In this Placer Bytes, we dive into the performance of Dick’s Sporting Goods and break down the newest addition to the Tractor Supply kingdom. Dick’s Sporting Goods is an especially impressive brand and the company’s offline recovery was – even amid COVID circumstances – certainly predictable. But the period from November 2020 through January 2021 may actually be one of the strongest testaments to the brand’s unique reach. Dick’s saw visits decline 30.5% year over year in November as holiday visits were hammered by a resurgence of COVID cases.

The mobile game Top War caught my eye as I watched it begin to rise up the grossing charts. On the surface, what stood out most to me was that it's not owned by one of the major players I’m used to seeing in the top charts. In fact the publisher is simply named 'Topwar Studio' after the game's namesake. After doing some light googling, I didn’t come across much on the game besides a few gameplay review videos on YouTube. Let’s poke and prod a little bit and get into what the game is, it’s performance thus far, and how it's faired against its competition.

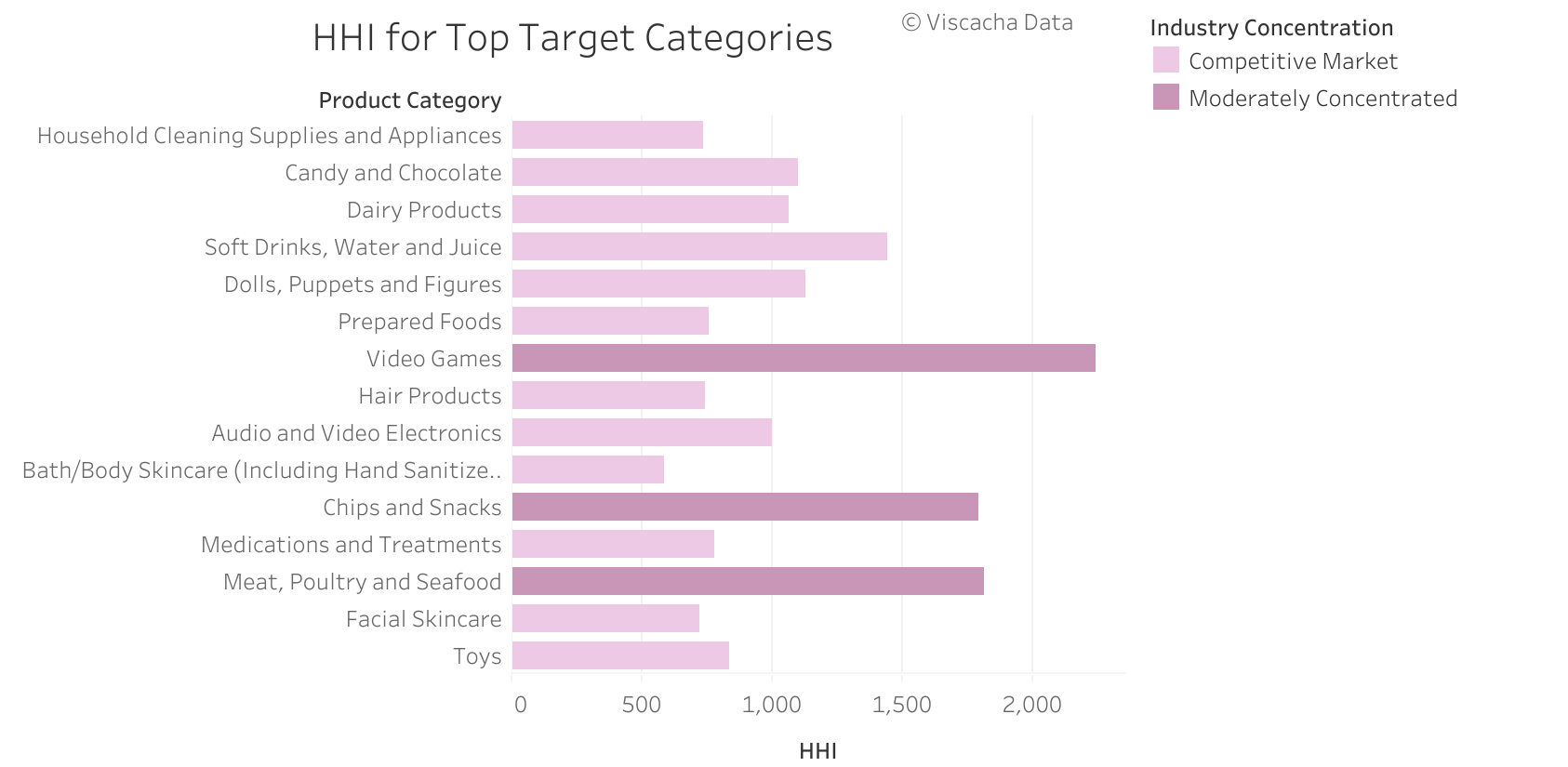

Antitrust has returned to the limelight with the rise of tech giants after enforcement fell during the Reagan administration. While public focus and congressional hearings have centered around market power among FAANGs, the potential for stronger antitrust regulation contained in proposals like that of Senator Amy Klobuchar would also have implications for large retailers and CPG brands. Viscacha Data’s store-level price and sales data helps to produce nuanced insights into antitrust risk that could result from changes in pricing strategy, mergers and acquisitions, and exclusive distribution agreements.

On Feb. 23, Estée Lauder announced its plans to pay $1 billion for a majority stake in Deciem – a Canadian-based company that owns multiple beauty brands. The Ordinary, Deciem’s flagship D2C brand netted $460M in sales the past year and has developed a cult-like following. In this article, we’ll explore The Ordinary’s winning eCommerce strategy and provide tips to advance it to the next level.

Superstores and wholesale retailers saw strong growth in downloads and engagement in 2020. We attribute this to consumers being especially focused on affordability and bulk buying this year. You can learn more about this consumer trend, and all the retail performers who benefited, in our joint analysis with Semrush.

With 2020 in the rear-view mirror, we can gauge the true impact of COVID-19 on the Business & Productivity app space, and it was truly remarkable. Our State of Mobile Report reveals that consumers across the world installed Business and Productivity apps 7.1 billion times in 2020 – up 35% from 2019. Predictably, the biggest surge began in mid-March 2020 when shelter-in-place became the norm across many regions. At this time, millions of employees were restricted from visiting their offices and had to find new ways of collaborating from home. While there was a surge in the spring, Business & Productivity app downloads remained high, as they were a consistent area of focus for the rest of the year and beyond.

In a challenging year for apparel companies, many clothing subscription companies doubled down on their e-commerce strategies. In March 2020, Nordstrom closed its brick-and-mortar Trunk Club locations in favor of ramping up its digital channels. Similarly, Rent the Runway announced that it would permanently close its five stores while revamping its membership tiers to eliminate the unlimited rental option.

Prior to the pandemic, Costco has been among the most consistently strong performers in all of retail with year over year visit growth essentially a given. On the other hand, BJ’s Wholesale had been the clear third wheel in the battle for wholesale club supremacy. Yet, since the pandemic, visits to the former have been up and down, while BJ’s has been one of the most impressive players with near ongoing year-over-year growth. So what does it all mean and how did traffic unfold in late 2020 and January 2021?

In this Placer Bytes, we dive into a critical lesson from Burlington’s recovery, the rebound potential for Nordstrom, and the opportunity for Dollar Tree. When Burlington removed its eCommerce capabilities the wider retail community was up in arms. This wasn’t helped by the onset of a pandemic that shut down Burlington locations, leading some to assume that it would affect Burlington in the long-run.

The COVID-19 pandemic has increased the popularity of third party delivery services, which have seen a surge in full-service restaurant partnerships as many restaurants turn to third-party delivery services to stay afloat. However, our consumer transaction data reveals that third party delivery services generate significantly more sales through quick-service restaurants than full-service restaurants, though they constitute a larger portion of total sales at full-service restaurants.

As consumer adoption of food delivery increases, the competition among food delivery companies on wallet share and loyalty continues. If a restaurant is available on all delivery apps, users get to choose which app to order from. To lure more users to their own platforms, food delivery companies need to adjust their pricing strategies, optimize the service, run various promotion campaigns, and even offer alternative services such as grocery deliveries.

With the COVID-19 pandemic leaving most shoppers sheltered in place, many Americans have turned to crafting to pass the time. JOANN is taking advantage of this fad to launch an IPO, but will the glitter of crafting stay glued once consumers are able to leave the house? In today’s Insight Flash, we examine JOANN’s prospects vs. other craft destinations based on overall growth, new customer acquisition, and demographics.

The digitization of money and banking was inevitable. The pandemic merely accelerated its adoption. 2020 forced us to finally download our bank's app (if we hadn't already) and take all of our transactions online. As a result, finance apps hit record highs for both downloads and user sessions in Q4. To unpack the recent growth of the fintech space, we sat down with mobile and banking experts from Adjust, MoEngage, Visa, Current and Kredivo. Together, we identified the key trends and success strategies of the past year.

Direct-2-consumer (D2C) businesses have grown considerably over the last decade-plus. When companies such as Warby Parker and Allbirds launched, their mission to deliver goods big and small to customers’ front door was a unique option that piqued busy Americans' interest. Today, virtually anything you need or crave is now available for delivery online — dish sponges, glasses, socks, cleaning supplies, mattresses, deodorant, luggage, even your groceries for the week.

With alcohol delivery sales reaching new heights in the pandemic, American Airlines has recently announced its plans to start a wine delivery service to sell some of its surplus wine that isn’t being consumed on flights. However, an increasingly crowded category and rising consumer demand means that market share among DTC wine companies has shifted over time.

In December 2020, Chick-fil-A led its competitors in chicken sandwich online spend, with Popeyes trailing a distant second. The battle between quick service restaurants for chicken sandwich sales has yet to lose any steam entering 2021. Both Popeyes and KFC have recently publicly expressed their efforts of “playing to win” in the fiercely competitive market, while Taco Bell has also announced intentions to join the fray.

As we previously covered, the iPhone 12 is finally allowing Apple enthusiasts to connect to 5G. We’re back with fresh data to see how user adoption and new 5G rollouts have affected performance worldwide. After the launch of various iPhone 12 models, the daily count of unique devices worldwide that are capable of connecting to 5G spiked significantly compared to the year as a whole.

Once upon a time, people could only buy deodorant and cold medicine from their local pharmacy or wholesale club. That was then. Now, Consumer Packaged Goods (CPG) have carved out a nice space for themselves in the online marketplace. So much so that close to one in four U.S. households buy their food and beverages exclusively online. Even more, the number of consumers ordering their health and hygiene products online could double within a year.

In this Placer Bytes, we dive into the impressive results from the TJX portfolio, and the Q4 performances from Dillards and Macy’s. The wider TJX portfolio had an exceptional end to 2020 and a very strong start to 2021. Visits to T.J. Maxx, Marshalls, and HomeGoods locations quickly overcame a visit drop between October and November as COVID cases surged and then sustained the positive momentum into 2021.

Ask any Disney Plus subscriber and they'll tell you: the $7-a-month streaming service isn't just for kids. There's something for the whole family from Star Wars and The Mandalorian to Marvel, Pixar, National Geographic, and Disney classics like Snow White. And with everyone cooped up in the house, it's the perfect family-friendly, socially-distanced escape from reality. Let’s go behind the scenes with Pathmatics marketing intelligence to see how Disney promoted its streaming service in 2020. Everything from the brand’s strategy to its top channels and advertisements is outlined below.