The alcohol delivery market has been abuzz with activity. Doordash recently launched an alcohol delivery option in select states, while Uber finalized its acquisition of Drizly. An analysis of transaction data reveals that even though bars and restaurants have gradually reopened during the pandemic, sales at same-day alcohol delivery companies like Drizly, Saucey, and Minibar exceed pre-pandemic levels.

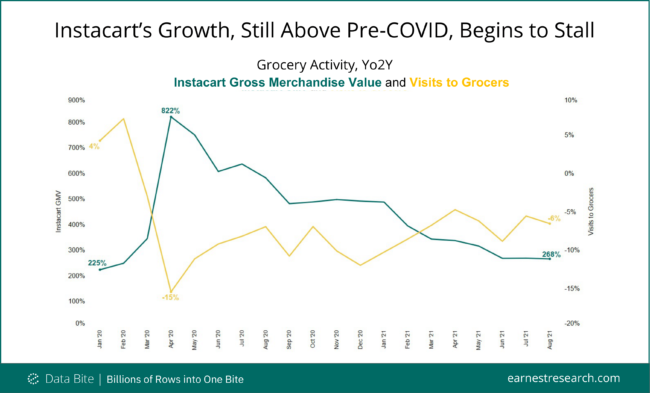

An analysis of Earnest Research data by Emory professor Dan McCarthy noted that GMV (Gross Merchandise Value) growth on Instacart is slowing faster than other convenience economy brands after peaking in April 2020. Earnest Research data in the report highlights that newly acquired Instacart customers are becoming less active over time—in contrast to restaurant delivery platforms such as DoorDash. The findings suggest that consumers’ switch to online grocery shopping may not have the staying power of other Covid-19 shifts.

The holiday season is on its way and while the last year and half provided an ongoing lesson in the challenges of ‘predicting’ during a pandemic, there is still value in attempting to highlight what the season could hold. Clearly the ongoing presence of COVID as an actual or potential disruptor is significant, but planning must go on and accordingly we decided to provide some of the key themes we believe will impact the holiday season.

Notable Hit 1: (TSCO:NASDAQ) On Thursday October 21 , 2021 Tractor Supply Company (TSCO) posted better-than-expected revenues of $3.017bn beating the consensus estimate of $2.84bn (-6.2%) and in the same direction as Advan's forecasted sales. The revenue was +15.8% YoY - Advan's foot traffic data captured an increase in foot traffic of +25% YoY at its locations for Q3 2021. As a result of beating the sales and EPS, the stock opened at $211.51, up +4.5% from its previous day's closing price and hit a high of $212.88 (+5.2%) shortly after the opening bell.

Covid-19 had consumers scrubbing every inch of their hands and homes throughout the pandemic. Cleaning and disinfectant products and brands jumped on the momentum to digitally advertise to consumers, showcasing how each product might help consumers stay safe during the pandemic. We’ll take a look at how top advertisers in the Household Cleaning Supplies, Cleaning and Disinfectant, and Hand Sanitizers categories performed in January of 2020 through August of 2021, and how things may shake out through the rest of the year.

Samsung and Apple have been making disruptive changes to the ad tech ecosystem. Apple, more than Samsung, is becoming more privacy-centric with every update. Yet it spends nearly all of its digital advertising on targeted, programmatic ads. As these two mobile device companies tighten their own advertising and privacy policies, how are they using targeted ads to reach potential customers?

Over the last few years, free shipping has become table stakes for many online retailers trying to compete with Amazon Prime. These types of promotions can eat away at margins. But while the hope is that minimum order sizes for free shipping will spur order consolidation and larger baskets, is consumer behavior actually affected? In today’s Insight Flash, we take advantage of shipping cost and item count breakouts in our CE Receipt data to analyze whether there is any relationship between shipping costs and type of order for the URBN family of brands – Anthropologie, Free People, and Urban Outfitters.

There has been an ongoing shake-up in China’s e-commerce industry lately. While Pinduoduo has been taking share gradually from traditional e-commerce giants Alibaba and JD since late 2020 mainly in sportswear and apparel sectors, Douyin and Kuaishou, the known-to-be live-streaming leaders, have also started to gain momentum in getting substantial market share in the past few months — especially for the apparel and cosmetic sectors.

Both Warby Parker and First Watch have been aggressively growing their offline presence. So, we dove into the foot traffic data to find out how the brick and mortar expansions are affecting visit patterns. Much has been written about Warby Parker’s brick and mortar expansion. The eyeglasses disrupter opened its first offline store in 2013 and now operates over 140 stores throughout the United States. And the growth in stores has led to a massive increase in foot traffic.

As businesses rooted themselves deeper in digital ecosystems, many sought counsel on digital transformation, IT and cloud security. The push for digital transformation, along with the increase of sophisticated cyberattacks last year, benefited large IT firms. By the end of next year, the cloud security market is expected to reach $12.73 billion. This will have been a 25.5% increase since 2017. As the market expands, companies will have to use elevated branding to set themselves apart from other services.

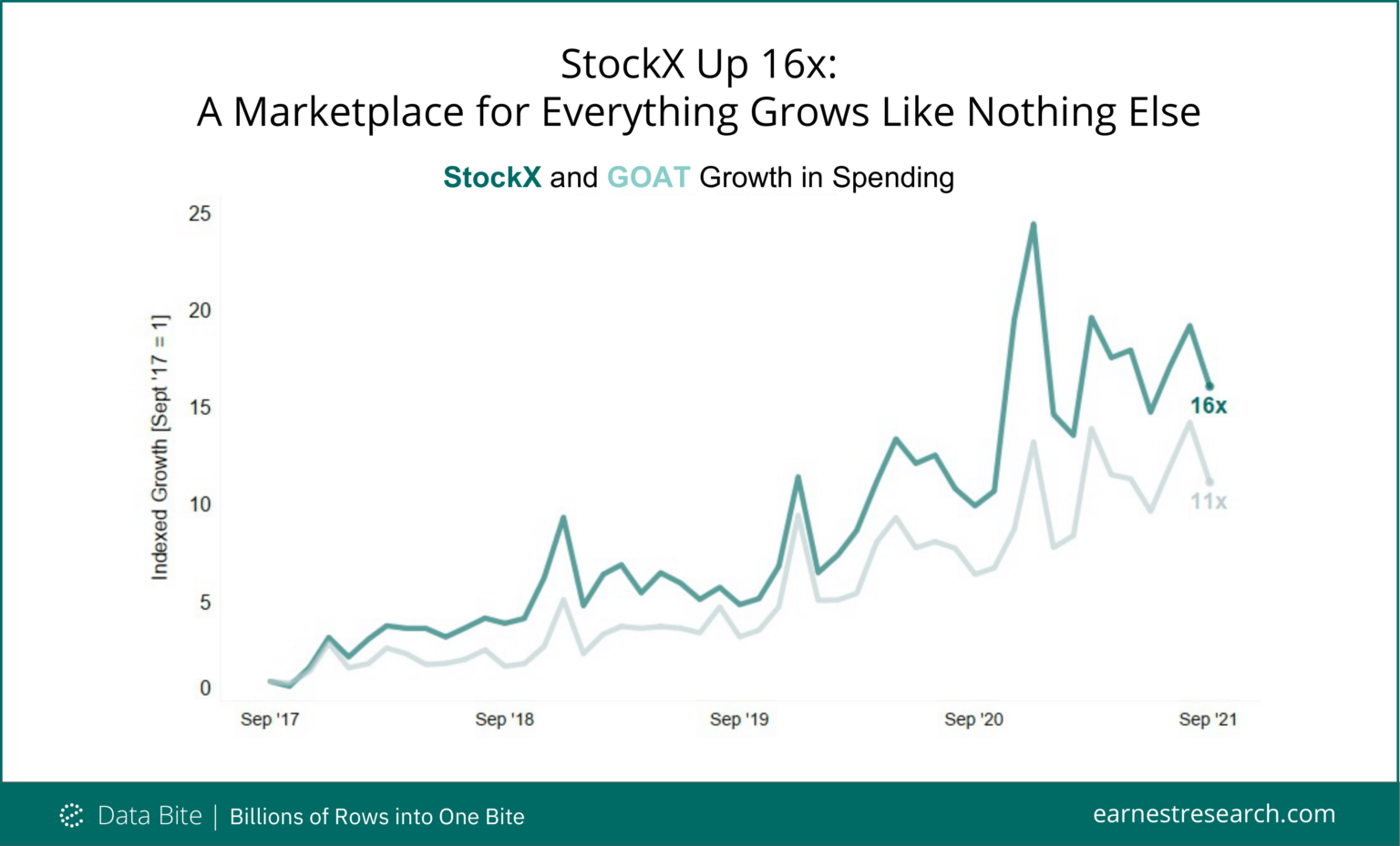

When StockX announced a $255 million funding raise in April, valuing the company at $3.8 billion, much was said of StockX’s uniqueness as a company: a “stock market of hype,” many of the goods bought and sold through its marketplace represent Gen-Z consumers’ interest in alternatives to traditional investments. Best known for apparel and accessory resale—primarily sneakers, streetwear, handbags, and watches—products on StockX have broadened to include collectibles and electronics.

Since the United States has no federal parental-leave policies, local governments and companies often step up to fill that void. Business Insider identified large public companies with the most generous parental leave and benefits for new parents. The list includes tech giants like Netflix and Amazon, as well as financial sector firms like Freddie Mac and Capital One. But do these company policies actually lead to measurable outcomes for women?

Our Q3 Quarterly Index is now live! We analyzed a wide array of brands in several major retail categories including apparel, grocery, fitness, home improvement, and superstores to bring you the latest insights and identify trends shaping retail right now. Below is a taste of our findings. In Q2, it seemed like the pandemic disruptions were waning and the grocery and superstore spaces were returning to pre-pandemic foot-traffic patterns, until COVID cases began increasing again, causing consumer concerns about the economy to surge once more.

If hotel prices are any indication, COVID-19 surges aren't going to keep travelers home this holiday season. The average daily rate for a hotel room in the US is $143.30— up 6% from 2019. In popular destinations like Hawaii, average daily rates are as high as $258.65, according to data from hospitality analytics firm STR. Which leaves many eager travelers (myself included) looking for alternative accommodations for family get-togethers or tropical getaways.

In September, challenger brand McDonald’s took 25% of spend among top brands, followed by Wendy’s with 16%. When it comes to the number of chicken sandwiches sold, McDonald’s and Chick-Fil-A are neck-and-neck. Most brands studied have sold increasing numbers of chicken sandwiches from 2020 to 2021, except for Popeyes. The Chicken Sandwich Wars have been raging so fiercely and for so long now that there’s even a Wikipedia page about it.

TV streaming platforms such as FuboTV, Sling TV, and YouTube TV have been on the rise for the past few years, bolstered by a combination of price increases and new subscribers. While OTT streaming platforms such as Netflix and Hulu experienced a spike in sales and customers at the start of the pandemic, a different pattern has emerged for TV streaming services. Consumer transaction data shows that TV streaming companies, especially FuboTV, generally experience the highest spike in sales and new subscribers in September, corresponding with the start of football season.

In this Placer Bytes, we dove into Target’s offline Deal Days performance, self-storage’s impressive monthly visit gains, and physical therapy chains’ summer surge. This year marked the first time that the Target Deal Day sales extended not only to the Target website and app, but also to all brick-and-mortar Target stores. The sale lasted from October 10th through October 12th amidst reports of supply chain challenges and impending retail shortages pushing consumers to get a jump-start on their holiday shopping.

Total construction starts rose 10% in September to a seasonally adjusted annual rate of $889.7 billion, according to Dodge Construction Network. All three sectors improved: nonresidential building starts rose 15%, residential starts moved 9% higher, and nonbuilding starts increased by 6%. “Construction starts have struggled over the last three months as concerns over rising prices, shortages of materials, and scarce labor led to declines in activity,” stated Richard Branch, Chief Economist for Dodge Construction Network.

Video streaming services have benefitted from a wave of content becoming available on home devices at the same time it’s been released in theatres. But as more delayed blockbusters such as the finally released No Time to Die James Bond movie come to the big screens, will viewers be lured away from the comfort of their couches? In today’s Insight Flash, we look at Video Streaming trends in the UK and US to see where the market currently stands, including doing a deep dive into US cross-streaming rates.

The wider Home Improvement category was one of the retail bright spots early on in the pandemic, with brands like Home Depot and Lowe’s showing a unique level of strength. Yet, one of the more interesting storylines was the rise of Tractor Supply – a brand that also outperformed over the last 18 months. Home furnishings leaders were also among the better performers over the last year as key trends aligned to give an added boost to their specific offerings.