Traditionally the next week is one of the most impressive displays of the success of the airline industry, the Big Three US carriers announce their third quarter earnings which cover the July to September period; the peak months of travel in many markets. Last year United Airlines reported net income of US$1.0 Billion, Delta Air Lines adjusted revenues of US$12.6 Billion and American Airlines paid some US$44 million in dividends in the quarter.

In this Placer Bytes, we dive into the pharmacy sector with a focus on Walgreens before taking a look at H&M following its announcement it’ll be closing 250 stores.

In addition to increased purchases of flour and furniture, the early spring lockdown in many states led to more consumption of video streaming services as consumers looked for alternative sources of entertainment under stay-at-home orders.

With the U.S. elections and the coronavirus pandemic diverting consumers’ attention away from the national to the regional level, understanding who’s winning and who’s moving up the ranks is crucial for both publishers and advertisers. Our infographic visualizes which news outlets in each state are seeing the strongest traffic numbers for August 2020, as well as the top keywords driving traffic to their sites.

September ushered in another school year. But for many students and teachers, this required the adoption of virtual classes and digital tools. We saw this play out on mobile with homework-help apps– an Apptopia defined market of apps that provide immediate answers or explanations to homework questions. I'm sure you're thinking, "Back in my day, we called this cheating."

Colleges and universities across the country struggled to respond to the COVID‐19 pandemic. But even as schools scrambled to keep existing students, faculty members, and community members safe, applications for graduate programs came pouring in. How did advertisers initially respond and has spending returned to normal?

The Stop Hate For Profit campaign sent shockwaves through the social media advertising communities in late June. Brand-name companies such as Unilever, Coca-Cola, Patagonia, Adidas, Verizon, and hundreds of others announced they would halt all Facebook advertising for at least the month of July to protest hate speech, misinformation, and derogatory content across the platform.

Neiman Marcus officially emerged out of bankruptcy in late September, a major feat for the brand and its loyal customers. But, looking at the numbers for the brand does little to inspire confidence that a fundamental turnaround is in store. Even before the pandemic brought store activity to a halt, Neiman Marcus had a mixed start to 2020 with visits down 1.4% in January and up just 2.4% in February even with an industry-wide, late-month surge and an extra day of February due to leap year.

In spite of the pandemic, Planet Fitness recorded approximately 44% more app downloads in H1 2020 than H1 2019 (U.S. only). Meanwhile, other brick-and-mortar gyms saw major declines in new app users. The Equinox app, for instance, saw a -60% drop in downloads, and Gold's Gym saw a -45% decline.

In the week that some 32,000 aviation professionals’ careers were placed at risk in the United States as the CARES Act expires, it feels like a really flat week for what is a great industry. It seems that this week’s capacity data reflects what is probably one of the most depressing weeks of the Covid-19 crisis; we knew those furloughs were coming but just hoped that they could be avoided, perhaps they still can.

In this Placer Bytes, we analyze IKEA’s surprising surge, the potential next steps for Levi’s, and the impressive performance of footwear retailers. Neiman Marcus officially emerged out of bankruptcy in late September, a major feat for the brand and its loyal customers. But, looking at the numbers for the brand does little to inspire confidence that a fundamental turnaround is in store.

Visits to clothing and shoe shops across the UK has declined 26% from a post-lockdown peak of 65pts on August 29th. Following a good start to the year with visits up 60% for January sales and a stable February, footfall fell sharply to residual levels from March 22nd before regaining 50% of normal levels by July 2nd and remain so for much of the summer. Recovering to to 65pts in August 29th – a date that coincides with the end of the summer and start of the school year – visits to clothing shops have since followed an even trajectory downwards to present levels of 39%, a fall of 26% in just 4 weeks.

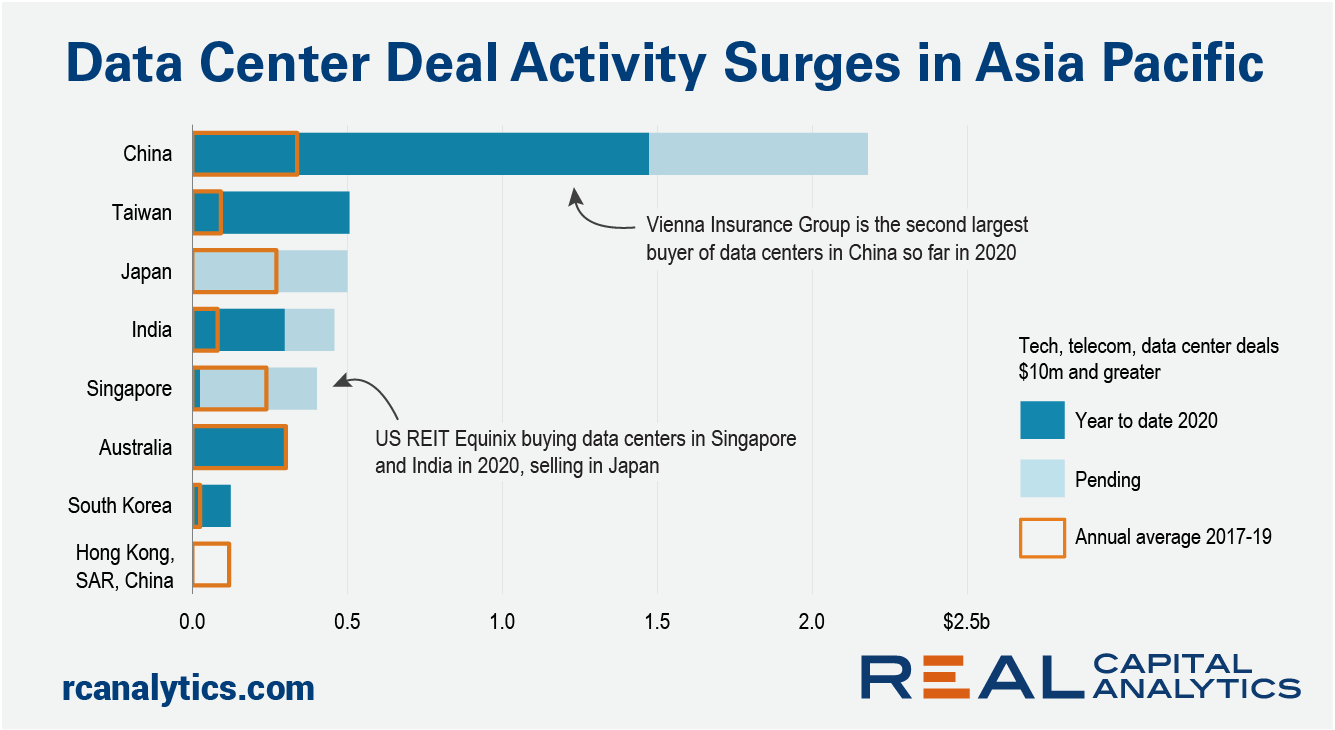

News of the planned sale of a Beijing data center campus for half a billion dollars may have come as a surprise to some. However, the deal — which, if it closes, would be the largest industrial deal in the Asia Pacific region in 2020 — is just one of a bundle of pending data center transactions in the region.

In early May, we noted the unique potential of the off-price apparel sector to buck the trend of the wider space and drive significant returns. And now, deep into the recovery, we are seeing that the return is even more impressive than expected, especially considering the ups and downs being driven by COVID resurgences across the country.

In the face of COVID‐19, the commercial automotive market experienced a nosedive. However, the push for new energy-efficient vehicles provides optimism for market recovery. This pivot comes at a time when few people are leaving their homes and many are relying on businesses to bring the outside world to them in the form of packages and food deliveries, making reliable fleet vehicles even more important.

Food producers in Europe are scaling up their staffing levels as the second wave of Covid-19 bites across the region. Huq’s European Industrial ‘Big-6’ Indicator shows a growth of 19% in the 4 weeks to date from August 31st. This contrasts with just a 10% rise in worker presence between February 20th and March 5th, it’s pre-lockdown high

With emergency government funding set to expire at the end of September, US Airlines are planning mass layoffs after a more than 80% collapse in revenues. The more cash rich carriers – such as SouthWest and Delta – have avoided Federal loans so far, hoping to tough it out until a vaccine arrives, with the prospect of a large increase in market shares for the survivors.

As some U.S. employers consider expanding the role of telework at their companies, many Americans may be working remotely indefinitely and have the freedom to flee COVID-19 hot zones in favor of greener pastures. By using grocery spending as a proxy for residency, transaction data reveals which of the states hardest hit by the pandemic are most likely to see residents leaving—and where they might be headed.

COVID-19 and the lockdowns have led to a boom for the console and computer games industry as shown in our July Edison Trends report. With pre-sales for the new Playstation 5 and Xbox Series X consoles having already begun ahead of a November launch and anticipated wave of COVID-19 in Autumn and Winter, the upward trend in spend is expected by most to continue.

The transatlantic for many airlines is a very lucrative source of revenue and with the IATA Winter Season now four weeks away we’ve looked at the typical revenue generated across the season. However, since Covid-19 was already bugging demand in January we’ve used Winter 2018/19 as a reference point.