The internet accounts for 2% of the world’s greenhouse gas emissions, the same as the global airline industry. Every time you Google a half-thought, play a silly cat video, or read a helpful blog (hi there), energy is used. But before you burn your router and boycott the internet, I’d ask you to finish this article first. With COP26 approaching and climate change growing as a hot topic, people are hunting for ways to educate their mind, eliminate their waste, and engage in the conversation on the quest to go green – all on the internet! Maybe the world wide web isn’t so bad after all.

One area where our CE Receipt data has been especially value added is in tracking mattress company direct-to-consumer online sales. With new entrants like Purple Innovation and Casper getting a majority of their revenue from direct sales, email receipt data can provide a powerful tool for analyzing these companies’ success, including financed sales that may not be picked up in other data sources.

In our Q3 Quarterly Index, we analyzed a wide array of brands in several major retail categories including apparel, grocery, fitness, home improvement, and superstores to bring you the latest insights and identify trends shaping retail right now. The apparel sector was hit hard by the pandemic, but foot traffic data shows that the category is bouncing back. Despite renewed COVID concerns, apparel visits grew this quarter, with foot traffic to apparel brands 3.0% higher, on average, than in Q2 2021.

Roughly 13% of the world’s shipping cargo is held up in traffic, according to Sea-Intelligence, an industry research firm in Denmark. Disruptions along the supply chain and an acute labor shortage are causing the nation’s ports to become severely clogged. With public fear of inflation, product shortages and the holiday season just around the corner, private companies are pressured to work 24/7. Shipping and logistics companies are in a stressful situation—is that impacting their advertising investment and creative?

Taiwan, the birthplace of bubble milk tea, is one of the fastest growing food delivery markets in Asia. In Taiwan, people created cute nicknames for UberEats and Foodpanda (吳伯毅 and 傅胖達), which sounds just like two guys’ names in Chinese. After Deliveroo quit the market in 2020, the “two guys” remain the biggest players in Taiwan and continue to own almost half of the market share respectively. Recognizing the huge potential in the Taiwan food delivery market, recently though E-commerce giants Shopee from Singapore and Coupang from Korea have decided to enter the game too.

Today’s article on Bloomberg News features analyses on competition for talent in the autonomous vehicle industry by Revelio Labs. The market for autonomous vehicles is growing fast, as headcounts are rising throughout all notable companies in the industry. The plot below tracks the growth of the companies that have experienced the biggest growth since 2018. Although employment growth is considerably large for all roles, Engineering roles have seen the largest growth, with an 80% increase since 2018.

With the acceleration of flexible working induced by the pandemic, investors in Asia Pacific have been watching closely to see if office prices would suffer. The pandemic did slow the increases in pricing recorded in some of the gateway cities in the region in the middle of 2020, but, in 2021 pricing in most markets has resumed an upward trajectory. For five of the eight cities shown in the chart, prices have now reached levels higher than those just before the pandemic.

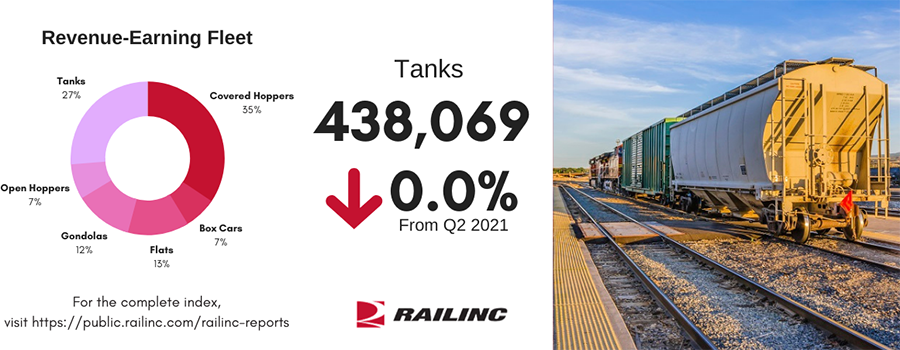

The North American rail equipment fleet decreased in total size during the third quarter of 2021. The total equipment count was 2,076,876 for a change of 0.2 percent. The four largest segments during the quarter were Covered Hoppers (29 percent), Tank Cars (22 percent) and Gondolas and Intermodal (10 percent). Five equipment groups increased from the last quarter, led by EOTs, up 3.8 percent, and IM Flats and Intermodal, up 2.7 and 0.4 percent, respectively. Hoppers and Flats led declines, down 2.1 percent and 0.5 percent, respectively.

In this Placer Bytes, we dove into the surge in visits to auto parts chains and looked into the latest data from Amazon Fresh to learn about the future of Amazon’s grocery push. Visits to auto parts chains have been skyrocketing since March, with year-over-two-year visits to every brand analyzed up by double digits for the past seven months. September visits were up by 26.2%, 22.8%, 17.5%, and 12.4% to O’Reilly Auto Parts, Autozone, Napa Auto Parts, and Advance Auto Parts, respectively, when compared to September 2019, to cap off two straight quarters of significant year-over-two-year growth in foot traffic.

STR’s latest 51-chart map shows a variety of recent national/regional trends as well as the general pace of the industry’s continued recovery. During the early weeks of autumn, revenue per available room (RevPAR) on a total-room-inventory (TRI) basis looked like 2019 for more markets. For the four weeks ending 16 October, 18 states outperformed their comparable 2019 RevPAR. That number was down from 21 states last month, but if we widen to “close misses” (i.e., an index score of 90 or higher), 37 states showed at least respectable returns toward their normal RevPAR.

Dating app industry growth has been a hot topic throughout the COVID-19 pandemic, as social distancing drove many U.S. consumers to virtual platforms to find love and make new friends. As in-person meetups are resuming, a number of dating apps have also rolled out features to help users filter potential matches by vaccination status. An analysis of a select group of companies in the online dating industry reveals that Bumble experienced the strongest increases in paid subscribers early on in the pandemic, as well as a second boost during the summer of 2021.

The alcohol delivery market has been abuzz with activity. Doordash recently launched an alcohol delivery option in select states, while Uber finalized its acquisition of Drizly. An analysis of transaction data reveals that even though bars and restaurants have gradually reopened during the pandemic, sales at same-day alcohol delivery companies like Drizly, Saucey, and Minibar exceed pre-pandemic levels.

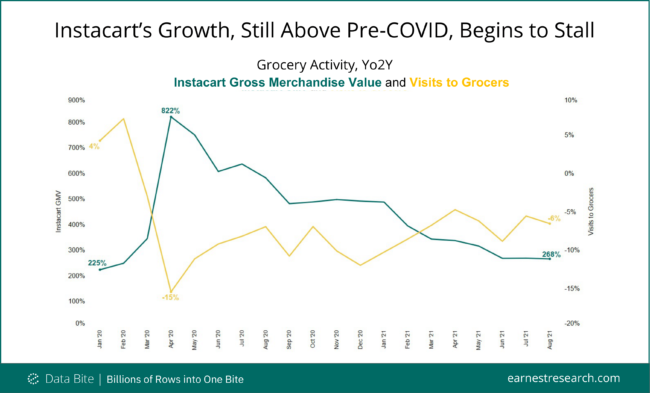

An analysis of Earnest Research data by Emory professor Dan McCarthy noted that GMV (Gross Merchandise Value) growth on Instacart is slowing faster than other convenience economy brands after peaking in April 2020. Earnest Research data in the report highlights that newly acquired Instacart customers are becoming less active over time—in contrast to restaurant delivery platforms such as DoorDash. The findings suggest that consumers’ switch to online grocery shopping may not have the staying power of other Covid-19 shifts.

The holiday season is on its way and while the last year and half provided an ongoing lesson in the challenges of ‘predicting’ during a pandemic, there is still value in attempting to highlight what the season could hold. Clearly the ongoing presence of COVID as an actual or potential disruptor is significant, but planning must go on and accordingly we decided to provide some of the key themes we believe will impact the holiday season.

Fevers - a hallmark sign of infectious illness - typically increase this time of year. Yet this year, they aren't. During a normal illness season, fevers hit their lowest levels in mid-summer. Starting in August, when schools return to session, fevers tick up again before peaking around the winter holidays, and slowly receding during the spring. This year, however, fevers began rising abnormally early, in the summer, peaking at the end of August.

New research from ForwardKeys reveals that flight bookings to the USA have soared following two announcements that the destination would reopen to vaccinated foreign travellers in November. By mid-October, weekly bookings exceeded 70% of pre-pandemic levels. The first announcement was made on 20th September, when the White House said that visitors from the United Kingdom, Ireland, the 26 Schengen countries, China, India, South Africa, Iran and Brazil would be allowed to enter the USA, without being subject to quarantine, provided they were fully vaccinated.

ATTOM’s just released Q3 2021 Special Report, spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the coronavirus pandemic, stated that New Jersey, Illinois and Delaware had the highest concentrations of the most at-risk markets in Q3 2021. The latest Coronavirus housing impact analysis, conducted by ATTOM, reported that the biggest clusters were in the New York City and Chicago areas, while the West remained far less exposed.

Notable Hit 1: (TSCO:NASDAQ) On Thursday October 21 , 2021 Tractor Supply Company (TSCO) posted better-than-expected revenues of $3.017bn beating the consensus estimate of $2.84bn (-6.2%) and in the same direction as Advan's forecasted sales. The revenue was +15.8% YoY - Advan's foot traffic data captured an increase in foot traffic of +25% YoY at its locations for Q3 2021. As a result of beating the sales and EPS, the stock opened at $211.51, up +4.5% from its previous day's closing price and hit a high of $212.88 (+5.2%) shortly after the opening bell.

The Columbus Day holiday propelled U.S. occupancy to 65.0% for the week ending 16 October. That level was the country’s highest since mid-August and surpassed the levels seen during the weeks of Memorial Day and Labor Day. This was also the 11th week since June that occupancy reached or surpassed 65%. The week-on-week gain in demand came almost entirely from Sunday with other weekdays providing much less improvement.

The headline rate of U.S. property price growth accelerated further in September, propelled by faster rates of growth from all four major property types, the latest _RCA CPPI: US_ report shows. The RCA CPPI National All-Property Index rose 16.1% from a year ago and 2.2% from August. The office sector index accelerated to a record 16.9% year-over-year rate in September, overtaking apartment and on par with the industrial sector. Suburban office prices powered the gain, climbing 20.2% year-over-year. CBD office prices fell 1.2%.