Yes, Black Friday marks the height of the holiday season – but the day itself can hardly be taken in isolation. For critical context, we took a look at the wider weekend to see how different the holiday season in 2021 has been. Looking at the Placer.ai Mall Index on Black Friday alone showed visits to indoor malls down just 8.5% compared to 2019, while visits were down 9.2% for outdoor malls. And while the visits marked a significant peak for malls and retailers, looking at the wider weekend metrics paints an even rosier picture.

Despite the best attempts of the latest Covid-19 variant 'Omicron', and a series of unilateral knee-jerk reactions from Governments around the world, global capacity this week remains stable. Rates are steady at 78.3 million, half of one percentage point down and the whole airline industry continues to watch events very closely, marvelling at the next crazy restriction that encourages travellers to find cunning ways to avoid taking a test. So far, fingers crossed at least, the airlines have not panicked.

As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats. Casinos and sports betting had an incredible year. In the third quarter, casinos hit a new quarterly record in winnings—$14 billion. Now, they are on track to break the annual record of $43.65 billion, set in 2019.

Twitter CEO and co-founder, Jack Dorsey, announced on Monday that he is leaving the company. This will actually mark the second time Dorsey will step down from the post; after being named the social platform’s first CEO in 2007, he was ousted just a year later, only to return to the role in 2015. Dorsey’s latest departure will see Twitter’s current chief technology officer, Parag Agrawal, stepping into the role of CEO with Dorsey remaining on the board until his term expires in 2022.

While flu levels are increasing nationally, they remain relatively low with some exceptions. For instance, Kinsa’s data shows cough, runny nose and G.I symptoms are above expected levels for this time of year in the South, one of the areas in the country also experiencing an uptick in verified flu cases. Also, as we’ve previously discussed, there have been numerous reports of influenza outbreaks on and around college campuses

With reports of slowing online sales this Black Friday as shoppers rushed back to the crush of in-store shopping, many may be wondering how the king of online retailers, Amazon.com, fared. One key advantage of our CE Receipt data is that it captures the date that shoppers made an online purchase, while sources like transaction data often reflect when a credit or debit card is charged, usually not until an item ships.

ATTOM’s just released Q3 2021 U.S. Residential Property Mortgage Origination Report shows that overall mortgage lending was down 8 percent in Q3 2021, marking the second straight quarterly decline and the first time in more than two years that total lending decreased in two consecutive quarters. The Q3 2021 loan origination analysis conducted by ATTOM noted the quarterly decrease in mortgage lending was the first time in any year since at least 2000 that lending activity declined in both the second and third quarters, typically peak buying seasons.

Traffic on Black Friday after Thanksgiving was materially higher across Advan Indices compared with last year’s levels. But visits are still down compared to 2019 records for most of the indices. Clothing and Accessories index saw an increase of 55% yoy but down 15.3% Yo2Y while Furniture and Food Stores including food stores such as Kirkland’s/Restoration Hardware and Kroger’s and Whole Foods respectively have bounced back to pre-pandemic levels.

Thanksgiving week for the U.S. hotel industry was record-breaking by all measures. Weekly occupancy topped 53%, which was 2.3 percentage points higher than the holiday week in 2019 and nearly a point higher than the previous record achieved in 2018. Thanksgiving Day occupancy (56.9%) fell a bit short to 2018’s level (57.3%) as did Monday’s, but occupancy on the other days of the week were at record highs. Looking at the 3-day weekend (Thursday to Saturday), occupancy reached 60.2%, 0.9 percentage points greater than in 2018 and 2017 which had been the bar to surpass.

The majority of global property markets registered improving capital liquidity at the end of the third quarter, the latest _RCA Capital Liquidity Scores_ report shows, an indication that the recovery from the Covid-19 pandemic is gaining momentum. Liquidity increased from a year prior in 90 of the 155 markets covered by the analysis, up from 55 at midyear and 29 in the first quarter. However, on average, liquidity is not yet back at pre-pandemic levels.

Covid-19 has stretched the creativity of every airline network planner in the last twenty months as they changed airline schedules on a weekly or even daily basis in response to various lockdowns and changes in policy. At OAG we have seen exponential increases in schedule updates arriving from airlines around the world, and although it proves the creativity and resilience of an industry caught in a crisis, we all want to see stability return to airline schedules.

As COVID-19 cases rise in many parts of the world, especially Europe, the travel industry may be set for another period of disruption as winter encroaches and traveler sentiment worsens. Uncertainty in recent days has mounted further as the new Omicron variant has spread quickly, leading to many countries reimposing COVID restrictions. The situation is particularly ambiguous as recent months had produced stronger levels of hotel performance with vaccination progress leading to buoyed demand, reduced restrictions and the reopening of many international borders.

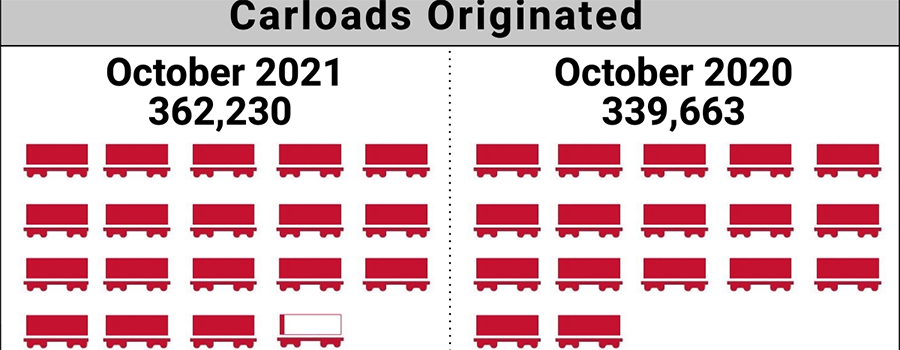

The number of carloads moved on short line and regional railroad in October 2021 was up compared to October 2020. Carloads originated increased 6.6 percent, from 339,663 in October 2020 to 362,230 in October 2021. Nonmetallic Minerals led gains again with a 63.4 percent increase. Crushed Stone, Sand and Gravel was up 22.1 percent, and Waste and Scrap Materials and Trailer or Container increased 20.0 and 16.8 percent, respectively. Motor Vehicles and Equipment led declines again, down 19.1 percent. Grain, Petroleum Products and Coal were also down in October.

We hope you all had a wonderful Thanksgiving, at home or visiting loved ones. Last week, holiday travel surged back to levels just shy of our 2019 pre-COVID benchmark. Compared to 2020 people were more likely to travel, traveled significantly further, and returned to airports en masse. Today, we’ll break down the pilgrimage for you all. But first, let’s touch on the big topic of the hour: the potential of the Omicron variant. There’s still so much we don’t know, but there’s some scenario planning we think is valuable for marketers as we stare down the idea of a new COVID wave.

As we approach the end of the year, we’ll be covering trends from 22 key markets. We’ll recap what each industry has experienced over the past year and what to watch for in 2022. Learn who are the top advertisers from each category and how they spend across formats. Of all things missed during the pandemic, travel was at the top of the list for many people. “\[Travel\] is a necessity, for lives and livelihoods, for families, as well as for economic and mental health,” said Gavin Tollman, CEO of the global guided tour company Trafalgar.

With climate change concerns on the rise, companies have taken to hiring so-called Chief Green Officers or Chief Sustainability Officers (CGO) into their C-suite. But can these employees actually make a difference to the sustainability of a company? Or are these appointments nothing more than greenwashing? Over the past decade, spikes in hiring of CGOs seem to coincide with public attention to climate and sustainability related issues. Below, the gray bars indicate whenever there is a spike in news searches for “sustainability” on Google Trends:

December 2, 2021

/

Business

Beauty Recap

Offline beauty visits came roaring back as restrictions on brick and mortar retail began to lift in spring 2021. Since then, foot traffic has remained impressively strong. As the sector heads into a critical holiday season, we dove into the data for Ulta, Sephora, and Sally Beauty to find out how the leading beauty retailers are performing in their owned stores and in their new collaborations with Target and Kohl’s.

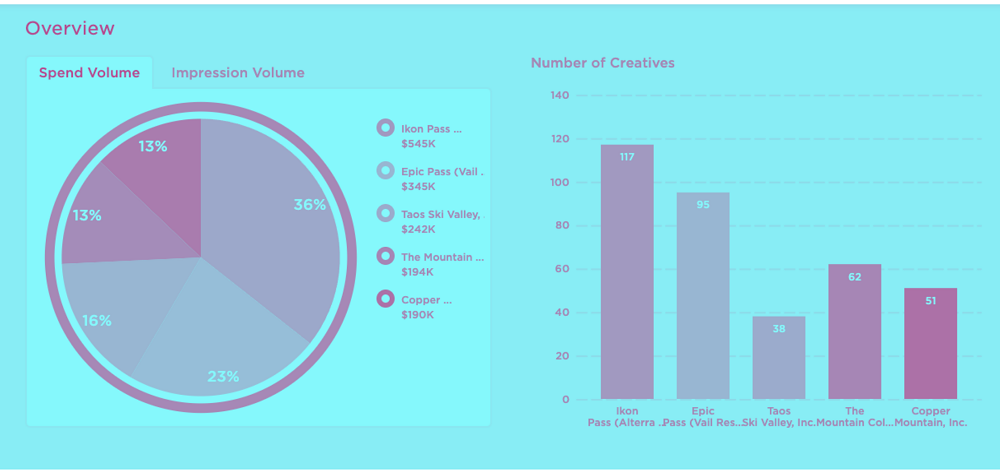

Ski and snowboard resorts were one of the first business categories to take a major hit during the first wave of COVID lockdown orders in March 2020. Now, in 2021, industry demand has slowly but surely recovered as domestic travel edges back up to pre-pandemic levels. Today, we'll review how the top three advertisers in the Ski Mountains, Lodges & Resorts category from September until now have ramped up their advertising efforts to prepare for a highly anticipated 2022 winter season.

After explosive growth during the first phase of the pandemic, streaming companies needed to move fast to keep the buzz up in 2021. We’ve seen companies take different approaches to attract new customers and reduce churn. Netflix is investing heavily in original content, and with each big release, like global sensation Squid Game, it gathers more user data across categories as diverse as action blockbusters, Korean soaps, anime, sci-fi, Sundance films, zombie shows, and kids cartoons.

A new report from ForwardKeys reveals which destinations were the most visited since 1st November by travellers from the eight southern African countries currently designated as most at risk due to the Omicron variant of COVID-19 – namely Botswana, Eswatini, Lesotho, Malawi, Mozambique, Namibia, South Africa and Zimbabwe. The data supports calls from many people objecting to immediate travel restrictions imposed on travel to and from these African countries.