Just over a month ago, Google Pay relaunched with new features: tap-to-pay, peer-to-peer, personal finance aggregation, customizable deals, and other traditional banking services. Some have compared the app to Venmo, but I’d say that Google Pay is now more all-encompassing.

ATTOM Data Solutions, curator of the nation’s premier property database, today released its annual 2020 Grocery Store Wars analysis, which shows how living near a Trader Joe’s, a Whole Foods or an ALDI might affect a home’s value – as a homebuyer based on home price appreciation and home equity, or as an investor looking for the best home flipping returns and home seller ROI.

Black Friday took an expected fall in 2020, and the loss of Thanksgiving traffic entirely alongside these dips created significant year over year visit declines for that entire weekend. But Super Saturday has a unique ability to give brands a boost, and there are indications that this year’s iteration may have significantly softened the negative blow.

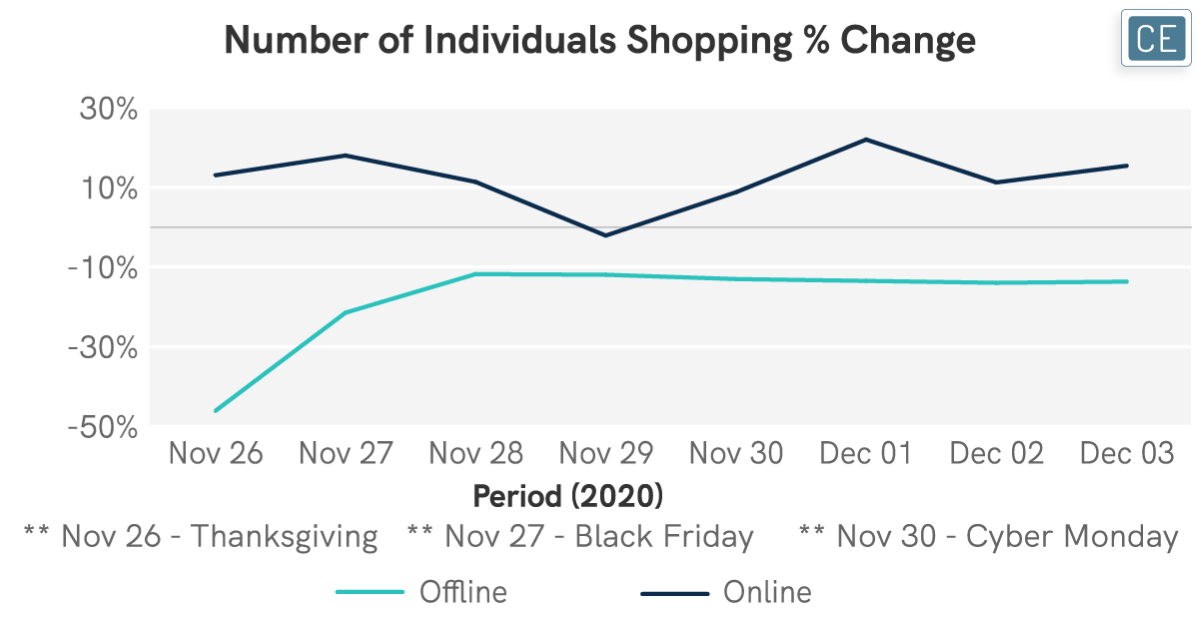

At this point, it should be unsurprising to hear that online sales grew faster than offline during Black Friday week, when customers in previous years have formed lines blocks long to catch early deals and it used to be that parking spaces at malls took hours to find.

Knowing you might not have time to watch our full webinars, we are pleased to continue our series of COVID-19 webinar summaries. In this latest edition, we talk performance in the Asia Pacific region. Demand gradually improving in Mainland China

While there are clear benefits to diving deep into the specific performances of key brands, there is also a value in stepping back to look at the retail space from a wider perspective. So, how has the recovery unfolded as 2020 comes to a close? We dug into industry analysis insights to see.

Traditionally, corporate supply chain information has been patchy. But over the past few years, Bloomberg have collected extensive supplier and purchaser data to shed light on the huge network of linkages between global coporate giants and the myriad of small and/or unquoted and unrated companies that form the fabric of the global economy.

Amidst the most unique holiday season in recent memory, Envestnet | Yodlee’s COVID-19 Income and Spending Trends sought out to observe how holiday shopping has differed this year compared to previous years. Spending on clothing has been steadily improving throughout the year, although even as the holiday shopping season is in full swing, it is still trending lower than 2019 due to a variety of reasons, ranging from shorter store hours to a slow economic recovery.

The COVID pandemic had a clear and demonstrable impact on the retail industry. But the biggest, and perhaps, most important challenge is discerning which of these trends are here to stay and which are short term phenomena limited to the realities and context of the pandemic itself. We took a look at several key trends that defined retail in 2020 with a look at which ones will have staying power into 2021.

In a year that has experienced a pandemic, political turmoil and unprecedented forest fires, it can seem that nothing is left unchanged – including the winter holidays. Consumers may be looking forward to taking a break at the end of such a difficult year, but with COVID case levels well above past highs, many states retreating back into lockdown and unemployment still significant, it’s unclear how much cheer will be found.

The 2020 holiday season has been as crazy as expected with major downturns on Black Friday for retail and malls. Yet, retailers have seen strength in new places this season, helping to offset those losses. And one place that may receive added focus in 2020 is Super Saturday.

Top spending day Cyber Monday grew 24 percent to $9.8 billion, while earlier start to holiday shopping season saw online sales pulled forward to Thanksgiving and Black Friday. Given the pandemic and its impact on in-person retail sales, we expected a big start to the online holiday shopping season.

Digital games earned $11.5B in November 2020, the highest monthly revenue ever. Overall earnings were up 15% over November 2019. Mobile grew 9% while PC rose 22% to reach a new revenue record, which was driven largely by the release of World of Warcraft: Shadowlands.

Election night last month left many with more questions than answers. But when the votes were counted, there was one clear winner: legal cannabis. In what many industry experts have dubbed the “green wave,” voters cleared cannabis for adult use in Arizona, Montana, New Jersey, and perhaps most surprisingly, South Dakota.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in November, sales for meal delivery services grew 125 percent, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase.

Nike stock has climbed over 40% in the last six months. The S&P 500 is up 18%. What will happen after Nike reports its earnings this Friday?This earnings season a key part of the equation is Nike’s digital health. Here’s why: At its last earnings report in September, Nike reported that digital sales exploded by 82%.

The recent work-from-home trends have made daytime pajamas the norm and led to declining sales (and in some cases bankruptcy) for many business casual clothing brands. One company that seems to be bucking the trend is Stitch Fix, which recently reported surprisingly strong sales trends.

There are few sectors that have felt the brunt of the pandemic’s retail impact like the wider apparel sector. After seeing a rapid recovery in the early weeks following springtime lockdowns, the category stagnated with visits down around 25-30% year over year for most weeks since the summer.

The air is electric as innovative automaker, Tesla, prepares for listing on the S&P 500 on December 21st. Adding the $555 billion company, which is prone to huge swings in price, is expected to trigger a massive $100B in trade. So big is the potential impact, S&P is considering the atypical move of adding the stock over multiple days to temper the effects.s.

In this Placer Bytes, we dive into Nike’s recovery and holiday performance, analyze the Sephora partnership with Kohl’s, and break down the impact of the COVID resurgence on key Darden restaurant brands. Using location analytics to analyze Nike’s retail strategy puts its offline push in a particularly positive light demonstrating the opportunity that exists there.