According to WeatherOptics predictions, a major storm will move across the country from today (Wednesday) to Friday, with 80 million people under some sort of winter weather advisory and a large forecast impact on retail sales. Today’s Insight Flash shows where the biggest sales losses are expected to be as the storm moves across its path, with discounters the most likely to lose business. As the storm moves across the country, there are varying impacts by retailer by state by day.

Before the PayPal Mafia ran tech, the Traitorous Eight were the “it” entrepreneurs that founded unicorns after having left Shockley Semiconductor. And before them, it was the folks from Bell Labs. But how about today? Is there a new PayPal Mafia in the making, whose employees will shift the tech landscape? Which companies are churning out the most successful entrepreneurs of tomorrow? Although consulting companies continue to boast the number of alumni who founded unicorns, we see that big tech companies still have an edge.

Our latest white paper dives into 10 retail brands that have shown significant growth in 2021 and are well positioned for an even stronger 2022. Below we highlight two of these retailers to watch – Blink Fitness and Raising Cane’s Chicken Fingers. According to the National Health & Fitness Alliance, over 20% of pre-COVID fitness club locations have permanently closed since the pandemic began – which means that there will be significant unit expansion opportunities for the fitness chains that have managed to weather the storm.

According to ForwardKeys’ Forecast data, this year, the number of Russian outbound travel is expected to increase by +64% when compared to 2021, and +96% when compared to 2020. Regarding when we can expect it to recover to 2019 levels, Nan Dai, China Market Expert at ForwardKeys says: “Looking at the current pattern and pace for bookings, it is expected to recover to 2019 levels approximately in 2025-2026.”

Q2 2020 will go down in history as an unprecedented period for the mobile economy. People stayed home and downloaded a lot of apps. With gyms closed in many countries, health and fitness app downloads surged from 565 million to 811 million in that single quarter (Q2 2020). After that dramatic spike in the early days of lockdown, download volumes of health and fitness apps settled down last year. Aside from the covid-induced anomaly year, the long term trend for the category was still growing as we head into 2022.

When hair salons temporarily closed at the beginning of the pandemic, many consumers turned to DIY haircuts—with varying degrees of success. Hair salons gradually reopened as COVID-19 cases slowed and state and local authorities lifted their shelter-in-place orders, but sales at Regis Corporation (NYSE: RGS)—the parent company behind salon brands such as Supercuts, Cost Cutters, and SmartStyle—remain below pre-pandemic levels. Our analysis of consumer transaction data shows that sales recovery for Regis Corporation has varied by state, especially early in the pandemic.

Amazon has emerged as a leading brick and mortar grocery player through its Whole Foods and Amazon Fresh brands. We dove into foot traffic data to understand how the company’s offline grocery ventures performed and interacted with each other in 2021. Over a year has passed since the first Amazon Fresh location opened its doors in Woodland Hills, California. The company now operates over 20 stores throughout the United States, with the highest concentration of Amazon Fresh locations in California and Illinois.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through December 2021 and forecasts through December 2022. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

National home prices increased 18.5% year over year in December 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The December 2021 HPI gain was up from the December 2020 gain of 8.9% and was the highest 12-month growth in the U.S. index since the series began in 1976. Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%. Home price growth in 2021 started off at 10% in the first quarter, steadily increasing and ending the year with an increase of 18% for the fourth quarter.

We've just released our data-packed report, Benchmarking the Global Mobile Retailing Landscape. The report looks at the global and regional shopping app leaders across Q4 2021 and the full calendar year. We then dive into the specific U.S. markets of Brick n' Mortar retailers, Fast Fashion, Direct to Consumer, C2C Marketplaces and Luxury retailers. For the top 30 Brick n’ Mortar apps, the .2% growth YoY in 2021 suggests mobile took a backseat to the physical stores that operated at near-normal in 2021.

When the mobile phone first emerged, it was a communication tool. People used phones to talk. Later, they texted. Then, around 2006, industry insiders started re-positioning the phone as a multimedia computer you could carry around in your pocket. They were right, of course. The smartphone did become a tool for information-gathering, shopping, banking — touching virtually every facet of our lives. It changed mobile behavior forever.

While our latest Coffee Deep Dive broke down the unique opportunity in the coffee and breakfast segment of the wider dining space, there was a specific need to call out the strength displayed by Starbucks in 2021. Considering the wider impacts of COVID on shopping and work behavior, it would have been fair to assume that visits would remain below normal levels throughout the year. And that is exactly how 2021 began, with visits down 16.1% and 18.4% in January and February, respectively, compared to the same months in 2019.

After a very tough month and a half, we’re seeing relief across the country. Kinsa’s data shows decreased illness levels across all regions of the US, even in areas where Omicron more recently peaked, like the South and the West. While case counts still remain higher than other waves during the pandemic, the worst of the Omicron surge seems to be behind us.

Disney+ has surpassed a major milestone of $2 billion in lifetime global consumer spend through the app stores. Disney+ joins the coveted $2 Billion Dollar Club — in the company of only 34 other mobile apps and games as of January 25, 2022. Within this group, mobile games represent 26 of the 35 apps — alongside only 9 non-gaming apps. Furthermore, Disney+ is 1 of only 5 video streaming providers to reach this coveted milestone, alongside Netflix, YouTube, Tencent Video and iQIYI.

Our Q4 Retail Quarterly Index Reports analyze the performance of five key retail sectors – grocery, home improvement, fitness, superstores, and apparel – from a location analytics perspective. The reports provide insights into the quarterly performance of each category by diving into foot traffic patterns in the sectors as a whole and evaluating visit metrics for leading brands. You can check out the full reports in The Square.

ForwardKeys’ latest analysis on Q1 inbound air travel in Brazil confirms the relevancy of casting a wider net during the pandemic – in terms of air connectivity and source market promotions. Meanwhile, the domestic travel market could be what keeps the ship afloat as new case numbers increase. When examining the latest ticketing data for confirmed arrivals in Brazil in January – March 2022, the total international arrivals are -54% compared to 2019.

In addition to elevated demand for owner-occupied and second homes since the onset of the pandemic, there has also been an increase in investor home purchases across the U.S. housing markets. As the recent CoreLogic analysis showed, investor purchases accounted for about a quarter (26%) of all home purchases in the third quarter of 2021, up from 16% seen in 2019. Among investors, there has also been an increase in iBuyer home purchases in 2021. An iBuyer, or “instant buyer,” is a real estate company that uses technology to buy and resell homes quickly.

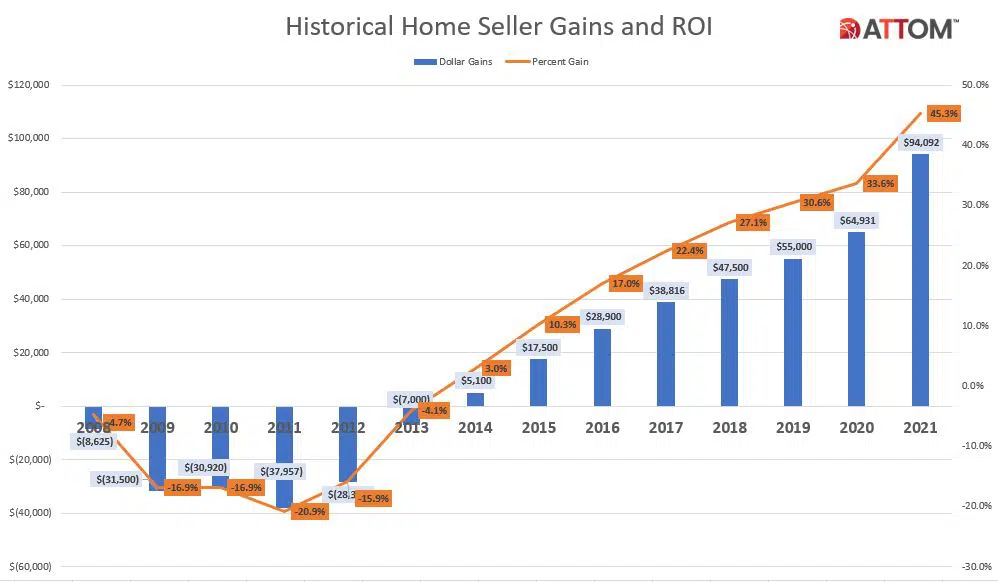

ATTOM, curator of the nation’s premier property database, today released its Year-End 2021 U.S. Home Sales Report, which shows that home sellers nationwide realized a profit of $94,092 on the typical sale in 2021, up 45 percent from $64,931 in 2020 and up 71 percent from $55,000 two years ago. Profits rose in more than 90 percent of housing markets with enough data to analyze and the latest figure, based on median purchase and resale prices, marked the highest level in the United States since at least 2008.

Across demographic cohorts, by age and gender, we’ve seen clear indications of preferences emerge. While some trends hold true, However, the intensity of the skew varies by country, along with the apps most likely to be used by each demographic cohort. However, it is important to note that our analysis is limited to males and females only and is not representative of all gender identities.

Welcome to the February 2022 Apartment List National Rent Report. After a slight dip to close out 2021, our national index ticked back up by 0.2 percent over the course of January. Even though month-over-month growth has moved back into positive territory, rent growth has still cooled substantially from last year’s peak. Year-over-year rent growth currently stands at a record-setting 17.8 percent, but over the past four months, rents have increased by a total of just 0.9 percent. Much of this cooldown is likely related to seasonal factors; it remains to be seen if rapid rent growth will return as moving activity picks back up in the spring and summer