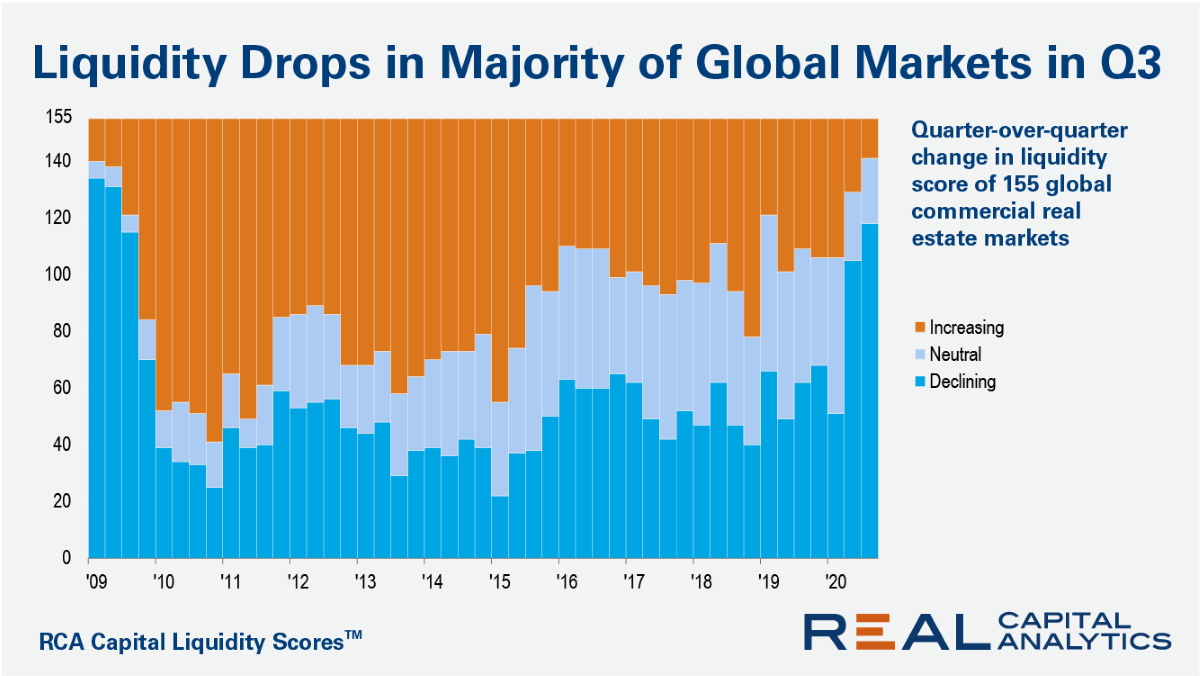

Market liquidity fell in 118 of 155 global commercial real estate markets in the third quarter of 2020, a widening swathe of liquidity declines than seen in the second quarter of the year, according to the latest update of the RCA Capital Liquidity Scores.

U.S. railroads originated 900,194 carloads in November 2020, down 5.8 percent, or 55,198 carloads, from November 2019. U.S. railroads also originated 1,136,695 containers and trailers in November 2020, up 11.5 percent, or 116,915 units, from the same month last year. Combined U.S. carload and intermodal originations in November 2020 were 2,036,889, up 3.1 percent, or 61,717 carloads and intermodal units from November 2019.

Malls around the US suffered a significant blow during what is usually the busiest shopping weekend of the year. Foot traffic was down 41% year-over-year on Black Friday and 45% on Saturday. As we reported last week, there was a pick-up in traffic during the first three weeks of November as many people opted to take care of their shopping sooner, in order to beat the rush and in anticipation of lock-down orders across the country.

If there’s one major sector that has borne the brunt of problems during COVID, it’s the US energy sector. Credit quality deterioration may not be as pronounced in the UK or EU energy sectors, but similar industry strains exist in both. Prices remain below their pre-pandemic levels, and demand will likely remain weakened until normal transportation habits and schedules return. The threat of COVID remains ever-present.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending November 21, 2020. For this week, total U.S. weekly rail traffic was 534,607 carloads and intermodal units, up 2.5 percent compared with the same week last year.

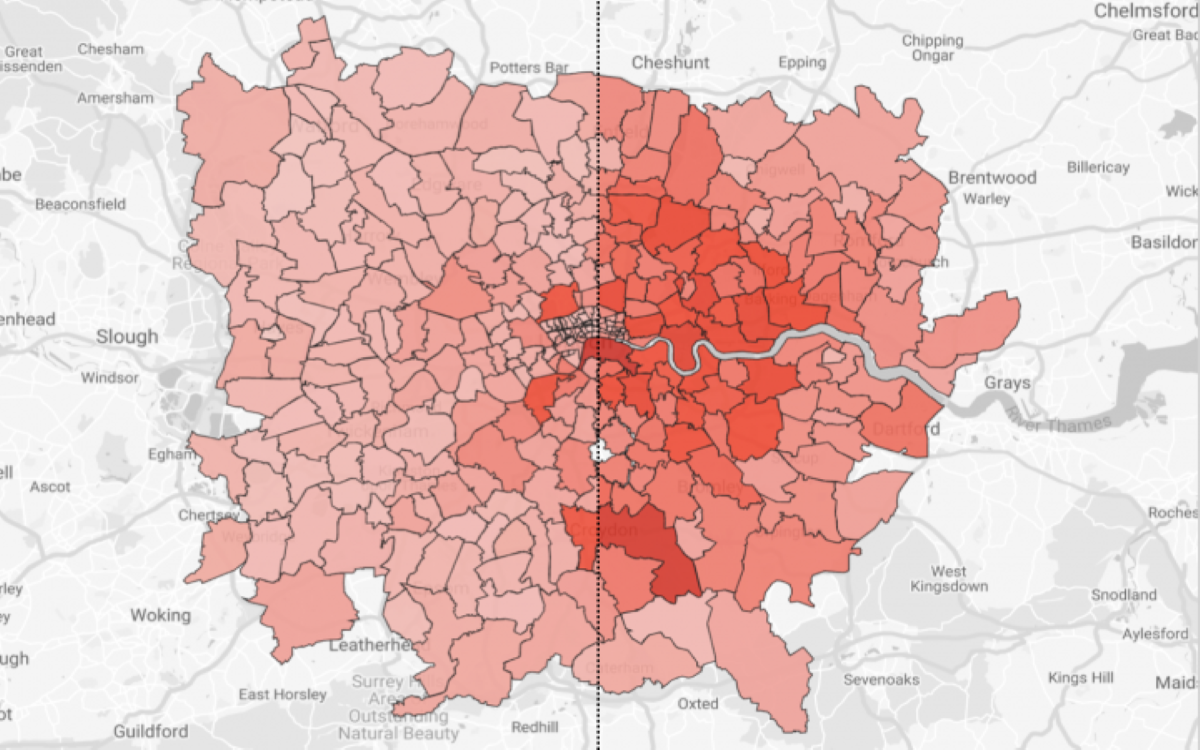

Huq has mapped the density of people within London by postcode district, month-on-month since the start of the year to create a time-lapse revealing emerging patterns. The visualisation shows how lockdowns one and two have transformed the capital, and what activity looks like across the city today.

Through the roller coaster year that has been 2020, one area of normalcy for the multifamily industry has been the extent of new construction activity. Though there were some delays earlier in the year, deliveries are on pace to be nearly to the level seen in 2018 and in 2019.

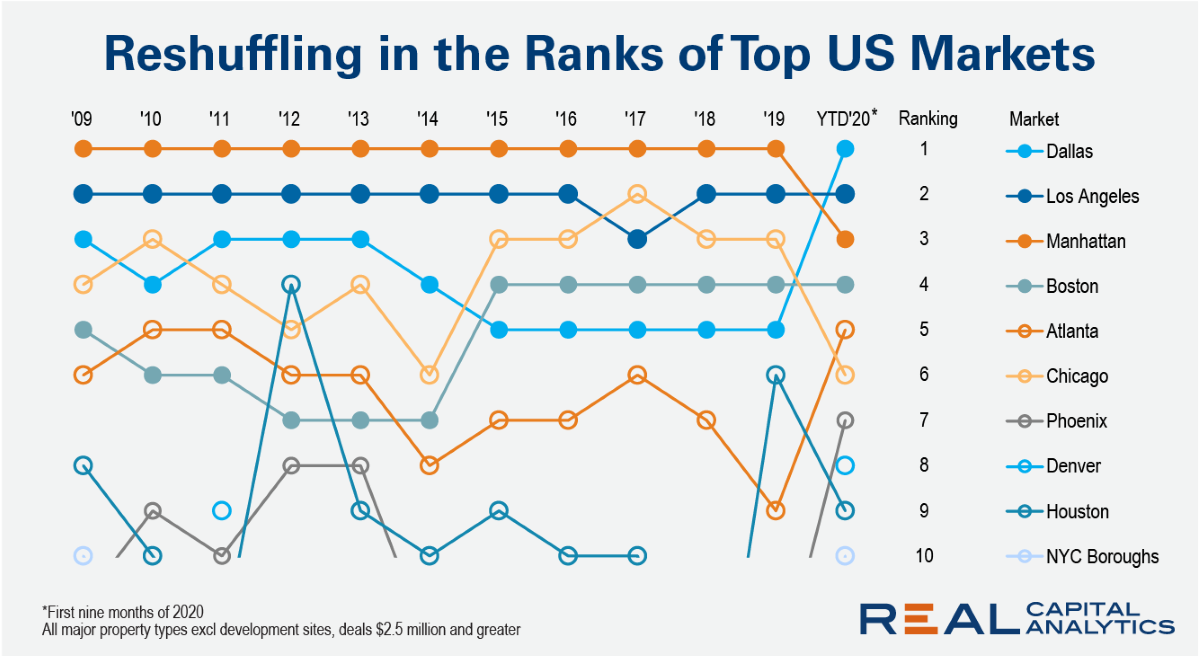

Dallas sits atop U.S. leader board for commercial property deal volume in the first nine months of 2020. Normally Manhattan would occupy the #1 position. Los Angeles has sometimes taken the top spot for shorter periods during times of market disruption in Manhattan, but Dallas has never topped the rankings for an extended period until 2020.

Steadily rising prices of ethylene between mid-April and mid-September caused many buyers to turn to alternative sources, but a recent pullback in the market has rekindled interest. Ethylene offtake this month is currently around 172,825 metric tons, and compares to 253,399 Mt in October. Ethylene prices on the US Gulf Coast rallied more than 225% between a low in April near 8c/pound and a peak in September at more than 26c/lb.

Credit Benchmark have released the November Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

The outlook for the US retail sector is now less bleak than in earlier months. After disappointing sales data in September, data released in October was more upbeat, even amid ongoing concerns about the economy. The economic situation is similar in the UK, with sales data released in September and October showing gains despite ongoing weaknesses in the economy, but credit quality for the UK retail sector continues to deteriorate.

As coronavirus continues to spark volatility in the U.S. economy, LinkUp’s jobs dataset provides unique insights into COVID-19’s impact on the labor market. In the most recent edition of our quarterly Economic Indicators Report, we observe a labor market edging toward recovery from the devastating hits doled out by the pandemic.

Following the temporary housing market freeze during April’s nation-wide shutdowns, national sales of homes during the summer outpaced last year’s levels with September sales averaging 10% higher compared to last September. And according to the latest home buying contracts signed, also known as Pending Sales, the positive trend is expected to continue in the autumn.

Many Americans who stopped paying student loan payments in April are still not paying. That can be seen in the Envestnet | Yodlee Income and Spending trends data through the month of October. The number of users making student loan payments beginning in April dropped by 50 percent.

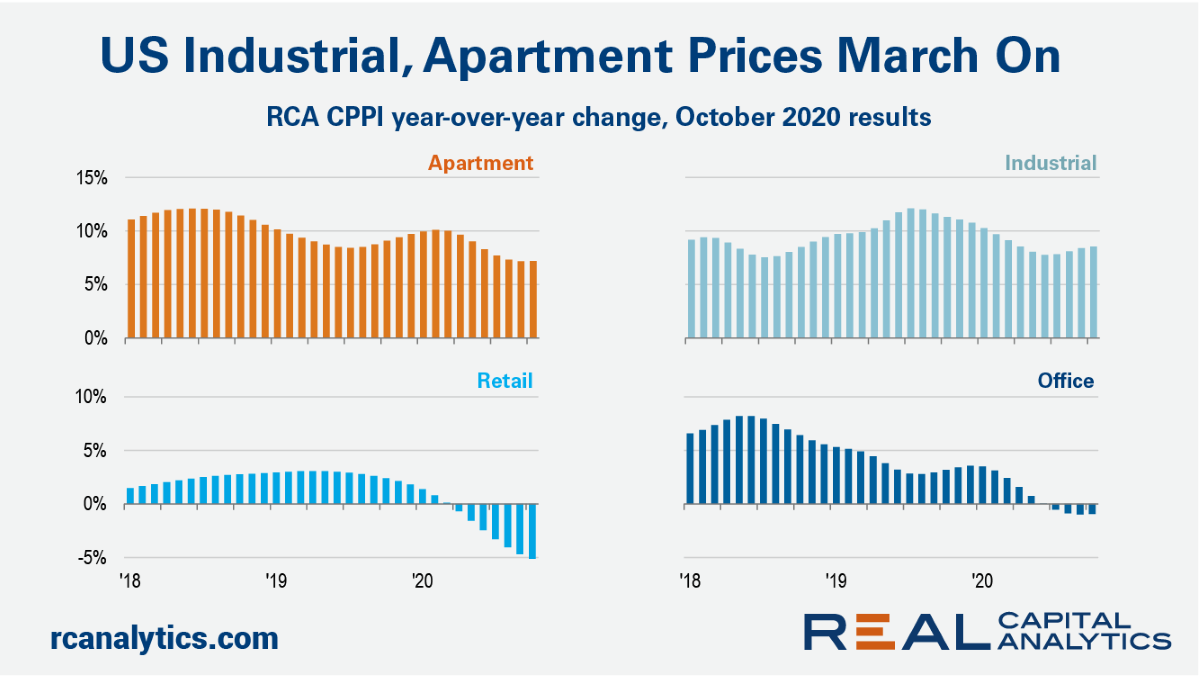

The U.S. national rate of commercial property price growth rose in October as the weight of capital into the high-flying apartment and industrial sectors boosted gains, the latest RCA CPPI: US summary report shows. The US National All-Property Index rose 3.6% from a year ago, the apartment index rose 7.2% and the industrial index 8.5%.

International travel arrivals average globally at -93% in October with the worst affected region being the APAC down by 97%. No surprises there once you realise the complexity of international travel in the Age of the Corona.

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending November 14, 2020. For this week, total U.S. weekly rail traffic was 527,462 carloads and intermodal units, up 5.2 percent compared with the same week last year.

The rays of light within credit markets are slowly growing. Known as Rising Stars, companies moving from high-yield or “junk” to investment-grade status are increasing across many sectors. According to the latest consensus credit data from Credit Benchmark, which tracks collective credit quality estimates of lenders to firms in various sectors, the total number of new Rising Stars has increased by 24 since the previous update.

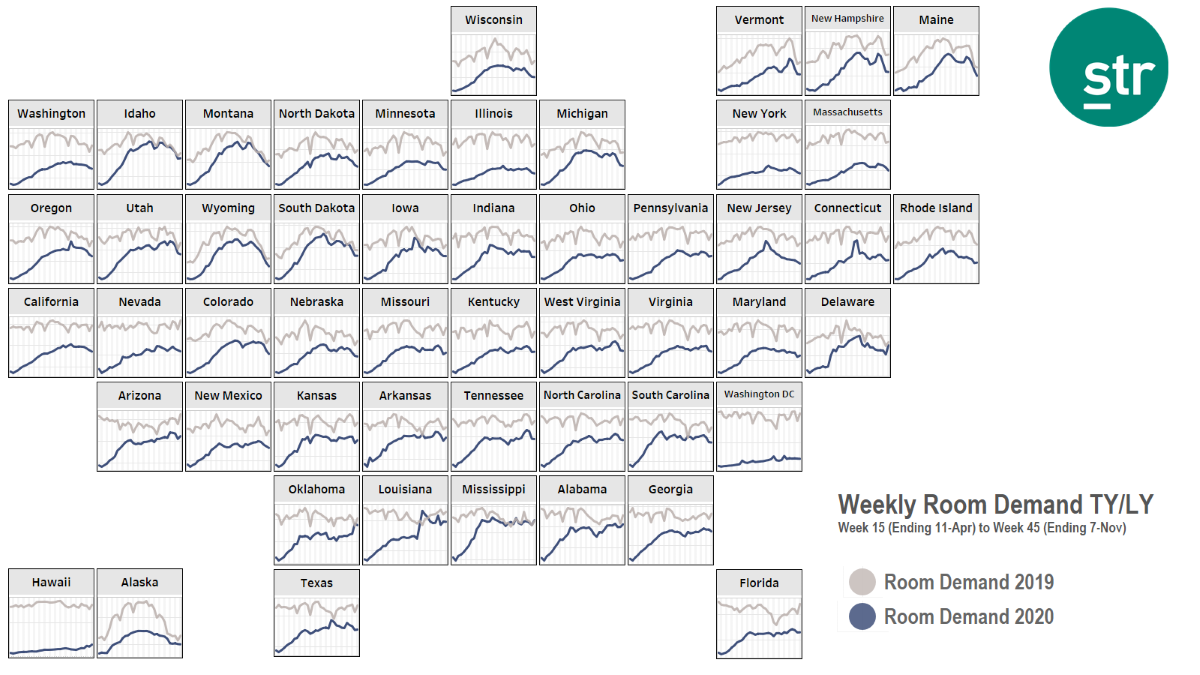

Most of the U.S. continues to see a sizable gap in weekly demand when measuring this year vs. last year (TY/LY). After STR’s October update, 44 states experienced less room demand through the week ending 7 November (week no. 45 of the year).

The number of Fallen Angels – companies whose credit quality has shifted from investment-grade to high-yield or “junk” status – continues to increase, yet each update brings a smaller total number than the last.