Consumers spent $10.6B on digital games in October 2020, up 14% year-over-year. Consistent with ongoing trends, console spending grew the fastest, with earnings up 18% over 2019. This was especially impressive growth given that Call of Duty: Modern Warfare launched in October 2019 and many of the biggest titles of the 2020 holiday season were not released until November.

As we head into the holiday season, the health of the newly acquired COVID shopper is top of mind. With the pandemic driving shoppers online, the retention and significance of this newly acquired cohort has become an increasingly important question.

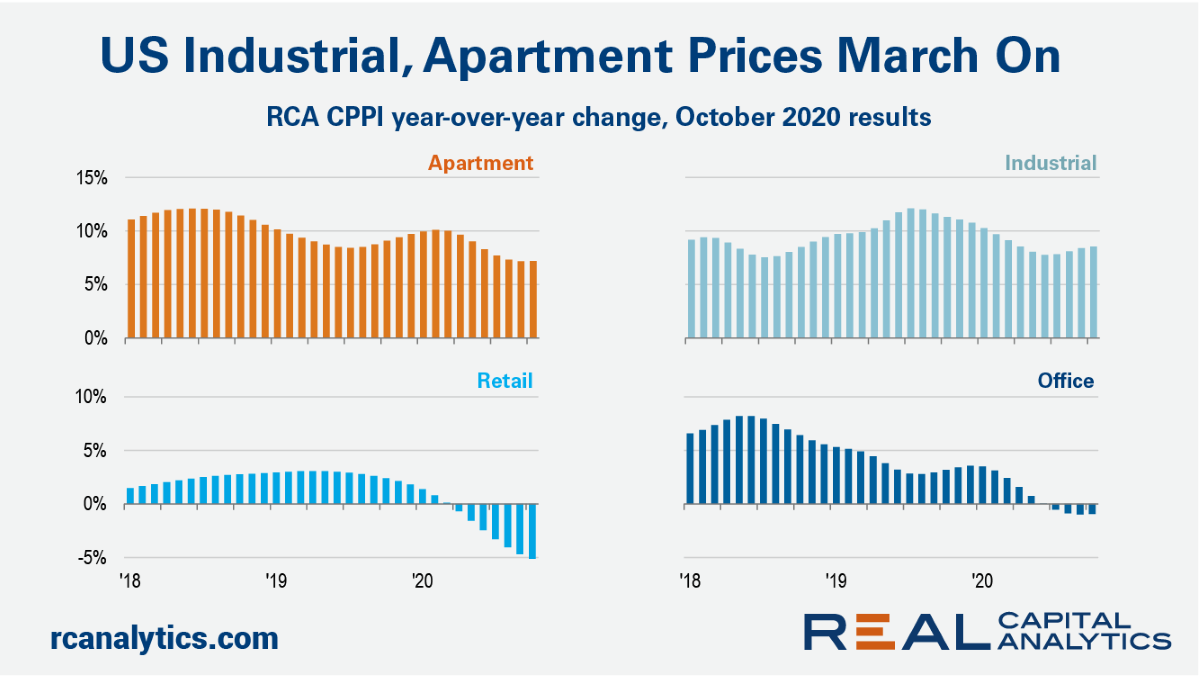

The U.S. national rate of commercial property price growth rose in October as the weight of capital into the high-flying apartment and industrial sectors boosted gains, the latest RCA CPPI: US summary report shows. The US National All-Property Index rose 3.6% from a year ago, the apartment index rose 7.2% and the industrial index 8.5%.

Among the many categories hit hard by the COVID-19 pandemic has been the Beauty sector. Year-over-year Beauty spend dropped by a quarter in March 2020 and by a third in April 2020 as quarantines and stay-at-home orders meant that beauty shoppers didn’t have anywhere to go out to, limiting the need for products such as lipstick and haircare.

In this Placer Bytes, we dove into the BevMo acquisition, Burlington’s pre-holiday pace and Dollar Tree’s latest offline performance metrics. Recently, goPuff announced the acquisition of specialty beverage chain BevMo, and it is as fascinating an acquisition as there has been in 2020.

When it comes to retail nobody does it bigger or better than Walmart. Where else you can find the Rush Hour DVD for $5, a boy yodeling on aisle three, and a crocodile in the frozen food section? Walmart — that’s where. With over 11,500 stores under 56 brand names in 27 countries (and eCommerce sites in 10 countries), they don’t call Walmart a “retail giant” for nothing.

The rays of light within credit markets are slowly growing. Known as Rising Stars, companies moving from high-yield or “junk” to investment-grade status are increasing across many sectors. According to the latest consensus credit data from Credit Benchmark, which tracks collective credit quality estimates of lenders to firms in various sectors, the total number of new Rising Stars has increased by 24 since the previous update.

Just when we thought we’d praised the coffee giant enough over its Pumpkin Spice Latte launch, Starbucks took another step that left us watching with awe. Red Cup Day. How effective was it? Shockingly effective.

The number of Fallen Angels – companies whose credit quality has shifted from investment-grade to high-yield or “junk” status – continues to increase, yet each update brings a smaller total number than the last.

Without the presence of events, many B2B companies are experimenting with new ways of advertising this year One medium that has attracted B2B brands is native advertising. Native ads have the look and feel of the media format in which they appear, but are actually paid ads.

When stay-at-home orders closed gyms and fitness classes in many states in March, many Americans turned to baking as an alternate activity, leading to jokes about the COVID-driven 19 pounds of weight gain. However, not all consumers turned to banana bread for comfort. Many former gym members began purchasing at-home equipment and streaming classes, leading to success for companies like Peloton.

Nearly nine months into the global COVID-19 pandemic, luxury retailers in big cities across the U.S. wait and hope that Black Friday will inject a much-needed dose of foot traffic into local stores. But with infection rates rising, migration from big cities underway, and a lack of tourists, luxury brands need more than hope.

Alternative real-time data from Huq predicts a bleak winter ahead for European manufacturing – particularly in food, chemicals and aerospace.

In this Placer Bytes, we dive into Best Buy, one of the true kings of offline retail, and two of our 2020 winners – BJ’s and Dick’s Sporting Goods. After proving just how substantial Amazon Prime Day’s offline impact could be, Best Buy looks well-established for an exceptional holiday season.

COVID-19 has changed the dynamics of the restaurant industry, with quarantine and shelter-in-place orders leading some to increase the amount of food they’re ordering in, while others hesitated to have any contact with even delivery workers. CE Vision provides the unique ability to look at individual transactions by restaurant and by delivery service in order to give users a more wholistic view of trends.

In this Placer Bytes we dove into the data surrounding apparel giants Gap & Old Navy, checked in on Nordstrom and Nordstrom Rack and analyzed Macy’s continued recovery. Gap recently announced its plans to close multiple stores and shift focus more to outdoor locations, following suit of its sister brand, Old Navy.

Supermarket shopping in the UK is holding resilient through the UK’s second national lockdown, with footfall over the last week comparable to last year’s levels while attendance to supermarkets on the continent has reached a new low.

November 16, 2020

/

Business

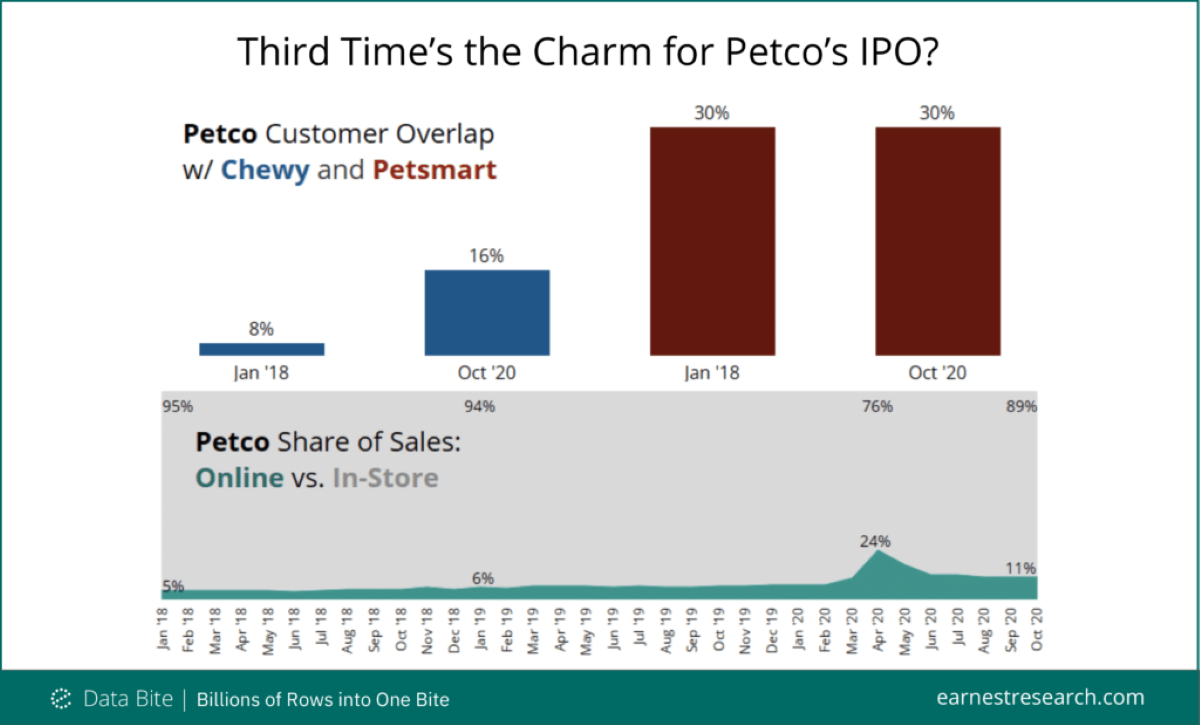

Petco’s IPO

With news of Petco planning to IPO (again) we looked at how they’ve performed against their main competitor, PetSmart. It’s interesting to note that the overlap of Petco shoppers also shopping at PetSmart’s online-only brand Chewy—while doubling from Jan’18 to Oct’20—is still relatively small at 16%

During the lockdown in many areas of the country, households were suddenly faced with finding activities to do with the family or occupy time while activities out of the home came to a halt. While some new skills may be short lived, some new habits emerged: households have increased their cooking activity and cultivated new bread making skills, while others embarked on more ambitious home improvements and upgrades that had previously been ignored.

Heading into what will likely be a particularly unique holiday season, there is a group of retailers that seem to be impervious to the effects the wider retail ecosystem is experiencing offline. And while this group certainly includes more than two brands, it is headlined by Walmart and Target.