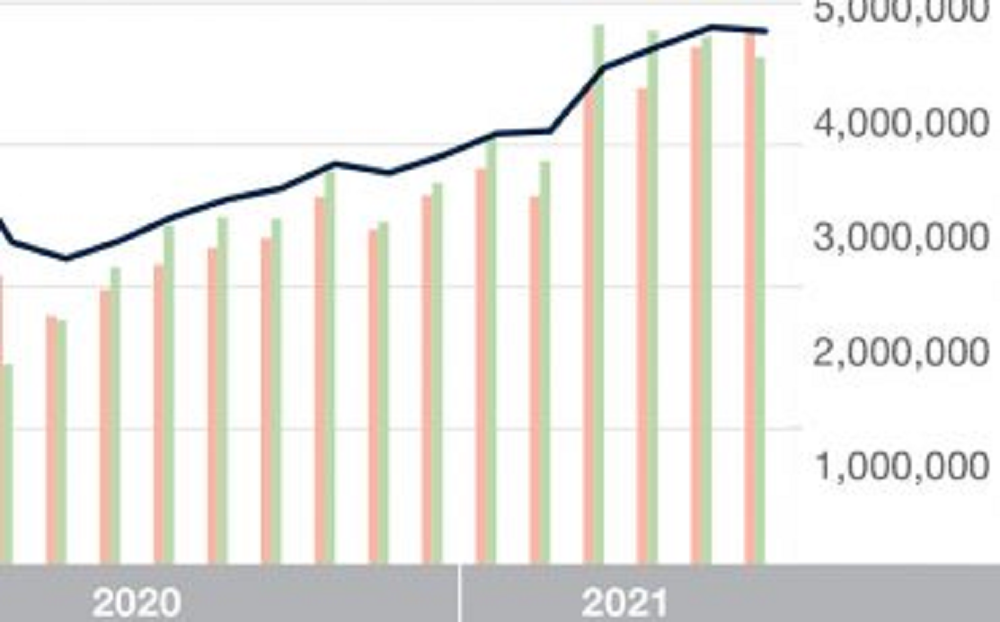

Grocery delivery sales skyrocketed early in the pandemic, as shelter-in-place orders went into effect and many consumers avoided going into brick-and-mortar grocery stores. Between March 2020 and April 2020, total sales among a select set of grocery delivery competitors–Instacart, Walmart Grocery, Shipt, Peapod, and FreshDirect–grew 62 percent. While demand for grocery delivery still exceeds pre-pandemic levels, sales have been gradually declining in 2021.

In the first half of 2021 there was an unprecedented surge in demand for mental health and fitness services. Tracking the salaries for health coaches over time, we see not only a recovery from the pandemic, but also an extremely rapid spike in 2021. But how are these new demands changing the wellness economy? This rising demand for wellness services has resulted in large salary increases for specific roles. In the figure below, we see that coaches, counselors, and support workers have the highest growth in salaries.

In our latest whitepaper, we analyzed retail giants, their pandemic performance, and their year so far. We looked at the sector leaders and dove into different superstore categories to explore the latest trends, see where competition was heating up, and understand whose dominance remains unchallenged. Costco, Target, and Walmart are three of retail’s most important and impressive players. And while Walmart is by far the biggest of the three—both in terms of numbers of stores and monthly visits—it is also facing the stiffest increase in competition.

In a previous article we discussed the UEFA Euro 2021 impact on host markets in Europe, now we focus on how 2021 Copa América affected Rio de Janeiro and Brasilia during the later rounds of the tournament. Copa América, originally scheduled to take place last year in Argentina and Colombia, was held from 13 June through 10 July 2021. During the quarterfinal between Uruguay and Colombia on 3 July, Brasilia registered its second highest occupancy level (53.8 %) of 2021. Hotel occupancy the day before and after the match was just 36%.

There's nothing quite like an international football tournament and the wave of excitement that takes over cities as fans flock to the stadiums of the host nations. During UEFA Euro 2020, that party atmosphere was for the first time extend to 12 different host markets, albeit with some limitations due to the pandemic. Regardless, Euro 2020 meant an influx of visitors and a subsequent impact on hotel performance, especially for smaller markets.

Like most of the world, the COVID-19 pandemic accelerated digital adoption across industries. The financial service industry in Canada was no exception. According to Similarweb data, web traffic to the Banking, Credit, and Lending category within the country increased 20% in 2020. In this article, we’ll use our Research Intelligence solution to hone in on the digital trends impacting the performance of top Canadian banks (known as the “Big 5”), and share lessons learned from the winners.

In this Placer Bytes, we dive into a retailer seemingly at the height of its powers and another that may be on the path to a serious rebound. For a digitally native company ahead of an expected IPO, plans to potentially open hundreds of stores are far from a given. Yet, Warby Parker has become one of the prime examples of the importance and value of owned retail. The eyewear brand has seen visits rebound very strongly during the recovery with visits up 75.6% and 48.1% in May and June of 2021 compared to the equivalent months in 2019.

It didn’t take long for TikTok to transform from a fledgling social media platform with questionable legal presence in the U.S. into one of the most popular apps around. TikTok was the most downloaded app of its kind last year, with more than 82 million downloads, and it continues to gain traction from consumers and advertisers every day. As the social media app matures, it has quickly become a platform used to drive fashion trends among the Gen Z audience.

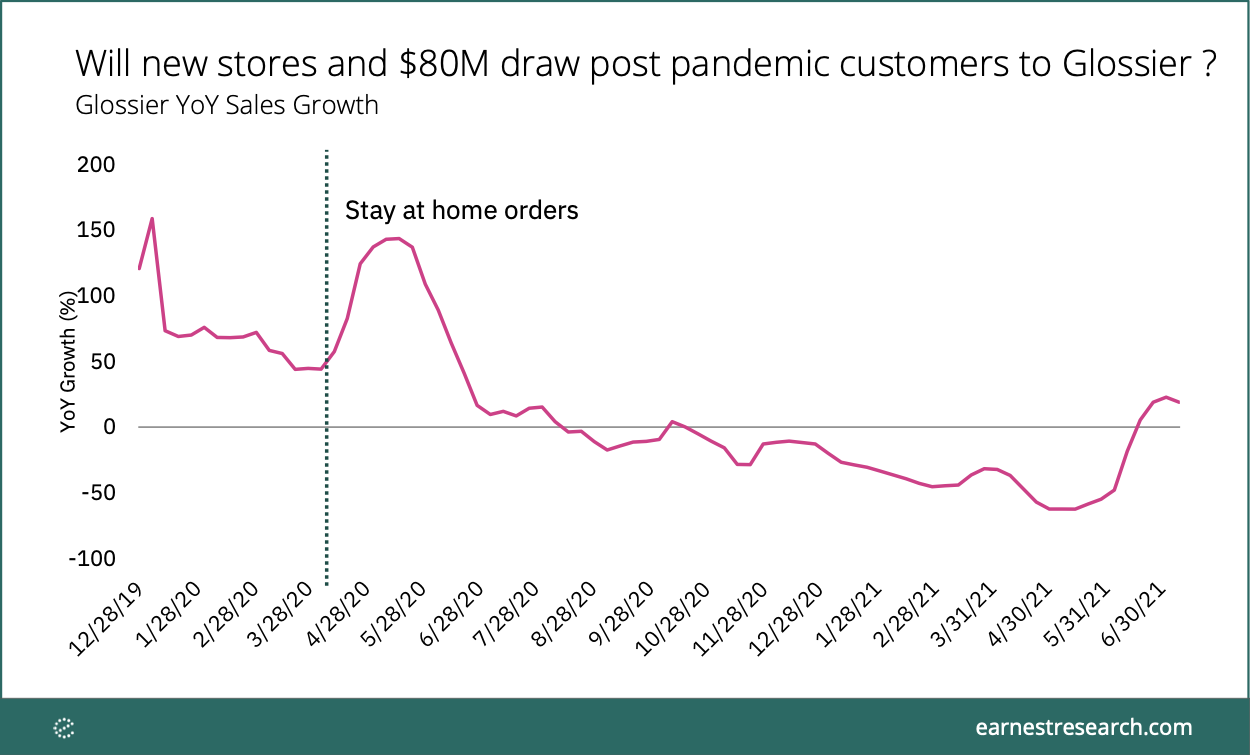

With news that Glossier recently closed a Series E round of $80M (led by Lone Pine Capital) now bringing the DTC company’s valuation to $1.2 billion, we looked at our spend data to see how the beauty brand has fared throughout the pandemic and beyond. Glossier YoY sales peaked in mid-May growing 143%, coinciding with stay-at-home orders that left many shoppers with online marketplaces as the only place to checkout. As COVID cases continued to grow, Glossier’s sales declined, hitting negative growth by late summer 2020

Total construction starts lost 7% in June, slipping to a seasonally adjusted annual rate of $863.6 billion, according to Dodge Data & Analytics. All three major sectors (residential, nonresidential building, and nonbuilding) pulled back during the month. Single family housing starts are feeling the detrimental effects of rising materials prices. Large projects that broke ground in May were absent in June for nonresidential building and nonbuilding starts, resulting in declines.

U.S. single-family rent growth increased 6.6% in May 2021, the fastest year-over-year increase since at least January 2005, according to the CoreLogic Single-Family Rent Index (SFRI). The May 2021 increase was nearly four times the May 2020 increase. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

Last month’s heatwave in the Pacific Northwest created unbearable conditions in an area where many homes don’t even have air conditioners. But as the temperature soared higher, some companies saw their sales melt while others were boosted along with the thermostat. In today’s Insight Flash, we dig into which companies benefitted and suffered the most, including a deep dive into surprising gains for Uber and Lyft.

Grocery stores and superstores carrying food and medicine were labeled “essential businesses” and allowed to stay open throughout the pandemic. Still, COVID affected in-store shopping patterns as shoppers limited their exposure to the virus by limiting their trips and spending more time in stores each visit as they filled bigger baskets – a key mission driven shopping trend. Now, with COVID’s retail impact subsiding, Americans are returning to their pre-pandemic habits. We dove into our Q2 Quarterly Index to find out more.

COVID-19 cases have more than doubled in the last two weeks, and — in sadly all too familiar news — hospitalizations and deaths are beginning to rise again. The more transmissible nature of the Delta variant is creating a unique challenge — although many of the recent outbreaks _began_ in states with low vaccination rates, they are now also spreading to areas where large portions of the population are protected.

In the battle to be the pre-eminent travel hub in the Middle East, the latest research from ForwardKeys, which has the world’s freshest and most comprehensive flight booking data, reveals that in the first half of 2021, Doha seized and consolidated a lead over Dubai airport. From 1st January to 30th June, the volume of air tickets issued for travel via Doha was 18% higher than it was through Dubai; that relationship looks set to continue. Current bookings for the second half of the year through Doha are 17% higher than through Dubai.

Following the normal pre-4th of July slump, U.S. industry occupancy rebounded to 67.2% for the week ending 10 July 2021. While this was good news, the gain was much less than expected as weekly demand improved 3% to 26 million. In the same week of 2019, demand increased 13% week over week, and occupancy hit 74%. We believe this illustrates the continued shortfall in business and group demand that in normal times would have supplemented seasonal leisure demand.

There has been lots of speculation around a potential initial public offering (IPO) from Klarna, which according to TechCrunch is the highest valued private fintech in Europe. The Swedish buy now pay later (BNPL) company is live in over 20 countries, and in May 2021 reported 90 million global active users, and 2 million transactions a day. So will Klarna IPO? We don’t know. But what we can tell you is that based on our web traffic alternative data the company’s online performance is looking robust.

Looking back at the month of June, we see growth has slowed and the labor market appears to be leveling off. The month brought the first signs that the job market is cooling down. It’s not quite a summer slump, but maybe, just maybe, this slowdown signifies things could be (dare we say it?!?) returning to “normal.” While more than half of industries saw decline, several did see strong job growth last month. Topping the list are Real Estate and Rental and Leasing (+7.3%), Finance and Insurance (+6.8%), Information (+5.4%), and Professional, Scientific, and Technical Services (+6.8%).

Nordstrom recently announced that it was taking a stake in four brands owned by UK retailer ASOS: Topshop, Topman, Miss Selfridge, and HIIT. As part of the agreement, Nordstrom will be the exclusive North American retailer for Topshop and Topman, making it the only brick-and-mortar outlet for these brands. Additionally, shoppers will be able to pick up online Asos purchases at Nordstrom stores. In today’s Insight Flash, we look at US sales of these brands and whether the relationship makes strategic sense, focusing on cross-shop and overlapping demographics.

ESG assets are set to reach over $50 trillion by 2025. According to Bloomberg, that’s a third of total global assets under management. Alternative data offers a powerful view into this fast-growing space. Here we’ll delve into ESG investing, what it is, how it’s scored, and why it matters now. ESG stands for environmental, social, and governance. You can use this framework to assess how one company performs in these three areas vs. its competitors.