The rapid increase of lumber prices has been all over the news throughout the COVID-19 pandemic, and everyone seems to have their own explanation of why this trend has been occurring. From increased demand, to the lack of timber, to the Mountain Pine Beetle destroying trees, or to the impacts of clearcutting, each of these explanations are true to varying degrees. But they’re also not the complete picture. When it comes to pricing, it’s important to distinguish between _demand for lumber_ and the _supply chain for lumber products_.

The last four weeks (ending Saturday, 12 June) continued to show a solid return to normalcy as we compare 2021 state-level weekly room demand against the comparable levels from 2019. As a reminder, STR currently benchmarks recent performance against 2019 performance levels rather than a pandemic impacted 2020. Twenty-six (26) states showed demand totals within a 10% margin of the corresponding period of 2019. Collectively, eight of those states actually sold more rooms for the 4-week period than they did 2019.

Canadian investors have been one of the most resilient sources of capital throughout the pandemic era so far. Since the beginning of 2020 they have largely maintained their capital outlay, though there has been a marked shift in where that capital has headed. Up until 2019, the U.S. had been garnering an increasing share of Canada’s overseas spending. However, since 2020, Canadian investors have diverted their attention outside North America, with around half of outbound allocations leaving the continent.

In this Placer Bytes we dive into the dining category with check-ins on Chipotle and Darden’s Restaurant portfolio. An emphasis on digital enhancements seemingly helped Chipotle weather the COVID-storm, but how is the brand performing post-pandemic? When comparing monthly visits to 2019 for one of America’s most popular chains, we see visits nearing pre-COVID levels While visits were down 22.1% in January, that visit gap shrunk to just 4.5% for March amid lifted restrictions across the dining category.

More than any other industry, travel feels like a large pendulum pulled to one extreme that is now quickly returning the other way. Perhaps _too_ quickly. Airline employees and Transportation Security Administration (TSA) agents are tasked with managing heavily booked flights, crowded airports, and passengers who’ve forgotten how to behave while traveling. Passengers are experiencing extremely long check-in and security lines, terminals with closed shops and restaurants, and multiple flight cancellations.

Mask mandates have been a beast for the beauty industry, especially when combined with stay-at-home orders giving shoppers fewer opportunities to glam up. With restrictions continuing to lift in the US and UK, we use our cross-continental transaction dataset to assess how the beauty recovery is progressing in both markets. In today’s Insight Flash, we dig into channel trends for the industry, changes in top brands, and which demographics are leading the recovery.

Whole Foods and Trader Joe's compete for grocer foot traffic in the premium grocery store category in San Francisco (SFO). Whole Foods operates eight stores in the area, while Trader Joe's operates six stores. They each offer prepared foods and options from local farmers as well as convenience and traditional grocery industry services. In each case, the geographic disbursement of each grocery store is more dense in the city and less so away from the urban center.

U.S. hotel industry occupancy soared to its highest level since November 2019, reaching 66.0% for the week ending 12 June 2021. Room demand surpassed 25 million in the week, up 1.6 million week on week, and was 91% of the level recorded in the comparable week from 2019. This is significant given the fact that business travel and group demand remain curtailed. Occupancy on Saturday reached 81%, a level like the Saturday of this year’s Memorial Day weekend, while the full weekend came in at 78.8%, the highest since fall 2019 and higher than the comparable weekend of 2019.

Recently, Consumer Discretionary (CD) has been an interesting sector to analyze. Due to its non-essential nature, COVID’s impact on the sector cannot be denied. However, as it looks like we are turning a corner on the pandemic, CD seems to be undergoing shifts that make it worth taking a closer look. We can see from the S&P 500 index that Consumer Discretionary took a significant hit right after the onset of COVID, as one might expect. But since then CD has had a strong recovery.

Data made available just 48hrs behind real-time reveals a 30pt rise in visits to London Estate Agents versus the autumn of last year, the period prior to the last lockdown. This rise suggests warming in the capital’s residential property market as people rush to complete before the end of the stamp duty holiday on 30 June. Official statistics released this week by the Office for National Statistics shows how, despite a small recent drop, property market has been running at its fastest pace since before the financial crisis in 2012.

Due to the COVID-19 pandemic, the federal income tax deadline for individuals was extended for the past two years, to July 15 in 2020 and May 17 in 2021. Consumer transaction data reveals that, consequently, sales for the tax prep industry were more spread out in 2020 and 2021 compared to previous years, resulting in smaller-than-usual sales spikes the week of and week before Tax Day. However, TurboTax continues to lead the tax prep industry and has steadily gained market share from its competitors over the past three tax seasons.

Investors intent on not letting a crisis go to waste will need to see beyond the distressed investing playbook that was formulated during the Global Financial Crisis (GFC). A different kind of crisis warrants a different distressed investment strategy and those investors strictly playing by past rules are likely to miss out. Distressed investing in the GFC era was about firms stepping in to help rebalance the capital stack. There were cash-flowing assets that simply had too high of a debt burden relative to income

While there are many COVID-driven trends that will likely fade as the pandemic does, one that could have a significant long-term impact is the fundamental disruption to migration patterns. Already in the early stages of the recovery it was clear that something had shifted, with far reaching implications to retail, office, and residential real estate. So where do things stand today?

As shoppers slowly emerge from months at home in their sweatpants, luxury brands are grappling with how to sell watches and purses in a post-pandemic world. Burberry reported its sales were down 48% in Q1 2020 — not surprising, considering that stores around the world were closed to stop the spread of COVID-19. Likewise, Gucci sales slid 22% in the first quarter of 2020 in spite of a boost from online shoppers. So far in Q1 2021, luxury goods seem to be regaining their pre-pandemic sparkle.

Founded in 2012, Southeast Aasia’s super app Grab is seeking an IPO through SPAC merger, which reportedly might become the biggest-ever U.S. equity offering by a South-East Asian company. Grab provides essential services including rideshare, food delivery, hotel booking, on-demand delivery, and payment services with its namesake mobile application. It now serves 670 million people across Singapore, Indonesia, Malaysia, Thailand, Philippines, Vietnam, Cambodia and Myanmar.

On March 10, 2021, as many other states braced for another wave of the pandemic, Texas took the bold steps of lifting mask mandates and removing other precautionary measures designed to slow the spread of COVID-19. Following the loosening of restrictions, Texas experienced the highest levels in Kinsa’s overall illness signal in more than a year, driven not by COVID, but by other common contagious illnesses like strep, RSV and even some flu, according to diagnostic data.

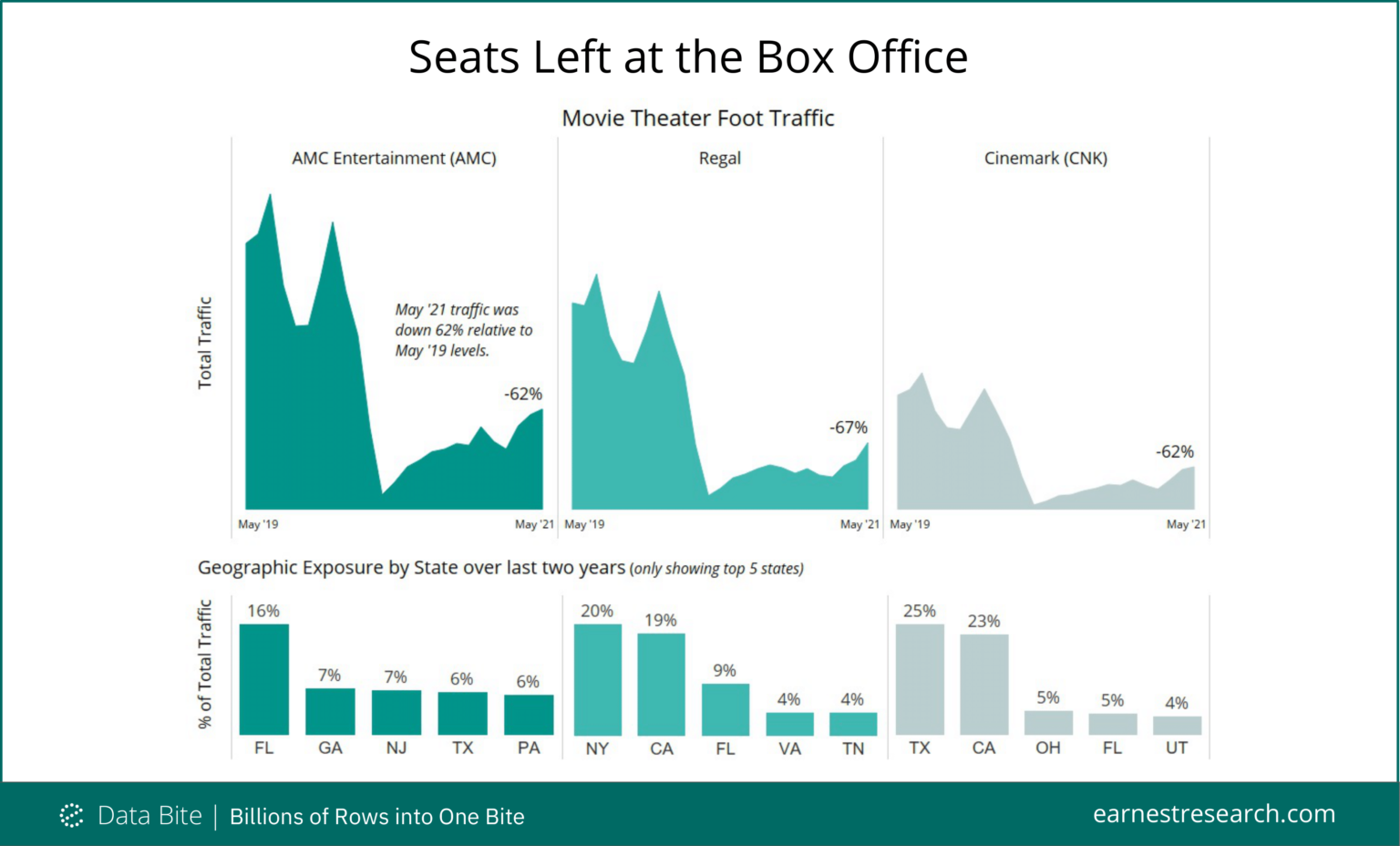

While much has been said about the latest meme-driven rally in AMC’s share price, we used Earnest Foot Traffic data to look at actual customer behavior and understand what’s really happening with movie theater attendance. AMC, with the largest footprint, recently saw traffic -62% of May 2019 levels—likely benefiting from the outperformance we’ve seen across several sectors in Florida, Georgia, and Texas, despite their lower vaccination rates.

While large companies with capital reserves, the ability to issue debt, and e-commerce sites were able to weather the COVID pandemic, many small businesses did not fare as well. Our CE Macro data classifies payment card spend as tagged to one of the over 10,000 brands part of our Brand Universe of interest to corporate and investor clients, or untagged, which is a proxy for small business activity. In today’s Insight Flash, we look at the extent to which small businesses have taken part in the recovery

There has been a great deal of attention brought to racial and gender inequities in the United States. And investors are now beginning to support companies that are trying to diversify their workforce. But even if these companies change their hiring behavior, is the tenure of the new diverse workforce consistent with the greater company’s? After hiring minority talent, a company could, seemingly, still converge towards a demographic monoculture. Not only would this be a vicious cycle, but also potentially hinder diversity of thought and productivity.

AMC’s stock began surging unexpectedly in mid May, as meme-driven retail investors bolstered a trading frenzy. But as AMC themselves admitted in their recent SEC filings: “We believe that recent volatility and our current market prices reflect market and trading dynamics unrelated to our underlying business.” So how is AMC really doing? We dove into the data to find out.