Global property is at a crossroads. For example, the build-to-rent sector is strong as urban rents spike around the world; and with general price levels rising at close to double digits, there is renewed interest in property as an inflation-proof real asset. But rising mortgage rates are hitting starter and family home markets globally.

The end of the pandemic was supposed to trigger an extended period of retail success, with brands finally seeing the wider constraints of COVID removed. Yet, with the decline of the pandemic came the rise of significant economic headwinds like rising inflation and gas prices. And so the challenges have continued with the retail sector pushing to cope with a seemingly endless period of volatility. But how would malls cope in October following challenging summer months ahead of a critical holiday shopping season?

Returning to work after a two-week holiday and it’s good to know that at least in the airline industry not much has happened! If only it were the same in other areas… The good news is that many of the major airlines around the world have been reporting their second quarter results in the last week and for many carriers they are certainly a lot better than this time last year and for many the third quarter outlook is better than expected.

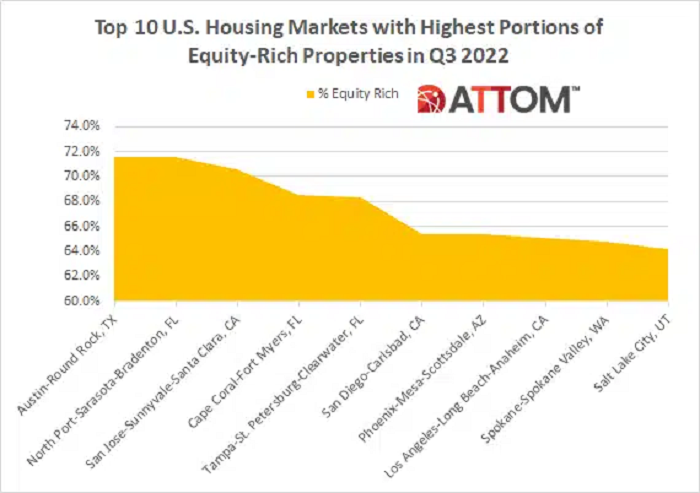

According to ATTOM’s Q3 2022 U.S. Home Equity & Underwater Report, 48.5 percent of mortgaged residential properties in the U.S. were considered equity-rich in the third quarter. The report noted that figure was up from 48.1 percent in Q2 2022 and 39.5 percent in Q3 2021. ATTOM’s latest home equity and underwater analysis also noted the latest increase fell below other gains in recent years, but still marked the 10th straight quarterly rise, and resulted in virtually half of all mortgage payers landing in equity-rich territory.

Ciao! It’s believed that the first ever food delivery took place in Naples, Italy in 1889, where King Umberto I and Queen Margherita received the first pizza delivery. Fast forward to over 100 years later, Italy’s food delivery market has grown to be around USD$1.15 billion in 2022 (forecast by Statistica). Let’s take a look at the market share of the Italian food delivery market occupied by the four players Deliveroo, JustEat, Glovo and UberEats.

Health and wellness remains a booming industry in 2022, as more and more Americans prioritize self-care in the wake of COVID. And while online fitness classes still provide a convenient option for many, premature predictions of the demise of the gym have proven greatly exaggerated: People crave community and human interaction – and they’re willing to leave the house to get it. Despite inflation rates hovering above eight percent throughout the summer, a year that started off well for the fitness industry has gotten even better.

Peloton was already in trouble when we wrote about its ad strategy earlier this year. Fast forward a few months, and things are considerably worse. Here are a few headlines that have hit the presses since May: Peloton Lays Off 500 Employees in Fourth Round of Cuts This Year - Peloton, Seeking to Cut Costs, Will No Longer Make Its Own Bikes - Peloton, the Troubled Fitness Company, Loses Another Top Executive For the pandemic darling, these headlines seem unbelievable. Unfortunately for Peloton and its advertisers, they’re not.

Keep up with the food delivery market in every market with Measurable AI’s transactional e-receipts data panel. This week we did an overview of the food delivery market in Europe throughout the past few years. First stop, España. Looking back, the Spain food delivery market has been quite competitive with over four players in the game: Glovo, JustEat, UberEats and Deliveroo. In 2020, Glovo was on a par with JustEat at around 35% of the market share by revenues.

Home price appreciation dropped in July for the first time since December 2018, ending a 40-month streak of growth. But depending on the statistic referenced, this decline could be considered either an extreme or minor correction. One of the most widely-cited industry metrics for home price changes is the median sales price, which determines trends based on the midpoint of all houses sold in a given market. By contrast, repeat sales indexes, such as CoreLogic‘s Home Price Index (HPI) and the CoreLogic S&P Case-Shiller Index, measure appreciation based on the difference between the price of a home now versus its previous sale.

The quiet yet promising launch of Temu marks yet another Chinese tech giant’s attempt to succeed in the American e-commerce market. The online marketplace is a subsidiary of Pinduoduo which successfully rose through fierce competition in the China e-commerce space. Just one month after it went live, Temu has ranked among the most downloaded shopping apps in the US. Will the fast growing platform maintain its momentum and pose a challenge to its main competitor Shein and other US e-commerce leaders like Amazon?

As the acute phase of the pandemic has waned and life has returned to normal, leading players in the pharmacy space have been forced to confront the challenging retail environment – characterized by inflation and consumer trading down – facing other sectors. Traditional drugstore giants CVS Pharmacy, Inc. and Walgreens Co. have also had to contend with increasing competition from Amazon, Walmart and others. A look at foot traffic for the past few months confirms, however, that despite these challenges, both chains are still experiencing strong performances.

Retailers are understandably nervous about the upcoming holiday shopping season. It’s a season that has traditionally accounted for up to 40% of annual sales. Given the economic turmoil of recent years, it’s no wonder merchants and service providers are anxious about whether they can expect the fourth quarter to resemble those of Christmases past, rather than the disruption they’ve endured since the onset of COVID. Fortunately, Envestnet® | Yodlee®’s wealth of consumer spending and transaction data may offer some insights.

For the first time ever, Amazon.com Inc (NASDAQ: AMZN) hosted two Prime Day sales events in the same year—one in July and one in October of 2022. So how did the Amazon Prime Day 2022 results in October fare against previous Prime Days, as well as competing sales events held by retail competitors Walmart Inc (NYSE: WMT) and Target Corp (NYSE: TGT)? Consumer transaction data reveals that Amazon.com Inc’s U.S. consumer sales during the week of the Prime sales event in October 2022 were lower than Amazon Prime Day week in July 2022, but higher than Prime Day weeks in prior years.

Recent statistics from the US Government Accountability Office show that only 42% of managers are females, although females represent 48% of the US workforce. Moreover, female managers earn only 71 cents on average for every dollar earned by a male managers. Could the gender gap in management be related to how male and female managers describe their expertise? An analysis of millions of online biographies of managers reveals that men and women use very different vocabulary to describe their expertise.

When we last looked at the coffee segment, several of the biggest players were seeing significant visit boosts driven by their seasonal drink releases. As the holiday season approaches, we checked in again to see how these java giants are faring. Starbucks, the largest coffee chain in the country with almost 16,00 locations, outperformed the wider coffee segment in a challenging economic period. The weeks of October 10th and 17th saw year-over-year (YoY) foot traffic down 7.6% and 8.1%, as the challenging economic context and comparisons to a uniquely successful 2021 limited this year’s visit peaks.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through September 2022 with forecasts through September 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

Global hotel hotel demand continues to strengthen, and the recovery index for the metric hit a pandemic-era high at the end of the third quarter of 2022. Among comparable, reporting hotels—those properties reporting data for the 2019 and 2022 year-to-date periods—September demand was just 6% shy of pre-pandemic levels. September was the fifth consecutive month with global demand recovery at a relatively stable point, at slightly more than 90% of pre-pandemic levels.

Whether it’s a meal for one or a pie to share, pizza is a staple of the restaurant landscape. We dove into the visit data for four restaurant chains doing exciting things in the pizza category – Taco Bell, Papa John’s Pizza, Pizza Hut, and Pizza Inn – and took a closer look at changes that are driving visits. While the visit metrics don’t fully capture drive-thru, takeaway, or deliveries, the data can still provide a sense of visitation trends in the pizza space.

It’s been a minute (more specifically, a year) since Netflix made its foray into free mobile games, whose purpose was to increase the retention of its subscriber base. The streaming giant has launched and/or acquired 35 mobile games to date, for a total of 34.1 million global downloads, 16% of which come from the United States, its leading market.

Welcome to the November 2022 Apartment List National Rent Report. Our national index fell by 0.7 percent over the course of October, marking the second straight month-over-month decline, and the largest single month dip in the history of our index, going back to 2017. These past two months have marked a rapid cooldown in the market, but the timing of that cooldown is consistent with a seasonal trend that was typical in pre-pandemic years. Going forward it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market.