In the last few weeks, there has been an endless amount of fascinating retail narratives, but there were three that really caught our attention. Nike was shutting down more of its wholesale accounts, department stores got headlines for less than positive reasons, and Walmart crushed earnings by making more out of less.

The Pacific region does not normally garner much attention in the LPG market because trade flows are typically very small relative to other parts of the world, but exports from Australia are very strong this month. Loadings in the country are up 60% in August and 23% year-over-year to 125,000 barrels per day, and would be the highest on our records if maintained through month-end.

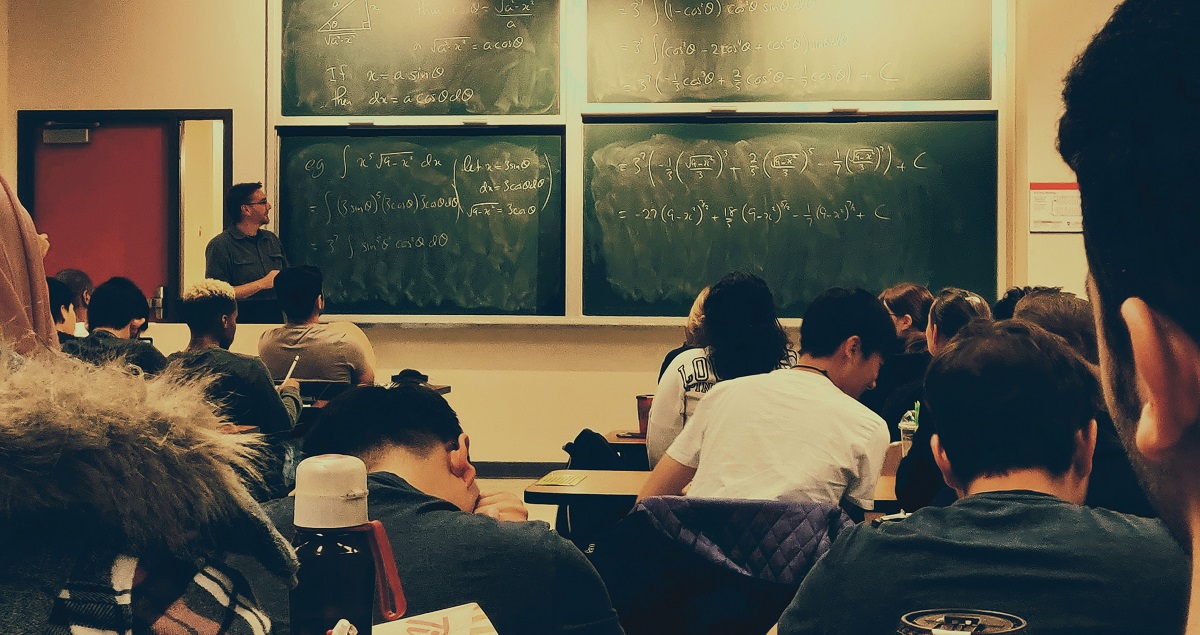

More than 60% of US K-12 public school students will be attending school remotely to start the school year, up from an estimated of 52% in early August according to a comprehensive and ongoing survey conducted by Burbio.com, a data service that aggregates school and community calendars nationwide.

Without trade shows in 2020, B2B marketers were forced to quickly reallocate their event budgets. Did marketers shift portions of their budget to digital ads? In short, yes. Using MediaRadar data, we analyzed the behaviors of the top twenty thousand event sponsors and exhibitors from 2019. The data makes it clear that COVID-19 impacted event sponsor advertising strategies—and in certain industries more than others.

It’s been a dramatic year for both discretionary and staple manufacturing across Europe with every sector seeing sharp drops in March and varying levels of recovery since. However, according to high-frequency geo-data, no sector has had more dramatic few months of highs and lows than Defence.

According to a Harris Poll survey conducted at the end of April this year, 39% of urban dwellers said the COVID-19 crisis has prompted them to consider leaving for a less crowded place. In addition, a number of recent news articles bring into question desirability of high-density living. In the following analysis, we examine recent changes in demand for condominiums as well as any potential impact on prices and inventory.

Global exports of liquefied natural gas in August totaled approximately 31.2 million tons on board 479 vessels, lower than August 2019’s pace of 32.5 million tons on 483 vessels, with a drop in loadings from the US & Pacific regions. Approximately 30.8 million tons arrived on 474 vessels at import terminals in August, compared to 32.9 million tons in August 2019.

There has been tremendous speculation about when a COVID-19 vaccine will be ready and what pharmaceutical companies will be involved in the manufacturing and distribution. It would be hard to find anyone whose well-being would not be dramatically improved by a vaccine.

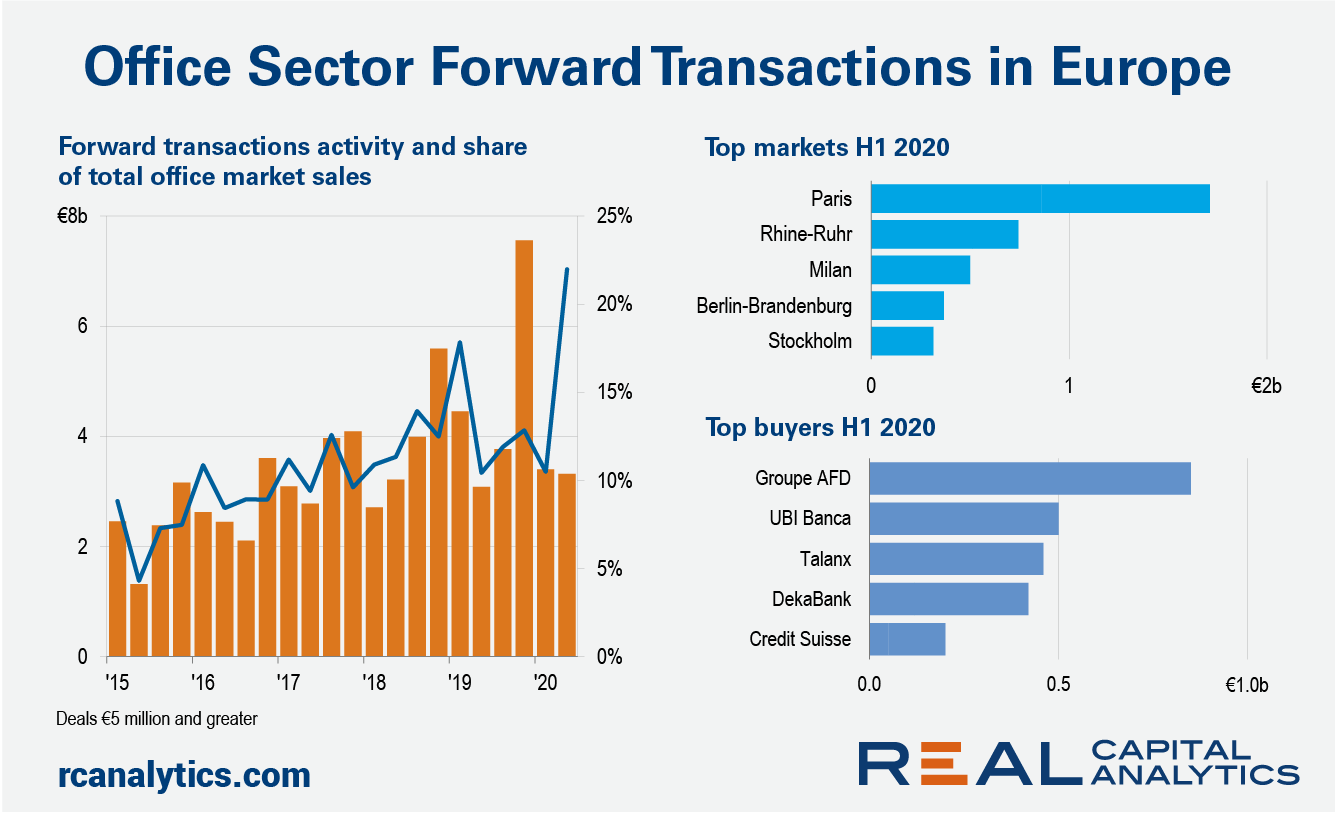

Investors stuck to the forward transactions route to acquire European office properties in the second quarter of 2020, indicating that investor demand for the asset type is still alive despite concerns over future needs for corporate space. Forward commitments leapt to a record proportion of European office deal volume, with the jump in share reflecting the resilience of these deals and the slump in the office market overall.

McKinsey, in a recent article “Meet the next-normal consumer” noted that companies will need data to increase their investment in insights to stay ahead of change and as critical to helping shape a positive future. In fact, in times of unprecedented change leveraging data and analytics to create insights to changing consumer behaviors can fuel successful corporate strategies.

As the world strives to regain some normalcy, for many people, a gradual lifting of lockdowns means a return to offices. For more than a century, workers have endured the daily commute to offices and toiled away their hours in a designated workplace.

Any other year, most of us would have spent the Summer with friends and family enjoying the great outdoors. This year, however, the pandemic has kept many of us isolated in our homes, staring at our screens, as the days and seasons roll on--and all seem to just blend together. How have these shifts translated to advertiser behavior on Instagram?

National home prices increased 5.5% year over year in July 2020, according to the latest CoreLogic Home Price Index (HPI®) Report. The July 2020 HPI gain was up from the July 2019 gain of 3.4% and was the highest year-over-year gain since August 2018. Strong demand, low mortgage interest rates and low supply of for-sale homes helped push home prices higher in July.

In this Placer Bytes, we dive into the recoveries of Lululemon, Macy’s, and Nordstrom to check on the status of some of apparel’s biggest brands. Heading into 2020, Lululemon was the darling of offline apparel and with good reason. Visits in January and February were up 17.1% and 24.8% respectively, continuing a trend of massive growth. Yet, the pandemic posed more than just a short term threat to the brand.

The U.S. job market is making a recovery according to data from LinkUp. Through the middle of August, over one million new positions were published which is in line with numbers from a year ago. The rebound in job postings in July and August is especially encouraging considering the sharp decline in hiring as a result of the COVID-19 economic shutdown.

In March 2020, the travel industry came to a near standstill. Trains, planes, and automobiles all saw a steep decline in consumer engagement as the vast majority of personal and corporate travel plans were scuttled. The lodging industry was also in a quagmire, with consumer spending on hotels and vacation rentals experiencing steep declines during the first weeks and months of the COVID-19 pandemic.

Seventy-eight percent of US four-year colleges and universities are having all students return to campus this Fall, according to a survey of the 950 largest schools in the country by Burbio, a data service that aggregates school and community calendar information nationwide. Ten percent are inviting a portion of the students to return to campus with only twelve percent of four-year colleges offering purely ‘virtual’ experiences to their students.

Due to a confluence of factors such as increased construction deliveries, reduced tourism and business travel, very high average rents, and a workforce more mobile than that in many areas of the country the Bay Area market in California has been especially negatively impacted from a multifamily perspective so far this year. For that reason, in this space today we’ll be taking a closer look at recent performance for the area across a variety of metrics.

The economic repercussions brought on by the pandemic caused some industries to soar this year, while others experienced major losses. Using MediaRadar data, we dive into the ad spending of various consumer industries in a two-part series. First, we will analyze the industries that slashed their ad spending, and have yet to recover. Next week, we will share the categories that significantly increased ad spending.

Following the longest period of economic growth in the U.S., the onset of the COVID-19 pandemic led to a decline in economic activity and a resultant recession. According to the National Bureau of Economic Research, February 2020 marked the end of the expansion that began in June 2009 and the beginning of a recession.