After surging through the pandemic, online traffic to many retailers’ websites has slowed, as consumers return to in-store shopping and shift more of their disposable income to experiences. This is true for even some of the largest U.S. retailers, Walmart and Target. In 1Q22, converted traffic (or traffic that leads to the sale confirmation page) to both target.com and walmart.com fell 5.5% and 4.3%, respectively, from the prior year, according to Similarweb estimates

In this Placer Spotlight, we dive into the visit data for Ulta Beauty to understand how the variety of its brick and mortar offerings is impacting retail foot traffic to the brand. Ulta is one of the non-essential retail brands that recovered the fastest from the COVID lockdowns and store closures, with retail foot traffic reaching 2019 levels in early 2021. As the country continued to open up and people began socializing again, Ulta’s visit surge continued, with foot traffic throughout most of 2021 higher than it was pre-pandemic.

If you're hiring for an open position, gear up for another wild year. Job openings are at their highest level in years, and there simply aren't enough workers to go around. This is making it harder to fill open positions and forcing employers to get creative in order to attract talent. According to the U.S. Bureau of Labor Statistics, there were 11.5 million openings in the United States at the end of March. Voluntary separations are also up, with 4.5 million workers retiring or quitting their jobs in favor of a better opportunity. Many of these employees will turn to recruiting sites to find jobs that offer higher pay, better benefits, and more flexible work arrangements.

What are America’s favorite pastimes? Baseball. Apple pie. Rearranging furniture. That’s right—home furnishing and furniture rearranging is on the rise. Pinterest’s popularity continues to climb; in Q1 2022, Pinterest reported 433mm monthly active users (MAUs). The TV channel HGTV (which focuses solely on home design, redecorating, and remodeling) also was the 9th most-watched TV network in 2021.

Peloton has been on a wild ride the past three years. When in-person gyms closed due to COVID-19, Peloton capitalized on providing an in-home fitness solution. Peloton’s shares were up 220% in 2020 due to the pandemic causing profits to rise. But nearly all of those gains were wiped out last year as the brand had a bumpy ride in 2021 with bad press, class action lawsuits, supply problems among their issues.

On Friday Kendrick Lamar announced his first tour in 5 years and presale tickets could be purchased via Cash App. This was no surprise after our findings in the Brand Relative App Growth Index (BRAG Index) revealed partnerships was a popular mobile marketing strategy used by top apps over the last six months. The savviest of apps, like Cash App and Chick-fil-A, thought beyond brand marketing and used partnerships to drive installs by lining up value on the other side.

Shortly before announcing its first quarter earnings results, DTC home furnishing company Wayfair Inc (NYSE: W) launched its fifth annual Way Day sales event. Bucking its trend of increasing sales every year, consumer transaction data shows that Wayfair sales during Way Day week in 2022 were lower compared to Way Day week sales during the previous two years. However, zooming out, average transaction values at Wayfair Inc have been on the rise in 2022.

We last looked at the impact of inflation and increased gas costs on retail foot traffic in late March 2022. With another month of data in, we dove into the numbers to find out if retail visits have recovered from the shock of rising prices and what categories are proving particularly resilient. Gas prices increased gradually in January and February 2022, but the beginning of March saw a dramatic spike relative to an end of 2020 baseline.

Online Food Delivery apps are changing the traditional fast food restaurant business. With their user-friendly experience, professional driver network, and rapid global expansion, many fast food chains have chosen to onboard the food delivery platforms to keep up with the on-demand economy. At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets.

The number of apps describing themselves and/or marketing themselves as "web3" is growing. Apptopia data indicates this trend started in 2020 and ramped up in 2022. The number of Web3 apps available for download is growing almost 5x faster in 2022 than in 2021. Year-to-date, apps available for downloads are up 88%.

In our recent collaboration with Business Insider, we studied talent flows from quant hedge funds and prop trading firms to the tech industry. This week we focus on who exactly is hiring this technical talent during the hefty non-compete period. While rival funds and trading firms are frequent destinations, Alphabet, Amazon, Facebook, and Microsoft are still the most common destinations for engineers, data scientists, and researchers.

Over the past couple of years, several home furnishing retailers – including At Home, HomeGoods, and Floor & Decor – have expanded their physical footprint, while other brands such as Tuesday Morning shrunk their store count. We dove into the foot traffic numbers to find out how modifying the store fleet size has affected these retailers’ recent performance. Despite the wider challenges impacting retail, recent location analytics data shows that several home furnishing leaders are seeing visits that match or exceed 2019 foot traffic levels.

Snapchat and TikTok reach billions of millennial and Gen Z users every day and have changed the social media landscape for brands, advertisers, publishers, and investors. Today, we’re thrilled to share that ad intelligence for Snapchat and TikTok is now available in Pathmatics Explorer. Customers will have full visibility into how brands are including these platforms as part of their media mix, as well as how seasonal trends are affecting share of voice and creative strategies.

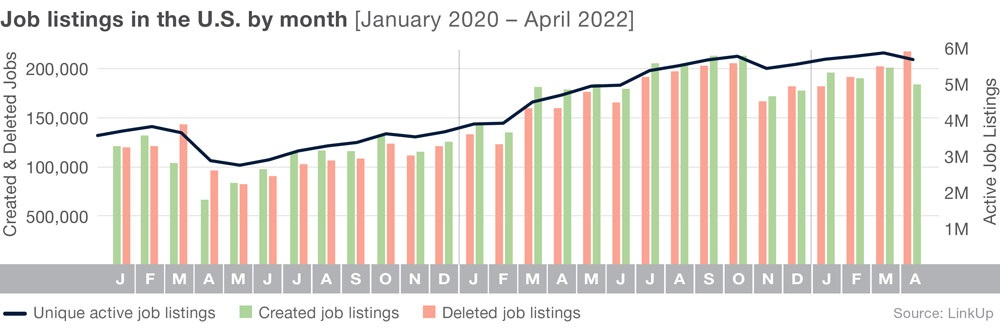

After the four previous months of slow, yet steady job listings growth, April jobs data shows employers are removing job postings and putting a pause on recruitment. With the uncertainty in the economy and increased interest rates businesses are being more conservative when hiring. Total active job listings in the U.S. were down by 3.1%, affecting nearly every occupation, industry, and state. Job listings with the highest rates of decline were concentrated in Healthcare, with listings down more than 5%.

[](https://blog.linkup.com/data-seekers/wp-content/uploads/sites/4/2022/05/LinkUpRecapMapApr2022.jpg)

When many Americans sheltered in their homes early in the coronavirus pandemic, meal delivery sales reached new heights. Our data reveals that in April 2022, sales for meal delivery services grew 7 percent year-over-year, collectively. The ongoing pandemic may also be driving more Americans to make their first meal delivery purchase. In April 2022, 52 percent of U.S. consumers had ever ordered from one of the meal delivery services in our analysis, up from 47 percent a year ago.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of year-end dips in 2020 and 2021, sales have been gradually recovering since April 2020. Bloomberg Second Measure transaction data shows that Uber sales were up 80 percent year-over-year and Lyft sales were up 49 percent year-over-year in April 2022.

The wholesale category was thriving when we last checked in. Costco landed on our 2022 Predicted Winners list and BJ’s and Sam’s Club were still riding the wave of 2021 success. But the end of 2021 and beginning of 2022 brought about a new set of challenges that threatened to upend the consistent strength the segment had seen. We dove deeper into the retail foot traffic trends to see how these chains are doing.

Total scheduled airline seats this week remains above the 90 million mark, a few regions have reported slight reductions in capacity leading to a total seat reduction this week of 190,000. Indications are that we should stay at this sort of level for the next few weeks by which time, with a bit of luck, China will once again be easing the latest lockdown. As always there are a few nuggets of change in the week’s data, and we are also going to look at the top twenty international airports this week compared to this time in 2019 with some notable absences, although not quite as many as in the Everton defence this weekend!

According to Furniture Today, the pandemic unsurprisingly fueled consumers’ “home goods” purchases. As pandemic restrictions ease, and even with consumer spending focusing more on experiences and travel, the “homebody economy” continues to flourish. Furthermore, this upward trend in consumer home goods spending is propelled by diminishing supply chain issues; among other factors. Overall, ad spend in the home goods industry should increase in step with consumer confidence in the category.

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. single-family rent price growth continued at a record pace in March, up 13.6% from one year earlier. Slim inventory continues to squeeze renters, as do robust home price gains – both familiar culprits in declining affordability.