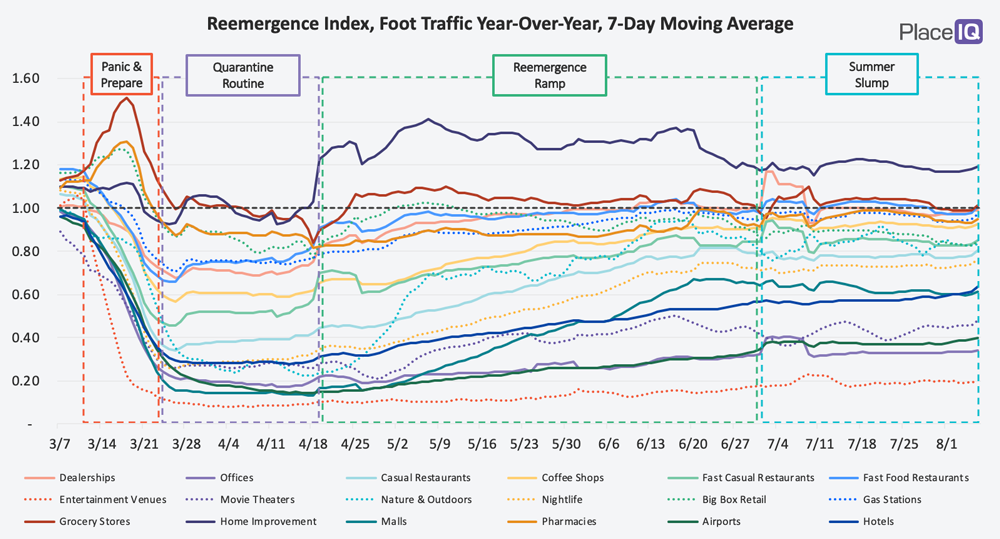

Time moves differently during a Pandemic. The news is constant, cramming what would have been a week’s worth of content into a single day. But at the same time, here we are in August. Time both crawls and runs in the era of COVID. Reviewing this week’s foot traffic category indices, we were similarly struck by how long the Summer Slump has persisted. Here we are, in August, still in the thick of sustained, flat traffic.

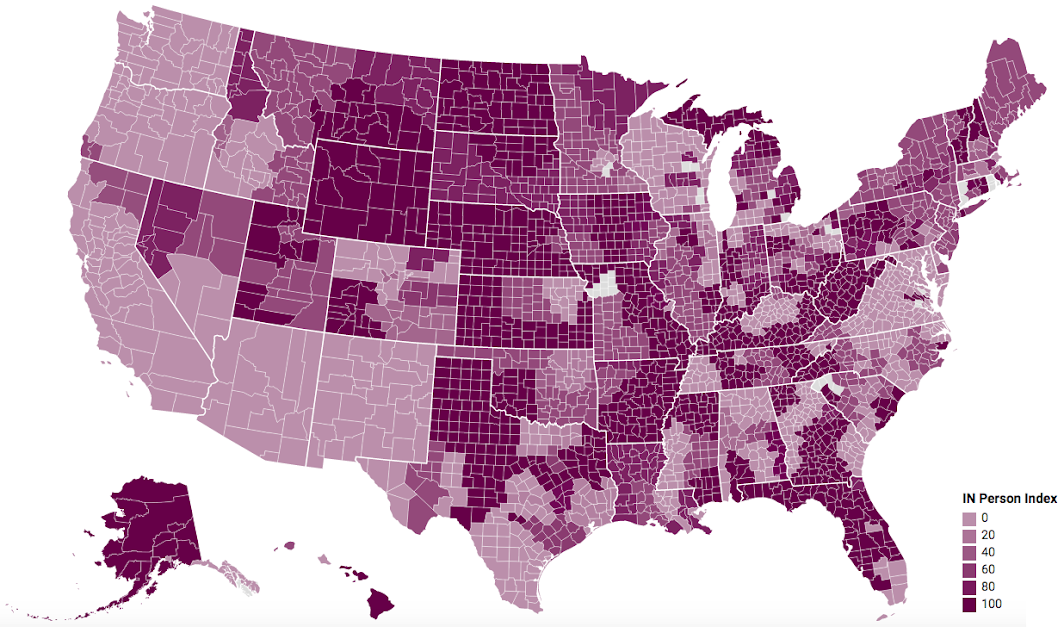

More than 50% of US K-12 public school students will be attending school remotely to start the school year, according to a comprehensive, ongoing survey conducted by Burbio.com. Specifically, 52% of students are projected to be learning online to start the year, 44% will be attending in-person either every day or certain days of the week, and 4% of students are in school districts that haven’t finalized plans.

U.S. consumer spending has been altered by the coronavirus pandemic. Our data reveals that consumers are changing the way they pay for goods and services, with some industries seeing spending shift toward online purchases. Additionally, the pandemic has changed the types of purchases consumers are making, with stimulus recipients increasing their spending on big-ticket items.

In July, over a thousand advertisers paused their spending on Facebook. The campaign did not have a significant impact on Facebook’s revenue—but did those advertisers divert those dollars elsewhere? MediaRadar did an analysis of thirty large brands who participated in the boycott—including Coca-Cola, Unilever, Verizon, and more—to see how these brands advertised across multiple channels in July.

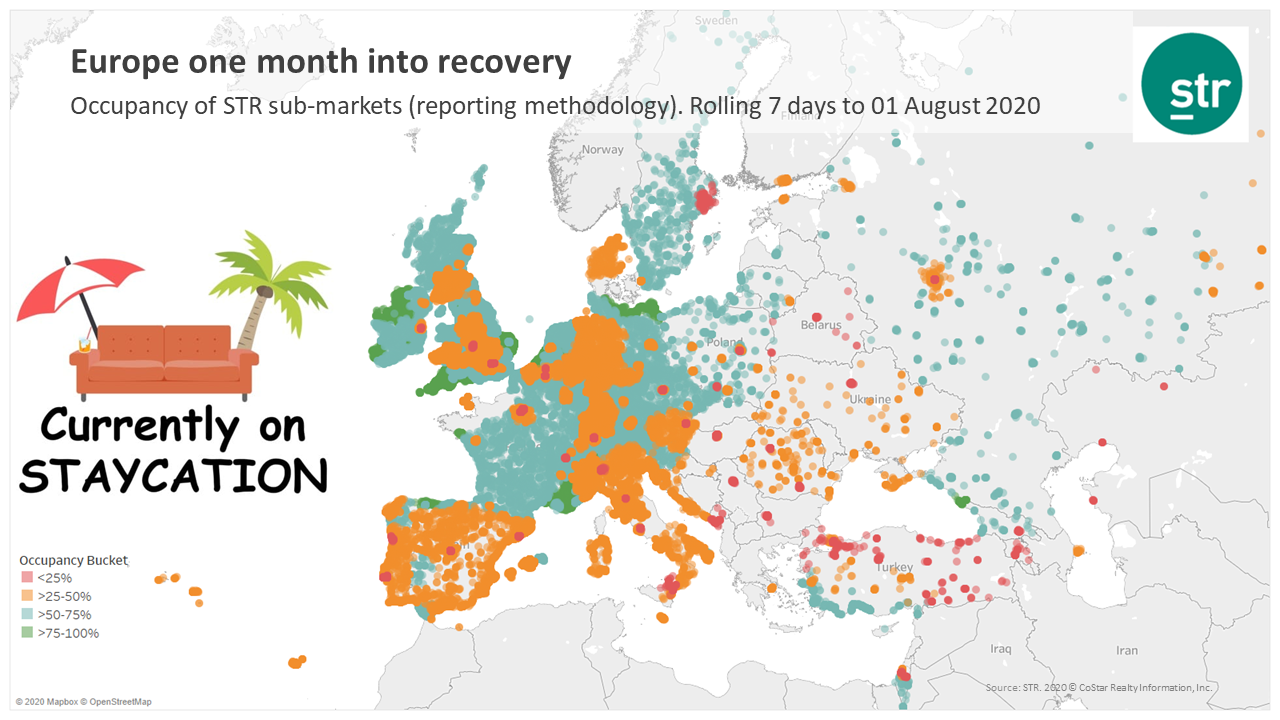

While Germany boasts the most open hotels in Europe, U.K. hotels are opening the fastest having started July with 70% of hotels closed and ending the month at just 20% hotels closed. European hotel occupancy is significantly healthier moving into August, with coastal markets in many countries experiencing the strongest recovery.

In this Placer Bytes, we dive into Kohl’s amidst wider concerns over the future of the department store and the impressive performances across the TJX portfolio. Kohl’s has experienced a strong recovery in recent months with June and July down just 26.7% and 26.1% year over year. And while this still marks significant declines, the brand has been hit hard by COVID resurgences in key states like California and Texas where they have a greater number of stores.

For years, experts have been hailing a new era where companies can hire talent on a per project basis and labor can have a more flexible work-life balance. With the advent of many infrastructural technologies (personal websites, automated invoicing, flexible cloud storage, etc), many individuals have been taking advantage of their valuable skills and joining the freelance economy.

n May 2020, 7.3% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure)\[1\], the highest overall delinquency rate since August 2014, according to the latest CoreLogic Loan Performance Insights Report. The May 2020 overall delinquency rate jumped 1.2 percentage points from the prior month as the impact of the coronavirus pandemic and resulting recession made it difficult for borrowers to make their monthly mortgage payments.

We may not have realised it at the time and it certainly didn’t feel that great, but last week’s global capacity may have represented the peak week for 2020 in the new world of Covid-19. Last week we broke through the 60 million mark; this week we are just below that point and although there are pockets of capacity growth around the globe there are also a number of new travel and rumoured travel restrictions dragging capacity down.

As per Census Bureau's Construction Spending Survey, over the 12 months ended Jun-20, the value of private construction put in place for Parking increased +131%, with Drug store being the 2nd best sector @ +46.7%. Given this staggering growth over recent months, in this article we will present probable reasons for this dramatic growth, along with an overview of the Parking industry.

In this Placer Bytes we dive into the data and recoveries for three major apparel retailers – Macy’s, JCPenney and Dillard’s. Macy’s started off 2020 with mixed results, with year-over-over visits for January down 0.9% but up 6.4% for February. As expected, visits dropped to 62.7% down for March as coronavirus hit the United States, and continued to decline into April – bottoming out completely.

In the last week, footfall across the UK’s foodservice sector has come close to 50% of pre-lockdown levels, but in the main appears to have steadied at around 35% since establishments re-opened for dine-in on July 4th. Both restaurants and quick-service outlets both achieved their highest levels since lockdown began, with restaurants peaking at 45pts on August 5th in contrast to quick-service’s high of 46pts following Super Saturday in early July.

Now that most US megacorps have reported their earnings for 2Q, we turn our attention and focus to two of this year’s hottest IPOs and one of the most interesting European companies that are reporting earnings this week. While we often focus on American companies, given their market size, our data goes far beyond the borders of the North American continent, and earnings season is a great time to take a look at our friends across the pond.

Airbnb, which now offers over six million places to stay in the world, is showing a strong rebound in the United States. According to Airbnb accommodation booking data from Airbtics, prior to the coronavirus pandemic the average US state was experiencing a strong weekly booking of 116% YoY.

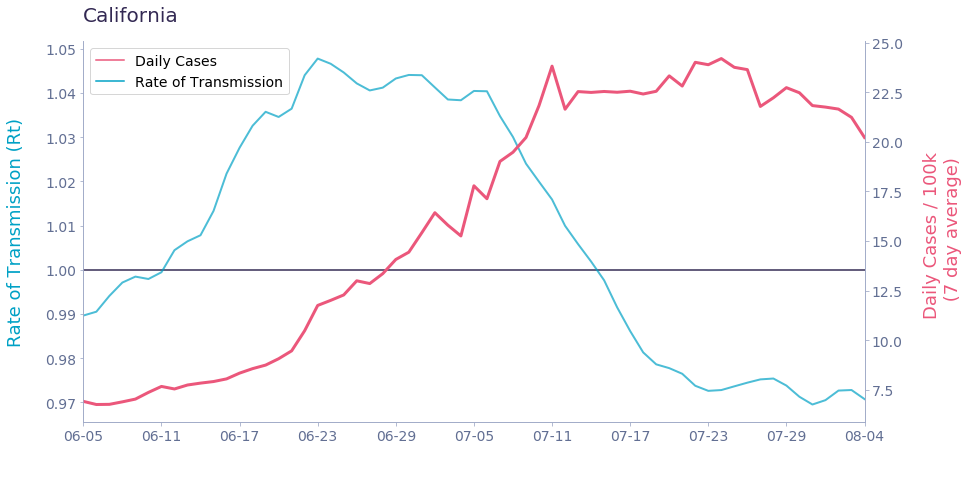

The start of summer brought with it a renewed surge in coronavirus cases, with daily new case counts climbing to a mid-July peak that was twice as bad as the initial spring wave. However, the latest national data shows a slight deceleration in cases over the past week. But is this just a temporary reprieve — or perhaps the result of reporting issues?

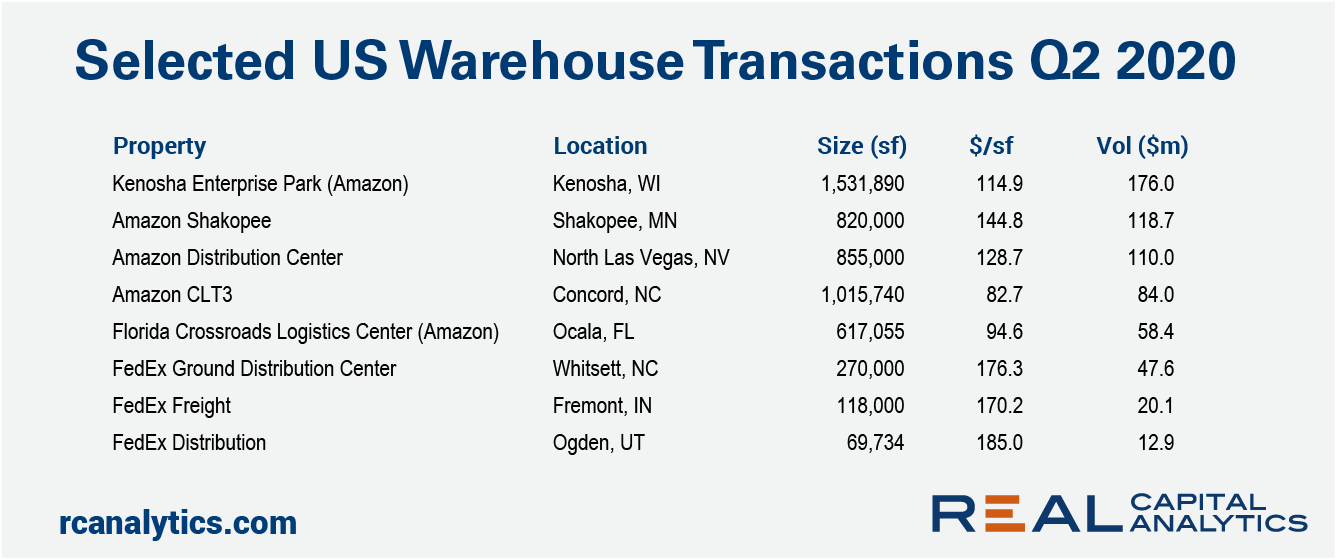

Distribution warehouses continued to be a target for investors in the second quarter of 2020 amid heightened attention on the backbone of logistics infrastructure. While sales activity in the U.S. industrial sector dropped during the quarter, buffeted by lockdown restrictions and economic uncertainties, the sector’s decline was the smallest of any major property type. And, of the $11.1 billion in industrial transaction volume, around one-third came from sales of distribution warehouses.

When we received stay-at-home orders back in March, the app market, and social media in particular, got a huge boost. Facebook, WhatsApp, Messenger, Instagram, TikTok, Snapchat and Twitter all broke their respective records for time spent in-app, globally, in March 2020. I, for one, spent too many hours scrolling through TikTok– I even made it to "beanTok" (if you know, you know). Anyway, more people than ever were tuning in to watch the latest trends, AND more people than ever were contributing to the content. How do I know?

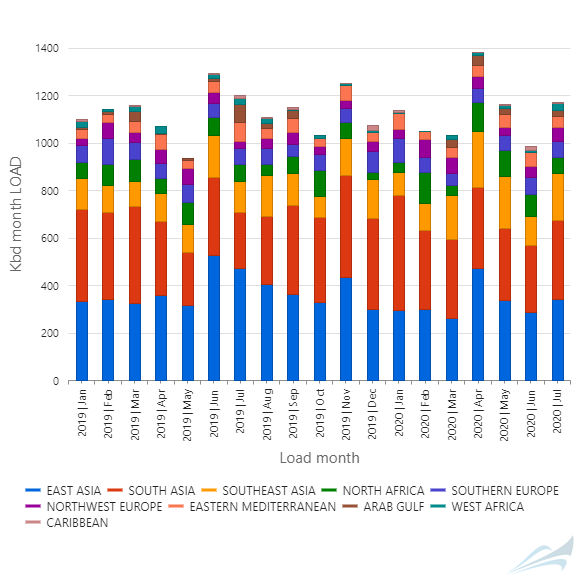

July finished with additional signs that the LPG markets are coming back into favor, with overall offtake increasing 14% from June. Higher discharges took place in parts of Asia, where Japanese and South Korean imports each grew 24%, to 324,000 bpd and 333,000 bpd respectively.

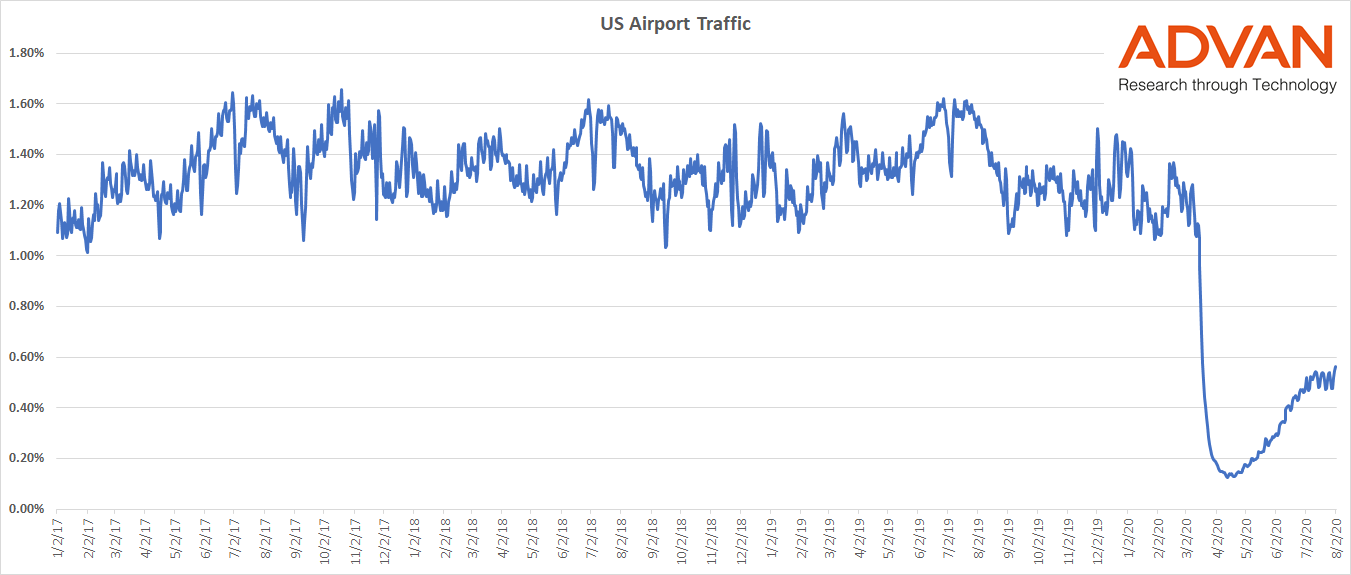

As we near the last stretch of the US summer season, we looked again at foot traffic data for US airports as one measure of the impact being felt by the travel industry. In our blog post on June 19th, we noted that traffic at US international hubs was severely depressed, with some regional hubs seeing a little more activity.

The Dodge Momentum Index moved 3.4% higher in July to 124.7 (2000=1000) from the revised June reading of 120.5. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. During the month, the commercial component increased 5.3% while the institutional component was unchanged.