside of Netflix, Hulu is arguably the biggest name in OTT. As of Q4 2021, Hulu had 43.8 million paid subscribers. (Netflix reported 221.8 million paid subscribers at the end of Q4 2021.)

Globally, demand for crypto apps has exploded, with new installs of the top 20 apps (wallets & exchanges) growing 902% YoY in the fourth quarter of 2021. In our most recent report, Fintech deep dive: digital currencies 2022 playbook, we collaborated with marketing analytics platform, Adjust to dive into the key drivers of cryptocurrency app adoption in 2021. For this same grouping of apps, the U.S. had a rate of 645%, while APAC registered at 475%. This is followed by EMEA at 284% and then LATAM with 182%.

Restaurants might have reopened in 2021, but people decided they liked ordering in anyway. App makers responded with 10 minute deliveries – and the category hit new heights. In 2021 the phrase 'fast food' took on a new meaning. The 2020 lockdowns had propelled the emerging habit for home delivery. In March 2020 global weekly sessions on Food and Drink apps stood at 1.9 billion. By December 2021 they had scaled to 4.4 billion.

After a historic 2021 in which apartment demand and rent growth rocketed well beyond their typical ranges, the expectation for 2022 could be broadly summarized as “robust, but not 2021”. National rent growth projections for this year have commonly been in the 5-7% range across various sources. This is based partially on the thinking that supply constraints, a fully re-opened economy, and remaining high demand would continue rent growth momentum even if that growth likely peaked in 2021.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in February 2022, sales for meal delivery services grew 10 percent year-over-year, collectively. The ongoing pandemic may also be driving more Americans to make their first meal delivery purchase. In February 2022, 51 percent of U.S. consumers had ever ordered from one of the meal delivery services in our analysis, up from 46 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of year-end dips in 2020 and 2021, sales have been gradually recovering since April 2020. Bloomberg Second Measure transaction data shows that Uber sales were up 104 percent year-over-year and Lyft sales were up 84 percent year-over-year in February 2022.

It stands to reason that salespeople leaving a company in droves is a bad sign, especially if that company depends heavily on selling products or services. But what does the data actually say about the consequences of high or low sales turnover? This week, we look at how company revenues and employee sentiment are actually affected when sales attrition varies. Pharmaceutical and medical device companies specifically depend heavily on sales. By looking at Abbott Laboratories as an example, we can see what happens to revenue when a company manages to reduce sales attrition:

Visits to pet supply shops have seen significant growth over the past two years. We took a closer look at foot traffic trends for Petco and PetSmart to see how the pet supply visit leaders fared over the past two years. Demand for pet supplies skyrocketed for the last two years. As work from home became widespread, homebound pet owners and first-time pet parents drove significant and lasting visit growth to brick and mortar pet supply stores.

Total construction starts rose 9% in February to a seasonally adjusted annual rate of $1.013 trillion, according to Dodge Construction Network. Nonresidential building starts swelled 32% due to the start of three large manufacturing facilities. By contrast, residential starts fell 3%, and nonbuilding starts fell by less than 1%. Without the three large manufacturing projects, total construction would have declined 6% in February.

France stood out among Europe’s largest property markets in 2021, posting a lower level of commercial real estate deal activity than during the pandemic-disrupted 2020. Of the top 10 European markets in 2021, only the Netherlands also registered a decline. Weakness in France’s office market was the culprit. Offices account for around 60% of the amount spent on French property since 2007 and the uncertainty affecting the sector has had an outsized effect on the market as a whole. Other more in-demand European sectors — namely apartment and industrial — have not compensated.

We analyzed foot traffic trends for leading plus size retailers – Torrid, Lane Bryant, Ashley Stewart, and Destination XL – to find out where the brick and mortar plus size apparel category stands two years into the COVID pandemic. The pandemic dealt a mixed hand to the plus-size apparel sector. Ascena Retail Group, owner of plus size apparel brands Catherines and Lane Bryant, filed for bankruptcy As a result, Catherines permanently shuttered its brick and mortar business to focus exclusively on its online store, and Lane Bryant announced the permanent closure of over 150 stores.

Two years ago, global airline capacity fell off a cliff; 21 million seats were cut in the space of seven days representing a 24% reduction, the Covid-19 pandemic was gathering pace and markets around the world were closing rapidly. Today, global capacity has settled at 82 million seats a week, an aviation recovery of sorts but still 22% below the same week in 2020 - although for the optimistic amongst you that is a 39% increase on this time last year. It seems that things are heading in the right direction, but as we expected the journey to recovery will not be without some bumps along the way and perhaps from events that we had not anticipated.

What do you think of when you hear the word “Alternative Data”? A neat definition would be non-traditional data sources that can provide indications as to a firm’s future performance other than conventional sources such as corporate filings and analyst predictions. Or to borrow from the Alternative Management Association (AIMA, 2020), “alternative data comes from unconventional information, mostly in an unstructured form, is not broadly distributed within the industry and is being used to deliver both investment alpha and operational alpha”.

U.S. single-family rent growth increased 12.6% in January 2022, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). January marked the 10th consecutive month of record-level rent growth. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. Annual rent growth in January 2022 was more than triple the gain recorded in January 2021 and more than quadruple the increase from January 2020.

As we begin lapping COVID-19 shutdowns two years ago, the world has changed in unexpected ways. In order to best see which companies have recovered and which are still suffering, Consumer Edge has been quick to add three-year growth calculations to its CE-Q dashboard suite for both US Transact and UK Transact. In today’s Insight Flash, see how growth rates compare across companies from these different time horizons. Keeping track of these differences in the next few weeks will be crucial to understanding the true pandemic recovery.

Apptopia recently released the market report “Travel Trendlines” bookmarking the performance of travel market segments and applications in 2021. These analytics cover 6 broad categories—OTAs, hotels, airlines, car rental, and cruise lines for the U.S. market. We open with OTA apps, an outlier among Travel app categories for its accelerated _growth_ in response to the pandemic. It’s not to say that bookings did not decrease substantially, but people turned to the apps to reschedule, cancel and dreamily browse deals and destinations for when the world reopened.

U.S. hotel weekly occupancy slipped a bit in the most recent week of reporting (27 February-5 March 2022), falling to 61.2% from 62.2% the week prior. While all attention is focused on rising gas prices and the potential impact on hotel demand, this week’s decrease was due to a weaker Sunday as the previous Sunday benefited from the Presidents’ Day holiday. Excluding Sunday, occupancy for the remaining six days reached 63.2%, the highest six-day result in the country since mid-November.

Some analysts see the world as a set of zero sum games. This view holds that the expansion of e-commerce means the demise of brick and mortar stores; the growth of at-home fitness means that gyms will soon be obsolete; and the rise of streaming services means that the demand for movie theaters will disappear. These voices grew especially strong over COVID. Many predicted that consumers would become so accustomed to shopping, exercising, and consuming entertainment from the comfort of their homes that they would no longer return to physical stores, fitness centers, and cinemas post-pandemic.

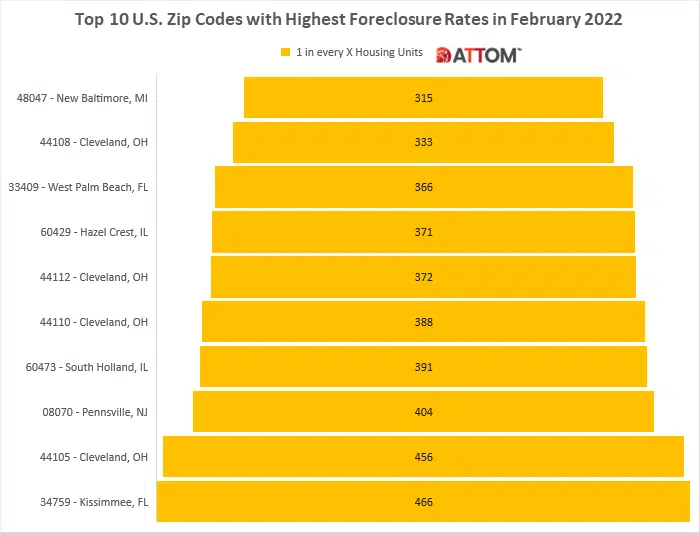

According to ATTOM’s February 2022 U.S. Foreclosure Market Report, foreclosure filings in February 2022 were up 11 percent from January 2022 and 129 percent from February 2021. ATTOM’s latest foreclosure activity analysis found there were a total of 25,833 U.S. properties with foreclosure filings reported in February 2022. The report noted that lenders repossessed 2,634 of those properties through completed foreclosures (REOs), down 45 percent from January 2022 but up 70 percent from February 2021.

Mobile games sustained strong momentum from the pandemic surge — reaching new heights at $116 billion in 2021 alone. Prior to 2020, mobile gaming was already in a league of its own — with record breaking levels of downloads and consumer spend across the app stores. But the following two years took engagement to new heights. Read our latest State of Mobile Gaming 2022 Report to uncover the phenomenal year gaming had on mobile: