There is typically pressure on imports to countries like Chile and Brazil due to less demand for LPG heating fuel. This year, however, there is more demand for coronavirus mitigation equipment that uses LPG feedstock to produce plastics and films.

Alternative real-time data from Huq predicts a bleak winter ahead for European manufacturing – particularly in food, chemicals and aerospace.

Total construction starts rose 12% in October to a seasonally adjusted annual rate of $787.9 billon. While sizeable, the increase does not erase September’s substantial pullback in starts. All three major categories moved higher over the month, nonbuilding starts rose 25%, nonresidential buildings increased 19%, while residential activity gained 2%.

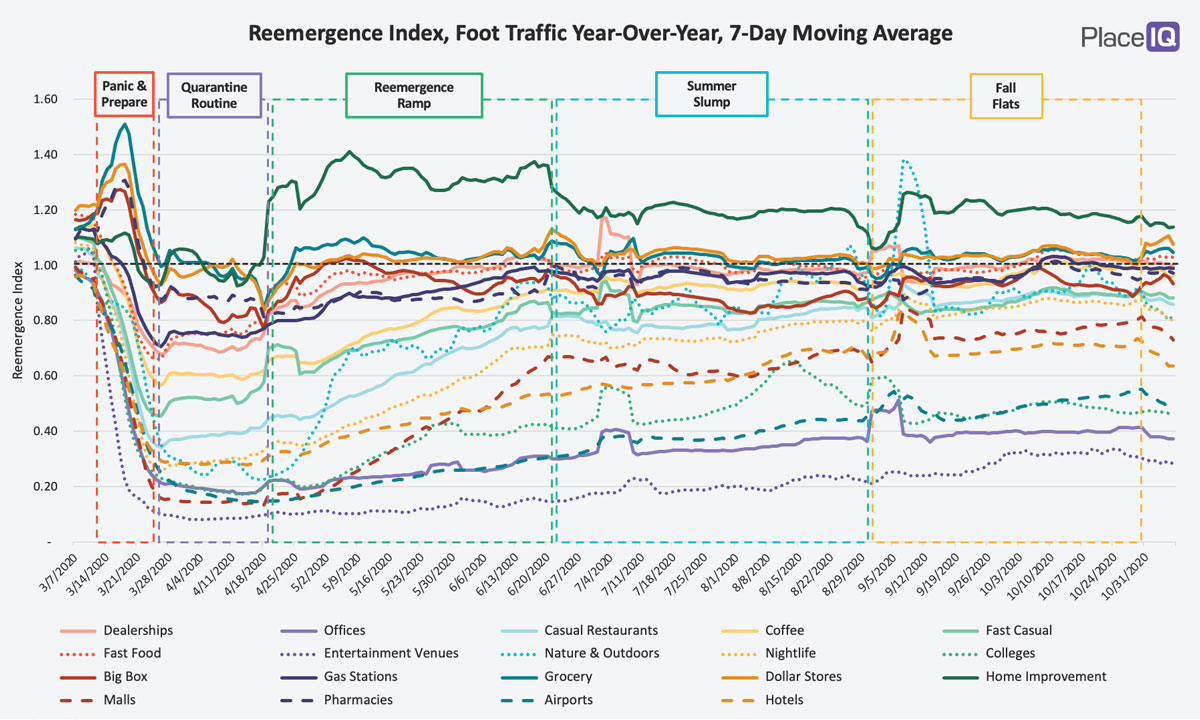

In our last issue, we named the Fall Flats, the latest phase we’ve measured in traffic reemergence. We had been hesitating to pick a name for this time period because, well, nothing was happening. Traffic had reached an equilibrium. The Summer Slump seamlessly transitioned to unchanging foot traffic in September and October.

With COVID-19 data from this week showing record case numbers and hospitalizations, Kinsa’s data show no signs of things getting better. 15 states are signalling imminent increases in our early-warning system, including the already hard-hit states of Texas, Missouri and West Virginia.

Catherine McGuinness, chair of policy at the City of London Corporation, which governs the financial district, warned of “a bleak winter”. She said: “People have been steadily coming back to the City but this plateaued in September and will now drop off.”

City population mobility in parts of the UK is just 15pts lower than usual levels in this second national lockdown, with Huq’s Index suggesting that residents have been far less restrained than they were during lockdown 1.0 in April.

The CoreLogic Home Price index has reported quickening appreciation in home values since May, and in September annual price growth was more than two percentage points faster than one year earlier. The acceleration in price growth reflected a demand and supply imbalance.

Overall, October job listings appear to mirror the modest increases we witnessed in September. The most striking change can be seen in created job listings which were up 6% in October, after a flat September. Deleted job listings largely held steady, finishing the month at 12%, just slightly above September’s increase of 11%.

The Covid-19 pandemic has accelerated structural trends that were already reshaping the global commercial property investment landscape. One of these trends is the continued shrinking of the investable universe, with a huge chunk of the retail sector now seen as uninvestable.

Among the many social and cultural changes that the pandemic has brought about, arguably the most impactful will be the ways in which it has influenced our decisions about where to live. Not just temporary relocations while we ride out lock-downs and WFH, but permanent migration that will alter how we live and how we spend.

The restaurant industry’s performance continues improving with October posting the best same-store sales growth results since the beginning of the pandemic. But there are some reasons for concern that the industry’s recovery has stalled in recent weeks and may be a sign of things to come. October’s same-store sales growth represented only a small improvement from the -8.1% growth reported for September.

As the Coronavirus tidal wave rolls its way through the world for Round Two, European cities have been tested for their resilience in Quarter Three and Four. Will the theme of “Sun and Fun” help countries stay afloat? ForwardKeys examines the latest flight data to share with you the freshest insights.

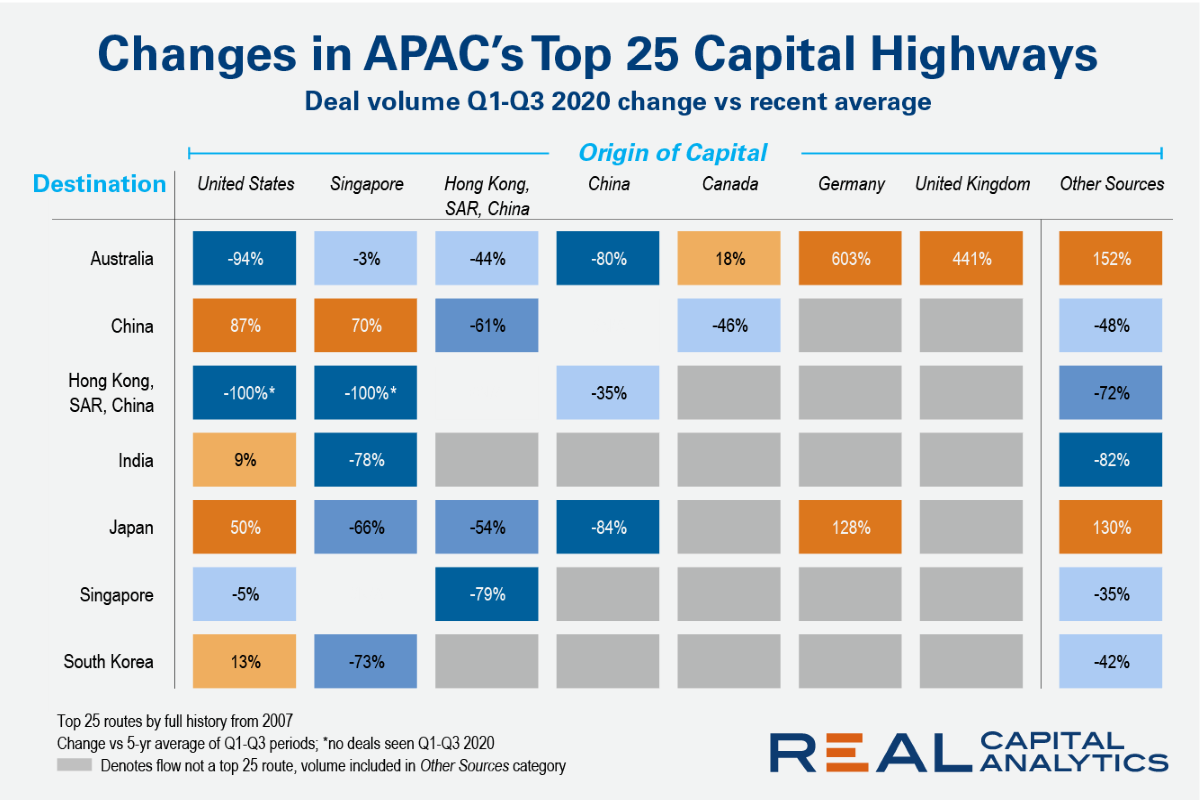

In the below chart we present the 25 biggest trade routes in Asia Pacific and illustrate how cross-border investment has behaved during this pandemic year. Novel capital flows, such as Austrian investors spending in China and Saudi players investing in Singapore, may be interesting from an anecdotal perspective, but market liquidity is ultimately driven by the most well traveled capital highways.

Dodge Data & Analytics today released its 2021 Dodge Construction Outlook, a mainstay in construction industry forecasting and business planning. The report predicts that total U.S. construction starts will increase 4% in 2021, to $771 billion.

Staffing levels at industrial facilities across Europe have fallen significantly with much of the continent in the midst of lockdown, with worker presence in some sectors dropping to levels beneath April. The second wave has brought steepest declines to Aerospace, Chemical and Food producers.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending November 7, 2020. For this week, total U.S. weekly rail traffic was 522,028 carloads and intermodal units, up 1.3 percent compared with the same week last year.

In August 2020, 6.6% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure)\[1\], unchanged from July 2020, but a 2.9-percentage point increase from August 2019, according to the latest CoreLogic Loan Performance Insights Report.

Following the COVID-19 pandemic and ensuing economic downturn, rental markets across the country experienced an uncharacteristic decline in rent prices this summer. Nationally, rents dropped 1.3 percent from March to June, a time period when rent prices rose roughly 2 percent in each of the three previous years.

Recent loan performance data from CoreLogic shows that the nation’s overall mortgage delinquency rate – the proportion of mortgage loans falling 30 or more days behind scheduled payment, including loans in foreclosure – have risen quickly during the COVID-19 pandemic, as millions of Americans lost their jobs and income due to the economic shutdown.