Athleisure – and workleisure – are having a moment. After the long months of shelter-in-place, many consumers are looking for clothes that make them look presentable without sacrificing the comfort they got used to during the lockdowns. But is the surge in athleisure translating to offline success for bona fide sportswear brands? We dove into visit trends at Nike and Under Armour to find out. The nationwide apparel recovery as a whole has been slower than in other industries.

The heat between gig companies and worker rights groups is intensifying. And the ad numbers show it. Last year, businesses like Uber and Lyft contributed a record-breaking $200 million to the Prop 22 campaign in California, which allowed the companies to classify workers as independent contractors rather than employees. As similar legislation gets closer to the ballot in Massachusetts, how much money will these companies shell out?

Another day, another Amazon headline. The world’s largest online retailer is making new again, this time with their recently announced plans to hire more than 125,000 warehouse and transportation workers. Delving into our data we can see a 13% increase in production occupations. While this number was not even close to the 125,000 roles they plan to increase, it does tell us they are definitely increasing hiring. We would anticipate more listings for production occupations will likely be posted in the future.

One of the main objectives of airline carriers is to optimize revenue, which they accomplish by deciding on what flights to operate, when and with what aircrafts depending on demand. Airline capacity is used by many tourism businesses as a proxy for the number of travellers that will be in a destination. It seems like a safe number to work with, as airline schedules are considered to be quite static. However, that time is long gone, the global trend of using big data for more exact planning and forecasts have been picked up by the airlines, which means that they do regularly change flights.

U.S. single-family rent growth increased 8.5% in July 2021, the fastest year-over-year increase in 16.5 years, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time. The July 2021 increase was nearly five times the July 2020 increase, and while the index growth slowed last July, rent growth is running well above pre-pandemic levels when compared with 2019.

Last week, Kroger made headlines when it announced the launch of its Delivery Now service, promising groceries delivered in 30 minutes or less. Grocery has been one of the many industries benefitting from the surge of online shopping over the last year and a half, but can Kroger’s gambit add a second burst to the trajectory? And could it be a model for other players both in the US and overseas? In today’s Insight Flash, we look at how grocery spend has grown by channel in the US versus UK, what the average ticket is for third-party delivery versus the Grocers’ direct channels in both markets

When we last looked at the Darden Restaurant Group, year-over-two-years visits to Longhorn Steakhouse were up but many of the parent company’s other restaurants were struggling. With September almost behind us, we analyzed the data to see how the summer has treated some of the group’s best known dining brands. Although the restaurant industry appeared to be making a full visit recovery in early July, the year-over-two-year growth in visits was short-lived.

It’s a mixed bag of COVID news this week: Nationally, overall illness stats looked promising, with COVID cases and hospitalizations both decreasing. And while this is excellent news, the declining numbers obscure a more significant illness trend. Many regions across the country see increasing levels of illness. The downward trend in overall numbers is due to illness levels decreasing in highly-populated and hard-hit areas like Florida, California and Texas.

Total construction starts fell 9% in August to a seasonally adjusted annual rate of $782.8 billion, according to Dodge Data & Analytics. All three sectors lost ground during the month: nonbuilding starts were down 2%, residential starts were 9% lower, and nonresidential building starts fell 13%. “Construction starts have hit a rough patch following the euphoria seen in the early stages of recovery from the pandemic,” stated Richard Branch, Chief Economist for Dodge Data & Analytics.

The recently announced partnership between Amazon and Affirm for the latter to provide shoppers with Buy Now Pay Later (BNPL) options on purchases over $50 dominated headlines. But does a company as large as Amazon really need the extra support from point-of-sale-lending? In today’s Insight Flash we dig into the specifics of the partnership, looking at cross-shopping trends between the two merchants, which subindustries see the biggest gaps in average ticket from BNPL shoppers, and repeat usage behavior from BNPL services.

With summer ending and the much-needed leisure travel surge waning, much of the industry’s attention and focus shifts to business travel. For true recovery to occur, the travel and hospitality industry needs to see business travel return to pre-pandemic levels. Unfortunately, the prospects for such a return do not appear good at the moment. The Delta variant continues to disrupt the reopening of economies in many parts of the world and, indeed, some countries are grappling with previously unseen levels of infections.

With the pandemic spurring more and more people to move into new, and often larger homes, outfitting these living spaces has become top-of-mind. However, with the rise of eCommerce, in-store furniture shopping has become passé – consumers are going digital instead. To help brands and retailers navigate this changing landscape, we’ll analyze the digital performance of top online furniture sites, using our eCommerce solutions, Research and Shopper Intelligence.

When we last checked in with the fitness industry, the sector was slowly making a comeback – although visits still lagged behind 2019 figures. Now, over a year and a half after COVID first hit the United States, we dove into the data to understand how this hard-hit industry is faring under the new normal. The fitness sector suffered a heavy blow over COVID. As health clubs closed throughout the country went into lockdown, many gyms could not afford to stay in business – according to one study, 22% of gyms have shuttered permanently since the start of the pandemic.

The NFL season is back this year with several changes. One of the most significant changes is the sports league’s stance on betting. Up until this year, the NFL has opposed legalized betting. But this year, the league announced that it signed deals with three Official Sports Betting Partners—Caesars Entertainment, DraftKings and FanDuel. With this change, we’ve seen programmatic advertising in this category increase 157% year-over-year, with DraftKings in the driving seat.

The pandemic has influenced homebuyers’ decision on where to buy a home. Our previous analysis showed that homebuyers who relocated to another metro in 2020 were often choosing metros that were either adjacent to their current location, had a lower cost of living or both. Although homebuyers were considering affordability and proximity while buying homes even before COVID-19, the migration rate grew during the pandemic. With the combination of low inventory, low interest rates and a shift to a more flexible working environment

Warby Parker—a Digitally Native Vertical Brand (DNVB) specializing in eyewear—has visions of an IPO. Warby Parker is known for its at-home try-ons and its “buy a pair, give a pair” initiative. The DTC company started in ecommerce and later became omnichannel, with a network of stores throughout the U.S. Consumer transaction data shows how sales have grown at Warby Parker during the pandemic, as well as how the company stacks up against other eyewear competitors.

A year and a half into the Covid-19 pandemic and loss rates for U.S. commercial real estate loans are not looking that bad. With the exception of the hotel and CBD office sectors, loss rates so far are well below the pace set through this stage of the Global Financial Crisis. The macroeconomic factors driving loan performance were simply different in this downturn. Investor tolerance for risk has followed a unique path during the Covid-19 downturn, one that varies from that seen during the GFC.

Londoners are staying closer to home than residents of other towns and cities as the country counts on a post-Covid recovery. Since the depths of lockdown England during January 2021, Huq’s measure of population mobility – that is, the mean maximum distance travelled each day – has recovered 50% as a whole. While residents in The South and North are building towards 75% and 86% of pre-pandemic levels respectively, London lags 35% behind at just 50%.

September 17, 2021

/

Business

Allbirds IPO

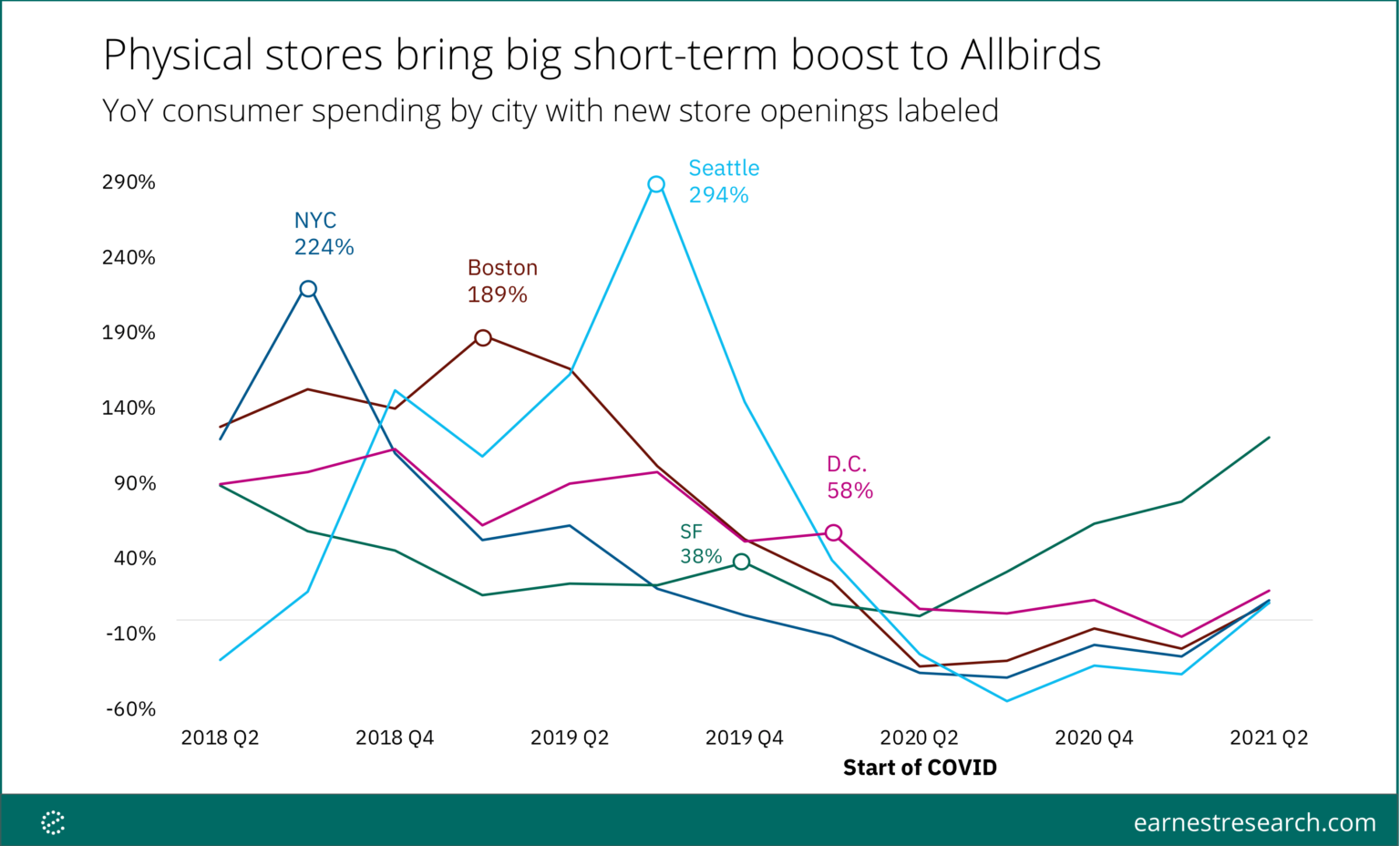

Sustainable footwear brand Allbirds has filed for an IPO to trade as $BIRD on the Nasdaq, joining a slew of other DTC brands going public. While Allbirds built its brand on direct e-commerce sales (almost 90% of Allbirds sales happen online), opening physical stores is increasingly important to the brand in attracting new customers, as cited in Allbirds’ S-1. Using Earnest consumer spend data, we analyzed the degree to which Allbirds sales were impacted by new store openings in cities across the U.S.

August saw a reversal in the upward momentum the restaurant industry’s sales and traffic had been riding in recent months. Amid a rising number of COVID cases and wide media coverage of its Delta variant, sales growth was 6.1% during the month, a drop of 2.1 percentage points compared to July’s strong sales growth. This was the softest sales growth reported for any month since May, and the worst traffic growth in the last three months. Traffic growth was -5.4% during August.