In this Placer Bytes, we dive into one of our 2020 winners, and two brands with strong hopes for a strong holiday season. Looking at monthly visits year over year, it’s critical to remember that the beauty brand kicked off 2020 with visits up 10.1% and 17.9% in January and February before the pandemic brought visits to a standstill.

We’re in the middle of a significant COVID surge, with a 54% growth in the new case rate over the last 14 days. Nearly every state is trending the wrong way and hospitalizations are up dramatically. In response, many states have issued new restrictions and guidance. So, how have consumers adjusted?

For what feels like the first time since 2020 began, there is good news on the horizon. Less than one year since the novel coronavirus changed our world, several vaccines boasting impressive efficacy are nearly ready to go to market, and even more are in the works.

Through the roller coaster year that has been 2020, one area of normalcy for the multifamily industry has been the extent of new construction activity. Though there were some delays earlier in the year, deliveries are on pace to be nearly to the level seen in 2018 and in 2019.

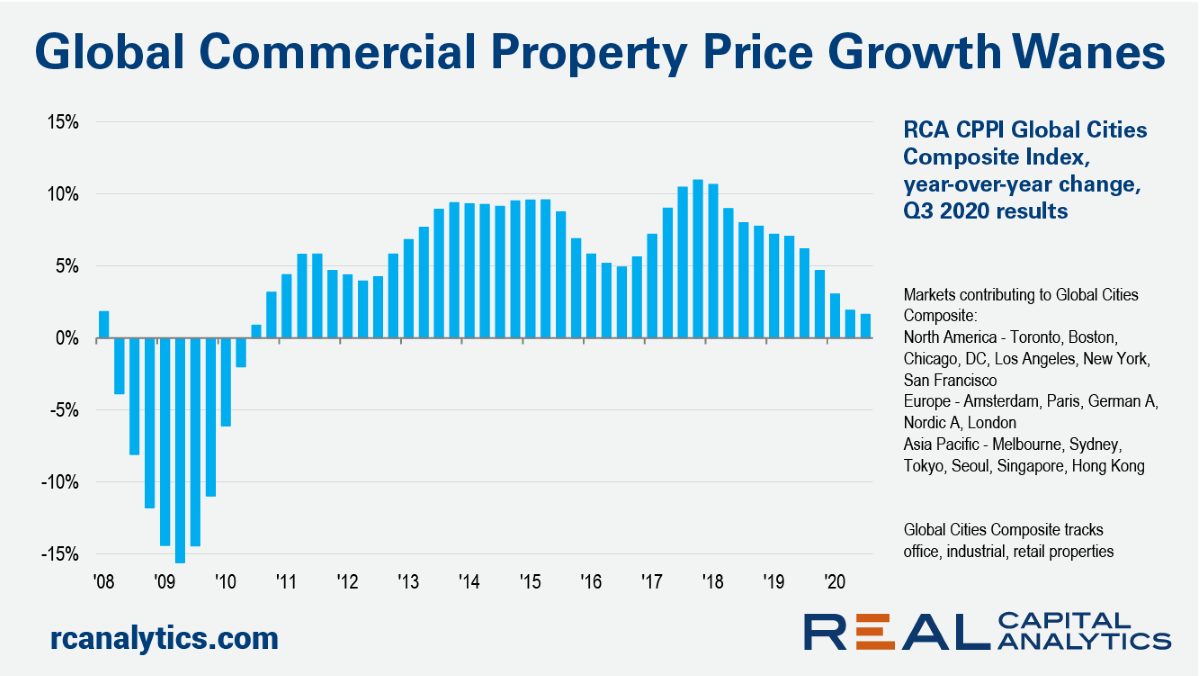

The global rate of commercial property price growth waned in the third quarter of 2020 as transaction activity continued to stumble amid the worldwide health crisis, the latest RCA CPPI Global Cities report shows.

When we last checked in on the hotel industry in August, things seemed to be going smoothly. But, with a resurgence of cases across the entire world, we decided to dive back into three of the largest chains to see if and how they’ve been affected.

COVID-19 forced people around the world to pack up offices, schools, and stores this year, sending people to stay home. At home, people were glued to their digital devices for work, studies, and entertainment. This led to a rise in content streaming—on over-the-top (OTT) platforms and websites.

With Covid rates rising across the US, K-12 schools that had introduced in-person learning are rapidly shifting to virtual. In the last week alone almost eight percent of US school children – totaling over 4MM students – have seen their in-person schools “go-virtual.”

The United Kingdom has seen considerable advances in 5G during the past year, but access to this emerging technology continues to be uneven across countries of the U.K. Looking at Q3 2020, data from Speedtest Intelligence® and Ookla Cell Analytics™ reveals how 5G affected overall mobile speeds, which country had the fastest 5G and where access was lacking.

Against a backdrop of different policies and lockdown measures across Europe, continental clothing retail is tracking at 38% of year-on-year levels compared to just 17% in the UK – where non-essential retail remains closed. Similar measures of customer levels for other discretionary sectors show the UK and EU in lock-step at low or close to zero, while staples – ie. Groceries – in the UK are tracking higher significantly higher.

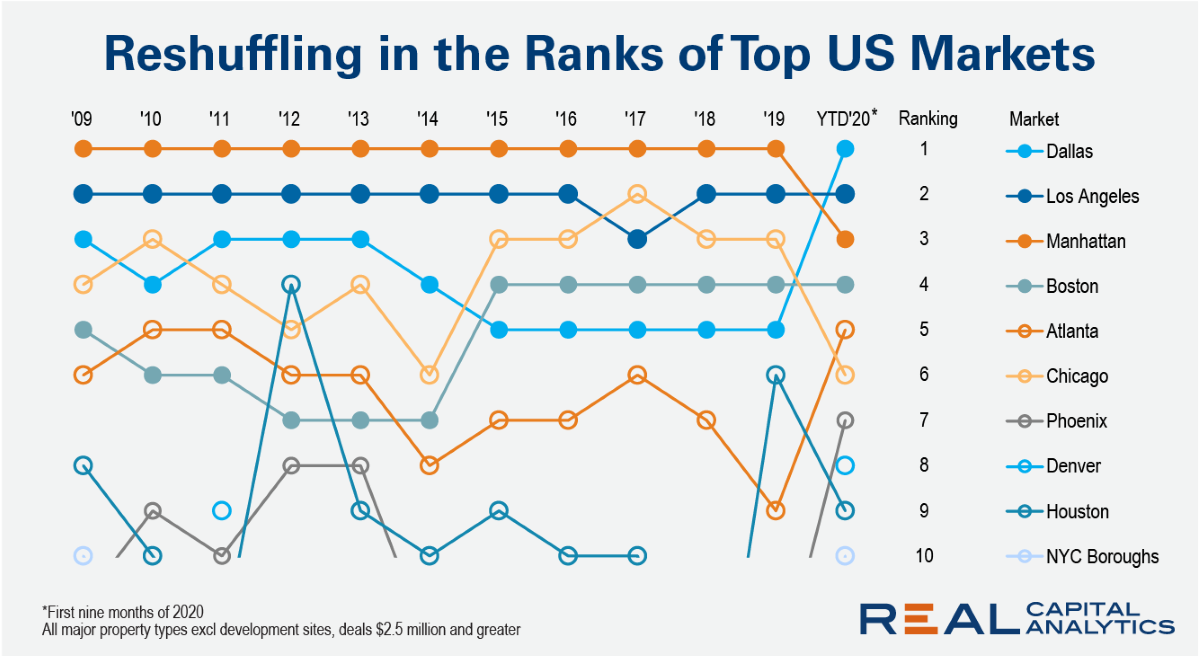

Dallas sits atop U.S. leader board for commercial property deal volume in the first nine months of 2020. Normally Manhattan would occupy the #1 position. Los Angeles has sometimes taken the top spot for shorter periods during times of market disruption in Manhattan, but Dallas has never topped the rankings for an extended period until 2020.

Steadily rising prices of ethylene between mid-April and mid-September caused many buyers to turn to alternative sources, but a recent pullback in the market has rekindled interest. Ethylene offtake this month is currently around 172,825 metric tons, and compares to 253,399 Mt in October. Ethylene prices on the US Gulf Coast rallied more than 225% between a low in April near 8c/pound and a peak in September at more than 26c/lb.

Research undertaken by ForwardKeys, the travel analytics firm, reveals that despite the COVID-19 pandemic and the collapse in aviation, many Americans are planning a last-minute return to the skies this Thanksgiving, travelling to be with their families at home; taking a break in sunny Florida or hitting the slopes

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. As rideshare is continuing to bounce back, in October, Uber sales were down 64 percent year-over-year and Lyft sales were down 66 percent year-over-year.

November 24, 2020

/

Culture

Holidays 2020

The 2020 holiday shopping season is shaping up to be unlike any other before. Retailers started advertising holiday deals nearly a month earlier than in previous years to encourage shoppers to spread out their holiday shopping throughout the fourth quarter. Amazon moved its annual Prime Day event to October due to the COVID-19 pandemic.

For many corporate strategy and business development groups, finding other brands with the right balance of similarities and synergies to form a partnership can be a challenging task. The ideal partner should be among the most successful in its industry, with best-in-class growth rates.

Credit Benchmark have released the November Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

In this Placer Bytes, we dive into the recoveries of value retailers Dollar General, Dollar Tree, and Five Below. Specifically, we analyze the timing of their visit growth ahead of a potentially massive holiday season for the value segment. Dollar General was strong pre-COVID, during the pandemic and is seeing visits back on the rise ahead of a critical holiday season.

The outlook for the US retail sector is now less bleak than in earlier months. After disappointing sales data in September, data released in October was more upbeat, even amid ongoing concerns about the economy. The economic situation is similar in the UK, with sales data released in September and October showing gains despite ongoing weaknesses in the economy, but credit quality for the UK retail sector continues to deteriorate.

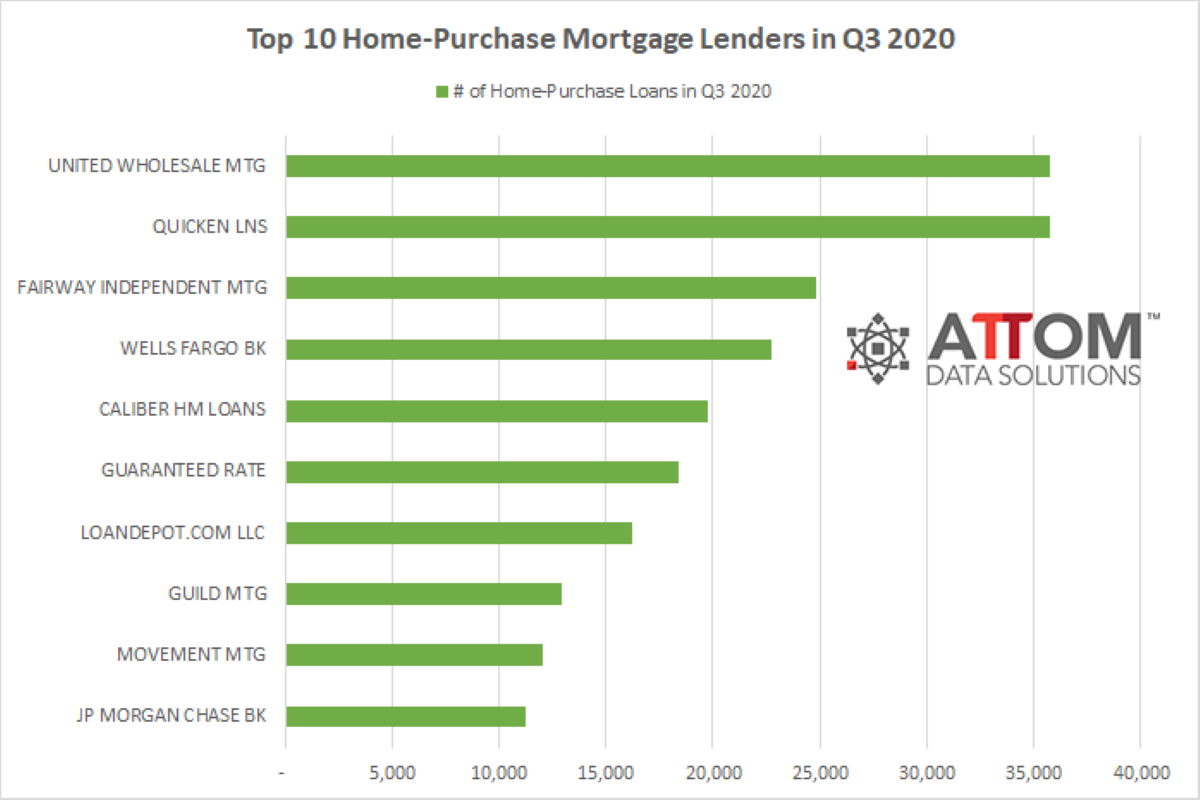

ATTOM Data Solutions’ newly released Q3 2020 U.S. Residential Property Mortgage Origination Report shows that 3.25 million mortgages secured by residential property were originated in Q3 2020 in the U.S. The report noted that figure was up 17 percent from Q2 2020 and 45 percent from Q3 2019, to the highest level in 13 years.