With one of the world’s largest airlines making nearly 800 schedule changes in one day and at the same time having to release over 17,000 dedicated employees, the challenges of running a scheduled airline are not getting easier. Global capacity has crept up to 60 million seats this week; some 4% up on last week and breaking through the halfway point to recovery; well at 50.4% of last year’s capacity it’s a positive statement!

Global exports of liquefied natural gas in July totaled approximately 28.7 million tons on board 474 vessels, much lower than July 2019’s pace of 31.7 million tons, with a reduction of loading from the US & Pacific regions. Approximately 27.6 million tons arrived on 471 vessels at import terminals in July, compared to 30.8 million tons in July 2019.

COVID-19 and quarantining forced most people to alter their fitness routine. While some mobile fitness apps managed to get traction with consumers, the reality is that commitment to a new habit is difficult, as illustrated by the data. Based on a sample of 11 popular mobile fitness apps, data from Apptopia show that COVID-19 had a significant impact on their rate of downloads. In January there was a 60% increase in downloads, totaling 3.37 million in just one month.

Three weeks of earnings are now behind us, which means we’re officially entering the back half of this 2Q earnings season. This week, we’re highlighting SimilarWeb data on Roku, Wix, Wayfair, Carvana, Booking, and Etsy. The data presented below is Desktop only, unless explicitly stated otherwise.

Dining is a category that has continued to change regionally, nationally, by category, even by meal time. With the nation still in what we’re calling a traffic Summer Slump, restaurants are reacting in real time to manage official guidelines and the safety and preferences of diners. The stall – or slump – in reemergence remains visible in our latest analysis.

There is a strong narrative present in today’s media that the $600 a week provided by the CARES Act is creating a disincentive for Americans to return to work. This narrative can be seen in Washington as politicians argue over the pros and cons of extending some benefits of the CARES Act. In this post we will examine whether LinkUp’s job listing dataset can provide support to this narrative.

Many families were caught financially unprepared with the sudden onset of the pandemic in the U.S. earlier this year. The national unemployment rate spiked from a 50-year low of 3.5% in February 2020 to an 80-year high of 14.7% in April. And while the sudden loss of income was partly muted by an income tax refund and enhanced unemployment insurance payments for eligible taxpayers and workers, nonetheless, many homeowners are struggling to stay on top of their mortgage loans, resulting in a jump in non-payment.

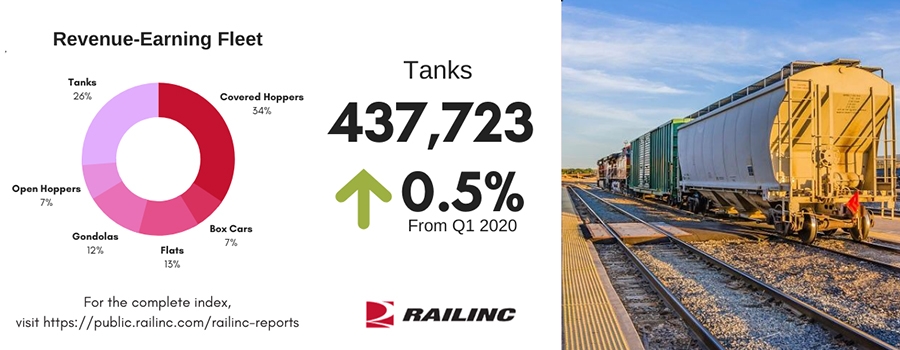

All but one car group decreased from the last quarter, the exception being Tanks, up 0.1 percent. Intermodal led declines, down 5.0 percent, followed by Hoppers, down 1.7 percent. Box Cars and Miscellaneous decreased 1.5 and 1.1 percent, respectively.

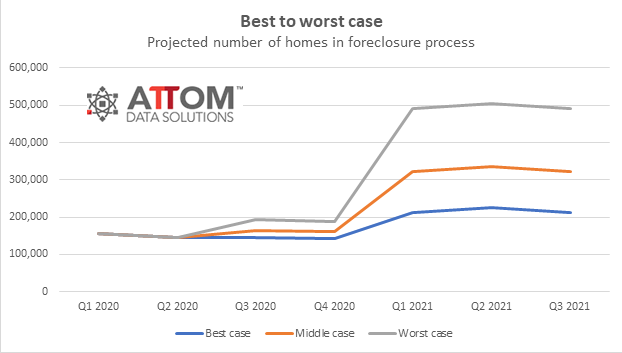

The United States faces a possible foreclosure surge over the coming months that could more than double the number of households threatened with eviction for not paying their mortgages – an offshoot of the worldwide Coronavirus pandemic that has cast a shadow over the nation’s eight-year housing market boom.

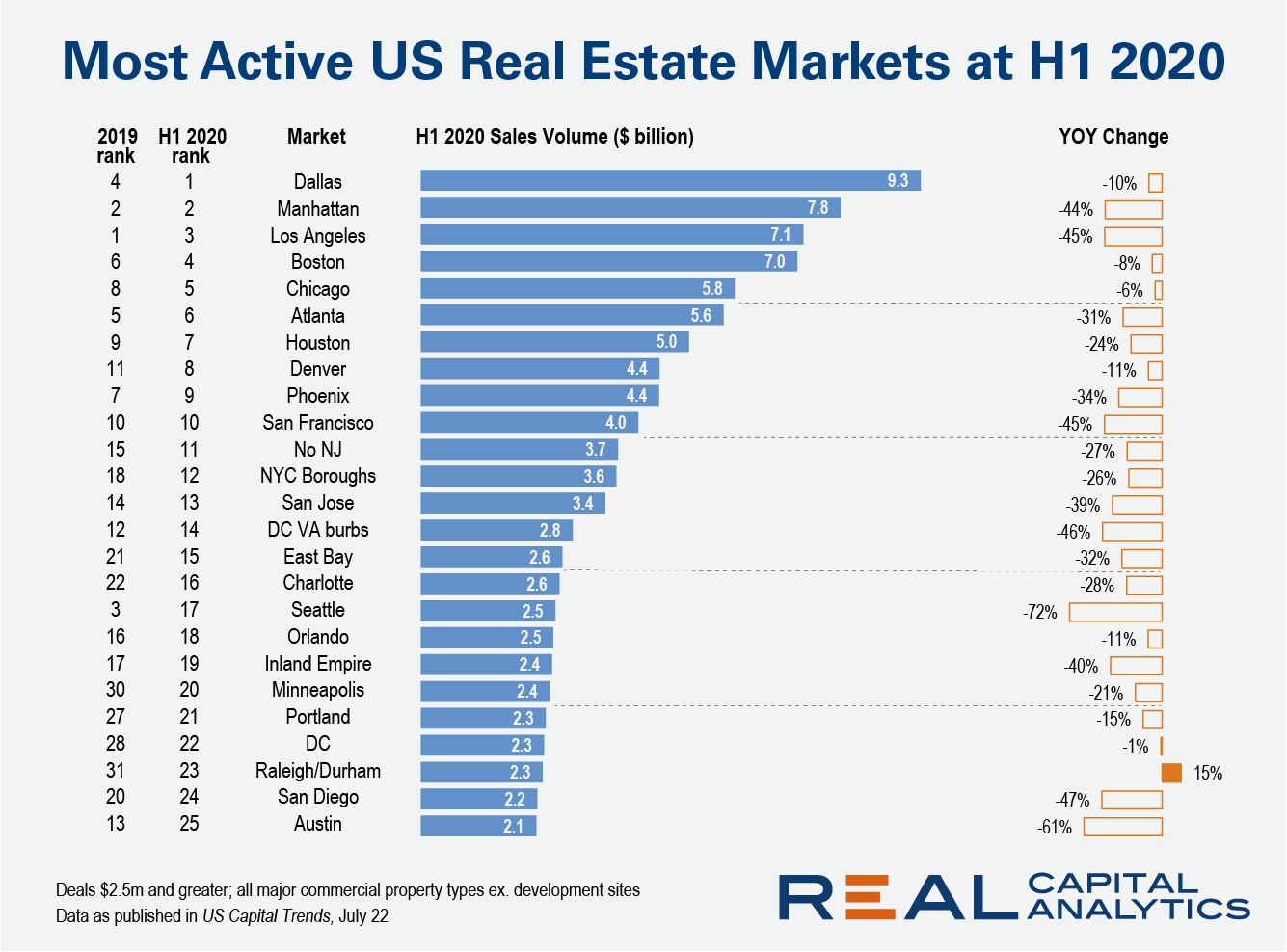

For the first time ever, Dallas ranked as the #1 U.S. commercial property market at the halfway mark of the year, despite a dip in investment activity. Dallas overtook Manhattan and Los Angeles, where sales activity fell by more than 40% compared to the first six months of 2019 as the Covid-19 crisis scuttled dealmaking and sidelined investors.

In May, manufacturing was one of the first industries to start reopening. There were many unresolved issues surrounding employees, supply chains, and bringing back operations. Some companies felt that their markets would be destroyed without outside assistance. Some experienced more bumps than others. For example, it only took two days before a reopened Ford factory reclosed its doors.

In this Placer Bytes, we break down traffic for one of the top pharmacies and analyze the recoveries for Wendy’s, Shake Shack and Wingstop. Though clearly within the essential retail category, CVS felt the impact of COVID. Visits reached a low point in April with traffic down 36.8% year over year. Yet, from that point, the brand has seen a strong recovery with visits down 27.8% year over year in May and just 10.6% in June.

MediaRadar research found that the number of advertisers running programmatic ads is up 26% since January. In June, spend levels hit their highest point since January. In fact, spend levels in June were down just 3% when compared to January. Advertising company Criteo also reported that market conditions in May improved and revenue trends were better than expected.

Problems in credit quality abound, yet few sectors are seeing deterioration like the US energy sector. Supplies remain elevated as demand remains lower, and the economy remains weakened as new COVID-19 cases surge throughout the country. So great is the strain for the sector that Deloitte projects up to $300 billion in write downs or impairments, and the list of bankruptcies is growing.

Looking at national rideshare trends, the gradual recovery of the industry is obvious. Both leading merchants have now regained about 25% of the ground they lost since their high points earlier in March. This slow but steady increase began mid-April and has continued since then, although spending from late June to early July showed a bit of a drop.

People are rediscovering the great outdoors with a new enthusiasm that we did not see in our data last summer. Why? Entertainment options may be closed for now but you can’t close the great outdoors. It’s giving people something to do while they can’t do anything.

From the second week of February all four of the chains we analyzed saw a steep and prolonged fall in stock price through to the first week of April, when they began to rebound. Extended Stay America in particular has experienced a healthy share price recovery, with its stock back to only 10% below where it was in February, which is worse than S&P’s 0.9% gain but better than its competitors; Marriott’s share price is still 40% lower than it was pre-COVID and Hilton’s hovering around -30%.

The home fitness industry is growing rapidly, with several companies now offering interactive fitness hardware with subscription access to classes, private training, or workouts. High-tech at-home workouts have been increasing in popularity, and among select private companies in this space, recent growth has been impressive. Our data indicates that Q2 2020 saw nearly 780 percent more consumers purchasing versus Q2 2019. Not all of this growth is due to the pandemic.

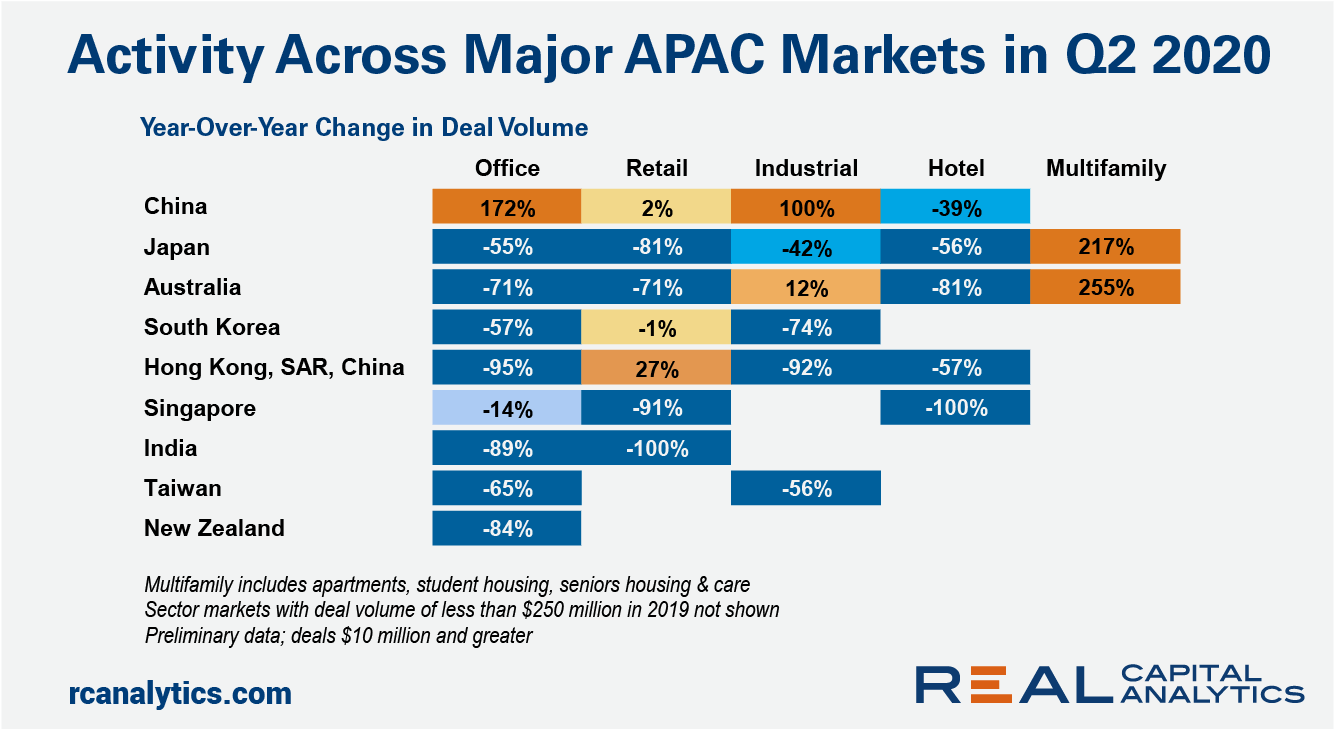

China’s commercial real estate market rebounded in the second quarter of 2020, while the worsening economic outlook took its toll on investment sentiment across the majority of sector-markets in the region. The demand for Chinese office skyscrapers leaped, with nine buildings priced over $250 million changing hands in the quarter.

In H1 2020, Kantar noted decreases in both Print and Digital promotion activity as brand manufacturers and retailers adjusted their coupon strategies in response to COVID-19. In Digital, we saw a decline in estimated prints/clips beginning in March as well as shorter coupon availability with average days online down 50% to just 9.5 days in March, April and May 2020.