In August 2021, 4% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) , which was a 2.6-percentage point decrease from August 2020 according to the latest CoreLogic Loan Performance Insights Report . However, overall delinquencies were still above the early 2020 pre-pandemic rate of 3.6%. The share of mortgages that were 30 to 59 days past due — considered early-stage delinquencies — was 1.1% in August 2021, down from 1.5% in August 2020.

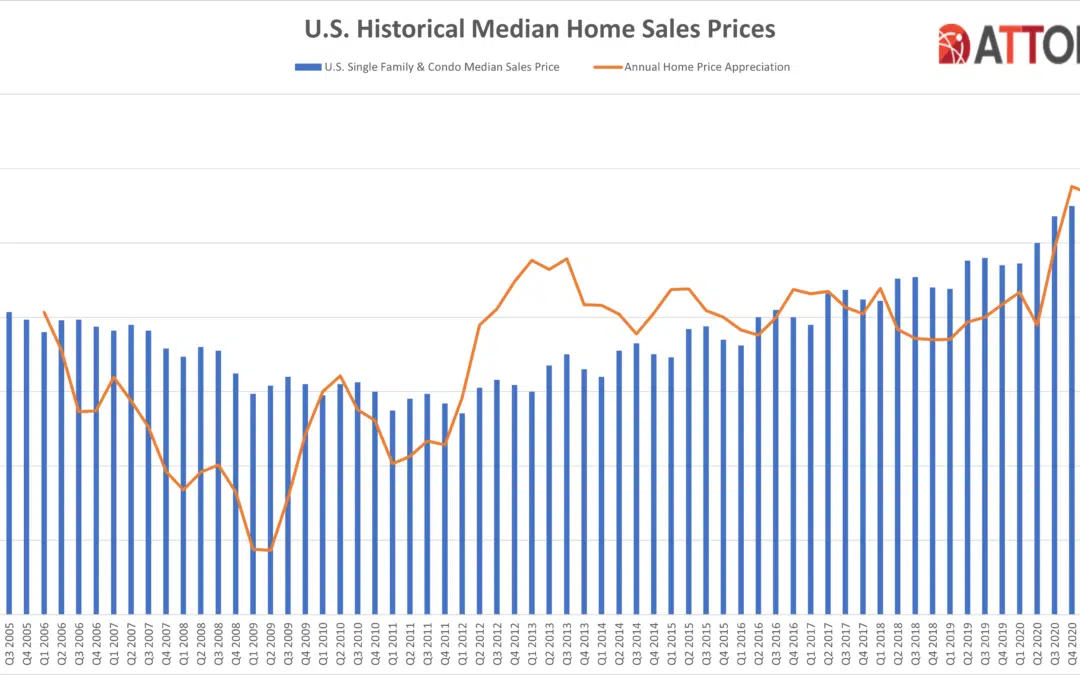

ATTOM, curator of the nation’s premier property database, today released its third-quarter 2021 U.S. Home Sales Report, which shows that profit margins on median-priced single-family home and condo sales across the United States jumped to 47.6 percent – the highest level since the end of the Great Recession a decade ago. In yet another sign of how strong the U.S. housing market remains, the report reveals that the typical home sale across the country during the third quarter of 2021 generated a profit of $100,178 as the national median home price hit a record of $310,500.

Supply shortages have been a hallmark of the pandemic. Not only is the U.S. facing a labor shortage, but many building materials are in short supply, slowing down new home construction and making it difficult for some sellers to prepare their existing homes for sale. The shortage in for-sale homes has driven the number of days homes are on the market to new lows in 2021.

National home prices increased 18% year over year in September 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The September 2021 HPI gain was up from the September 2020 gain of 6.6% and was the highest 12-month growth in the U.S. index since the series began in 1976. The increase in home prices was fueled by low mortgage rates, low for-sale supply and an influx in homebuying activity from investors. Projected increases in for-sale supply and moderation in demand as prices grow out of reach for some buyers could slow home price gains over the next 12 months.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through September 2021 with forecasts from September 2022. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

Welcome to the November Apartment List National Rent Report. Our national index increased by 0.8 percent from September to October, the lowest month-over-month growth rate since February. Although the pace of rent growth has slowed down significantly from its July peak, growth is still outpacing pre-pandemic trends, with rents continuing to rise during a time of year when seasonality normally causes prices to dip. Since January of this year, the national median rent has increased by a staggering 16.4 percent.

With the acceleration of flexible working induced by the pandemic, investors in Asia Pacific have been watching closely to see if office prices would suffer. The pandemic did slow the increases in pricing recorded in some of the gateway cities in the region in the middle of 2020, but, in 2021 pricing in most markets has resumed an upward trajectory. For five of the eight cities shown in the chart, prices have now reached levels higher than those just before the pandemic.

ATTOM’s just released Q3 2021 Special Report, spotlighting county-level housing markets around the U.S. that are more or less vulnerable to the impact of the coronavirus pandemic, stated that New Jersey, Illinois and Delaware had the highest concentrations of the most at-risk markets in Q3 2021. The latest Coronavirus housing impact analysis, conducted by ATTOM, reported that the biggest clusters were in the New York City and Chicago areas, while the West remained far less exposed.

The headline rate of U.S. property price growth accelerated further in September, propelled by faster rates of growth from all four major property types, the latest _RCA CPPI: US_ report shows. The RCA CPPI National All-Property Index rose 16.1% from a year ago and 2.2% from August. The office sector index accelerated to a record 16.9% year-over-year rate in September, overtaking apartment and on par with the industrial sector. Suburban office prices powered the gain, climbing 20.2% year-over-year. CBD office prices fell 1.2%.

U.S. single-family rent growth increased 9.3% in August 2021, the fastest year-over-year increase in over 16 years, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The August 2021 increase was more than four times the August 2020 increase, and while the index growth slowed last summer, rent growth is running well above pre-pandemic levels when compared with 2019.

Buying a home is considered the American dream, but during a pandemic, that dream swiftly vanished, especially for real estate brands trying to advertise to consumers who, ironically, were stuck in their homes. We analyzed the top advertisers in the space to find out how their spend, strategy, and creatives adapted to the changing pandemic landscape, and a 2021 housing market which finds consumers paying top dollar for a scarce supply of homes.

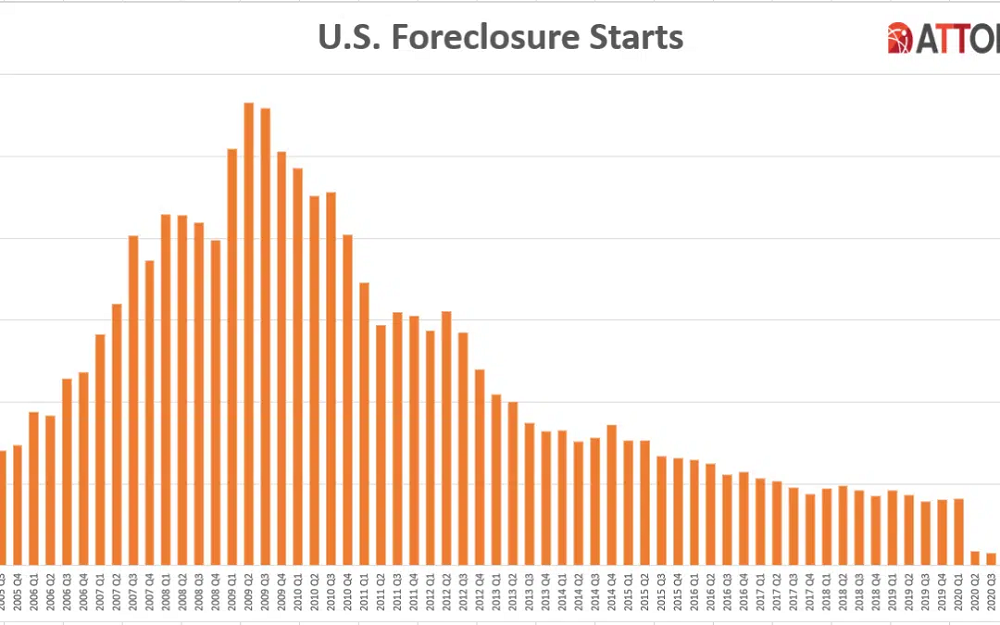

ATTOM, licensor of the nation’s most comprehensive foreclosure data and parent company to RealtyTrac (www.realtytrac.com), the largest online marketplace for foreclosure and distressed properties, released its Q3 2021 U.S. Foreclosure Market Report, which shows there were a total of 45,517 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — up 34 percent from the previous quarter and 68 percent from a year ago.

Germany’s office transaction market has picked up momentum through the spring and summer, with deal activity for the first eight months of the year now on par with the average for the five years before the pandemic. The second quarter of 2021 was the ninth best quarter on record for office transaction volume. Investors spent €8.4 billion ($9.7 billion) in the quarter and another €3.8 billion over the normally quiet summer months of July and August.

In July 2021, 4.2% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.3-percentage point decrease from July 2020 according to the latest CoreLogic Loan Performance Insights Report . However, overall delinquencies were still above the early 2020 pre-pandemic rate of 3.6%. The share of mortgages that were 30 to 59 days past due — considered early-stage delinquencies — was 1.1% in July 2021, down from 1.5% in July 2020.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through July 2021. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The 2021 multifamily bounce back has been like nothing seen in decades. Dazzling apartment demand has propelled lease concessions downward and average rent to stratospheric levels despite an increase in new supply compared to previous years. Of course, beneath the national metrics, some important differences emerge. As always, all numbers will refer to conventional properties of at least 50 units.

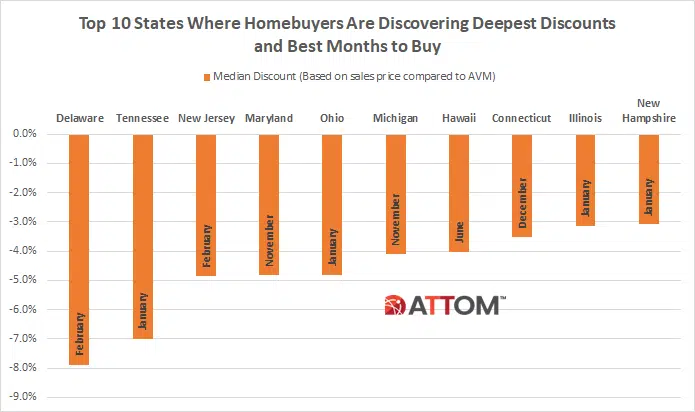

ATTOM’s newly released 2021 analysis of the best time of the year to buy a home reveals that homebuyers are fetching lower premiums during the month of October, as well as the winter months, compared to the spring buying season. The study of more than 33 million single family home and condo sales over the past eight years found that while the premium is still above market value, homebuyers that close in October are only dealing with a 2.9% premium, compared to the month of May, when homebuyers are experiencing an 11.5% premium.

2021 is shaping up to be a very different year for investors than 2020. After pulling back their market activity at the onset of the pandemic, investors had a business-as-usual winter, before capturing the highest market share seen in the last 10 years in the second quarter. Figure 1 shows the share of total purchases that were made by investors in each month. 2019 shows the normal seasonal pattern. Investor purchase shares are highest in the winter months when owner-occupied buyers are less active.

Last month we showed that U.S. inflation may be underestimated due to the use of a measure called owners’ equivalent rent, which makes up 30% of the core consumer price index. When the CoreLogic single-family rent index is used as an alternative measure for price changes in owner-occupied housing, we saw core inflation increasing by one-to-two percentage points faster than what was reported from April to July of 2021. The CoreLogic single-family rent index is also available for more than 100 metro areas, which can be used to compute metro-level inflation measures.

CE Web webscrape data provides deep and accurate analysis of the iBuying businesses of real estate websites like OPAD, OPEN, and ZG. In today’s Insight Flash, we show how our new CE Web CE-Q dashboards help users get to insights from the data more quickly, specifically seeing which metrics are growing fastest for OPAD, OPEN, and ZG as well as diving further into how the ratio of resale value to acquired value is trending and what inventory trajectories may say about future growth.