In the United States, mobile shopping leaders in 2021 slightly favored logistics heavyweights, but it’s wearing off. Amazon maintained its #1 position from 2020 and Shopify’s Shop app moved up one spot to #3 after a year of strategic partnerships essentially made the app a hub for tracking the transit of all your non-Amazon orders. You can find our full list of 2021 worldwide download leaders here, and compare them with 2020's most downloaded apps. If you need to fully understand what a download is and what it does/does not measure, we have that for you as well.

2022 is here, and it is time to give 2021 one last look before diving headlong into the new year. Whereas 2020 was a historic year for mostly undesirable reasons, 2021 will be a year multifamily industry participants reference and discuss for a long time to come. The story of 2021 was generational apartment demand and rent growth. Pent up demand from 2020, economic re-opening, stimulus efforts, population migration, changing renter preferences, and more fueled one of the most active years on record for the industry. As always, numbers will refer to properties of at least 50 units.

As a record number of Americans resigned their jobs in 2021, we are proud to present our research in MIT Sloan Review’s Toxic Culture Is Driving the Great Resignation, co-written with MIT adjunct faculty and co-founders of Culture X, Donald Sull and Charles Sull, and Revelio Labs CEO Ben Zweig. The article investigates the main drivers of employee attrition and actual strategies managers can employ to retain talent.

Escalating urgency behind the ongoing climate crisis continues to drive many facets of the economy forward. From growing technologies like electric vehicles to areas of potential job creation like infrastructure, opportunities to benefit from our collective problem solving abilities abound. But now we’re witnessing an interesting shift among investors, toward funds with more sustainable stocks. Those new to the market and seasoned investors are both showing interest in companies making measurable impact in addressing important environmental issues, as well as the social issues that fuel them

The sales mix for club stores online can be very different than in-store. In today’s Insight Flash, we use our CE Receipt data to dig into individual online transactions for Costco and BJ’s. Although Costco is generally more likely to be thought of as a destination for higher-end goods like wine and jewelry, we dig into how the item mix really differs versus BJ’s and what role seasonality plays. Although Costco online sees substantially more transactions than BJ’s online, BJ’s was chipping away at that share in the beginning of 2020.

Pandemic engagements and holiday shopping have corresponded with dazzling sales for jewelry companies, including both brands that are mostly focused on ecommerce as well as those that have historically sold through brick-and-mortar stores. Transaction data indicates that sales at newly public DTC e-tailer Brilliant Earth (NASDAQ: BRLT) have more than doubled between November 2019 and November 2021. At the same time, sales at more traditional jewelry retailers owned by Signet Jewelers (NYSE: SIG)—such as Zales, Kay Jewelers, and Jared—have resumed their seasonal patterns after an initial disruption early in the pandemic.

The rise of the Omicron variant coincided with the start of the 2021 holiday travel season, and many worried that the rise in cases would throw a wrench into Americans’ much anticipated travel plans. We dove into the foot traffic data to find out – how did the current COVID wave affect holiday travel? Despite the fourth and fifth COVID waves, location analytics data shows that the hotel industry has been on the path to recovery for quite some time. In July, at the height of the summer travel season, all the hotel chains analyzed showed impressive year-over-two-year (Yo2Y) growth in visits.

Global airline capacity has fallen this week as the impact of travel restrictions begins to be felt across the European market with 3.4 million fewer seats in Western Europe and 720,000 fewer in Eastern Europe. Ryanair did warn us all that this was going to happen, and it has - a 24% reduction in Western Europe and 20% in Eastern Europe. It’s slightly ironic that last week the UK Minister of Transport eased travel testing requirements around the Omicron variant just as capacity was cut, finger on the pulse and UK Government decisions have never been aligned during the pandemic, have they?

In October 2021, 3.8% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure), which was a 2.3-percentage point decrease from October 2020 according to the latest CoreLogic Loan Performance Insights Report . Comparatively, the overall delinquency rate in October 2019 was 3.7%. The share of mortgages that were 30 to 59 days past due — considered early-stage delinquencies — was 1.2% in October 2021, down from 1.4% in October 2020. The share of mortgages 60 to 89 days past due was 0.3% in October 2021, down from 0.6% in October 2020.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through October 2021. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

This year’s illness season is here, as COVID, flu and cold grip the nation. For the first time since the pandemic began, every state in the country is simultaneously at “Critical” COVID risk, according to HealthWeather. Beginning just before Christmas, Kinsa data showed fevers accelerating upward, with the number of fevers nationwide quadrupling during December. The same trend continued into the new year as Omicron swept the nation, flu bubbled up regionally, and the viruses that cause the common cold spread.

Another holiday season has come and gone, but like the one experienced in 2020, 2021’s iteration was anything but ‘normal’. For many retailers, Thanksgiving was again removed from the mix and the wider season was dominated by concerns over supply chain challenges, labor shortages, and the omnipresent risk of rising COVID cases. And, as perhaps should have been expected considering the 2021 experience, all of these effects were felt. Yet, the situation was hardly doom and gloom, with many retailers seeing exceptional traffic to locations throughout the holiday season.

The U.S. has experienced record annual home-price growth with faster appreciation for detached houses than attached homes. A similar pattern has occurred for rent growth, and that experience is not unique to the U.S. The CoreLogic Single-family Rent Index has found an acceleration in annual rent growth to the highest recorded since the series’ inception in 2005. The double-digit rise of the past year is eight percentage points faster than measured one year earlier. Likewise, the CoreLogic Hedonic Rental Index for Australia has also accelerated a similar amount.

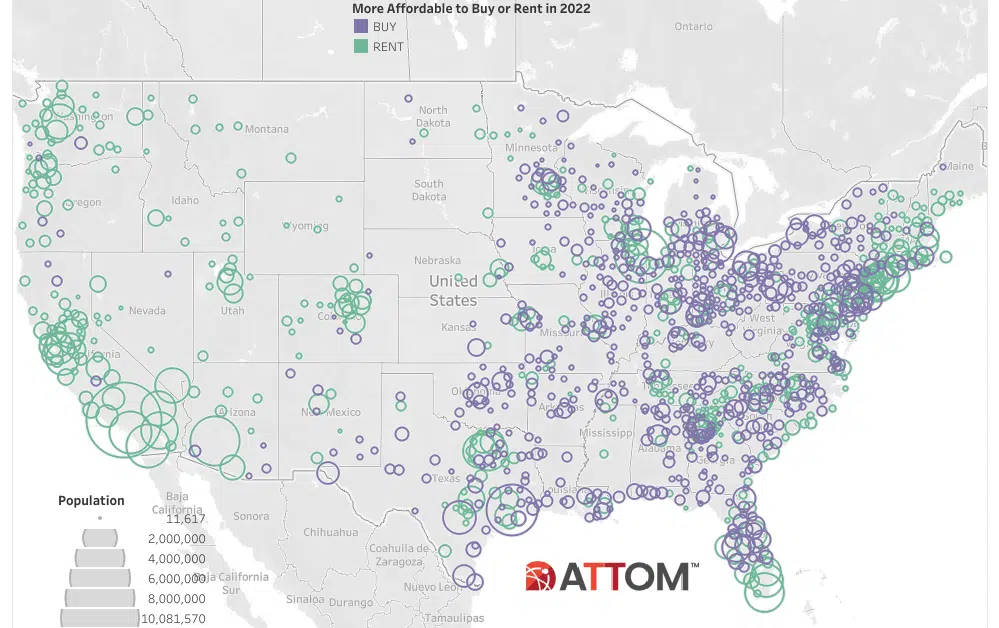

According to ATTOM’s just released 2022 Rental Affordability Report, home ownership remains more affordable than renting, even though median home prices have increased more than average rents and more than averages wages in 88 percent of U.S. counties analyzed. ATTOM’s 2022 rental affordability report shows that owning a median-priced home is more affordable than the average rent on a three-bedroom property in 58 percent of the counties analyzed.

Investors have been looking to alternative asset classes such as life sciences properties as demand trends for traditional investments like offices and retail face uncertainty. Location may not matter as much moving forward for those traditional asset classes; for life sciences assets though, investors are focusing on specific markets. Location may matter for life sciences assets for now, but not forever. The life sciences sector is heavily dependent on knowledgeable workers trained in arcane matters of biology.

Apptopia estimates indicate December 2021 closed out with 6.8 million MAUs for the top sportsbook mobile apps combined, in the United States. A slew of states legalizing the industry this year has certainly aided the 199% year-over-year growth for the month of December. Sportsbook app downloads spiked 297% m/m (month-over-month) in September with 2.9 million installs, due to the start of NFL season. They then fell 31% m/m and continued to fall until December.

In this Placer Bytes, we dive into First Watch, a rising star in the breakfast space, and Staples, a legacy brand that has been making a surprising comeback. Last winter, while the pandemic was still limiting the dining industry, First Watch was continuing with its expansion plans and opening new locations. And although the daytime restaurant concept’s year-over-two-year (Yo2Y) overall monthly visits were up – thanks to the brand’s aggressive expansion – Yo2Y average visits per venue were down by 21.6%, 22.6%, and 15.5% in January, February, and March, respectively, indicating that the brand was definitely feeling the effects of the drastic downturn in diners.

ATTOM, curator of the nation’s premier property database, today released its 2022 Rental Affordability Report, which shows that owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting. Home ownership remains more affordable even though median home prices have increased more than average rents and more than averages wages in in 88 percent of the counties analyzed.

What happened in 2021? Cryptocurrency happened in 2021. Last year the top three apps combined for 18 million downloads and this year they combined for 145 million. The Crypto.com app recently (early January '21) hit 50 million downloads since launch in 2017. Most (82%) of those downloads came in 2021, making the app the second most downloaded crypto app globally in the calendar year.

Welcome to the first Apartment List National Rent Report of 2022. Our national index fell by 0.2 percent during the month of December, marking the only time in 2021 when rents declined month-over-month. A slight dip in rents at this time of year is typical of seasonality in the market, but it’s especially notable after a year of record-setting growth. Over the course of calendar year 2021, the national median rent increased by a staggering 17.8 percent. To put that in context, annual rent growth averaged just 2.3 percent in the pre-pandemic years from 2017-2019.