After Antenna reported that Netflix is losing subscribers for the first time in a decade, some saw it as a sign that streaming services are on the verge of decline. But the data tells a different story. Premium streaming subscriptions have grown nearly 25% year-over-year, with 37.4 million new subscribers in Q1 2022. At the same time, streaming services lost 29.8 million subscribers — suggesting that customers are ‘churning’, or bouncing from one service to another.

A volatile economic environment has caused large swings in performance for many companies, making it more important than ever to understand the macroeconomic trends affecting all merchants. In today’s Insight Flash, we highlight several analyses that are part of Consumer Edge’s unique suite of macro products, looking at y/y growth in total spend, spend cut by demographics, and which industries and subindustries are most impacted by spending trends in a particular demographic.

Airlines with high cancellation rates gained seven points in market share by daily active users (DAUs) year-to-date, but simultaneously lost just as much market share by new installs. It's not too hard to see what is going on here. Fliers are launching the app to sort out cancellations, then they are moving on to check out the more reliable carriers. DAUs typically equate to loyal customers. In this case, Spirit, JetBlue, Frontier, Allegiant and Alaska are gaining "Ghost DAUs". The here today, gone tomorrow type.

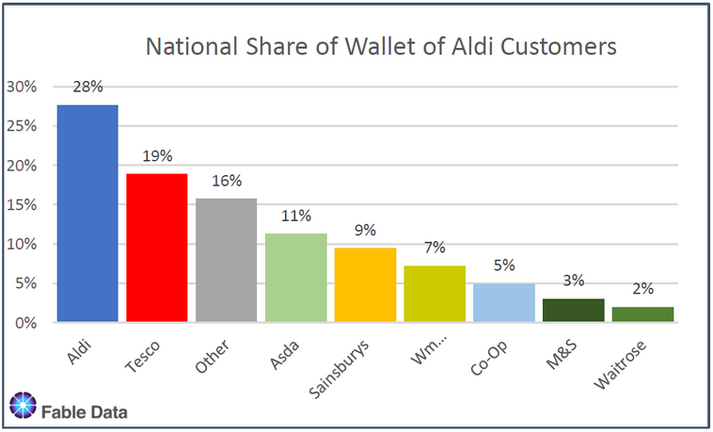

The current cost of living crisis has seen a significant shift in consumer spending patterns as household budgets have been increasingly squeezed. The Grocery sector traditionally acts as a reliable barometer for the wider economy, so it’s perhaps unsurprising that since April, there has been a noticeable shift in consumer spend towards Discounters - Aldi, Lidl and Iceland. This has occurred at the expense of the large Multiples, and Sainsbury’s, Waitrose and Morrisons are particularly feeling the pinch, as shown in the graph below.

We looked at year-over-year (YoY) and year-over-three-year (Yo3Y) visits to BevMo!, Total Wine & More, and ABC Fine Wine & Spirits to understand where BevAlc (Beverage Alcohol) visitation patterns stand as we head towards the second half of 2022. BevAlc foot traffic broke records in 2021, as many Americans turned to alcohol to cope with the pandemic stress. Consumers visited BevMo!, Total Wine & More, and ABC Fine Wine & Spirits in droves to purchase the beers, wines, and spirits they could no longer get at bars and restaurants.

If you’ve had COVID-19 or know someone who has had it, you are likely familiar with this illness timeline: Wake up feeling crummy...Wonder if you’re sick...Check your temperature (oh no, a fever!)...Make an appointment for testing (or buy an at home test)...Get tested...BOOM! Positive for COVID-19. You likely know that your positive COVID-19 test result (if done by a healthcare professional) is reported to your local health department, which allows them to monitor the disease’s trends, like in this graph below:

The summer travel outlook report, produced for the World Travel Market (WTM) by ForwardKeys, reveals that in the third quarter of the year, July, August and September, global air travel is set to reach 65% of where it was before the pandemic in 2019. However, the revival is patchy, with some parts of the world doing much better than others and some types of travel, particularly beach holidays, being much more popular than urban city visits and sightseeing.

Big names in tech like Peloton, Netflix, and Coinbase, who benefitted from a rise in demand during the pandemic, have recently announced major layoffs. Is this a mere blip or should we be expecting a wave of layoffs on the horizon? By using the latest data from the WARN Act, which requires companies to provide notice of at least 60 days to the DOL in case of a large layoff (50 employees or more), we can see what lay-offs are coming soon.

Amazon has announced that this year’s Prime Days will be held on July 12th and 13th. We dove into data from past Prime Days to understand what this year’s online retail holiday may have in store for Amazon, Target, Best Buy, and Walmart. Amazon Prime Days have been around since 2015, and the online retail holiday seems to get bigger every year.

Not all Big Macs are equal. Well, that’s when it comes to Big Macs you order online from any of the food delivery apps. They may all seemingly look and taste the same, but when you press the “order” confirm button, they will arrive at different times. More importantly, you will be charged different prices depending on which delivery service you order your Big Mac from.

If you've been paying attention to the news, we've been hearing a lot about inflation and recession. A quick look at some high level indicators help explain why: Dow Jones Industrial Index = -14% YTD NASDAQ = -27% YTD Bitcoin = -57% YTD U.S. Consumer Price Index = +3.4% YTD U.S. national gas price average = +34% YTD So as you can see, things are going pretty well -_- . These kind of market conditions tend to change the way people spend. We've already reported that consumers are flocking to grocery store apps to access digital coupons to save on their supermarket shopping.

Our latest report unveils the State of Food & Drink on mobile with unprecedented granularity. Powered by App IQ, we dive deep into 7 subgenres including Food Delivery & Carryout, Ultrafast Delivery, Grocery Delivery and more. Our State of Food & Drink report uncovers nuanced insights publishers need to succeed in the new mobile-first food & drink landscape across 20 key markets.

As online and brick-and-mortar giants like Amazon, Walmart, and Target continue to expand their health and wellness offerings, the traditional pharmacy sector has had to adapt. We took a look at three of the biggest players in the market – CVS, Walgreens, and Rite Aid – to see how they are reinventing themselves in an increasingly competitive space.

On June 10, the US government removed a restriction that travelers flying in from other countries needed to show a negative COVID-19 test to enter the country. This restriction was a potential barrier not only to foreign tourists, but to US citizens who were hesitant to travel abroad and risk getting stuck in a foreign country. In today’s Insight Flash, we look at spend growth on international airlines for US travelers and US airlines for UK travelers to determine the extent to which the policy change has boosted foreign travel.

Costco, BJs and Sam’s Club mobile app downloads are expected to close out Q2 at a growth rate of 74% year-over-year, as shoppers commit to membership clubs for inflation relief. This is the highest YoY growth among clothing, fast food and home improvement retail categories. The user sessions correlation charted below indicates why: combined mobile sessions for the three store apps reached an all-time-high when the national gas average reached $4 per gallon in March.

Welcome to the July 2022 Apartment List National Rent Report. Our national index rose by 1.3 percent over the course of June, consistent with last month’s increase. So far this year, rents are growing more slowly than they did in 2021, but faster than they did in the years immediately preceding the pandemic. Over the first half of 2022, rents have increased by a total of 5.4 percent, compared to an increase of 8.8 percent over the same months of 2021. Year-over-year rent growth currently stands at a staggering 14.1 percent, but has been trending down from a peak of 17.8 percent at the start of the year.

Robust top-line hotel performance indicators for the four weeks ending 11 June point to a clean transition between a rock-solid recovery during the spring to summer’s traditionally leisure-heavy travel period. With domestic leisure travel expected to remain strong, along with a recent lifting of international travel restrictions, STR expects a record-breaking summer season with numerous U.S. hotel markets to surpass 2019 comparables.

In our most recent white paper, we took a closer look at the home improvement and decor sector. We examined how recent economic shifts are affecting the industry and how consumer attitudes are changing as the pandemic fades into the background and inflation takes center stage. Shifts in home ownership can have a significant impact on the home improvement sector. Now, homeowner rates are dropping in 2021 for the first time in five years, and rising housing prices and increasing rental costs are making it difficult for potential buyers to enter the market.

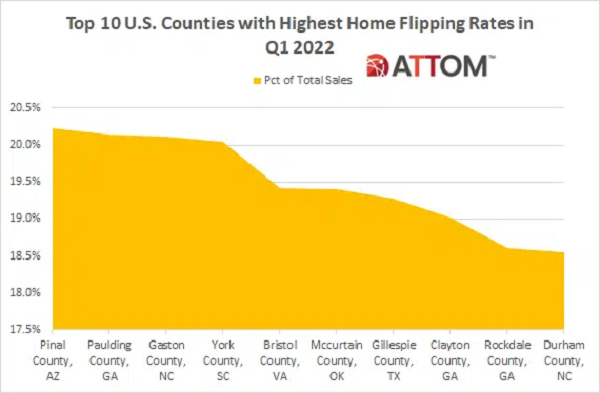

According to ATTOM’s just released Q1 2022 U.S. Home Flipping Report, the home flipping rate in the first quarter was at the highest level since at least 2000, with single-family home and condo flips representing 9.6 percent of all home sales. The report noted that figure was up from 6.9 percent in Q4 2021 and 4.9 percent in Q1 2021. ATTOM’s latest home flipping analysis also reported that jump in the home flipping rate in Q1 2022 marked the fifth straight quarterly increase, and the largest quarterly and annual percentage-point gains since 2000.

Instant delivery companies proliferated early in the pandemic, especially in urban markets like New York City and Boston. But for many of these companies, their life cycle has also been ultrafast. In recent months, instant delivery competitors including Jokr, Buyk, and Fridge No More have permanently shut down or ceased operations in the U.S. However, one of the more established rapid delivery companies, Gopuff, is continuing to expand into new domestic and international markets.