Casinos took a major hit during the pandemic as indoor recreational activities temporarily shut down to halt the spread of the virus. Now, with most restrictions lifted, the industry is coming back to life – but the overall pace of recovery for US public gaming companies has been choppier than for other sectors. We dove into national and regional foot traffic trends for Boyd Gaming, Bally’s Corporation, Caesars Entertainment, MGM Resorts, Red Rock Resorts, Penn National Gaming, and Wynn Resorts to see how this sector is performing through the reopening.

Money transfer and payment apps are seeing an unprecedented spike in adoption and usage. While these initial surges aligned with retail business closures and statewide stay-at-home orders, the gradual proliferation of contactless payment apps reflects consumers' mounting desire for both convenience and safety in how they manage their financial lives. Today, we'll review how PayPal, Venmo, and Cash App pivoted their digital creative and spending strategies to account for shifting trends in consumer spending habits throughout the pandemic and our fundamental understanding of money.

In some ways, the U.S. agriculture and farming sector is thriving. Agricultural export values are setting new records: they reached [**$59 billion**](https://www.feednavigator.com/Article/2021/07/01/Strong-possibility-of-record-breaking-year-for-US-agriculture-products-such-as-beef-corn-and-sorghum) over the first four months of 2021. With increased foreign demand for products like corn, soybean, sorghum, wheat and animal products, farmers have been able to sell their products at competitive prices abroad. But the industry does face significant challenges—chiefly labor shortages and drought.

We all remember the buzz of back-to-school season as kids: excitement about a new teacher or classroom, reunions with friends and planning that special outfit for the first day. This year, many employees will experience something similar when they return to the office after working remotely during the pandemic. To learn how workers feel about the coming transition, we surveyed 450 employees who have been working from home due to COVID-19.

On Monday, July 19, 2021, Ice Cream brand Ben & Jerry’s announced that it will cease selling ice cream in West Bank. The announcement was followed by widespread condemnation from the Jewish community worldwide, and a stern warning from Israel’s PM to Unilever, B&J’s parent company, that there would be legal and other consequences. But what about the actual customers? How have they reacted? Looking at the recent foot traffic across all 380 Ben & Jerry’s stores that Advan Research covers, there does not seem to be a material effect on customer visits.

I didn’t meet my husband the ‘old fashioned way,’ in a bar. Nope. We met on Tinder. While some may be surprised I found love on a dating app, it’s definitely not the exception to the norm anymore. The online dating industry has grown 23% in 2021 alone. People worldwide are hoping to connect with that special someone and are looking to technology to give them a hand. Case in point: One billion people visited dating and relationship websites last month.

Grocery delivery sales skyrocketed early in the pandemic, as shelter-in-place orders went into effect and many consumers avoided going into brick-and-mortar grocery stores. Between March 2020 and April 2020, total sales among a select set of grocery delivery competitors–Instacart, Walmart Grocery, Shipt, Peapod, and FreshDirect–grew 62 percent. While demand for grocery delivery still exceeds pre-pandemic levels, sales have been gradually declining in 2021.

In the first half of 2021 there was an unprecedented surge in demand for mental health and fitness services. Tracking the salaries for health coaches over time, we see not only a recovery from the pandemic, but also an extremely rapid spike in 2021. But how are these new demands changing the wellness economy? This rising demand for wellness services has resulted in large salary increases for specific roles. In the figure below, we see that coaches, counselors, and support workers have the highest growth in salaries.

In our latest whitepaper, we analyzed retail giants, their pandemic performance, and their year so far. We looked at the sector leaders and dove into different superstore categories to explore the latest trends, see where competition was heating up, and understand whose dominance remains unchallenged. Costco, Target, and Walmart are three of retail’s most important and impressive players. And while Walmart is by far the biggest of the three—both in terms of numbers of stores and monthly visits—it is also facing the stiffest increase in competition.

Like most of the world, the COVID-19 pandemic accelerated digital adoption across industries. The financial service industry in Canada was no exception. According to Similarweb data, web traffic to the Banking, Credit, and Lending category within the country increased 20% in 2020. In this article, we’ll use our Research Intelligence solution to hone in on the digital trends impacting the performance of top Canadian banks (known as the “Big 5”), and share lessons learned from the winners.

In this Placer Bytes, we dive into a retailer seemingly at the height of its powers and another that may be on the path to a serious rebound. For a digitally native company ahead of an expected IPO, plans to potentially open hundreds of stores are far from a given. Yet, Warby Parker has become one of the prime examples of the importance and value of owned retail. The eyewear brand has seen visits rebound very strongly during the recovery with visits up 75.6% and 48.1% in May and June of 2021 compared to the equivalent months in 2019.

It didn’t take long for TikTok to transform from a fledgling social media platform with questionable legal presence in the U.S. into one of the most popular apps around. TikTok was the most downloaded app of its kind last year, with more than 82 million downloads, and it continues to gain traction from consumers and advertisers every day. As the social media app matures, it has quickly become a platform used to drive fashion trends among the Gen Z audience.

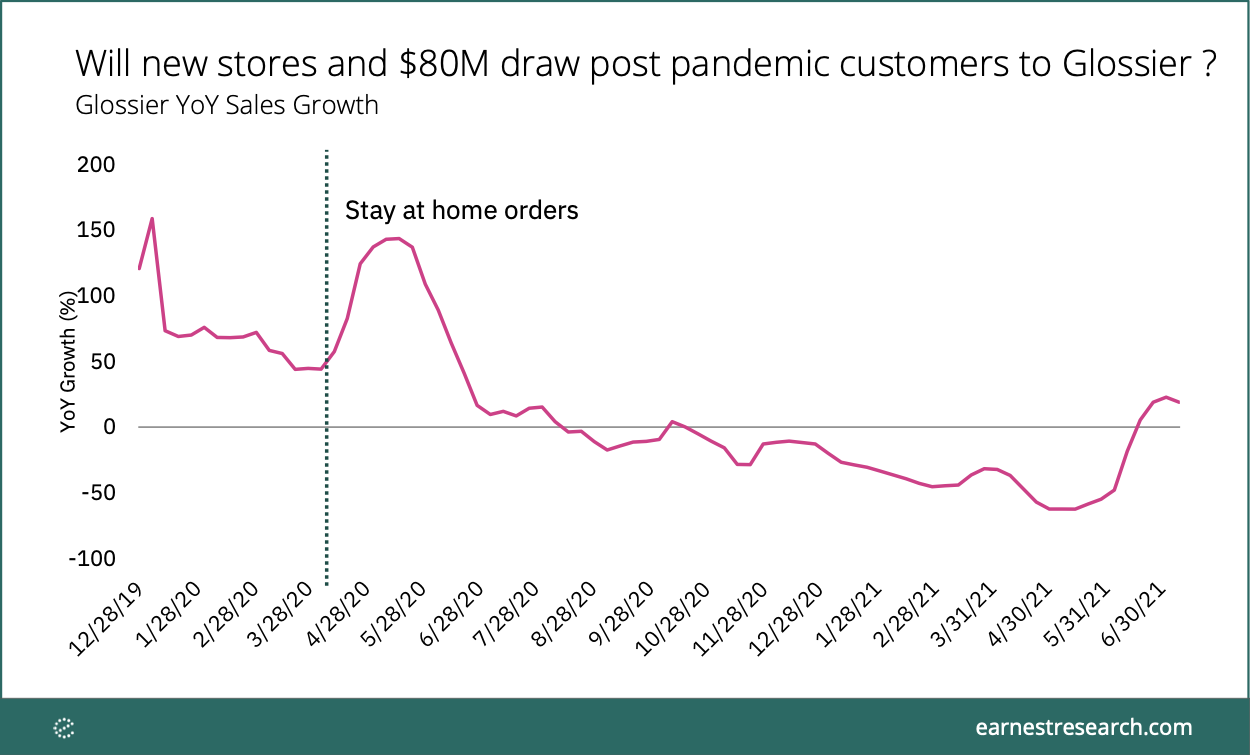

With news that Glossier recently closed a Series E round of $80M (led by Lone Pine Capital) now bringing the DTC company’s valuation to $1.2 billion, we looked at our spend data to see how the beauty brand has fared throughout the pandemic and beyond. Glossier YoY sales peaked in mid-May growing 143%, coinciding with stay-at-home orders that left many shoppers with online marketplaces as the only place to checkout. As COVID cases continued to grow, Glossier’s sales declined, hitting negative growth by late summer 2020

Total construction starts lost 7% in June, slipping to a seasonally adjusted annual rate of $863.6 billion, according to Dodge Data & Analytics. All three major sectors (residential, nonresidential building, and nonbuilding) pulled back during the month. Single family housing starts are feeling the detrimental effects of rising materials prices. Large projects that broke ground in May were absent in June for nonresidential building and nonbuilding starts, resulting in declines.

Last month’s heatwave in the Pacific Northwest created unbearable conditions in an area where many homes don’t even have air conditioners. But as the temperature soared higher, some companies saw their sales melt while others were boosted along with the thermostat. In today’s Insight Flash, we dig into which companies benefitted and suffered the most, including a deep dive into surprising gains for Uber and Lyft.

Grocery stores and superstores carrying food and medicine were labeled “essential businesses” and allowed to stay open throughout the pandemic. Still, COVID affected in-store shopping patterns as shoppers limited their exposure to the virus by limiting their trips and spending more time in stores each visit as they filled bigger baskets – a key mission driven shopping trend. Now, with COVID’s retail impact subsiding, Americans are returning to their pre-pandemic habits. We dove into our Q2 Quarterly Index to find out more.

Nordstrom recently announced that it was taking a stake in four brands owned by UK retailer ASOS: Topshop, Topman, Miss Selfridge, and HIIT. As part of the agreement, Nordstrom will be the exclusive North American retailer for Topshop and Topman, making it the only brick-and-mortar outlet for these brands. Additionally, shoppers will be able to pick up online Asos purchases at Nordstrom stores. In today’s Insight Flash, we look at US sales of these brands and whether the relationship makes strategic sense, focusing on cross-shop and overlapping demographics.

For the past few years, some superstore retailers have hosted their own sales events to coincide with Amazon Prime Day. In 2021, these companies included Walmart, Target, Best Buy, and Bed Bath & Beyond. Consumer transaction data reveals that despite competing sales events during Prime Day 2021, Amazon sales increased and the company experienced higher week-over-week sales growth than a select set of retailers. Additionally, Amazon captured market share from top retail competitors, especially Walmart and Target.

Casual dining took a major hit during COVID as diners avoided enclosed spaces and states introduced capacity restrictions to curb the spread of the virus. Now, foot traffic analysis of twenty-eight leading casual dining chains shows that the sector is returning to pre-COVID levels. Restaurants were still struggling in Q1 as cold weather made outdoor seating impractical while COVID regulations and customer precautions limited indoor seating options.

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in June 2021, sales for meal delivery services grew 20 percent year-over-year, collectively. Shelter-in-place orders may also be driving more Americans to make their first meal delivery purchase. In June 2021, 49 percent of U.S. consumers had ever ordered from one of the services in our analysis, up from 41 percent a year ago.