The home improvement sector was a clear retail winner throughout the pandemic, but by late 2020 home goods brands like At Home and Floor & Decor were seeing similarly impressive levels of strength. The sector surged by riding a similar wave as a homebound audience was pushed to look for ways to improve their increasingly central surroundings and greater migration drove a need for new furnishings. And like the home improvement sector, home furnishings leaders saw that strength continue into 2021.

Though digital advertising has been around for years, we’re just getting to a point where individual print publications are seeing their digital sales consistently outpace their print sales. Meredith publications—the publisher of Better Homes and Gardens, Southern Living, People, Real Simple and many other national lifestyle magazines—made $107 million on online advertising during Q1 2021. This is about $10 million more than their print sales.

Visits to the UK’s hospitality and restaurant sector went up by around a third (32%) in the week immediately following the re-opening of indoor hospitality on Monday 17 May. The data includes the first Saturday since restrictions were relaxed. The North West region saw the largest jump in activity, rising by an average of 39%. However, Greater London came dead last, showing a rise of only 22%.

Below, ETR recaps the datasets on leading vendors in the Data Warehousing, Productivity Apps, and Storage sectors. This article is based on ETR's Spring Technology Spending Intentions Survey (TSIS), which captures where IT budgets are being invested, citing participation from 1,500 IT decision-makers. Below are specific excerpts from each vendor's TSIS report, originally published on April 16th, 2021.

In 2020, when stay-at-home orders first went into effect and people began working, learning, playing, and eating all within the same four walls and time on our hands, what used to be bearable imperfections quickly became must fixes. With sit down restaurants, parks, movie theaters, and the like shut down, home improvement projects skyrocketed as people tried to transform their home into an oasis.

As the road to recovery continues, we looked at a leading indicator of returning to normal behavior: fitness spending and gym attendance. We also checked in on home fitness leader Peloton given its pandemic-driven spotlight. Note that parts of this analysis calculate growth relative to two years prior – written throughout as “Yo2Y” – in order to benchmark current performance against “normal” consumer levels.

In spite of pessimistic predictions made during the height of the pandemic, the fitness sector is experiencing an impressive offline recovery. And while the sector’s recovery pattern can undoubtedly be tied to an accelerated pandemic-influenced health trend, there is another significant contributor to its gradual growth in visits. Fitness brands are internalizing and quickly adapting to new challenges and shifts in consumer behavior patterns.

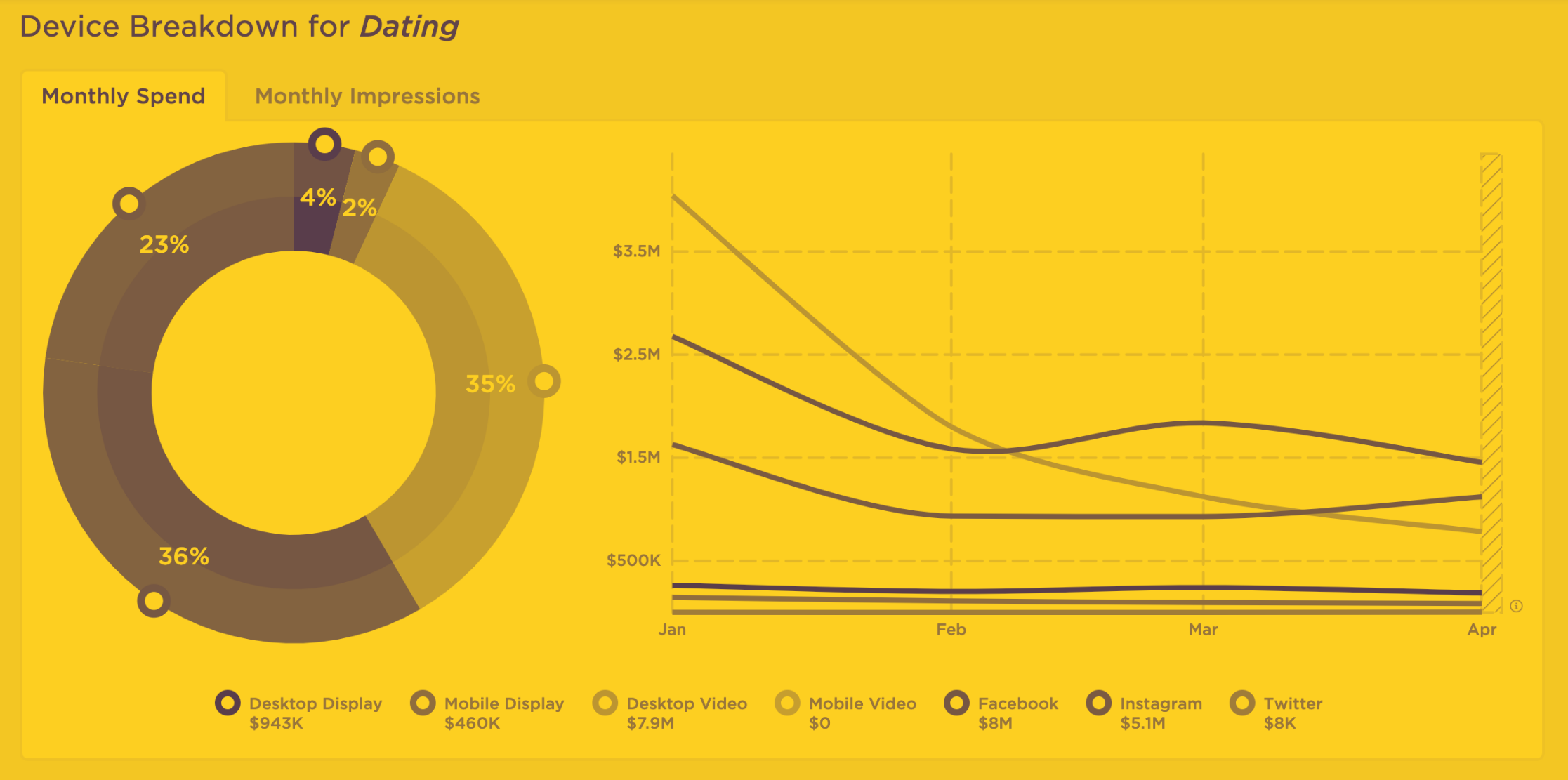

Not since the 60's has a nation had so much pent up tension and longing for intimate connection - and back then, the only place you could swipe right was a rotary phone. Now, love is just a click away! Well, except for that whole pandemic-quarantine thing? But all that is about to change. It's been a long year, and the dating apps are preparing for "single and ready to mingle" to transition into, "vaccinated and ready to get the hell out of my house and meet someone who hopefully looks like their profile picture!" Or, some version of that, anyway.

Two years ago, the death knell seemed to be sounding for department stores as shoppers gravitated towards e-commerce sites and shopping on their sofas. Post-pandemic, however, the couch has lost it allure and many department stores have seen sales gains above consensus in the most recent quarter.

As pandemic restrictions loosen and indoor dining reopens at greater capacities, the convenience of food and grocery delivery is expected to remain a key part of consumers’ daily lives. Globally, we’ve seen weekly active users of top food delivery apps increase significantly in the weeks pre-pandemic to our new normal today.

China’s Labor Day holiday (1-5 May) stimulated travel demand and provided a noticeable boost to hotel performance. Thanks to an additional day during the holiday period, the rise in performance pushed levels beyond another recent holiday and even some 2019 comparables. The impact, however, was not even across all markets and hotel classes. The highest hotel occupancy point during the Labor Day period was day two, which reached 91.3%.

KEY global advertising markets have already begun to recover from 2020’s record declines in ad spend, and our exclusive market intelligence is reporting that the investment by national advertisers in the first quarter of 2021 has grown 1% beyond that achieved in Q1 2019. Standard Media Index collects and publishes real media agency ad spend, and our data shows a strong rebound in the US, UK, Australian, NZ and Canadian markets.

Monday.com has officially filed for its initial public offering (IPO) on the NASDAQ stock exchange, under the ticker MNDY. The project management tech company is yet to report a profit, but did report impressive total revenue for 2020, of $161 million. The company has not yet disclosed its target valuation. In the meantime, let’s see what the alternative data has to say, ahead of the monday.com IPO.

Considering the unique effects of COVID, QSR brands were among the best situated in all of offline retail, but especially the dining sector. A value orientation in a time of economic uncertainty provided a benefit that was bolstered by pre-existing strength in takeaway, drive-thru and delivery. The result was a strong ability to drive strength during the pandemic.

Visits to non-food retail stores more than doubled since restrictions eased last month, with the trend showing that footfall has risen from 10% to over 30% of pre-pandemic levels. This index from Huq Industries measures in-person visits to stores ranging from clothing, shoe shops and homeware to DIY, pet shops and opticians to chart how that value has changed in relation to the equivalent weekday median in February 2020.

As the global COVID-19 pandemic took hold in the United States in early 2020, both grocery and food delivery services saw huge increases in business. Several online grocery purchase platforms saw a 6x increase in new customers making their first-ever purchase during the week of March 31.

Now it’s the turn of SaaS companies to take center stage this earnings season. For the first quarter, SaaS expectations called for sustained enterprise momentum. However, for certain B2B platforms, there are concerns that these expectations could prove aggressive. That’s the case even for those who have experienced account growth acceleration in 2021, such as cloud-based software provider Salesforce (CRM) and Workday (WDAY).

Facebook and OTT advertising may offer similar programmatic opportunities, but the two formats generally win over a different set of advertisers. Over the last few weeks, we’ve dug into Facebook advertising data and released a Facebook advertising trend report.

Predicting the return of corporate travel would be a cinch if foretelling the future was foolproof. No one, however, has that extraordinary prescience and even if they did, the future is, at best, murky. The continuing popularity of work-from-home arrangements, the COVID-19 induced reluctance of both individuals and companies to get back out on the road, and issues throughout the travel supply chain are all converging to create a less-than-hospitable environment for individual business travelers.

When U.S. cities and states faced shelter-in-place orders to limit the spread of the coronavirus, Americans’ reduced mobility resulted in plummeting sales at rideshare companies. With the exception of a late 2020 dip, sales have been gradually recovering since April 2020. Uber sales were up 380 percent year-over-year and Lyft sales were up 359 percent year-over-year as of April 2021.