Europe’s commercial property market moved back into the black in Q2 2021 after four quarters of declines in deal activity caused by the pandemic, the latest _Europe Capital Trends_ report shows. Commercial property sales increased 20% compared to a year ago, led by the U.K. where sales jumped 77%. Industrial sector deals and a couple of large London office transactions boosted the U.K. deal volume total. London was the most active commercial property market for the first six months of the year, reclaiming the top spot from Paris, which fell to third position.

Australian commercial real estate sales rose in the second quarter, fueled by increased deal appetite among domestic investors and a multibillion-dollar logistics deal, the latest _Australia Capital Trends_ report shows. Sales of income-producing properties priced A$1 million and greater totaled A$13.4 billion (US$9.9 billion) in Q2 2021, a 15% improvement on deal levels of a year ago. The biggest boost for the quarter was Blackstone’s sale of the 45-property Milestone Industrial Portfolio. The transaction was the largest portfolio deal on record in Australia.

It’s not news that B2B advertisers were forced to switch to digital marketing advertising last year. With few print magazines being delivered to offices and the lack of in-person events, marketers were forced to redirect their marketing resources to new channels. Print used to be a huge source of advertising investment in the B2B space—but as pandemic restrictions ease, will we see spending return to previous levels?

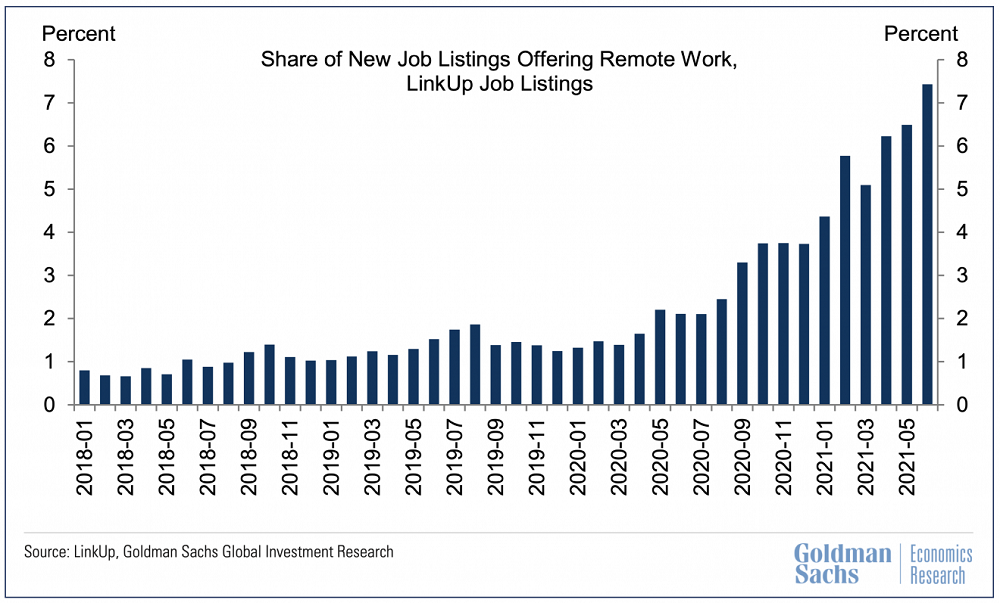

In our Non-farm Payroll forecast earlier this month, we highlighted the yawning chasm of the bid-ask spread between employers and employees these days and touched on some of the structural mechanics of the job market in the context of how efficient or inefficient the job market is (typically), how COVID has obliterated any normalcy that might have previously existed in the job market, and what we expect to see in the coming months.

The number of people visiting Brighton’s shops dropped by 6% over the last month, as Huq’s geo-data reveals how the economy of the most ‘pinged’ city in the South East is being impacted by people being told to self-isolate. In our deep-dive series exploring the link between alerts and the impact on economic activity, today’s focus is on the South East where more than 87,309 NHS self-isolate alerts were sent and the seven days leading up to 14 July.

In the latest report from INRIX, “Mall Resurgence Proves Brick and Mortar Still Alive Despite Pandemic,” we learned about the difficulties mall owner/operators and tenants faced over the last year and a half. The COVID-19 Pandemic – along with local government’s response to the outbreak – reduced visits to malls by 91% in April 2020. And while the recovery varied from city to city, we found certain cities stand out from others. For example, by July 2020, Chicago jumped from being -95% down from pre-COVID levels to just -19%.

Ahead of its forthcoming $35B IPO, we looked into Robinhood’s stated growth strategy to “continue adding new customers to \[their\] platform” as well as which customer cohorts are most valuable for the trading app. Customers who joined the Robinhood platform in 1Q20 or later have a far greater Cumulative Deposit Value than prior cohorts, starting with a higher initial deposit, in the range of $240-$340, vs. an appx. $200 in previous periods.

To use a technical term, housing markets across the nation are “hot.” The news is filled with stories of bidding wars, homes selling in hours and homes selling significantly above the list price — not to mention listing inventory at record low levels and supply-chain constraints pushing lumber prices up 42% YoY in March, adding to new construction costs. Certainly, the housing market has been a bright spot during the COVID-19 pandemic.

The UK Grocery industry has been in a state of transition for the past several years. Much earlier than their counterparts in the US, Grocers in the UK had to contend with online competition from Ocado and an influx of deep discount competition. In today’s Insight Flash, we do a pulse check on the industry to see what’s been leading growth most recently and where future opportunities may lie.

Companies are increasingly building alumni networks, enabling former employees to stay connected. These networks offer powerful benefits, not only for the employees but for the companies themselves, such as improving the quality of new talent and building stronger strategic partnerships. So in this new type of corporate community, which company has the most powerful alumni network?

In this Placer Bytes, we dive into the recovery of top Restaurant Brands International chains, Chick-fil-A and GameStop. Looking at two of the top Restaurant Brands International chains shows the continued strength of QSR. Burger King saw the further shrinking of the year-over-two-year visit gap with visits down just -4.5% the week beginning July 12th. It was the strongest mark of 2021 for Burger King and continues the strong trend the brand has seen in in-store visits.

E-commerce and omnichannel shopping were not born out of the pandemic, but the arrival of COVID-19 accelerated these trends in ways that would have likely taken decades otherwise. The pandemic also didn’t conceive convenience, or inspire customers to demand it, but it did shine a light on how important it is in everyday life—particularly in a global health crisis. Now, as consumers resume many of their pre-pandemic activities, retailers need to remain focused on convenience—even as consumers leave the comfort of their homes.

The NHS’ Covid-19 app sent a record 607,486 contact tracing alerts in the week ending July 14th and despite the UK today has entering its seventh daily drop in cases, high-frequency geo-data shows how the ‘pingdemic’ continues. In our deep-dive series exploring the link between alerts and the impact on economic activity, today’s focus is on the East of England which includes Essex, Great Yarmouth and Cambridge.

The 2020 Tokyo Olympics are games like no other. With Covid restrictions in place and fans barred from the stadiums, the need for mobile apps to stay connected with favorite athletes and watch competitions has skyrocketed. Since the opening ceremony on July 23, Olympic-related apps have seen significant bumps in downloads as fans from around the world tune in to cheer on their home country. The Olympics have traditionally drawn large crowds of spectators. The 2016 Games in Rio de Janeiro drew over 500,000 in-person spectators

While the world seemingly shut down when the COVID-19 pandemic hit, grocery stores had a steadier path than the rest of the economy. On the other hand, many big box stores like Target, Costco, and Walmart, experienced a bit more volatility with higher highs, but also lower lows. Big box stores saw a 28.4% decrease in foot traffic in April 2020, but then jumped back up 28% the following month. On the other hand, grocery store foot traffic decreased only 18.4% from March to April 2020 and then increased just 3.7% the following month.

As travel-related sectors are bouncing back from the COVID-19 pandemic, rental cars have been in short supply. Consumer transaction data reveals that June 2021 sales for top rental car parent companies like Avis Budget Group and The Hertz Corporation exceeded sales from the same month in 2019 and 2020. At the same time, peer-to-peer car rental companies like Turo continue to capture market share from competitors. Similar to a recent trend in the rideshare industry, average transaction values for rental car companies rose throughout the spring and early summer of 2021.

Visits to McDonald’s took a hit over the pandemic, but since February the brand seems to be on an accelerated path to a full offline recovery. Visits in April, May and June were down -12.1%, -12.5% and -11.1% respectively – an impressive result considering the existing strength in delivery and drive thru, and the lingering COVID effects on ‘normal’ routines. One of the factors limiting a full visit return for McDonald’s this past quarter was patrons’ slow return to their pre-pandemic dining patterns.

There may not be any spectators at the Tokyo Olympics this year, but the show _will_ go on, and the advertisers are here for it. From television to OTT to digital, brands have had an extra year to gear up for the worldwide Summer event, and are using the opportunity to gain the attention of a public who, after a long 15 months, are looking for something to celebrate. Between official sponsorship opportunities and general Team-USA cheer, advertisers have a lot to work with when it comes to Olympic themed advertising--and they've shown up in full force this year.

Mobile operators are rapidly expanding 5G deployments across the globe, with 16,410 new 5G deployments across 109 countries added to the Ookla 5G Map™ in June 2021 alone. Huge investments in 5G are being made to increase performance, especially in major cities. We used Speedtest Intelligence® to see which world capitals have the best 5G speeds and availability, based on locations with commercially available 5G during Q1-Q2 2021. We’ve also created a white paper that highlights 5G performance in select cities around the world, including 5G performance at a provider level.

The Olympics aren’t the only professional sports taking place this month. The NBA finals and the Stanley Cup finals took place in July, while regular season MLB play carried on. With the chaotic sports seasons last year, viewership and ratings were down significantly. Despite this, networks did a good job of retaining advertisers. This year, leagues are focused on reaching and growing audiences while the pandemic limits in-person attendance. In some cases, they’re using innovative ways to attract new crowds.