Two years ago, the death knell seemed to be sounding for department stores as shoppers gravitated towards e-commerce sites and shopping on their sofas. Post-pandemic, however, the couch has lost it allure and many department stores have seen sales gains above consensus in the most recent quarter.

As pandemic restrictions loosen and indoor dining reopens at greater capacities, the convenience of food and grocery delivery is expected to remain a key part of consumers’ daily lives. Globally, we’ve seen weekly active users of top food delivery apps increase significantly in the weeks pre-pandemic to our new normal today.

Welcome to the June Apartment List National Rent Report. Our national index increased by 2.3 percent from April to May, representing the third straight month of record-setting rent growth, going back to the start of our rent estimates in 2017. After this recent spike, year-over-year rent growth now stands at 5.4 percent nationally, and prices are now in line with where we expect they would have been if the pandemic-related rent declines of 2020 never occurred.

Zoom Video Communications (ZM) is on the cusp of its fiscal first quarter earnings report on June 1. As expected, Zoom’s momentum is fading as lockdowns ease and on-site activity returns. Shares are significantly underperforming year-to-date, even when compared to the overall weaker performance across the tech space.While many organizations are moving to adopt a more permanent flexible work environment, the risk-reward ratio for Zoom has now undeniably shifted.

China’s Labor Day holiday (1-5 May) stimulated travel demand and provided a noticeable boost to hotel performance. Thanks to an additional day during the holiday period, the rise in performance pushed levels beyond another recent holiday and even some 2019 comparables. The impact, however, was not even across all markets and hotel classes. The highest hotel occupancy point during the Labor Day period was day two, which reached 91.3%.

KEY global advertising markets have already begun to recover from 2020’s record declines in ad spend, and our exclusive market intelligence is reporting that the investment by national advertisers in the first quarter of 2021 has grown 1% beyond that achieved in Q1 2019. Standard Media Index collects and publishes real media agency ad spend, and our data shows a strong rebound in the US, UK, Australian, NZ and Canadian markets.

According to the Bureau of Labor Statistics, roughly 18% of the United States labor force consists of foreign-born employees. This rate has seen moderate increases over the past several years, although 2020 has proved especially devastating for foreigners working in the United States. It’s estimated that 38.4% of the drop in employment over the past year has been concentrated around foreign born persons.

The increase in U.S. commercial real estate investment in April might suggest that the market is through the worst effects of the Covid-19 pandemic. Still, while there were high double-digit annual growth rates in commercial property sales for the month, all the problems from the pandemic are not yet in the rearview mirror. The good news is that deal activity is climbing. Commercial property sales were up 66% from a year earlier in April.

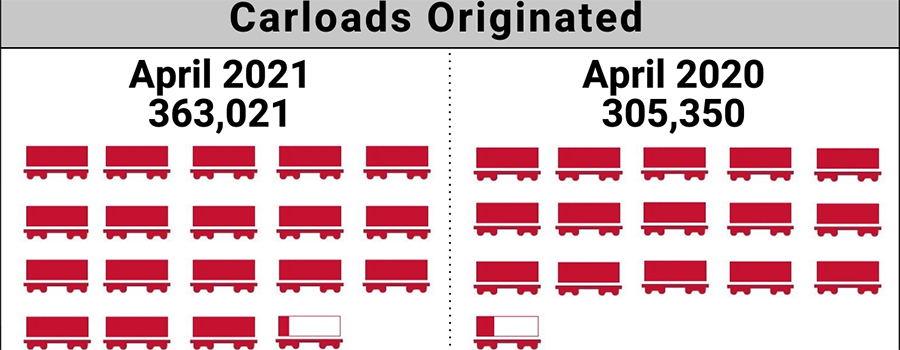

The number of carloads moved on short line and regional railroads in April 2021 was up compared to April 2020. Carloads originated increased 18.9 percent, from 305,350 in April 2020 to 363,021 in April 2021. Virtually all carload groups were up. Motor Vehicles and Equipment led gains with a 212.0 percent increase. Nonmetallic Minerals was up 82.9 percent and Waste and Scrap Materials and Petroleum Products increased 54.9 and 50.8 percent respectively.

Monday.com has officially filed for its initial public offering (IPO) on the NASDAQ stock exchange, under the ticker MNDY. The project management tech company is yet to report a profit, but did report impressive total revenue for 2020, of $161 million. The company has not yet disclosed its target valuation. In the meantime, let’s see what the alternative data has to say, ahead of the monday.com IPO.

Relative to other European markets, the Danish market has boomed through the pandemic. Transaction volume increased 44% year-over-year in the 12 months through Q1 2021, and at a shade under €8.4 billion ($10.2 billion) eclipsed the market’s annual record high for transactions of 2017. Moreover, first quarter deals topped €3.5 billion, which makes the start of 2021 one of the best three-month periods for the market on record, catapulting the market to become the fourth most active in Europe at the start of the year.

Considering the unique effects of COVID, QSR brands were among the best situated in all of offline retail, but especially the dining sector. A value orientation in a time of economic uncertainty provided a benefit that was bolstered by pre-existing strength in takeaway, drive-thru and delivery. The result was a strong ability to drive strength during the pandemic.

Visits to non-food retail stores more than doubled since restrictions eased last month, with the trend showing that footfall has risen from 10% to over 30% of pre-pandemic levels. This index from Huq Industries measures in-person visits to stores ranging from clothing, shoe shops and homeware to DIY, pet shops and opticians to chart how that value has changed in relation to the equivalent weekday median in February 2020.

As the global COVID-19 pandemic took hold in the United States in early 2020, both grocery and food delivery services saw huge increases in business. Several online grocery purchase platforms saw a 6x increase in new customers making their first-ever purchase during the week of March 31.

U.S. room demand continues to push toward the comparable levels of 2019. As a reminder, 2019 is being used as the recovery benchmark due to the heavy pandemic impact in 2020. For the 4-week period ending 15 May, 29 states experienced room demand totals within a 15% margin of the comparable period in 2019. Recalling that overall U.S. room demand dropped by greater than 80% during the worst weeks of this recession.

Now it’s the turn of SaaS companies to take center stage this earnings season. For the first quarter, SaaS expectations called for sustained enterprise momentum. However, for certain B2B platforms, there are concerns that these expectations could prove aggressive. That’s the case even for those who have experienced account growth acceleration in 2021, such as cloud-based software provider Salesforce (CRM) and Workday (WDAY).

In the last year, the dollar store sector has clearly been among the better positioned segments within all of retail. And there is real reason to believe that this is just the beginning. Brands like Dollar General and Big Lots are poised for big things in the next year, and new concepts like Dollar General’s Popshelf could make the coming years even more exciting for an increasingly sophisticated sector.

Facebook and OTT advertising may offer similar programmatic opportunities, but the two formats generally win over a different set of advertisers. Over the last few weeks, we’ve dug into Facebook advertising data and released a Facebook advertising trend report.

Coronavirus cases in the U.S. were again on the rise last month, stalling the hope that we were nearing the end of the pandemic, despite wider availability of vaccines. While this spring’s bump — aided by fast-spreading variants — was much smaller than the spike in confirmed cases in January, it surpassed the peaks of previous surges last spring and summer.

Predicting the return of corporate travel would be a cinch if foretelling the future was foolproof. No one, however, has that extraordinary prescience and even if they did, the future is, at best, murky. The continuing popularity of work-from-home arrangements, the COVID-19 induced reluctance of both individuals and companies to get back out on the road, and issues throughout the travel supply chain are all converging to create a less-than-hospitable environment for individual business travelers.