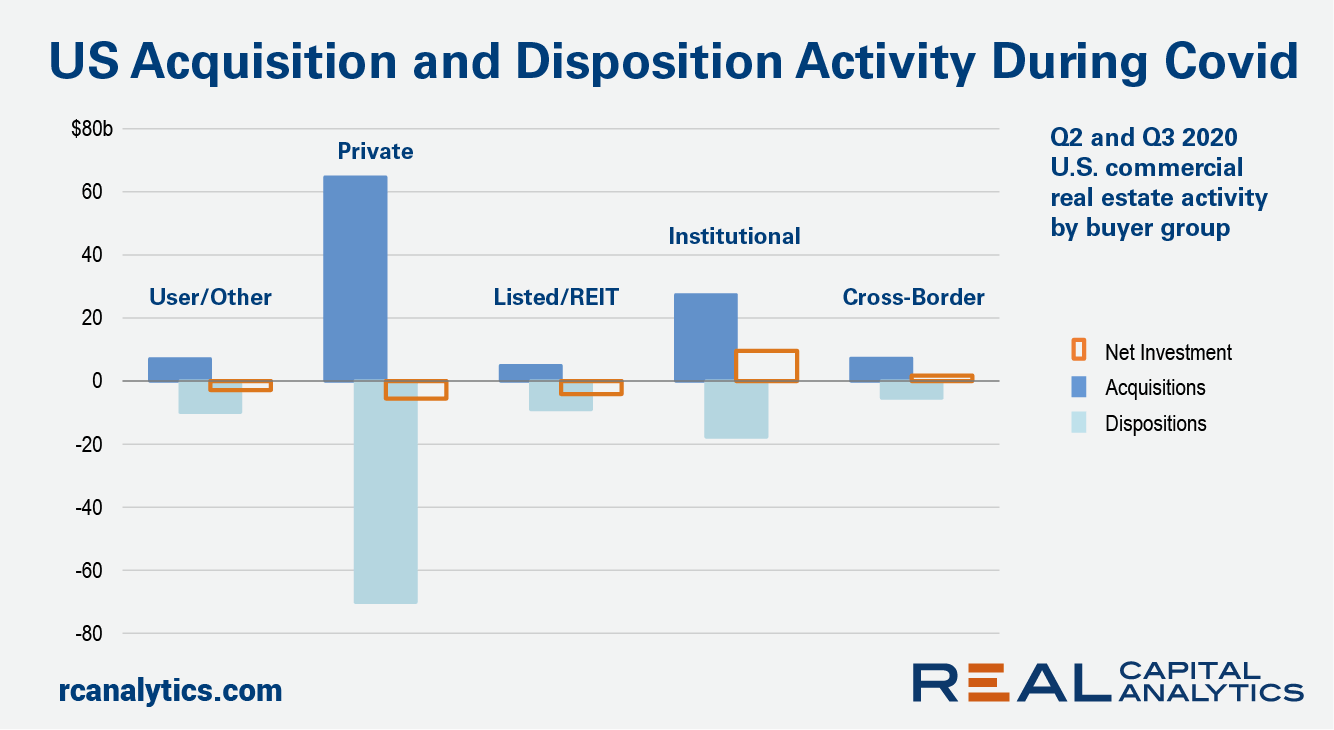

U.S. deal activity has corrected in 2020 following the onset of the Covid-19 crisis. Looking at total acquisitions by all investor types, deal volume for the past two quarters has retreated to levels last seen in 2012. Institutional investors, however, stand as net buyers of U.S. commercial real estate in the face of the pandemic.

For an industry that was among the hardest hit by the pandemic, September brought some welcome good news. The sales recovery continued into September, which at -8.1% same-store sales growth, became the best performing month since February (before the pandemic hit restaurant sales at a national scale).

Total construction starts dipped 18% in September to a seasonally adjusted annual rate of $667.7 billion, essentially taking back August’s gain. While some of this decline is certainly payback from several large projects entering start in August, the drop in activity brought total construction starts below levels seen in June and July. Nonresidential starts fell 24%, while residential building dropped 21% over the month.

Since the Great Recession of 2008, the real estate market has rebounded nicely to say the least. In fact, as home prices continue to climb, it has become increasingly difficult for the average American to afford to purchase a home. Simply put, home prices are increasing at a faster rate than income.

The holiday season approaches, and another quarter is in the books. The second quarter was a rough one for multifamily, as with the broader economy, but some positive signs emerged in the last few months. This month we take a closer look at Q3 performance and, as always, numbers will refer to conventional properties of at least 50 units.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending October 10, 2020. For this week, total U.S. weekly rail traffic was 520,452 carloads and intermodal units, up 1.9 percent compared with the same week last year.

Europe’s hoteliers enjoyed a far stronger post-lockdown recovery than those in the UK over summer, with hotels on the continent experiencing guest levels comparable to 2019 whilst the UK struggled to muster much more than 70%.

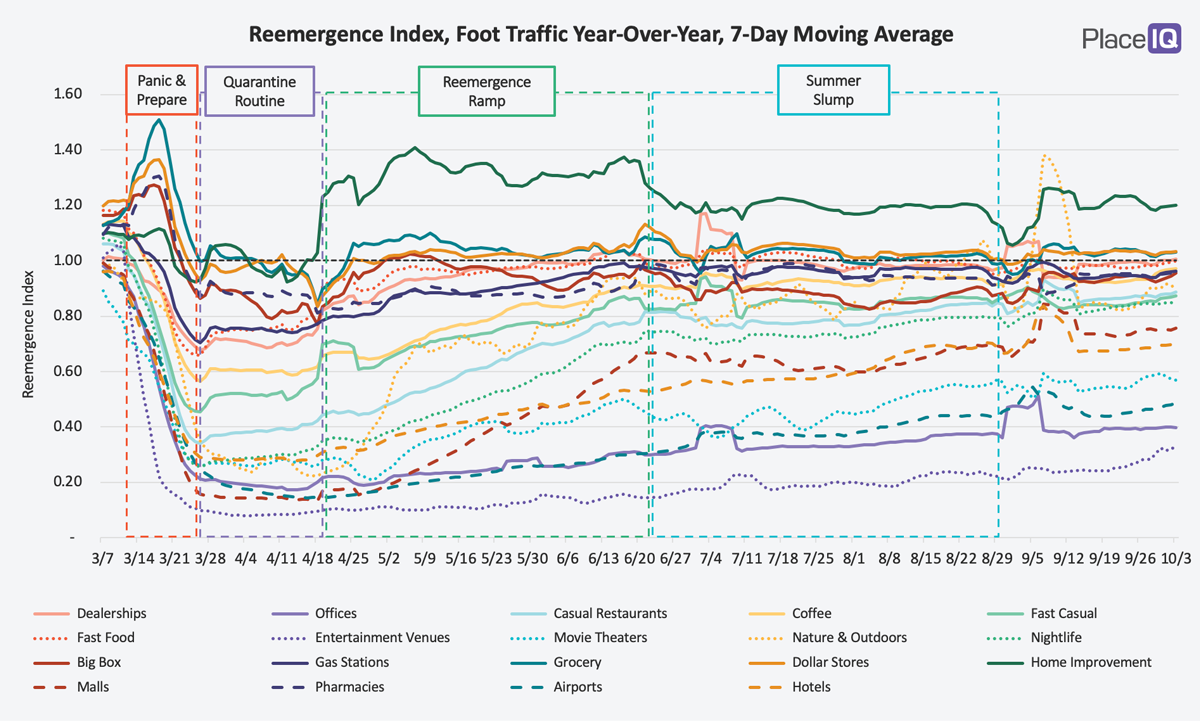

We are now into Fall, but the phase after the Summer Slump defies definition. It is a slowww crawl upwards for most categories – barely above a flatline.

While the vast majority of civil contractors (73%) are experiencing delays with their projects due to the COVID-19 pandemic, contactors are still seeing high levels of backlog and remain relatively optimistic about the state of the civil construction market, according to new data from Dodge Data & Analytics.

While the early pandemic months dealt a blow to auto sales industry-wide in the U.S., online shopper interest in the new vehicle market has clawed back from double digit year-over-year (YOY) losses in the spring of this year to just a few percentage points shy of last year’s shopper interest in the summer (and was even up YOY in July!).

Worker presence at food manufacturing plants across Europe has dropped to just 16pts of equivalent levels last year, a low not seen since countries began to re-emerge from the first lockdown at the end of April.

Leveraged Loans continue to divide investor opinion. Values declined as part of the High Yield rout earlier this year, but they have been slower to recover. Winnie Cisar, Head of Credit Strategy at Wells Fargo points to a simple lack of liquidity, which is only now filtering back into the Leveraged Loan space with prices closing the gap vs. general High Yield.

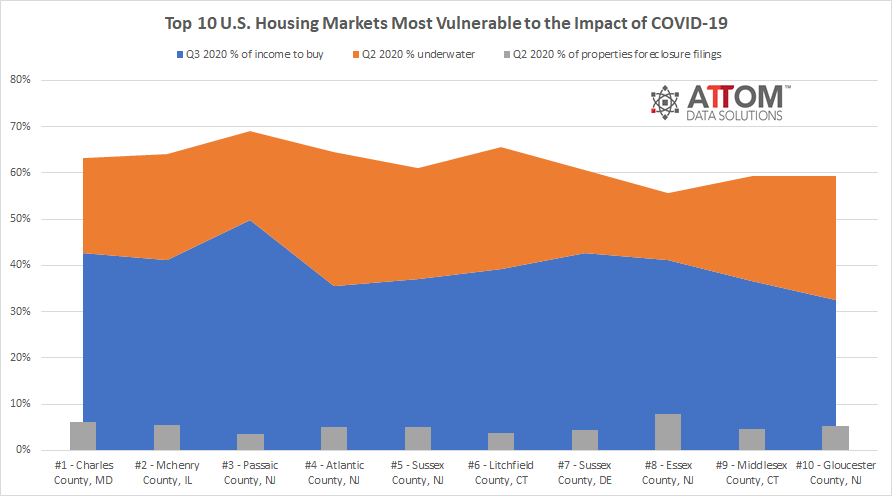

ATTOM Data Solutions’ just released Q3 2020 Special Report, spotlighting the U.S. housing markets more or less at risk of an economic impact related to the Coronavirus pandemic, shows that pockets of the Northeast and Mid-Atlantic regions were most vulnerable in Q3 2020, while the West and now Midwest fared less at risk.

Major economies in Europe, including the U.K. and those in the Eurozone, recently confirmed what we already suspected. Economies across the continent have entered an economic recession because of the impact of COVID-19—an impact that has been devastating for the hospitality industry.

The holidays often seem to sneak up on consumers. In fact, a 2017 survey found that over half of shoppers planned to buy gifts within two days of Christmas. Retailers, on the other hand, think about the holiday season year-round. Employers usually start their holiday hiring as early as September to deal with surges, as 21% of retail sales come during this time.

Typically this time of year finds our analysts at LinkUp pouring over our jobs data to get a preview of holiday labor demand. Generally, we’d be looking at when seasonal hiring begins, who is doing the most hiring, and what all this might mean for holiday retail. But if we’ve learned anything over the past months, it’s that 2020 is anything but typical.

With the overall economy slowly recovering and the country returning to ‘normalcy’, some sectors have been hit far harder than others. None more so than travel. So with a return en route, we dove back into this space to see how leading players are responding.

Most Vulnerable Counties in Third Quarter of 2020 Concentrated in States Running from Connecticut through Maryland; New York City, Baltimore, Washington, D.C. and Now Philadelphia Among Areas with Clusters of High-Risk Counties; Midwest Joins the West as Regions Less at Risk of Housing-Market Problems

At the onset of the pandemic, consumer spending on both grocery and food delivery services experienced large spikes. Several online grocery purchase platforms reported a massive increase of new customers making their first-ever purchase during the week of March 31. States like Florida, Georgia, North Carolina, Illinois and Pennsylvania saw high growth in new customers opting for grocery delivery.

Staff-levels at manufacturing plants, a proxy for productivity, in the UK have caught up with those in the EU for the first time in 2020, with attendance even nudging higher than the EU for the first time since April in the last week. Both regions saw a gradual recovery in staffing following a sharp decline in March, but the start of summer saw the UK’s manufacturing recovery stagnate to around half of European levels.