According to data from leading consumer credit agency Equifax, limits for newly issued bank credit cards collapsed as COVID accelerated within the United States. Average origination credit limits compressed from $5,000 in early January, dipping as low as $3,500 in April. At the same time overall bank card balances had decreased more than 5% between early March and mid April. This balance reduction is equal to the total increase in US bank card balances from a year ago.

In response to the coronavirus pandemic, the U.S. government has begun issuing economic impact payments via the IRS to qualifying Americans. To date, the majority of stimulus payments hit bank accounts on April 14, 15, 21, and 22. These cash infusions are helping U.S. consumers cover their basic expenses as well as stimulating the economy at large.

Since the COVID-19 pandemic began, we’ve been sharing how the virus is impacting foot traffic to a variety of places across the United States (past editions [here](https://enterprise.foursquare.com/intersections/)).

This week, we’re taking a closer look at Georgia, using the state as a case study to understand how consumers respond when businesses are allowed to reopen. Recovery will mean officials permit businesses to reopen, businesses themselves choose to reopen, and consumers choose to visit those businesses.

The Dodge Momentum Index moved 6.0% lower in April to 135.9 (2000=100) from the revised March reading of 144.5. The Momentum Index, issued by [Dodge Data & Analytics](https://www.construction.com/), is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index pulled back during the month – the commercial component fell 7.6%, while the institutional component dropped 3.2%.

April is in the books and as the first full month in which COVID-19 response measures were in effect for much of the country, industry observers have been anxiously awaiting a look at final results for the month. As part of ALN’s ongoing analysis of the impact of COVID-19 on the multifamily industry, today we take a look at price class performance in the month of April.

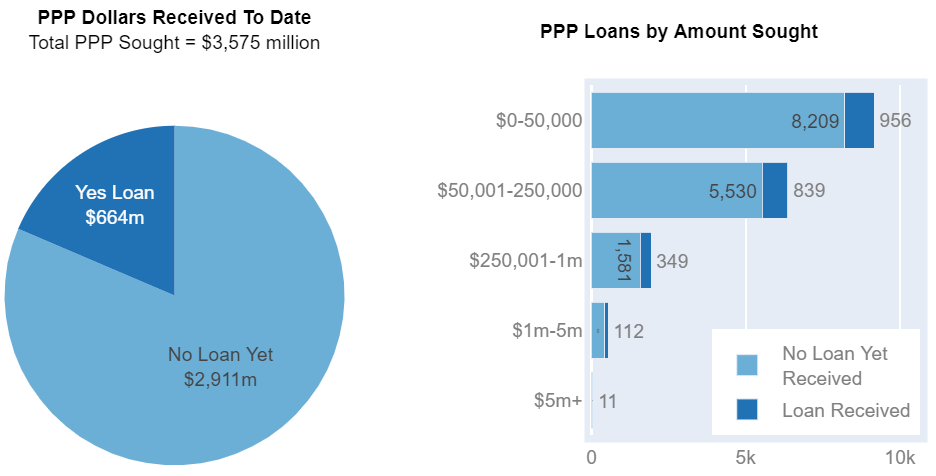

With many businesses shut down, legislators rushed in to help keep businesses afloat and to help keep their employees paid. The U.S. Small Business Administration (SBA) and the US Treasury announced on March 27th, 2020 that $349B had been authorized to the Paycheck Protection Program (PPP). By April 16th this money had been exhausted, and on April 24th an additional $310B was made available.

Based on foot traffic data from Advan Research, the last four weeks have shown a resurgence in visits to gas stations. It appears that people have quarantine fatigue after being locked in their homes for nearly two months.

Visits to gas stations reached a national low during the week ending April 5th. According to figures from Advan, traffic was down 38.1% from the yearly average and down 36.5% from the first week of April 2019.

Our biggest observation this week? People are feeling the itch to get back to the real world. As officials begin the process of relaxing some business restrictions, we’re starting to see upticks in foot traffic to various places. This is true across regions, regardless of state-specific policies. For some categories, the last week has produced the most substantial changes since foot traffic bottomed out around the end of March.

Across the top 10 affiliates that refer traffic to Amazon, seven sites have dramatically decreased referrals sent to amazon.com (-51%). Slickdeals.net, dealnews.com, and pcpartpicker.com, the top three affiliates for Amazon in Q1, fell 35%, 85%, and 56%, respectively.

With COVID-19 leading to a massive increase in unemployment, many creditors are allowing consumers to defer payments, causing reduced visibility into the health and credit worthiness of many US consumers.

According to data from leading consumer credit agency Equifax, the total amount of consumer loans delinquent more than 60 days dropped by more than 25% month over month for the week ending April 20th. This compares to a maximum decline of 8.5% over the previous 12 months. At first glance one could view this decline as a positive, potentially signaling that people are paying off their bills and are therefor less delinquent. The reality unfortunately isn’t a positive one.

With the US economy mostly shut, the impact to consumer spending has been dramatic. By examining transaction data from leading data provider 1010data, we can see the extent of the magnitude of damage to the consumer economy.

Prior to the European travel ban which went into effect in mid-March, weekly consumer spending in the US was fluctuating between -5% and 5% in terms of year over year growth. Within two weeks after the travel ban was implemented, credit card expenditures tracked by 1010data had falled 46%. After two weeks of bouncing along this spending trough, the US consumer has finally started to show signs of reacceleration. Peak weekly spending for the past four weeks has improved sequentially YoY: -35%, -34%, -32% and had recovered to -30% as of a week ago.

China container exports to the United States rose 63.1% in April in terms of gross tonnage versus a March low. This represents a significant jump compared to a 22.3% month-over-month rise in April 2019.

As China’s largest trading partner, the United States accounts for 16.8% of all exports. April’s total tonnage of 4.0 million tons shipped to the United States represents a 16.2% annual decline. This is a significant turnaround relative to the 37.2% annual decline in March 2020.

Figures from a leading customs data provider, Descartes Datamyne, point to a rebound in China that is led by shipments of home goods, machinery, plastic goods, iron goods, and toys. The recovery, in fact, is quite broad as 73 of all 99 cargo categories (HS 2) experienced an increase in tonnage, even when adjusted for seasonality.

Additionally, on average, containerships travel 0.26% empty. In March 2020, empty containers nearly quadrupled to 0.94%. As a sign of balance and an increase in shipping demand, empty container rates have recovered to 0.40% in April.

Airbnb hosts in Texas are seeing a rebound in bookings and occupancy, according to new data provided by AllTheRooms Analytics, a provider of short-term rental and Airbnb data and analytics.

Texas Airbnb 30-day occupancy rates, a measure of the percentage of properties listed on Airbnb that are booked over the next 30 days, reached 18.9% on the 30th of April.

This represents a 19% increase from the lowest point, which was recorded as 15.9% on the 22nd March; 9 days after Governor Greg Abbott declared a state of disaster on March 13th.

As the COVID-19 pandemic took hold of the globe these past weeks, comscore has continued to see the downturn in visitation to travel sites. With society still adhering to social distancing guidelines, consumers continue to avoid unnecessary travel and visitation to travel sites is still 55-65 percent lower than volumes we saw during the week of February 3, 2020.

Container imports into the United States in April fell by 8.4% in terms of gross tonnage versus April 2019. Containers coming from Mexico, Germany and Japan were the most heavily impacted of the larger US trading partners with declines of 43%, 33% and 17% versus a year ago.

Data from a leading customs data provider, Descartes Datamyne, showed US imports continuing their decline throughout the month of April, ending the month at the lowest levels. Most ocean containers, especially those from Asia, sit on docks and then transit on the water for several weeks before arriving into the United States. As factories across the world only began shutting down in Mid March, the full impact of the global quarantine is unlikely to be felt until May or June.

Stripping out oil imports, April showed no material decline in overall imports. With businesses mostly shut down across the US, this signals the start of a potentially dangerous inventory build cycle. With significantly larger inventories than normal and faced with a “new normal” of likely decreased consumer demand for many products, factories face the risk of complete shutdowns which could last multiples as long as the original lockdown.

Georgia is one of the first US States to reopen businesses after the nationwide shutdowns began in mid-March. After the first week we analyze different parts of the state’s economy to understand what this reopening says about life post quarantine in the country.

The response measures taken in the face of the COVID-19 pandemic began to be felt in earnest in March for much of the US multifamily industry. ALN is conducting an ongoing survey of more than 60,000 conventional properties around the United States in effort to understand to what extent on-time full rent payments are being made and what measures properties are taking to work with their residence during this challenging and unprecedented period.

Our first look at this data will focus on Texas and all numbers are derived from the responses of about 500 conventional properties of at least 50 units.

Tech M&A has been decimated, literally and etymologically. Spending on acquisitions so far in April is tracking to just one-tenth the level we have recorded for average months in recent years. And even as the value of tech deals this month plunges to an eight-year low, there doesn’t appear to be any uptick on the horizon.

According to 451 Research’s M&A KnowledgeBase, the coronavirus pandemic and accompanying economic slowdown has knocked tech M&A spending in the first half of April to just $2bn. Assuming the rest of the month continues at the same funereal pace, the amount spent by all acquirers around the world for the entire month would be lower than the amount some buyers have spent in a single transaction. For reference, the M&A KnowledgeBase shows 25 individual tech deals announced in 2019 that were valued at more than $4bn.

As paltry as the current acquisition activity is, there isn’t much coming after the few transactions that have already been announced. Pipelines have been hollowed out to historic levels because of uncertainty. That came through clearly in a special 451 Research survey of senior investment bankers, where we sought to quantify the devastating impact of the coronavirus outbreak on the tech M&A market. (See the full report.)

In our Flash Survey: Technology Investment Banking Outlook, half of the respondents said coronavirus has derailed at least one of every four deals they were working on before the outbreak. But highlighting the depth of the current crash, among this bearish group, one in four bankers (24%) said at least half of the transactions they were working on in February are no longer moving ahead, either temporarily or permanently.

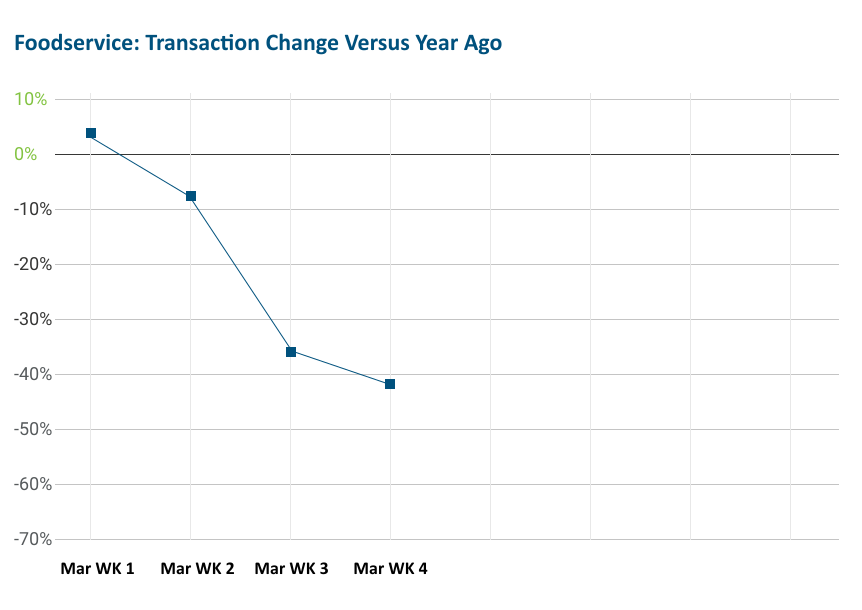

According to research and data firm The NPD Group, restaurant customer transactions dropped by 42% in the fourth week of March (week ending March 29) compared to the same week year ago.

“The transaction declines partially reflect the struggle of on-premise restaurants to pivot to off-premise models,” says David Portalatin, our food industry advisor. “Many restaurants that are attempting to make the move are doing so with limited menu offerings and without the benefit of drive-thru lanes, he added.”

On March 11th, Amazon put a halt to its spending on Google Ads to counterbalance the increased demand due to the COVID-19 outbreak. By March 12th, their paid search traffic was down 90% from the previous day, and by March 25th, this decision had already cost it 11.2M visits. Amazon seems to have completely removed itself from the competition for essential goods, effectively leaving one million daily visits on the table for other competitors to take.

Video games are another story, though, and remain a significant source of revenue for Amazon. Despite the overall decrease in PPC spending, the mega-retailer continues to bid on video game-related keywords to capitalize on the recent surge in stuck-at-home online gaming during the coronavirus pandemic. In March, Amazon-owned subsidiary, Twitch, was up in traffic by 15% YoY, worldwide.

Meanwhile, eBay is ahead of the game (pun intended). Just days after Amazon’s decision, the competitor marketplace upped its investment on high-volume keywords such as “toilet paper,” “n95 mask”, and “hand sanitizer” by 60%, which has brought in an incremental 330K visits to the site every day.